- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

A resource-rich and economically evolving country, Chile offers a favorable business environment to companies looking to expand their horizons in South America. However, navigating its complex labor and tax regulations can be challenging. That’s why an Employer of Record (EOR) in Chile can be the best way to streamline your operations and ensure compliance with local laws without needing a local business entity.

Step 1 – In-Depth Planning & Assessment

Your collaboration with a Chilean EOR, like INS Global, begins with a comprehensive consultation to align with your business goals. This includes evaluating the number of employees required, their roles, and your timeline for expansion. The EOR customizes its services to meet your specific needs, ensuring a seamless integration process in Chile.

Step 2 – Effective Setup, Recruitment & Onboarding

Whether you’re forming a new team in Chile or relocating current employees, the EOR manages all legal and administrative obligations. This includes handling visas, work permits, payroll, contract management, and ensuring compliance with Chilean labor laws. Acting as your legal employer in Chile, the EOR eliminates the need to set up a local entity, saving both time and resources.

Step 3 – Ongoing HR Management & Compliance

Once your employees are operational in Chile, the EOR handles ongoing HR and payroll tasks. This includes processing salaries, managing employee benefits, and ensuring compliance with health insurance and social security regulations. The EOR serves as the HR link between you and your Chilean team, managing administrative duties and resolving employee issues, enabling you to focus on expanding your business with confidence.

A Chilean EOR allows your business to quickly enter the Chilean market without the need to establish a local entity, facilitating a faster and more efficient expansion.

The EOR ensures full compliance with Chilean labor laws, including regulations on taxes, employment contracts, and employee benefits, reducing the risk of legal complications.

The EOR assists in recruiting and managing local staff, giving you access to Chile’s skilled labor market while taking care of all employment-related requirements.

By partnering with a Chilean EOR, you can avoid the high costs associated with setting up and managing a local entity. The EOR handles payroll, benefits, and HR functions, enabling you to focus on core business activities.

A Chilean EOR provides the ability to scale your operations up or down based on market conditions without the long-term commitment of setting up a local entity, offering greater operational flexibility.

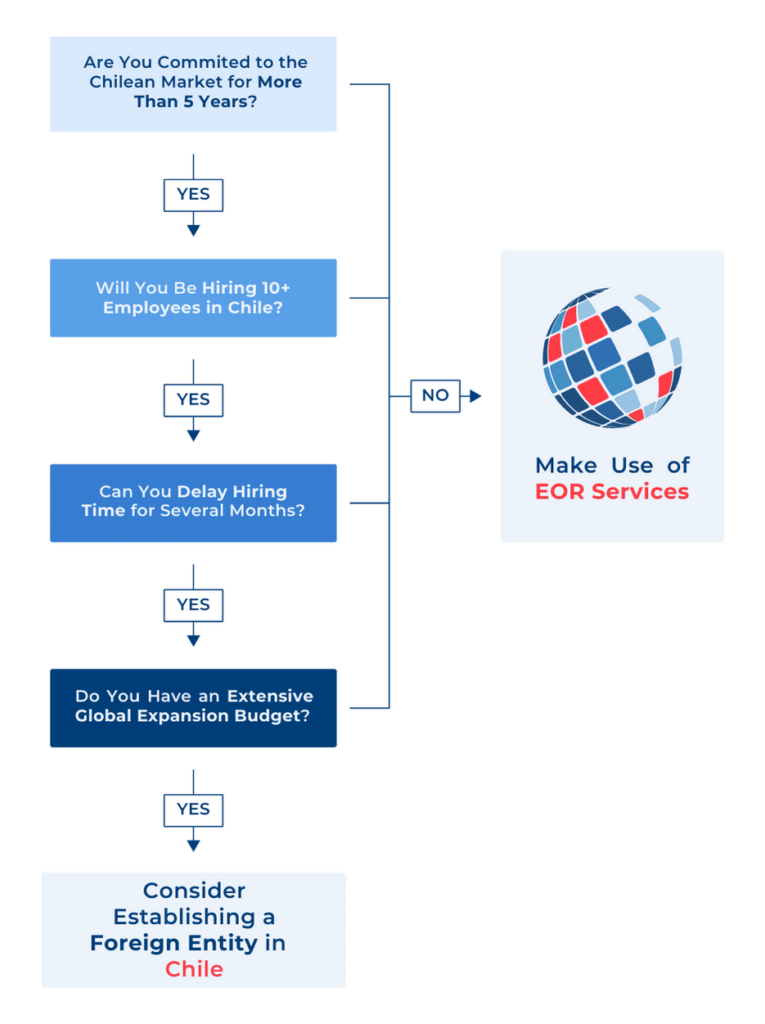

While establishing a subsidiary in Chile is a traditional approach to local expansion, partnering with an EOR presents several advantages:

Choosing the right EOR in Chile is critical for a smooth market entry. Consider these essential factors:

Navigating these complex issues is time-intensive and demands constant awareness of legal developments. Partnering with an EOR in Chile serves as your local legal partner, ensuring compliance with labor laws and mitigating potential risks.

An EOR in Chile takes care of all legal, HR, and compliance tasks involved in employing workers, allowing businesses to swiftly enter the Chilean market without establishing a local subsidiary

Using an EOR in Chile can be more cost-effective than setting up a local entity, as it avoids the costs associated with incorporation and reduces ongoing administrative expenses.

Yes, a Chilean EOR oversees the entire visa and work permit application process, ensuring compliance with local immigration laws and procedures.

EOR services in Chile are particularly beneficial for businesses of all sizes looking for rapid market entry, cost efficiency, and less administrative burden.

EORs in Chile have local experts who stay informed about regulatory changes and manage all compliance tasks to ensure adherence to local labor laws.

While the Chilean EOR is the legal employer, you maintain significant control over the day-to-day management and operational decisions regarding your employees.

Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard

Singapore 018983DOWNLOAD THE INS Expansion Insights

DOWNLOAD THE PDF