Thanks to strong digital infrastructure and internationally minded businesses, it is increasingly possible to work for an Austrian company remotely while living anywhere in the world. However, with recently updated and reinforced rules concerning remote work in Austria, the rules governing how such employees work will depend heavily on whether you are classified as an employee or a contractor, whether the company has a registered entity abroad, and what the legal requirements are in the country where the work is actually performed.

In 2025, the rules around remote work in Austria have been expanded to specify that this defines any type of work performed as an employee outside of the employer’s standard workplace, opening up new opportunities as well as potential areas of risk around how this could apply to specific circumstances or not. In general, cross-border employment is complex and requires careful consideration of tax obligations, Austrian employment law, social security contributions, and compliance requirements. Employers and employees must also manage practical challenges such as time-zone differences and cultural expectations.

To help clarify what remote work means in terms of employees working either for Austrian companies abroad or foreign companies while based in Austria, this article will look at the rules as they apply, as well as suggest viable alternatives to traditional company branch formation models.

Austrian Labor Laws and Remote Workers

For employees, Austria consistently ranks among the top countries in Europe for work–life balance and employment protections, so being able to keep a career with an Austrian company while relocating abroad can be highly attractive. For employers, allowing remote work means retaining valuable staff and accessing a global talent pool. For both sides, there are numerous advantages to pursuing remote work options and expanding operations on a global stage.

Austrian labor law is known for its strong worker protections, especially around leave entitlements, termination rights, and social benefits. Many aspects of Austrian employment relationships are also shaped by collective bargaining agreements (Kollektivverträge), which cover most industries and provide rights that go beyond statutory minimums. For those working for Austrian companies abroad, keeping these protections may be a good way to ensure long-term satisfaction, while for those companies with employees based in Austria yet working remotely, it is essential to offer the full range of mandatory employee benefits in order to be compliant with local labor laws.

For remote workers in general, the application of these rules depends on where the work is performed. Put simply, if an employee is based in Austria, Austrian law applies in full. If they relocate abroad, then the host country’s labor law usually takes precedence.

Key Features of Austrian Labor Law

- Salaried Employees Act (Angestelltengesetz) – Provides white-collar employees with protections such as notice periods, severance pay, and paid sick leave.

- Collective Bargaining Agreements (Kollektivverträge) – Cover the vast majority of Austrian employees and set out minimum wages, overtime pay, allowances, and extra leave entitlements.

- Annual Leave (Urlaubsgesetz) – Employees are entitled to 25 days of paid annual leave per year, increasing to 30 days after 25 years of service.

- Working Time Act (Arbeitszeitgesetz) – Limits weekly working hours to 48, with a standard 40-hour week and mandatory rest periods, in line with EU regulations.

- Maternity and Parental Leave (Mutterschutzgesetz and Väterkarenzgesetz) – Offers extensive protections, including job security and state-backed financial support.

How This Affects Austrian Remote Workers Abroad

When an Austrian employee relocates abroad, they do not automatically keep their Austrian legal protections. Instead, the host country’s employment law applies. For example, an Austrian engineer moving to Spain will be subject to Spanish labor law regarding working time, dismissal, and leave rather than Austria’s Angestelltengesetz or Urlaubsgesetz.

This means:

- Annual leave and overtime entitlements align with the host country’s minimums.

- Severance pay and termination procedures follow host-country rules.

- Collective agreements that applied in Austria may not transfer abroad, unless the employer voluntarily continues them contractually.

However, some Austrian employers may wish to continue offering the same high level of employee benefits to those based abroad in order to establish continuity and employee trust. In these cases, having adaptable local payroll procedures is a must.

Employer Obligations in Austria

For Austrian companies with employees working abroad, compliance obligations shift significantly. Employers must:

- Update Employment Contracts – Contracts must reflect the laws of the country where work is performed, including notice periods, dispute resolution mechanisms, and local labor protections.

- Manage Social Security Contributions – Under EU Regulation 883/2004, employees working in another EU/EEA country are usually covered by that country’s social security system. Outside the EU, Austria has bilateral agreements with countries such as the U.S. and Canada to avoid double contributions.

- Ensure Local Insurance Coverage – Employers must confirm whether the host country requires local accident, health, or unemployment insurance.

Remote Work Within Austria

For employees working remotely within Austria, whether from home in Vienna or in a flexible arrangement in Salzburg, the full range of Austrian labor protections applies, meaning employers remain responsible for ensuring compliance with:

- Arbeitszeitgesetz (Working Time Act): Remote employees must still respect maximum working hours and rest breaks.

- ArbeitnehmerInnenschutzgesetz (Occupational Health and Safety Act): Employers must ensure that home working conditions meet minimum safety and health standards.

- Data Protection (GDPR): Employers must safeguard employee and company data, especially when staff are working off-site.

Employer Options for Hiring Remote Workers in Austria

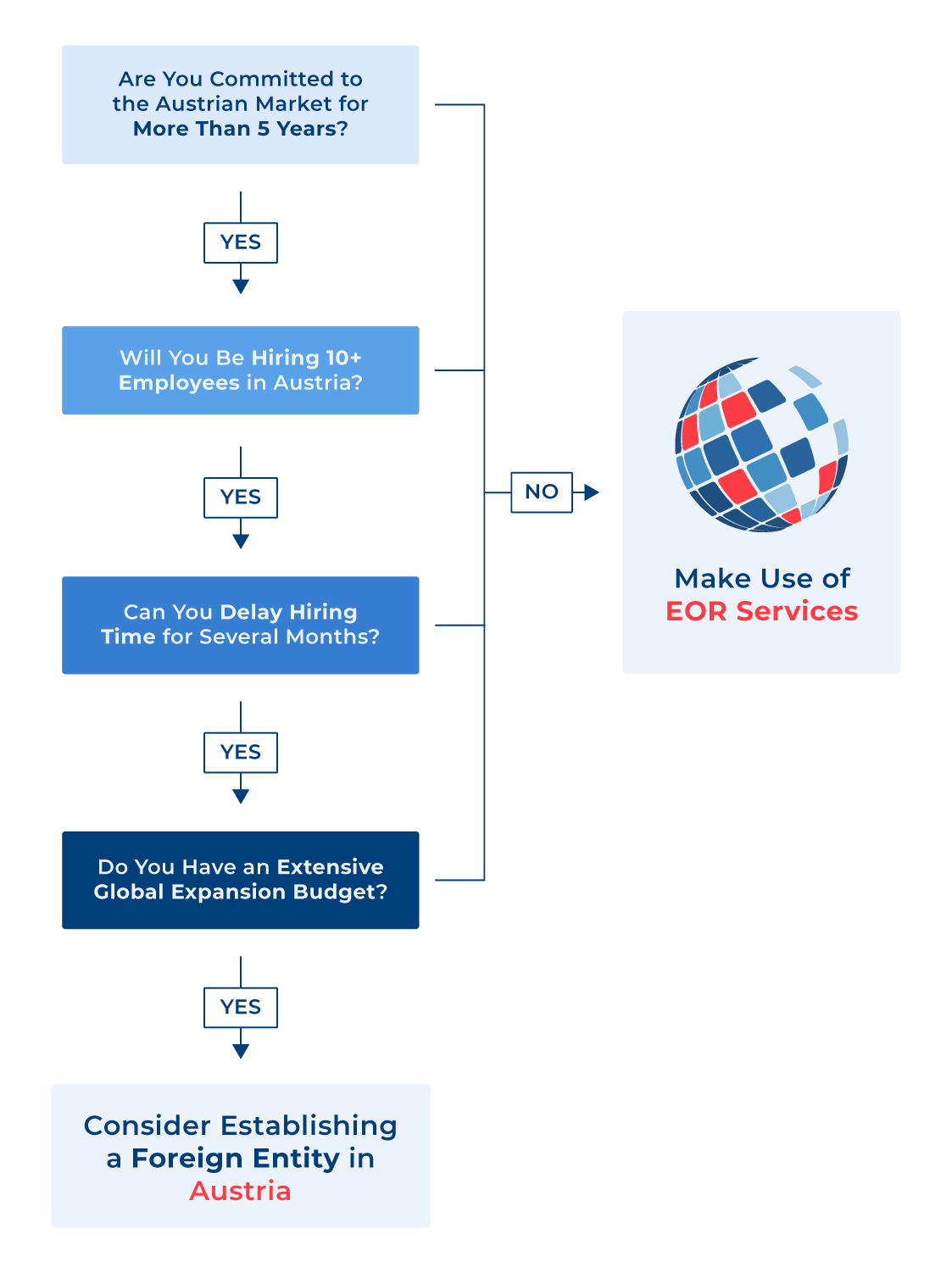

Whether it’s international companies that want to hire talent in Austria or Austrian companies seeking to employ staff working remotely from abroad, there are several possible approaches. Each comes with its own set of obligations, costs, and risks:

1. Establishing a Local Entity

Foreign employers who want full control over hiring in Austria can set up a subsidiary (Tochtergesellschaft) or a branch (Zweigniederlassung). This allows the company to employ Austrian staff directly under Austrian law, manage payroll, and contribute to statutory systems like Österreichische Sozialversicherung (social security) and occupational accident insurance.

- Advantages – Full autonomy, local credibility, direct compliance with Austrian law.

- Disadvantages – High setup costs, ongoing reporting to the Austrian Commercial Register (Firmenbuch) and Finanzamt (tax office), and complex labor law compliance.

2. Hiring Independent Contractors

Some employers choose to work with Austrian professionals as self-employed contractors (freie Dienstnehmer or Werkvertragnehmer). This can offer flexibility and avoid the need for payroll contributions.

However, due to the rise of hiring freelancers as a perceived cheaper alternative to employing workers, Austrian authorities closely monitor for Scheinselbstständigkeit (false self-employment). This is where a contractor is effectively working under supervision, with fixed hours or exclusivity, where they may legally be reclassified as an employee. Employers in this case face back pay of wages, unpaid social contributions, and penalties.

- Advantages – Speed, flexibility, lower upfront costs.

- Disadvantages – High misclassification risk, no long-term retention, limited control.

Because of this, it’s absolutely essential that any company hiring freelancers in Austria understands the legal definitions and limitations this entails, and then plans accordingly to avoid the significant consequences that come with non-compliance.

3. Using Cross-Border or EU Agreements

Within the EU, Austrian companies benefit from EU labor mobility rules, making it easier to hire staff across member states. EU Regulation 883/2004 coordinates social security systems to ensure employees don’t pay contributions twice. However, for employees based outside the EU (e.g., in the U.S. or Asia), compliance requires careful analysis of bilateral agreements or risk of double taxation.

- Advantages – Easier compliance within the EU, smoother workforce mobility.

- Disadvantages – Administrative complexity, limited applicability outside the EU.

4. Partnering with an Employer of Record (EOR) in Austria

The most straightforward and efficient way for companies without a legal presence in Austria to employ staff is through an Employer of Record (EOR). The EOR becomes the official employer in Austria, managing:

- Drafting locally compliant contracts.

- Running payroll in euros with correct tax withholdings.

- Managing contributions to Sozialversicherung, pensions, accident insurance, and other mandatory benefits.

- Ensuring compliance with Austrian labor law and collective bargaining agreements (Kollektivverträge).

This model allows companies to access Austrian talent quickly without the cost or risk of entity setup, while also protecting employees with full statutory benefits managed by local experts. For Austrian employees relocating abroad, the EOR also ensures their contracts align with host-country law, avoiding double taxation or gaps in benefits.

- Advantages – Full compliance, reduced risk, fast market entry, and employee protections.

- Disadvantages – Service fees apply, less direct responsibility for HR administration (though strategic control remains with the employer).

How do Employer of Record Services Work?

When an Austrian company wishes to hire someone abroad without setting up a local entity, a legally compliant Employer of Record (EOR) becomes the most cost-effective and time-saving strategic solution. The EOR is the legal employer in the host country, while the Austrian company directs the day-to-day work.

The EOR handles:

- Payroll – Salaries processed in local currency, with deductions for host-country taxes.

- Benefits & Social Contributions – Instead of paying into Austria’s system (Sozialversicherung, Unfallversicherung, etc.), the EOR ensures contributions align easily with host-country law.

- Compliance – Contracts adapted to local regulations, reducing the risk of disputes or penalties.

This model saves Austrian employers from the expense and complexity of registering a foreign entity, which involves corporate registration, tax filings, and labor compliance across multiple jurisdictions.

Can I Work Remotely for a Company Through an EOR?

Yes. Whether it’s Austrian employees relocating abroad or foreign nationals hired by Austrian firms, workers can be onboarded through an EOR in their host country without the need for the employer to establish a local entity. This ensures that:

- The employee receives a fully compliant contract with host-country entitlements, including notice periods, leave, and termination protections.

- The employer avoids the risk of creating a permanent establishment (PE) in the host country, which could trigger corporate tax liability.

- Employees continue to enjoy statutory benefits (health insurance, pensions, accident insurance) under the local framework, while employers can also “equalize” benefits to mirror Austrian standards.

For instance, an Austrian software company expanding into Germany could hire remote developers through an EOR in Berlin, ensuring compliance with Germany’s Sozialversicherung system while scaling efficiently.

How Much Does an EOR Cost?

Austrian EOR costs vary, but typically follow one of two models:

- A flat monthly fee per employee

- A percentage of gross salary

Compared to setting up a subsidiary in Austria’s neighboring countries like Germany or Switzerland, which can cost upwards of €15,000–€25,000 in registration, legal fees, and ongoing compliance costs, an EOR is far more cost-effective for companies hiring a handful of staff.

Time is also a factor: entity setup in Austria or elsewhere in Europe can take 3–12 months, while onboarding through an EOR is typically completed within 1–3 weeks.

Are There Limitations When Working Overseas for an Austrian Company?

Both employees and employers must be aware of the following considerations:

- Social Security Contributions – Austria participates in EU social security coordination rules, so employees working in another EU/EEA country generally contribute to that country’s system instead of Austria’s. Outside the EU, bilateral agreements apply in some countries, but not all.

- Double Taxation Treaties – Austria has an extensive network of double taxation agreements with EU states, the U.S., and many Asian economies. These treaties prevent employees from being taxed twice, but proper reporting is required. (See: Federal Ministry of Finance – Double Taxation).

- Time-Zone and Communication Issues – Austrian workplaces value punctuality, structure, and consensus decision-making. Remote employees in distant time zones may struggle to fully integrate unless employers establish clear expectations for availability and meetings.

- Collective Bargaining Agreements (Kollektivverträge) – Most Austrian employees are covered by CBAs that guarantee minimum wages, allowances, and extra benefits. Once abroad, these may not apply unless explicitly extended in the contract. Employers must decide whether to replicate these benefits under the EOR model or adapt to the host-country framework.

5 Benefits and 5 Risks of Hiring or Employing Remote Workers in Austria

Benefits

- Highly Skilled Workforce

Austria is home to a well-educated workforce, with strengths in IT, engineering, finance, life sciences, and advanced manufacturing. The country consistently ranks highly in OECD education and skills benchmarks, giving employers access to talent that is internationally competitive. English proficiency is widespread, particularly in professional services, making cross-border collaboration smoother. - Strong Digital Infrastructure

Austria offers excellent digital connectivity, with broadband coverage reaching over 95% of households and 5G networks being rapidly deployed. This ensures remote employees have reliable internet access and digital tools for collaboration. - Work-Life Balance and Productivity

Austrian labor culture emphasizes both efficiency and balance. Employees are accustomed to flexible and hybrid working models introduced during the COVID-19 pandemic, and productivity levels remain high while maintaining employee satisfaction. - EU Single Market Integration

As an EU member state, Austria allows employers to benefit from free movement of labor and harmonized tax and social security coordination. This makes it easier for Austrian companies to employ staff across the EU and for international companies to hire Austrian workers without duplicating contributions. - Employer Branding and Global Attractiveness

Offering remote work in Austria can strengthen a company’s image as a modern and internationally oriented employer. Austria is known for high living standards, safety, and quality of life, making it an attractive base for employees who want career stability while enjoying cultural and environmental benefits.

Risks

- High Employment Costs

Austria has relatively high non-wage labor costs, including compulsory contributions to Sozialversicherung (social security), accident insurance, and pensions. Employers must also budget for 13th and 14th salary payments (holiday and Christmas bonuses), which are standard in most Austrian employment contracts. - Complex Collective Bargaining Agreements (Kollektivverträge)

Most Austrian employees are covered by collective bargaining agreements (CBAs), which regulate minimum wages, overtime, holiday entitlements, and sector-specific benefits. Employers unfamiliar with these agreements risk non-compliance and unexpected costs. - Strict Employee Protections

Austrian labor law provides employees with strong protections, including long notice periods, mandatory severance under the Abfertigung system, and regulated working hours. Employers must carefully plan HR strategies to avoid disputes and financial liabilities. - Tax and Compliance Risks

Foreign companies hiring Austrian employees directly may unintentionally create a permanent establishment (PE), leading to corporate tax obligations in Austria. Furthermore, failing to register with Austrian authorities or contribute to statutory schemes can result in fines. - Cross-Border Legal Complexity

When Austrian employees relocate abroad, host-country labor laws typically take precedence. Employers may need to restructure contracts, ensure compliance with local insurance requirements, and navigate double taxation treaties.

Conclusion – How INS Global’s Employer of Record Can Help Companies Work Worldwide

Hiring or managing remote employees in Austria, or doing the same for Austrian employees in other countries, brings a wide range of both opportunities and challenges. Employers gain access to a highly skilled and internationally minded workforce, but at the same time, they must navigate collective bargaining agreements, high social contributions, and strict employee protections.

In these cases, employees need flexibility but expect strong statutory benefits to be maintained, and that’s where INS Global’s Employer of Record (EOR) services provide the ideal solution. By acting as the legal employer in Austria or abroad, INS Global enables companies to:

- Hire staff quickly without setting up a local subsidiary.

- Manage payroll, taxes, and social contributions in compliance with Austrian law.

- Avoid risks like employee misclassification, permanent establishment tax liability, and non-compliance with CBAs.

- Support employees with locally compliant contracts, pension payments, and HR processes tailored to Austrian standards.

Whether you are an Austrian company retaining staff relocating abroad, or an international employer seeking to expand into Austria, INS Global simplifies cross-border employment so you can focus on strategy and growth.

Contact our advisors today to learn more about our EOR in Austria, recruitment, payroll, and contractor management solutions, and explore how we can help your business expand in Austria and over 160 other markets worldwide.

FAQ

Can I work for an Austrian company while living in Spain?

Yes. Thanks to EU freedom of movement, Austrian residents can work in Spain for an Austrian employer. However, Spanish labor law and taxation will apply once the work is performed there. Employers may need to contribute to Seguridad Social instead of Austrian social insurance. To stay compliant, many companies use an EOR in Spain to handle payroll and benefits.

Do I still pay Austrian tax if I live abroad while working remotely?

That depends on your tax residency. If you live abroad for more than 183 days in a year, you may become a tax resident in your host country. Austria has an extensive network of double taxation agreements to avoid paying tax twice, but employees must notify the Finanzamt when relocating.

Can a foreign employee work remotely in Austria for a U.S. company?

Yes, but they must hold a valid residence and work permit if they are not EU/EEA/Swiss nationals. Salaries earned in Austria are subject to Austrian income tax and social contributions. U.S. companies without a local entity often use an EOR Austria solution to handle payroll and HR compliance.

Can I work remotely in the EU for an Austrian employer?

Yes. Austrian employers can hire staff across the EU relatively easily, but each country’s local employment rules take priority. For example, overtime laws in France or severance rules in Italy may differ significantly. Using an EOR in the host country ensures correct compliance while protecting both the employer and employee.

Can I be paid in Austria while living abroad?

It’s possible, but not ideal. If you live in Germany, for example, being paid from Austria without German payroll contributions could create compliance risks and even permanent establishment issues for the employer. Best practice is to process payroll in the host country’s currency with the correct tax and social deductions.

What if I want to switch from contractor to employee with an Austrian company?

This is a common need that requires serious compliance checks. Many Austrian employers start with contractors but later convert them into employees, as this transition offers benefits like health insurance, paid leave, and pension contributions under Austrian law. An EOR can facilitate this shift by drafting a compliant employment contract in the host country.

Can I work for an Austrian company while living outside the EU (e.g., the U.S. or Asia)?

Yes, but compliance requirements are stricter. In the U.S., for example, working for an Austrian employer could trigger IRS reporting obligations and local labor law requirements. In Asia, visa and employment regulations vary by country. An EOR helps ensure contracts, payroll, and benefits are aligned with host-country law.

Can Austrian employees keep their collective bargaining benefits abroad?

Not automatically. Kollektivverträge (CBAs) only apply while the employee is in Austria. Once abroad, host-country law takes over unless the employer explicitly continues CBA benefits in the contract. Some employers replicate parts of CBAs (e.g., extra holiday allowance, 13th salary) through an EOR to stay competitive in talent retention.

SHARE