- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

We are your Employer of Record in Argentina. This country, with a rich history and diverse culture, offers a business environment full of opportunity for companies able to navigate its evolving economic environment. However, navigating its complex labor and tax regulations can be challenging. An Employer of Record (EOR) in Argentina can streamline your operations and ensure compliance with local laws.

Step 1: Thorough Planning and Needs Analysis

A thorough consultation to ascertain your business goals is the first step in working with an Employer of Record in Argentina, like INS Global. This entails assessing the quantity of workers, their positions, and your timetable for growing into Argentina. The Employer of Record then tailors its offerings to meet your unique needs, ensuring a seamless integration procedure.

Step 2: Streamlined Onboarding, Recruiting, and Setup

An Employer of Record takes care of all legal obligations, whether they are related to relocating current employees or starting a new team in Argentina. This entails overseeing payroll, contracts, work permits, visas, and complete adherence to Argentine labor regulations. The Employer of Record spares you the trouble and cost of setting up a local company by serving as your employer legally from the beginning in Argentina.

Step 3: Continual Management and Assurance of Compliance

An EOR oversees continuous payroll and HR operations after your staff members are working in Argentina. This covers processing salaries, overseeing benefits for staff members, and making sure social security and health insurance contributions are made on time. By managing administrative duties and resolving employee complaints, the Employer of Record serves as the HR point of contact between you and your Argentinean team, freeing you up to securely concentrate on business expansion.

An Employer of Record assists you in navigating Argentina’s complex labor and tax regulations. Employer of Record services guarantee compliance right away by streamlining the entire setup procedure.

Although Argentina’s regulations can be complex and onerous, Employer of Records are qualified to ensure that your company complies with local labor laws, social security obligations, and tax laws.

An Employer of Record, who serves as your official employer in Argentina, assures compliance with all legislation and reduces the risks related to employment laws.

For smaller teams or shorter-term projects in particular, Employer of Record services are frequently more cost-effective than establishing a local subsidiary. They assist you in avoiding one-time incorporation fees as well as continuous administrative duties such as employing internal HR personnel.

Your Employer of Record can handle HR duties like hiring, payroll processing, and tax administration, freeing you up to focus on your main business operations.

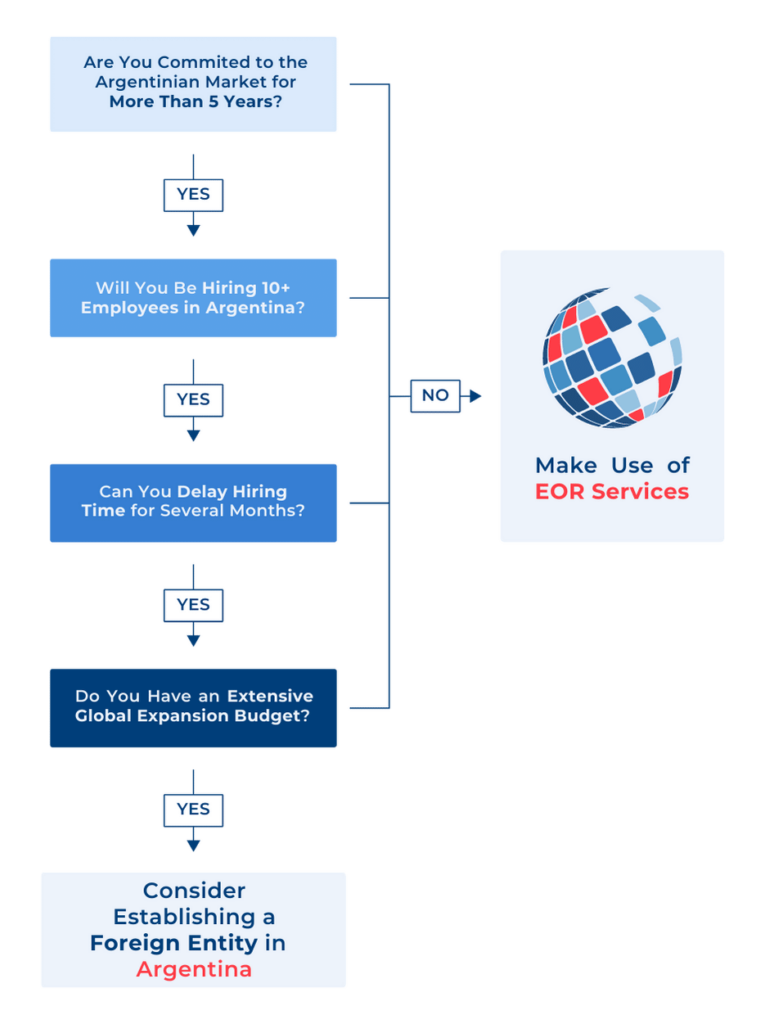

Although establishing a subsidiary in Argentina is a typical strategy for local expansion, there are a number of advantages to using an Employer of Record:

Selecting the appropriate Employer of Record in Argentina is essential for a fruitful market debut. Take into account these important factors:

Handling these complexities can be demanding and requires staying informed about legal updates. Partnering with an EOR in Argentina provides a local legal partner, ensuring that your business remains compliant with labor laws and reducing the risk of potential issues.

By taking care of all legal, HR, and compliance duties associated with hiring people overseas, an Employer of Record in Argentina enables companies to swiftly access the Argentinian market without having to set up a local corporation.

Due to the elimination of the initial formation charges and the reduction of ongoing administrative expenses, using an Employer of Record in Argentina may prove to be more economical than establishing a local subsidiary.

Yes, an Argentinean Employer of Record oversees the complete application procedure for visas and work permits, making sure that all local immigration laws and regulations are followed.

Businesses of all sizes can benefit from Argentinian Employer of Record services, but those looking for quick market access, financial savings, and less administrative work would particularly benefit.

Employer of Records in Argentina have local specialists who oversee all compliance matters and keep abreast of legislative modifications, guaranteeing your company complies with Argentine labor regulations.

Even if the Argentinian Employer of Record is the official employer, you still have a lot of power over day-to-day operations and management choices pertaining to your staff.

Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard

Singapore 018983DOWNLOAD THE INS Expansion Insights

DOWNLOAD THE PDF