Testimonial

Manuel Ramos

TERAO ASIA

Managing Director

We think INS Global is a good solution about starting in a market like China. Understanding the market doesn’t mean you need to set up a company immediately.

5/5

Expanding to new markets doesn’t have to be a lengthy and complicated process. With a professional and reliable partner like INS Global you can enter Latvia quickly and confidently. INS Global has been helping companies reach their expansion goals for the past 15 years. Our staff are uniquely equipped to meet any challenges you might face and offer personalized solutions for every need.

Partnering with an Employer of Record (EOR) in Latvia allows you to easily hire and onboard local talent. An EOR takes care of recruitment, contract management, and more so that you can focus on reaching your market goals.

Understanding a foreign legal system is not easy, and any misunderstanding can lead to paying expensive fees and fines. A EOR will not only keep you legally secure, but will also make sure you implement any necessary changes as new laws or bills are passed.

Rather than having to train your staff to handle complex HR tasks, a EOR covers all administrative responsibilities with speed and professionalism.

Having a EOR handle payroll, taxes, and contract management gives you more time to explore the new market and make valuable business connections to further your expansion goals.

With traditional company incorporation you might have to wait a whole year before you can start operations. A EOR can have you set up in just a few days.

Instead of having to outsource to multiple services, you can have all your needs met on a single platform.

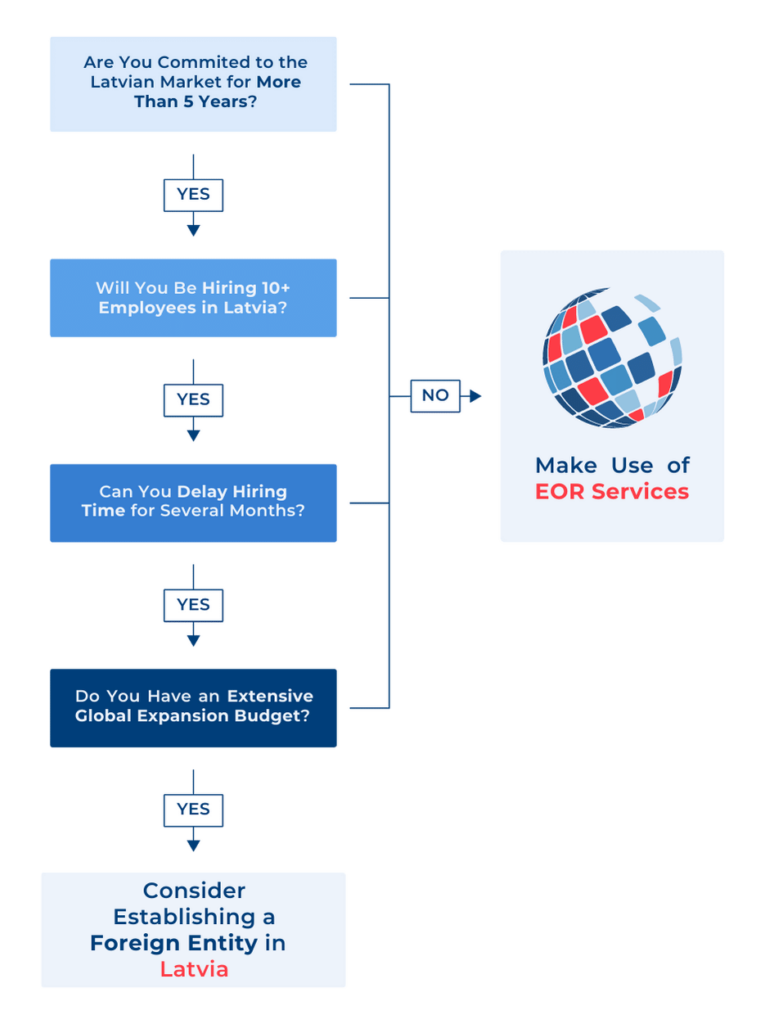

While company incorporation is a more traditional method of global expansion, it’s time-consuming and can have a much higher risk of non-compliance errors. A EOR acts as the legal entity through which you can expand to new markets. This cuts down the wait time and reduces the amount of paperwork you have to go through.

Other benefits of a EOR include:

Manuel Ramos

TERAO ASIA

Managing Director

We think INS Global is a good solution about starting in a market like China. Understanding the market doesn’t mean you need to set up a company immediately.

INS Global uses a tried-and-proven four step plan to help realize your expansion dreams:

In Latvia, the price of specialized EOR services is calculated as a percentage of a coworker’s monthly income. This price includes all HR tasks required to ensure compliance with all local employment rules.

Without the need for a new firm structure, handling employer duties through an EOR is secure, legitimate, and efficient in Latvia. EOR services achieve this by having top-notch HR support and in-depth familiarity with local legal authorities.

With an EOR service agreement, your team members will be completely protected by the law, receive correct and timely monthly payments, and be eligible for all Latvian employee benefits.

While working with clients through a Latvian EOR, independent contractors have complete control over their work and may be eligible for many or all of the same benefits as regular employees or as if they were utilizing an umbrella firm.

Our recruiting professionals can find the best local employees in Latvia for your needs by utilizing their vast professional networks, in-depth knowledge of the local business resources and standards, and strict adherence to ethical hiring processes.

As a result, integrating them into our Latvian EOR system will be easier and more effective than hiring these candidates through more conventional employment methods.

You obtain thorough compliance-assured employment outsourcing assistance from a genuinely global EOR services provider through INS Global. An EOR complies with all relevant municipal, national, and regional laws.

There may be strict hiring requirements or a limit on the number of employees you can hire at once at some Latvian PEO or EOR service providers. However, your global business plan may require you to scale up or down quickly.

INS Global is aware of this, so when you work with us, you can employ as few or as many individuals as you need to in order to accomplish your goals.

Payroll costs, hiring costs, signing bonuses, and other direct and indirect expenditures like incentive programs, managing the taxes of international workers, and social insurance should all be considered as parts of the total labor cost in Latvia.

Using Latvian PEO services won’t need a local site, which could help you avoid onerous incorporation regulations.

It’s still a good idea to give your staff the option of working in a shared workspace or the freedom to do so whenever and wherever it’s most convenient. INS Global can help set up suitable working environments in Latvia.

If Latvian citizens or foreigners are subject to various local employment standards, tax legislation, or employee incentives, we can deal with all the important distinctions, like visa and work permit requirements.

The best EOR and PEO solutions are accessible to businesses of all sizes, from SMEs to multinational corporations. Employment outsourcing solutions enable the efficient and secure hiring of international or local staff.

Our services can even replace more complex internal HR requirements and are easy to scale up to meet the demand for new hires.

The legal expertise provided by PEO and EOR services would be beneficial to businesses in a number of industries that either don’t have their own structures in a target country (or seek to avoid cost-scaling difficulties while focusing on expansion).

Staffing firms and umbrella corporations are two more third parties that may be used to directly or indirectly employ independent contractors.

In Latvia, most independent contractors are self-employed or run their own small businesses. According to Latvian law, hiring contractors requires using labor agreements rather than employment contracts.

An independent contractor might have to produce a CV, portfolio, verifiable references, and a signed NDA before work begins.

Payroll in Latvia is typically organized every month, with different rules for residents and non-residents. Employers are generally responsible for managing tax and social security contributions on behalf of their employees.

The monthly minimum wage in Latvia was raised to €620 per month for 2023.

As a country within the Schengen area, Latvian visas follow typical Schengen patterns. EU and EEA citizens can live and work in Latvia without requiring a visa, but for everyone else, there are C (short stay, 90 days) and D visa (90 days to 1 year) types alongside the EU Blue Card (for highly qualified specialist works, valid for up to 4 years).

In Latvia, employers must contribute an amount equivalent to a percentage of an employee‘s salary to their social security fund every pay period. This percentage depends on the company‘s registration status but typically varies between 20-23%.

Employees in Latvia are eligible for all the usual employee benefits provided by Latvian Labor Law, including paid leave, overtime, workplace safety protection, pension, unemployment, and health insurance.

All amendments to an employment contract in Latvia must be made by mutual consent, with adequate notice given in advance.

Latvian citizens are eligible for free healthcare through a public system funded by social security contributions.

Expat workers may be required to pay an additional fee to access the public healthcare system.

Notice periods for employees in Latvia must be a minimum of 1 month unless otherwise specified in the employee’s contract or CBA.

Employees who are terminated due to redundancy or economic reasons may be eligible for severance pay equalling 1-4 months of salary (dependent on seniority).

The Latvian Labor Inspectorate oversees the implementation of occupational safety and workers’ rights in the country.

There are typically 15 days of paid public holidays per year in Latvia, with employees expected to work on a public holiday eligible for double pay or time off on another day.

Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard

Singapore 018983DOWNLOAD THE INS Expansion Insights

DOWNLOAD THE PDF