- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

France, known for its strong economy and strategic role within Europe, offers numerous opportunities for businesses looking to expand internationally. However, entering the French market involves navigating a complex network of labor laws and tax regulations. Partnering with an Employer of Record (EOR) in France can streamline this process, serving as your local ally to facilitate a seamless market entry and ensure ongoing compliance with all necessary legal requirements.

Partnering with an EOR in France, such as INS Global, begins with an in-depth analysis of your business goals. This process involves understanding the number of employees, their roles, and your timeline for entering the French market. The EOR customizes its services to align with your specific needs, ensuring a seamless and effective market entry.

When establishing a new team in France or relocating existing staff, an EOR handles all crucial legal formalities. This includes managing visas, work permits, payroll, and contract management, ensuring full compliance with French labor laws. Acting as your legal employer in France, EOR services eliminate the complexity and cost of setting up a local entity.

Once your operations are underway in France, an EOR manages ongoing HR and payroll functions. This encompasses salary processing, overseeing employee benefits, and ensuring compliance with health insurance and social security contributions. The EOR acts as the HR liaison between you and your French team, managing administrative duties and addressing employee concerns, allowing you to focus on business growth.

An EOR in France eases the challenges of entering the French market by efficiently managing tax systems and labor laws, ensuring your compliance from the outset.

Handling France’s regulatory framework can be intricate, but EORs possess the expertise needed to ensure your business consistently adheres to local tax laws, labor regulations, and social security requirements.

By serving as your legal employer in France, an EOR minimizes the risks associated with employment regulations, maintaining full compliance and reducing potential liabilities.

Outsourcing HR tasks like recruitment, payroll, and tax administration to your EOR allows you to concentrate on essential business operations and strategic growth.

EOR services in France are often more economical than establishing a local entity, especially for smaller teams or temporary ventures, helping you sidestep incorporation expenses and ongoing administrative challenges.

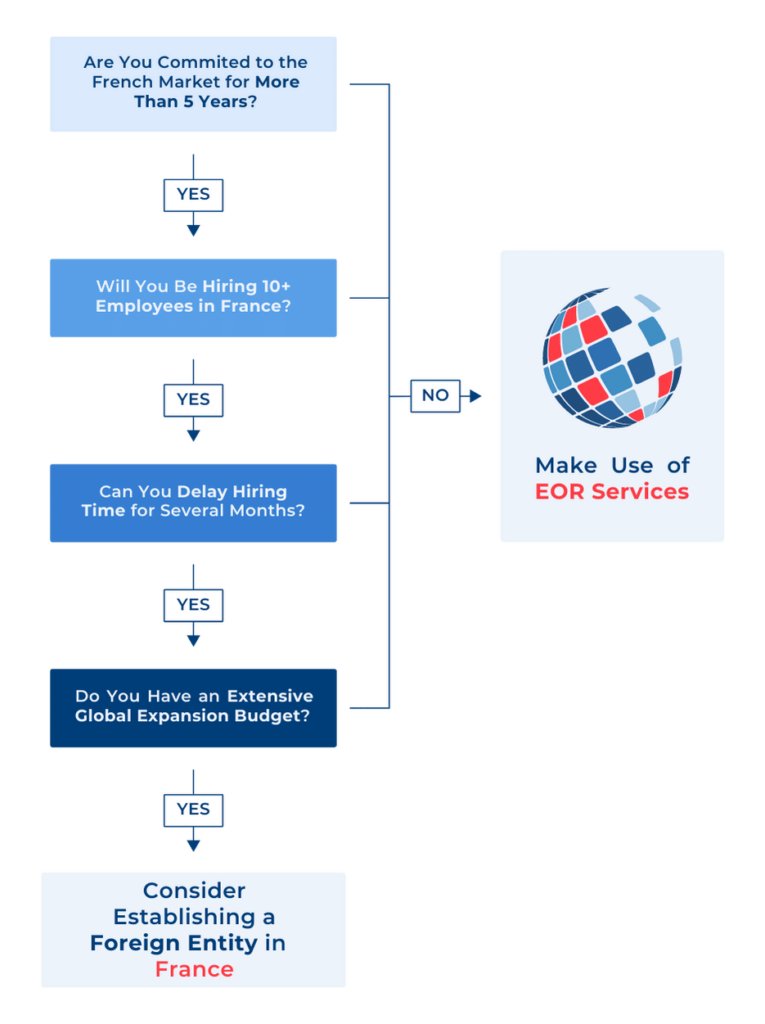

While establishing a subsidiary in France is an option, leveraging an EOR offers numerous benefits:

Choosing the right EOR in France is vital for a successful market entry. Consider these 5 key factors:

An EOR can help you navigate complex French labor laws and tax regulations, ensuring your business complies with local requirements from the start. They handle all HR and administrative tasks, allowing you to focus on growth.

Using an EOR in France is often faster and more cost-effective than setting up a subsidiary. It allows you to hire staff quickly and efficiently without the overheads of establishing a local entity.

An EOR handles all aspects of employee benefits in compliance with French regulations, including health insurance, social security contributions, and pension schemes, ensuring that employees receive the appropriate entitlements.

Yes, an EOR can manage work permits and visas for expatriates, ensuring compliance with French immigration laws and facilitating a smooth relocation process for international staff.

An EOR in France can provide support in resolving labor disputes, offering guidance on French employment laws, and ensuring that all resolutions are compliant with local regulations to minimize risk and liability.

An EOR manages all tax filings and payments on behalf of your business, ensuring that you adhere to French tax laws and avoid penalties for non-compliance.

Yes, an EOR manages payroll processing, ensuring accurate and timely payment of salaries, tax withholdings, and social contributions in line with French regulations.

An EOR ensures that any employee terminations are handled in accordance with French labor laws, including appropriate notice periods and severance pay, reducing legal risks for your business.

Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard

Singapore 018983DOWNLOAD THE INS Expansion Insights

DOWNLOAD THE PDF