- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

Partnering with an EOR in Greece, such as INS Global, starts with a thorough analysis of your business plans. This includes determining the number of employees, their roles, and your intended timeline for entering the Greek market. The EOR customizes its services to fit your business needs, ensuring a streamlined market entry.

Whether establishing a new team in Greece or relocating existing staff, an EOR handles all necessary legal procedures. This includes processing visas, work permits, payroll, and contract management, ensuring compliance with Greek labor laws. Acting as your legal employer in Greece, the EOR simplifies the complexities and costs associated with setting up a local entity.

Once your operations are underway in Greece, an EOR takes care of ongoing HR and payroll functions. This includes salary processing, managing employee benefits, and ensuring compliance with health insurance and social security contributions. The EOR acts as the HR contact between you and your Greek team, addressing administrative tasks and employee concerns, allowing you to focus on business development.

An EOR in Greece simplifies your market entry by effectively managing tax systems and labor laws, ensuring compliance from the beginning.

The regulatory landscape in Greece can be complex, but EORs are skilled in keeping your business aligned with local tax laws, labor regulations, and social security standards.

As your legal employer in Greece, an EOR helps mitigate risks tied to employment laws, ensuring your business remains fully compliant and safeguarded.

By outsourcing HR tasks such as recruitment, payroll processing, and tax management to an EOR in Greece, you can dedicate your energy to core business activities and strategic growth.

EOR services in Greece offer a cost-effective alternative to setting up a local subsidiary, especially for smaller teams or short-term projects, helping you avoid the financial burden of incorporation and continuous administrative tasks.

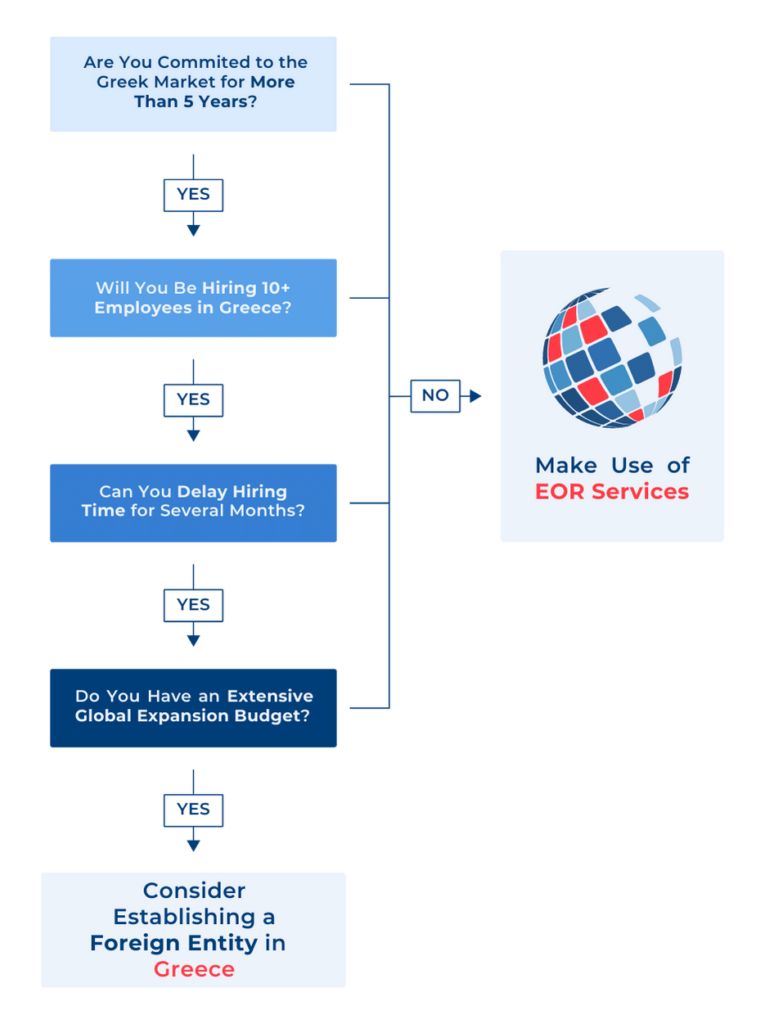

While establishing a subsidiary in Greece is an option, opting for an EOR provides several advantages:

Selecting the right EOR in Greece is essential for a smooth market entry. Consider these 5 important factors:

An EOR provides a streamlined entry into the Greek market by managing compliance with local labor laws and tax regulations, allowing your business to quickly hire and operate without establishing a local entity.

Using an EOR can be faster and more cost-effective than setting up a subsidiary, allowing you to hire and manage staff without the overhead costs and complexities of a local setup.

An EOR ensures that employment contracts comply with Greek labor laws, clearly outlining salary, benefits, working hours, and termination conditions to protect your business from legal issues.

Yes, an EOR can manage visas and work permits for expatriates, ensuring compliance with Greek immigration laws and facilitating a smooth transition for international staff.

An EOR administers employee benefits in accordance with Greek regulations, covering health insurance, social security, and other entitlements, ensuring compliance and employee satisfaction.

An EOR provides support in resolving labor disputes, offering expertise in Greek employment laws to ensure that disputes are managed legally and effectively.

Yes, an EOR handles payroll processing, ensuring accurate payment of salaries, tax withholdings, and social contributions in line with Greek regulations.

An EOR ensures that employee terminations comply with Greek labor laws, providing guidance on notice periods and severance pay to minimize legal risks for your business.

Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard

Singapore 018983DOWNLOAD THE INS Expansion Insights

DOWNLOAD THE PDF