PEO in China & Employer of Record

Hire Globally, Pay Locally, Expand Effortlessly

INS Global is your local partner for global Human Resources services. Through our PEO you can set up, hire, and start working in 100+ countries, while cutting through the red tape and costs of global expansion.

For companies looking to expand their services safely, quickly, and cost-effectively, a PEO in China is the perfect way to access global mobility expertise. An INS Global PEO in China lets companies recruit and assure HR services for employees in-country in as few as two days.

An Employer of Record in China acts as an employer for purposes of outsourcing complex employer responsibilities. This is particularly useful for companies looking to expand their services globally in a safe and cost-effective way. INS Global’s EOR in China allows companies to follow their global expansion plans in less than 48h.

A PEO (Professional Employer Organization), similar to an EOR (Employer of Record) is a local partner for companies wishing to outsource their HR services or expand into a new region or country without having to go through the complex processes involved in establishing a new separate legal identity.

PEO in China & Employer of Record - Summary

PEO in China & Employer of Record

Advantages Of Using A Professional Employer Organization

Assured Legal Compliance

A PEOs knowledge of local legal and administrative procedures ensures your compliance with every aspect of local law in the simplest and safest way

Reduced Cost And Time

Simple issues with HR can cause costly fees and fines when entering a new market. A PEO provides local expertise to help you avoid costly errors

Focus On Company Growth

By providing payroll outsourcing, recruitment, headhunting, and contractor management services, a PEO takes care of the HR processes required for your entry into a new market while you can concentrate on successful growth

Fast Market Entry

Estimated time for Company Incorporation in a new market: 4-12 months

Estimated time to establish a PEO relationship: 5 days

*Global estimate

One Platform For Everything

A PEO covers every aspect of HR services through one point of contact

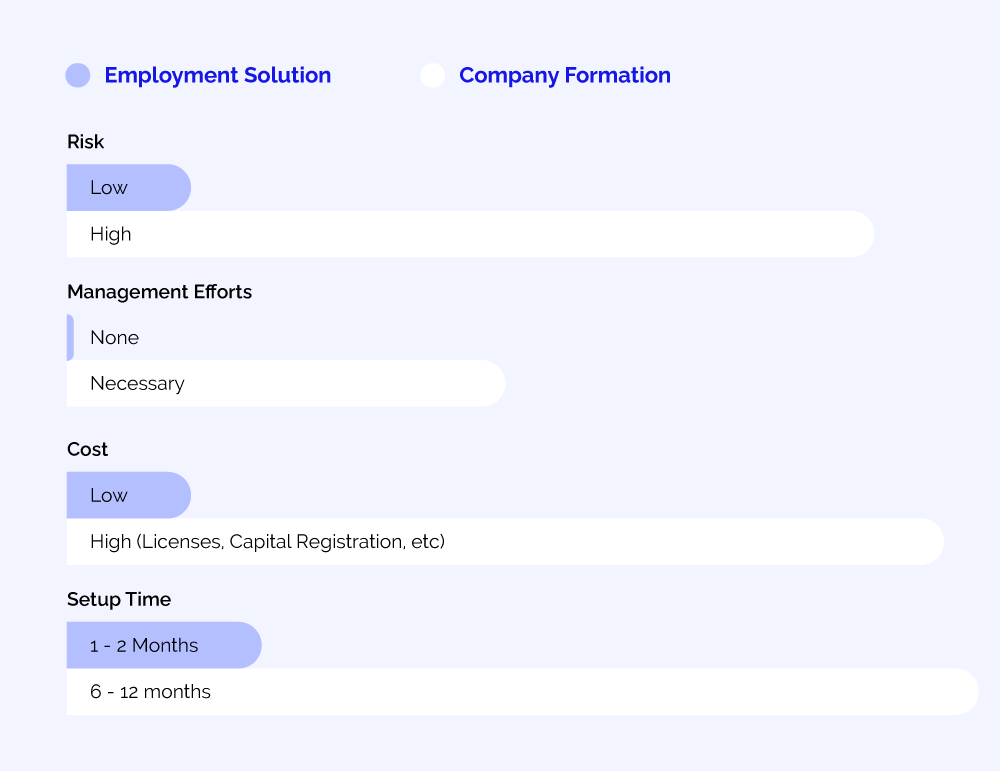

Why Choose A PEO Over Company Incorporation?

Incorporating a company in a foreign market is a complicated and arduous process requiring a legal and physical presence in the target market. A PEO allows a company to operate in a new market without first going through the steps necessary to form and incorporate such a separate entity.

A PEO:

- Saves time

- Saves money

- Avoids potential bureaucratic or legal pitfalls

- Utilizes local networks and expertise

How Does A PEO In China Work?

INS Global’s PEO manages your employee recruitment or assignment needs in China in 4 simple steps:

- We discuss your requirements and formulate a plan that best serves you

- Our organization provides a legal entity through which you can bring in staff to begin operations in China.

- We take on the administrative and legal aspects of hiring and paying your staff

- Your staff continue day-to-day operations and work towards your success in the Chinese market while we take care of the HR

What’s The Difference Between PEO And Employer of Record?

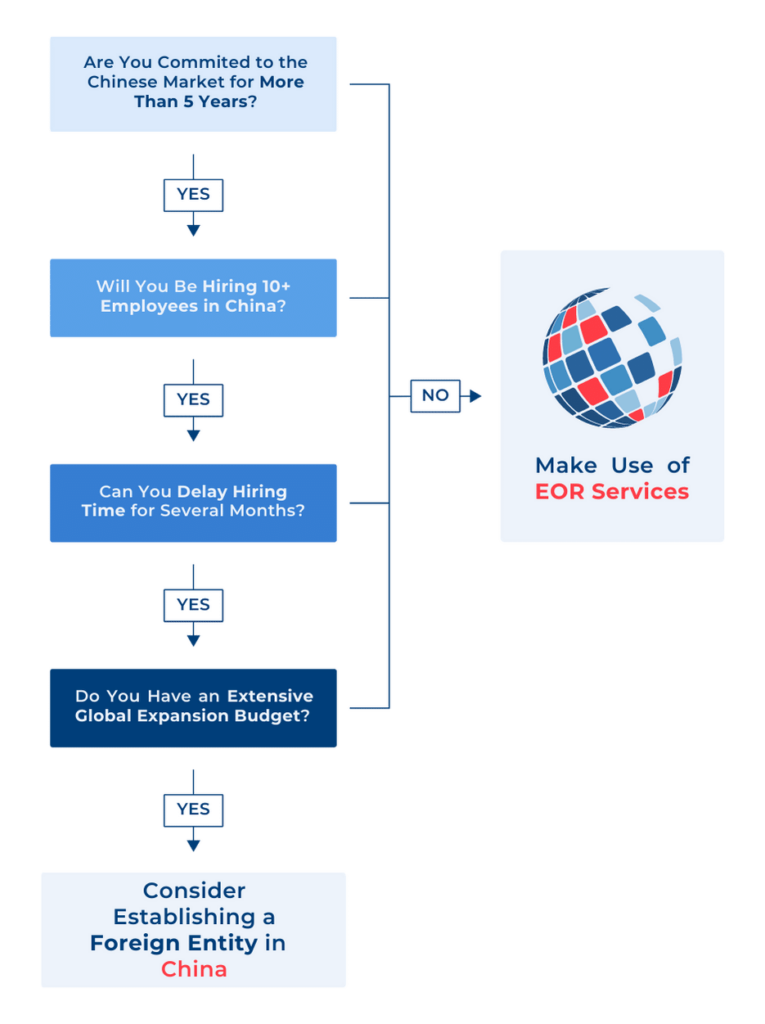

When you have decided to expand into a new market and wish to begin a PEO/EOR agreement, it’s necessary to understand the differences in order to choose the one which best suits your needs:

- A PEO is a company that provides HR services to employees of other companies.

- These services include payroll, tax, and legal regulation compliance, among others.

- An EOR is a company that acts as a PEO but also legally and officially hires employees on behalf of other companies.

- In addition to the services provided by a PEO, an EOR is responsible for all liabilities of recruiting and employing employees.

- In a PEO agreement, the contract remains between the original company and the employee.

- In an EOR agreement, the contract is directed by the original company but made fully between the Employer Of Record and the employee.

Labor Law in China - 2024 Updated

Employment Contracts

- Employment in China must be accompanied by a written offer of employment and then a contract of employment which details every part of the employee’s responsibilities and benefits.

- All amounts in a Chinese employment contract must be written in RMB rather than any foreign currency

- Typically, according to Chinese Labor Law, contracts in China provide strong job security against termination for the employee

- If an employer decides to terminate an employee in China, they will typically have to make a severance payment to avoid long drawn-out termination procedures

- The employer can however terminate an employee’s contract without a severance payment if the employee has demonstrated behavior found to be seriously in breach of the rules and regulations of the job as stated in their employment contract

- In the case of termination during a set probationary period, the employer may terminate the employee without severance pay if the employee has proven themself to be demonstrably unfit for the job

Working Hours

- China Labor Law declares a standard working week to be 8 hours per working day, five days per week

- Most offices in China follow a standard working day of 8am to 6pm

- Lunch breaks are typically 1 hour, but may be as much as 2 hours

- Work hours exceeding this are classes as overtime and must be paid at 1.5x rate

- Overtime hours must not exceed more than 3 hours in a single working day or 36 hours in a month

- Workers expected to work on a weekend day must be paid 2x normal rate

Holidays

- Employees expected to work on a Chinese National Holiday should be paid at 3x standard rate according to Chinese Labor Law

- The Chinese government has declared 7 paid national holidays: New Year’s Day, Chinese New Year/ Spring Festival, Qing Ming Festival, Labor Day, Dragon Boat Festival, and National Day

- These holidays may include more than one day as a public holiday, and may occur according to the lunar calendar so employers are reminded to be aware of yearly changes to the dates of some of these holidays

- Chinese New Year/Spring Festival is of particular importance to local people and organizations, so it is recommended that employers are flexible with annual leave around this time

- China works on a system of substitution days when public holidays fall on typical rest days, or often in order to extend a public holiday to a weekend

The minimum number of annual vacation days that must be given to workers in China relates to the number of years that they have worked for a company :

- Less than 1 year- 0 days

- 1-10 years- 5 days

- 10-20 years- 10 days

- 20+ years- 15 days

- For each day of untaken paid leave (up to the number as mandated by the official government minimum) the employer must pay the employee standard wage plus 2x the standard salary for the untaken day of leave (where the daily wage= monthly salary divided by 21.75)

Sick leave

- Depending on the length of time an employee has been with a company, employees in China are entitled to be between 3 to 24 months of leave for medical treatment

- Pay during this period should be not less than 80% of the local minimum wage [Ba2]

- Illness or injury received as a result of work will result in employee compensation of up to 1 year’s sick leave at full pay, according to Chinese Labor Law

Maternity/Paternity Leave

- Chinese law guarantees 98 days of paid maternity leave

- Some regions may allow for up to 30 days additional leave for women above the age of 24

- Women on maternity in China are typically given full pay (either by the employer or through social security) and are strongly protected by the law against termination of contract during this period

- Chinese law does allow for limited paternity leave, dependent on the regional authority but not exceeding 14 days

Tax Law In China

- Health Insurance, Pension, Worker’s Compensation, Maternity Benefits, and Unemployment Benefits are provided for workers under Chinese Labor Law as the “5 insurances”

- Regions may also include Housing Benefits on top of these insurances and are based on the individualized income bracket of the employee

- Recent changes to Chinese law have removed many exemptions for foreign employees

PEO in China & Employer of Record

CONTACT US TODAY

Discover More Solutions in China

FAQs

No, it is necessary to use a local entity abroad to comply with each country labor law.

Foreign companies can either set up a local entity in each country or use the services a local PEO (Professional Employment Organization) to hire the staff on-site directly.

The employer of record is the legal entity liable for the staff employed in a specific country. In practice, a foreign company can either open a subsidiary to become the employer of record of its abroad employees or use a PEO to act as the employer of record.

procedures, etc.

In general, 1-month is necessary to have an employee based out abroad using an existing PEO as the employe of record. When incorporating a new subsidiary to be the employer of record, the delay varies from 4-12 months.

A high-quality PEO services provider will take care of every necessary HR function from payroll to contract management and tax compliance assurance, all for a single monthly fee based on the salary of your co-employed workers.

Yes, EORs give you a safe, legal way to hire or transfer employees in China, either long-term or while you take the time to set up a company structure.

Salaries and payroll in China are typically paid monthly, with many companies offering a 13th-month bonus. Employers are then responsible for deducting payroll taxes and employee social insurance contributions on behalf of their workers.

Recruiting and employing new workers in China means not only paying their salary, but also providing for indirect costs such as social insurance contributions, plus any bonuses or incentives.

Yes, while labor regulations differ across the various cities and provinces in China, an EOR can take care of employment requirements wherever you need workers to operate.

All changes to employment contracts in China need to be agreed upon with the employee. Trying to change contracts unilaterally can lead to severe fines, with companies also typically being ordered to pay for damages.

Employers in China are responsible for many things, including providing a safe working environment, managing payroll deductions, and ensuring that worker contracts meet the national minimum standards.

Yes, in addition to paying taxes, companies must take care of both employee and employer contributions to China’s social insurance system which includes 6 different payments (called the “5+1” system). The exact amounts for these contributions vary depending on the city or administrative district.

Some PEO companies may set minimums or maximums on the number of staff you can employ through their services. However, with INS Global you can manage as many or as few workers as you need for your expansion strategy.

Severance pay is not mandatory in China for dismissal with just cause. Standard severance pay for other forms or dismissal amounts to the equivalent of one month’s salary for each year of service.

In cases where employees successfully claim unfair dismissal, companies may be severely fined and/ or made to pay additional compensation.

Both remote work and “work from home” are available options for employees in China. While companies must have a physical address, employees can work in whatever way is most suitable (with the agreement of their employer).

Absolutely, our recruitment experts are well-versed in local benchmarks and best practices, with access to professional recruitment resources and networks both online and offline.

Recruitment platforms in China are not usually expensive but may require a small fee from employers.

A professional recruitment agency or provider in China will typically charge a recruitment fee based on a percentage of the new hire’s monthly gross salary.

There are 7 official paid public holidays in China. Some of these are based on the lunar calendar so change every year. In addition, holidays in China may be adapted to incorporate weekends (called “golden weeks). However, in these cases, employees are expected to make up for extra days by working on surrounding weekends.

Despite improvements in recent years, workers’ rights in China vary. While workers are nominally very protected by employment law, foreign employees may find it difficult to traverse the legal system. Work visas are also tied to a single employer and role, increasing the complexity for non-native employees to transition to new positions.

Employers in China must navigate complicated legal and national requirements to maintain compliance. Meeting all employer responsibilities in China is time-consuming and difficult, and companies are constantly at risk of changes to regulations that come abruptly, often with little to no warning. Failure to assure legal compliance can mean serious fines or penalties, or even criminal charges.

Yes, options exist to simplify employment functions for both Chinese citizens and foreigners.