- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

We are your Employer of Record in Colombia. This country experiencing significant economic growth, presents attractive opportunities for businesses looking to invest in South America. However, understanding its complex labor and tax laws is crucial for successful operations. An Employer of Record (EOR) in Colombia can provide the necessary expertise and support.

Step 1 – Comprehensive Planning & Assessment

Your partnership with a Colombian Employer of Record, such as INS Global, starts with a thorough consultation to understand your business objectives. This involves determining the workforce needed, defining their roles, and setting a timeline for expansion. The Employer of Record tailors its services to meet your unique needs, ensuring a smooth integration process in Colombia.

Step 2 – Streamlined Setup, Recruitment & Onboarding

Whether you’re forming a new team in Colombia or relocating existing staff, the Employer of Record handles all legal and regulatory requirements. This includes managing visas, work permits, payroll, contract administration, and ensuring compliance with Colombian labor laws. As your legal employer in Colombia, Employer of Records remove the need to establish a local entity, saving both time and money.

Step 3 – Continuous HR Management & Compliance

Once your employees are active in Colombia, the Employer of Record manages ongoing HR and payroll functions. This includes salary processing, managing employee benefits, and ensuring compliance with health insurance and social security contributions. The Employer of Record acts as the HR intermediary between you and your Colombian team, handling administrative tasks and addressing employee concerns so you can focus on growing your business confidently.

A Colombian Employer of Record allows you to rapidly enter the Colombian market without the need to establish a local legal entity, facilitating a quicker expansion process.

The Employer of Record ensures your business adheres to Colombia’s labor laws, including those related to employment contracts, taxes, and employee benefits, minimizing the risk of legal issues.

The Employer of Record aids in recruiting and managing local employees, providing access to top talent in Colombia while handling all employment-related matters.

Partnering with a Colombian Employer of Record helps you avoid the expenses associated with setting up and operating a local entity. The Employer of Record manages payroll, benefits, and HR tasks, allowing you to allocate resources to growth initiatives.

A Colombian Employer of Record provides the flexibility to scale your business operations as needed without the complexities of establishing a permanent local entity, offering greater adaptability to market changes.

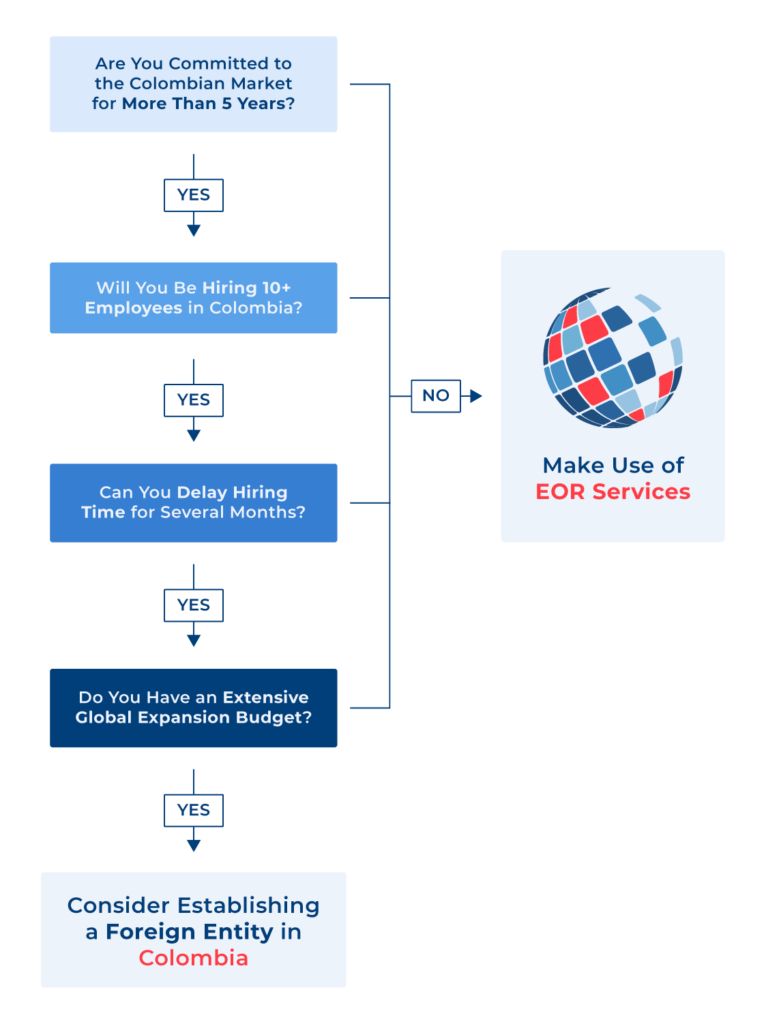

While establishing a subsidiary in Colombia is a traditional method for local expansion, using an Employer of Record offers several key benefits:

Selecting the right Employer of Record in Colombia is crucial for successful market entry. Keep these key factors in mind:

Managing these challenges can consume a lot of time and requires keeping up with legal changes. Partnering with an Employer of Record in Colombia provides a local legal partner who ensures your business stays compliant with labor laws and protects you from any potential risks.

An Employer of Record in Colombia takes charge of all the necessary legal, HR, and compliance tasks, enabling businesses to quickly enter the Colombian market without establishing a local entity.

Using an Employer of Record in Colombia is often more cost-effective than setting up a local subsidiary, as it eliminates the need for incorporation and reduces ongoing administrative expenses.

Yes, a Colombian Employer of Record handles the entire visa and work permit application process, ensuring compliance with local immigration laws and requirements.

Employer of Record services in Colombia are advantageous for companies of all sizes, especially those seeking rapid market entry, cost reductions, and decreased administrative burdens.

Employer of Records in Colombia employ local experts who stay updated on regulatory changes, ensuring your business adheres to Colombian labor laws and regulations.

Although the Colombian Employer of Record is the legal employer, you retain considerable control over day-to-day management and operational decisions regarding your employees.

Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard

Singapore 018983DOWNLOAD THE INS Expansion Insights

DOWNLOAD THE PDF