- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

Mexico, a rapidly growing economy with a strategic location, presents significant opportunities for businesses looking to expand their operations in the Americas. However, understanding its complex labor and tax laws is crucial for successful operations. An Employer of Record (EOR) in Mexico can provide the necessary expertise and support.

Step 1 – Comprehensive Planning & Assessment

Your engagement with a Mexican EOR, like INS Global, starts with an in-depth consultation to understand your business objectives. This includes evaluating the workforce needed, their roles, and your expansion timeline. The EOR customizes its services to fit your specific needs, ensuring a smooth transition into the Mexican market.

Step 2 – Efficient Setup, Recruitment & Onboarding

Whether you’re forming a new team in Mexico or relocating existing employees, the EOR manages all legal and administrative requirements. This includes handling visas, work permits, payroll, contract administration, and ensuring compliance with Mexican labor laws. Acting as your legal employer in Mexico, the EOR removes the need for establishing a local entity, saving both time and resources.

Step 3 – Continuous HR Management & Compliance

Once your employees are established in Mexico, the EOR oversees ongoing HR and payroll functions. This includes salary processing, managing employee benefits, and ensuring compliance with health insurance and social security obligations. The EOR serves as the HR intermediary between you and your Mexican team, managing administrative tasks and addressing employee concerns, enabling you to focus on business growth confidently.

A Mexican EOR allows you to quickly enter the Mexican market without the need to set up a local entity, enabling faster business expansion.

The EOR ensures your business complies with Mexican labor laws, including those related to employment contracts, taxes, and employee benefits, reducing the risk of legal complications.

The EOR aids in recruiting and managing local and foreign staff, ensuring access to the best talent in Mexico while handling all aspects of employment.

Partnering with a Mexican EOR helps you avoid the high costs associated with establishing and maintaining a local entity. The EOR manages all payroll, benefits, and HR tasks, freeing up resources for growth.

A Mexican EOR provides the ability to scale your operations up or down based on market needs, without the complexities of setting up a permanent entity, offering greater flexibility.

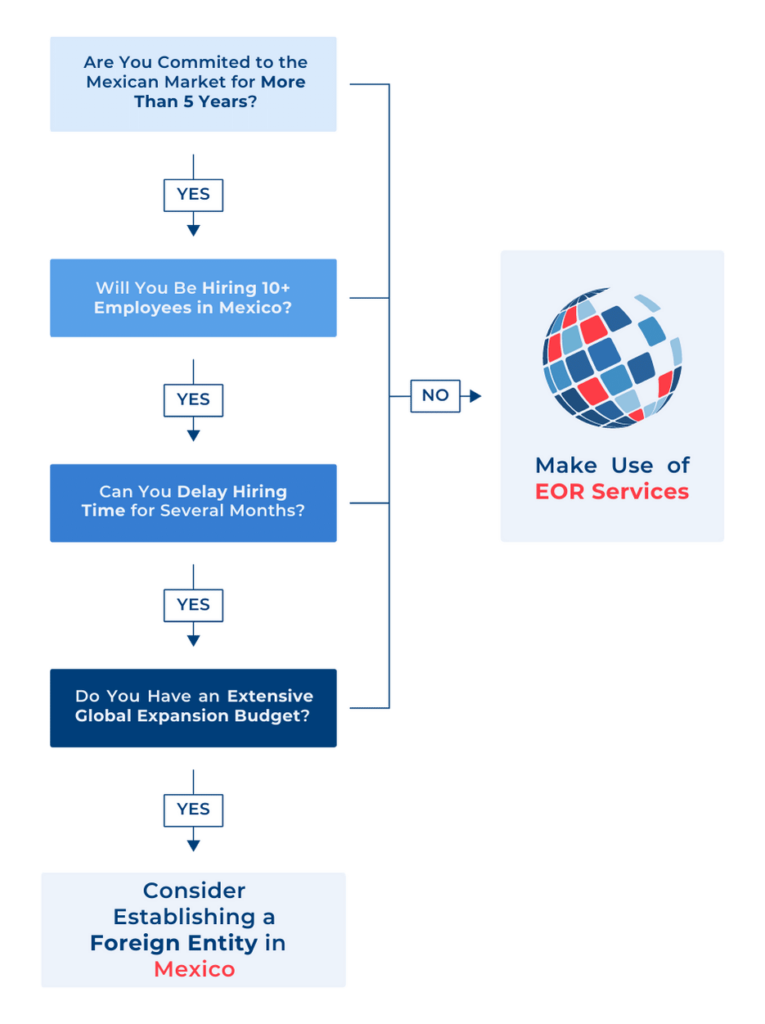

While establishing a subsidiary in Mexico is a traditional approach to local expansion, using an EOR offers several distinct benefits:

Selecting the right EOR in Mexico is vital for successful market entry. Consider these essential factors:

Navigating these intricate challenges can be time-consuming and necessitates staying current with legal changes. Partnering with an EOR in Mexico acts as your local legal ally, ensuring your business adheres to labor laws and protects you from possible liabilities.

An EOR in Mexico manages all legal, HR, and compliance-related tasks, allowing businesses to swiftly enter the Mexican market without needing to establish a local subsidiary.

Using an EOR in Mexico can be more economical than setting up a local entity, as it avoids the costs of incorporation and reduces ongoing administrative expenses.

Yes, a Mexican EOR manages the visa and work permit application process, ensuring full compliance with local immigration laws.

EOR services in Mexico are advantageous for companies of all sizes, particularly those seeking quick market entry, cost reductions, and less administrative burden.

EORs in Mexico have local professionals who stay up-to-date on legal changes, managing all compliance tasks to ensure your business operates within Mexican labor law requirements.

Though the Mexican EOR is the legal employer, you retain substantial authority over the day-to-day management and decision-making processes concerning your employees.

Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard

Singapore 018983DOWNLOAD THE INS Expansion Insights

DOWNLOAD THE PDF