Country Guide

Employer of Record in Canada (EOR in Canada)

Capital City

Canberra

Languages

English

Currency

Australian dollar ($, AUD)

Population Size

25,771,300

Employer Taxes

18.45%

Employee Costs

2%

Payroll Frequency

Monthly

Hire Globally, Pay Locally, Expand Effortlessly

Canada, a developed economy with a strong reputation for stability and quality of life, offers numerous opportunities for businesses looking to expand their operations in North America.

However, understanding its complex labor and tax regulations is crucial for successful operations. An Employer of Record (EOR) in Canada can provide the necessary expertise and support.

Want to have a Team in Canada TODAY?

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers

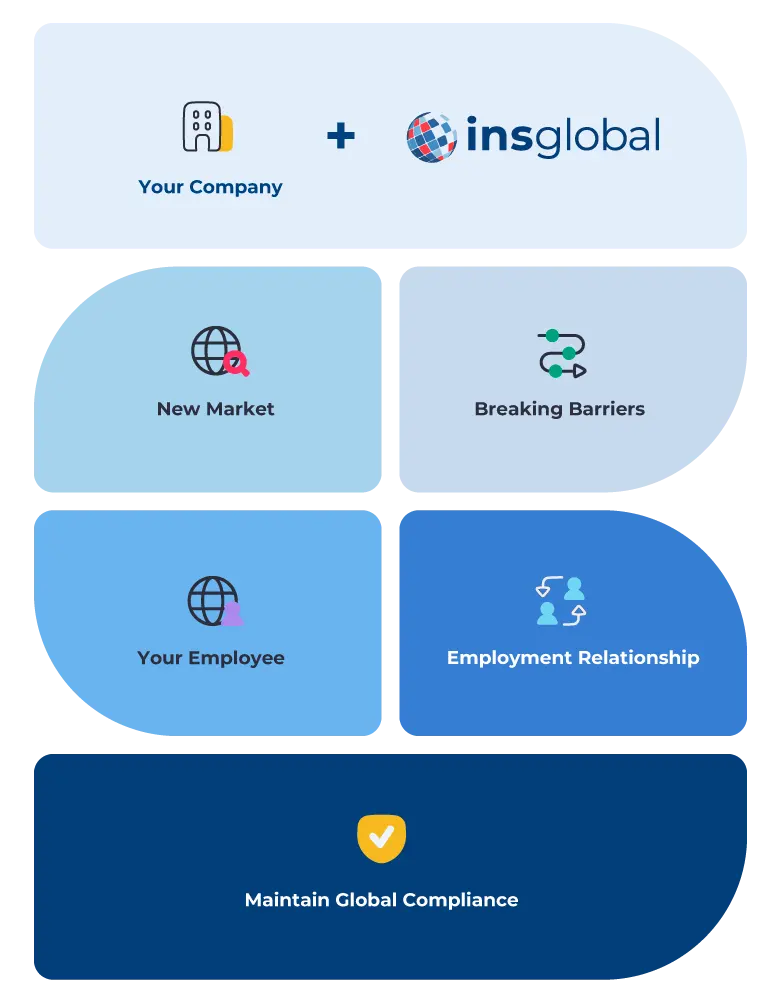

How an EOR in Canada Streamlines Your Expansion in 3 Steps

Step 1 – Thorough Planning & Assessment

Collaborating with a Canadian EOR like INS Global starts with a detailed consultation to understand your business objectives. This involves assessing the number of employees required, defining their roles, and establishing a timeline for your expansion. The EOR tailors its services to align with your specific needs, ensuring a smooth integration process in Canada.

Step 2 – Streamlined Setup, Recruitment & Onboarding

Whether you’re establishing a new team in Canada or relocating existing personnel, the EOR manages all legal and administrative requirements. This includes handling visas, work permits, payroll, contract management, and ensuring compliance with Canadian labor laws. Acting as your legal employer in Canada, the EOR eliminates the need for setting up a local entity, saving both time and money.

Step 3 – Ongoing HR Management & Compliance

Once your employees are active in Canada, the EOR takes care of ongoing HR and payroll responsibilities. This includes processing salaries, managing employee benefits, and ensuring health insurance and social security contributions compliance. The EOR serves as the HR intermediary between you and your Canadian team, handling administrative tasks and addressing employee concerns, allowing you to focus on business growth confidently.

- Cuts through red tape

- Reduces timelines

- Reduces costs

- Makes the most of local expertise

- Makes the most of local networks

PEO/EOR vs Company Incorporation

The Advantage in Figures

PEO/EOR

Company Incorporation

Price

80% Less Expensive

Market Entry

2-5 Days

6 Months

Benefits of Partnering with a Canadian EOR

Quick Market Penetration

Partnering with a Canadian EOR allows you to swiftly enter the Canadian market without the need to establish a local legal entity, accelerating your expansion efforts.

Compliance with Canadian Regulations

The EOR ensures your business operations in Canada adhere to local labor laws, including employment contracts, taxes, and employee benefits, mitigating legal risks.

Access to Canadian Talent

The EOR supports the recruitment and management of local employees, providing access to Canada’s diverse talent pool while handling all employment-related responsibilities.

Cost-Effective Expansion

A Canadian EOR helps you avoid the significant costs of setting up and maintaining a local entity. The EOR manages payroll, benefits, and HR tasks, allowing you to focus on scaling your business.

Operational Flexibility

A Canadian EOR offers the flexibility to adjust your operations as needed without the complexities and long-term commitment of establishing a local entity, making it easier to adapt to market conditions.

EOR vs. Company Incorporation in Canada: Making the Right Choice

While establishing a subsidiary in Canada is a well-known route for local expansion, using an EOR offers several distinct advantages:

1

Speed – With an EOR like INS Global, the setup process in Canada is significantly faster, allowing you to start operations and hire staff much quicker than traditional company incorporation, which can take months. An EOR can have your team operational within weeks or even days.

2

Compliance – Both EORs and subsidiaries must adhere to Canadian tax laws and labor regulations. EORs have the expertise to navigate these complexities and ensure ongoing compliance, reducing the risk of legal issues.

3

Cost – For smaller teams or temporary needs, EOR services are often more cost-effective than establishing a subsidiary, as they avoid the substantial upfront costs of incorporation and ongoing administrative expenses. For larger companies, EORs provide streamlined solutions that efficiently integrate new markets into multi-country payroll systems.

4

Control – While incorporating provides full control over HR, finances, and operations, EORs offer similar control over your workforce while reducing administrative responsibilities and liability.

Key Considerations for Choosing the Ideal Employer of Record in Canada

Choosing the right EOR in Canada is essential for successful market entry. Consider these crucial factors:

- Professional Expertise and Industry Standing – Search for a Canadian EOR with proven experience and a solid industry standing, like INS Global. Client reviews and industry accolades are good indicators of their reliability.

- Full-Service Capabilities – Ensure the EOR provides all necessary services or can customize their offerings to suit your needs, including visa and work permit support, payroll processing, tax compliance, and navigating Canada’s labor regulations.

- Service Scalability – Opt for an EOR that can expand its services as your business grows. Their team should be capable of managing an increasing workforce and evolving business requirements.

- Transparent Communication and Consistency – Choose an EOR known for clear and consistent communication. They should keep you well-informed about regulatory updates, upcoming deadlines, and potential issues, offering a dedicated point of contact and online tools for easy access to critical information.

- Fair and Transparent Costs – Review the pricing models of different EORs. Ensure their fees are clear, competitive, and free of hidden charges. Third-party advice can help you obtain the best value for your EOR in Canada.

INS GUIDES

Check Our Canada Labor Law Guide

Canada Labor Law Overview

Navigating these complexities can be time-consuming and requires staying updated on legal changes. Partnering with an EOR in Canada acts as your local legal partner, ensuring your business remains compliant with labor laws and protects you from potential risks.

Working Hours

Standard working hours in Canada are usually 8 hours per day and 40 hours per week, with overtime paid at 1.5 times the regular rate. Regulations can vary by province and industry, with about 17% of Canadian workers regularly working overtime, particularly in sectors like healthcare and finance. Flexible working arrangements are becoming more common to support work-life balance.

Types Of Leave

Holidays and Annual Leave

Canadian labor law ensures employees are entitled to paid leave, including vacation, statutory holidays, and sick leave. Most employees start with two weeks of vacation after one year of work, with some provinces offering more.

Sick Leave

Sick leave and statutory holiday entitlements vary by province, with federally regulated workers entitled to up to 10 paid sick days annually. On average, Canadians take 7.4 sick days per year.

Contact Us Today

Discover More Solutions in Canada

Employer of Record (EOR) in Australia

View Details

Employer of Record (EOR) in Australia

View Details

solutions

Frequently Asked Questions

faqs

An EOR in Canada takes charge of all necessary legal, HR, and compliance work, enabling businesses to quickly enter the Canadian market without setting up a local entity.

Opting for an EOR in Canada is often more cost-effective than establishing a local subsidiary, as it eliminates the need for incorporation and reduces ongoing administrative expenses.

Yes, a Canadian EOR oversees the visa and work permit application process, ensuring compliance with local immigration laws and procedures.

Businesses of all sizes, particularly those seeking swift market entry, cost savings, and reduced administrative burdens, benefit from EOR services in Canada.

EORs in Canada employ local experts who stay informed about legal changes, managing all compliance-related tasks to ensure adherence to Canadian labor laws.

Although the Canadian EOR is the legal employer, you retain substantial control over daily management and strategic decisions related to your employees.

A Global Employer of Record is an effective solutions for companies like yours that are looking to expand a workforce abroad effortlessly.

This approach allows you to outsource the international hiring process quickly and efficiency, providing access to a global talent pool while still managing payroll compliance in each country.