Country Guide

Employer of Record in the US (EOR in the US)

Capital City

Languages

Currency

Population Size

Employer Taxes

Employee Costs

Payroll Frequency

Hire Globally, Pay Locally, Expand Effortlessly

The United States, a global economic powerhouse with a diverse industrial base and a highly skilled workforce, offers vast opportunities for international businesses. However, navigating the complexities of the US regulatory environment, including labor laws and tax regulations, can be challenging. An Employer of Record (EOR) in the US can simplify this process by serving as your local partner, facilitating smooth market entry, and ensuring ongoing compliance with all necessary regulations.

Want to have a Team in the US TODAY?

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers

EOR vs. Company Incorporation in the US: Making the Right Choice

While establishing a subsidiary in the United States is a traditional approach to local expansion, using an EOR offers several benefits:

- Speed – With an EOR like INS Global, the setup process in the US is significantly faster, allowing you to start operations and hire staff much quicker than traditional company incorporation, which can take several months. An EOR can have your team operational within weeks or even days.

- Compliance – Both EORs and subsidiaries must adhere to US tax laws and labor regulations. EORs already have the expertise to manage these complexities and ensure ongoing compliance, reducing the risk of legal issues.

- Cost – For smaller teams or temporary projects, EOR services are often more cost-effective than establishing a subsidiary, as they avoid the significant upfront incorporation expenses and ongoing administrative costs. For larger companies, EORs offer streamlined solutions that integrate new markets into multi-country payroll systems efficiently.

- Control – While incorporation gives you full control over HR, finances, and operations, EORs provide similar control over your workforce while alleviating administrative burdens and reducing liability.

PEO/EOR vs Company Incorporation

The Advantage in Figures

PEO/EOR

Company Incorporation

Price

80% Less Expensive

Market Entry

2-5 Days

6 Months

Benefits of Partnering with an US EOR

Simplified Market Entry

Partnering with a US EOR allows you to quickly and efficiently enter the American market without the need to establish a local entity. This speeds up your expansion and reduces administrative overhead.

Legal Compliance

A US EOR ensures your business adheres to all federal and state labor laws, including complex regulations around taxes, employment contracts, and employee benefits, reducing the risk of legal issues.

Access to Local Talent

The EOR assists in recruiting and managing a local workforce, helping you attract top talent in the US market while managing all related employment matters.

Cost-Effective Operations

By using an EOR, you save on the significant costs associated with setting up a subsidiary in the United States. The EOR handles all payroll, benefits, and HR responsibilities, allowing you to focus on growing your business.

Flexibility and Scalability

An EOR provides the flexibility to scale your operations up or down without the long-term commitment of establishing a local entity, making it easier to adapt to changing business needs.

Simplify Expansion in 3 Steps with an Employer of Record in the US

1

Detailed Planning & Assessment

Your partnership with a US EOR, such as INS Global, begins with a thorough consultation to understand your business objectives. This includes assessing the number of employees required, defining their roles, and setting a timeline for expansion. The EOR then tailors its services to meet your unique needs, ensuring a smooth integration process into the US market.

2

Streamlined Setup, Recruitment & Onboarding

Whether you’re establishing a new team in the United States or transferring existing staff, the EOR manages all legal and administrative requirements. This covers visas, work permits, payroll, contract management, and compliance with US labor laws. Acting as your legal employer in the US from the start, the EOR removes the need for you to create a local entity, saving significant time and resources.

3

Continuous HR Management & Compliance

Once your employees are operational in the United States, the EOR takes care of ongoing HR and payroll responsibilities. This includes processing salaries, managing employee benefits, and ensuring adherence to health insurance and social security regulations. The EOR acts as the HR link between you and your US team, managing administrative duties and resolving employee issues, allowing you to focus on scaling your business with confidence.

Critical Factors for Choosing the Ideal Employer of Record in the US

Selecting the right EOR in the United States is key to a successful market entry. Keep these important factors in mind:

- Expertise and Credibility – Search for a US EOR with a well-established track record and solid industry credibility, such as INS Global. Client reviews and industry awards can be strong indicators of dependability.

- Comprehensive Service Range – Verify that the EOR provides all necessary services or can customize their offerings to your specific needs, including visa and work permit assistance, payroll management, tax compliance, and navigating US labor laws.

- Ability to Scale to Your Needs – Choose an EOR that can expand its services in line with your business growth. Their team should be equipped to manage an expanding workforce and adapt to evolving business demands.

- Consistent Communication and Openness – Opt for an EOR recognized for its transparent and regular communication. They should keep you updated on regulatory changes, important deadlines, and potential issues, offering a dedicated contact and online tools for easy access to vital information.

- Fair and Transparent Pricing – Evaluate the cost structures of various EOR providers. Ensure their pricing is clear, competitive, and free of hidden charges. Independent advice can help you secure the best value for your EOR in the US.

INS GUIDES

Browse Our US State-Specific Labor Law Guides

Understand how labor laws impact employers and employees across different states with our comprehensive, state-specific guides.

US Labor Law

Employment Contracts In the US

In the US, employment contracts are not mandatory for most workers, as employment is generally “at-will,” meaning either the employer or employee can terminate the relationship at any time without cause. However, contracts are common in certain professions, such as executive roles or unionized positions, where they outline terms like salary, benefits, and job duties. These contracts must comply with federal and state laws, such as the Fair Labor Standards Act (FLSA). Disputes over contract terms, especially regarding termination and non-compete clauses, are frequent, with the US seeing an increase in employment-related litigation, particularly around issues of wrongful termination.

Probationary Periods In the US

In the US, probationary periods are used by employers to evaluate new hires, typically lasting between 30 to 90 days. During this time, employees may not be eligible for certain benefits, and termination is easier and often without the full procedural protections provided to permanent employees. However, even during probation, employees are protected under federal laws against discrimination and wrongful termination. The use of probationary periods is common, especially in industries with high turnover or positions requiring specific skill sets.

Working Hours

Standard working hours in the US are 40 hours per week, with the FLSA mandating overtime pay at 1.5 times the regular rate for any hours worked over 40 in a week. Certain exemptions apply, especially for salaried employees in executive, administrative, or professional roles. According to the US Bureau of Labor Statistics, around 25% of American workers report regularly working overtime. The trend towards remote and flexible work arrangements has also increased, with nearly 25% of the US workforce engaging in some form of remote work as of 2023.

Paid Leave

The US does not have a federal mandate for paid leave, making it unique among developed countries. However, the Family and Medical Leave Act (FMLA) requires employers with 50 or more employees to provide up to 12 weeks of unpaid leave for certain family and medical reasons. Some states, such as California and New York, have implemented paid leave programs, offering partial wage replacement during leave. Despite this, only about 25% of private-sector workers in the US have access to paid family leave, and around 77% have access to paid sick leave, according to 2022 data.

Social Insurance

Social insurance in the US primarily consists of Social Security and Medicare, funded through payroll taxes under the Federal Insurance Contributions Act (FICA). As of 2023, employees and employers each contribute 6.2% of earnings to Social Security and 1.45% to Medicare, with high earners paying an additional Medicare surtax. Social Security provides retirement, disability, and survivor benefits to about 66 million Americans, while Medicare offers health coverage to individuals aged 65 and older and to some younger people with disabilities.

Severance Pay

Severance pay in the US is not mandated by federal law but is often offered as part of employment contracts or company policies. When provided, it typically amounts to one to two weeks’ pay for each year of service, though this can vary widely. Severance agreements often include conditions like non-disclosure or non-compete clauses. In 2022, about 40% of US employers offered severance packages, particularly in industries undergoing downsizing or restructuring, such as technology and finance.

Dealing with these complexities can be labor-intensive and requires constant monitoring of legal updates. By collaborating with an EOR in the United States, you gain a local legal partner who ensures your business stays compliant with labor regulations, safeguarding you from potential risks.

Contact Us Today

Frequently Asked Questions

faqs

A U.S.-based EOR takes charge of all legal, HR, and compliance-related duties, enabling businesses to quickly enter the US market without needing to establish a local branch.

Opting for an EOR in the US can be a more budget-friendly option compared to setting up a local entity, as it eliminates the initial setup costs and cuts down on ongoing administrative expenses.

Indeed, a US EOR manages the entire visa and work permit application process, ensuring compliance with US immigration laws and requirements.

Businesses of various sizes, particularly those aiming for rapid market entry with minimized costs and administrative tasks, benefit significantly from EOR services in the US.

U.S. EORs employ local experts who are always informed of the latest regulatory updates, ensuring your business remains compliant with US labor laws.

Although the US EOR is the legal employer, you retain full control over the daily management and operational decisions concerning your workforce.

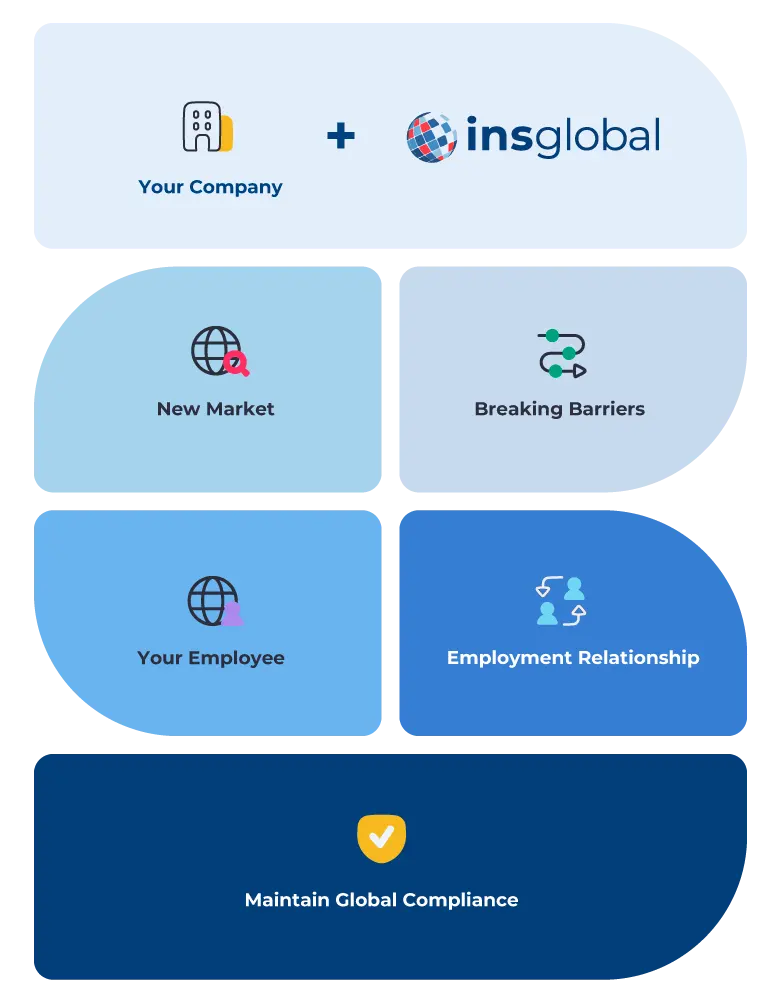

A Global Employer of Record is an effective solutions for companies like yours that are looking to expand a workforce abroad effortlessly.

This approach allows you to outsource the international hiring process quickly and efficiency, providing access to a global talent pool while still managing payroll compliance in each country.