- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

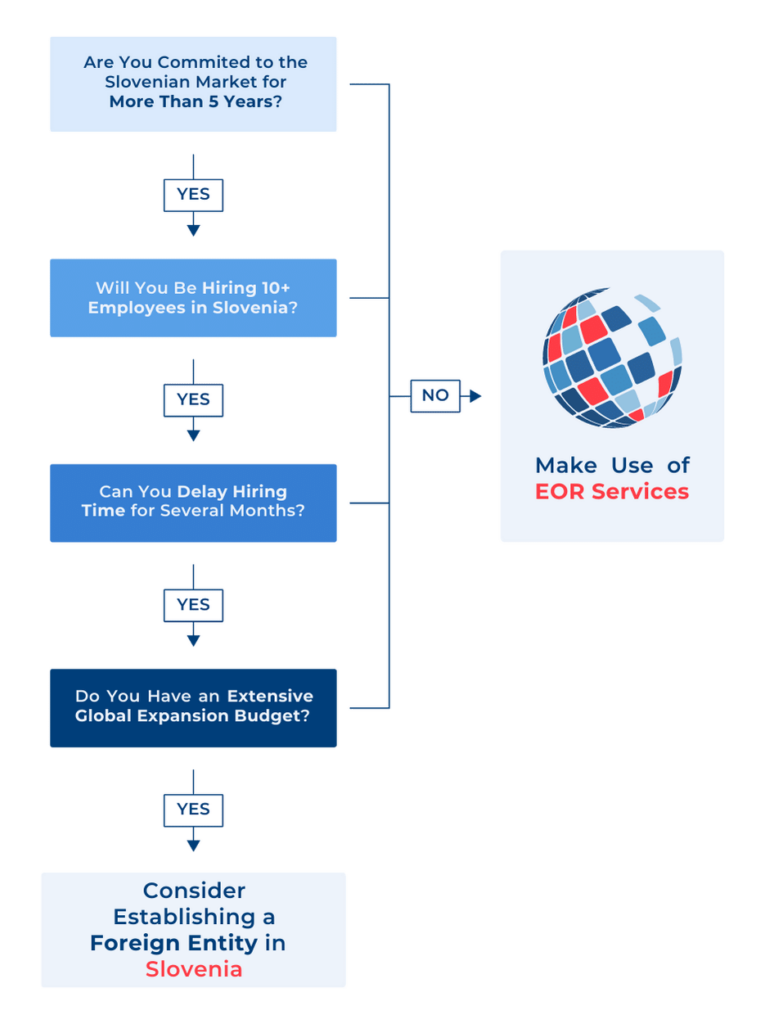

Slovenia, a highly developed nation in Central Europe, offers excellent business opportunities due to its strategic location, skilled workforce, and pro-business environment. As a member of the EU, Slovenia provides access to a large market while maintaining competitive labor costs. However, expanding into the Slovenian market requires navigating local labor laws, tax regulations, and ensuring full compliance with employment legislation. Using an Employer of Record (EOR) in Slovenia simplifies the process, allowing businesses to hire local employees without establishing a legal entity.

This guide will show how EOR services can help your business grow in Slovenia while remaining compliant with local regulations.

The process of working with an EOR in Slovenia begins with a detailed assessment of your business goals and workforce needs. This includes evaluating the number of employees, their roles, and the timeline for entering the Slovenian market. The EOR tailors its services to meet your specific needs, ensuring a smooth market entry while complying with local regulations.

Once your plan is in place, the EOR handles the recruitment, onboarding, and compliance processes. This includes managing work permits, visa processing, payroll setup, and ensuring that employment contracts comply with Slovenian labor laws. The EOR acts as your legal employer, ensuring that all employees are hired legally, without the need for your company to set up a legal entity in Slovenia.

After your operations are set up, the EOR manages all ongoing HR tasks, including payroll processing, benefits administration, and tax compliance. The EOR ensures that your business complies with Slovenian social security contributions and health insurance requirements, acting as a bridge between your company and your local team. This allows you to focus on growing your business while the EOR takes care of all local employment regulations.

Navigating Slovenian tax laws and labor regulations can be challenging, but an EOR simplifies the process by managing these complexities from the start, allowing your business to enter the market quickly and efficiently.

With its detailed labor laws and regulatory framework, Slovenia requires in-depth local knowledge to ensure compliance. An EOR ensures that your business follows all employment laws, social security contributions, and tax requirements, reducing the risk of non-compliance.

By acting as your legal employer in Slovenia, the EOR takes on the risks associated with local employment regulations. The EOR manages employment contracts, payroll, and employee benefits, ensuring compliance with Slovenian labor laws and reducing legal exposure for your business.

An EOR offers a cost-effective solution for entering the Slovenian market. By outsourcing administrative tasks to the EOR, your company can avoid the significant costs associated with setting up a local entity, making it an ideal solution for temporary or project-based expansion.

Outsourcing HR tasks such as recruitment, payroll, and tax management to an EOR allows your company to focus on its core business activities and growth strategies, without the administrative burden of local employment laws.

Establishing a subsidiary in Slovenia may be a helpful option for some, but an EOR offers several immediate and distinct advantages:

An EOR in Slovenia allows for a much quicker entry into the market. Setting up a legal entity can take several months, while an EOR can have your team operational within weeks, providing a faster market entry.

Both EORs and subsidiaries must comply with Slovenian labor laws and tax regulations, but an EOR brings local expertise to ensure your business remains fully compliant, reducing the need for in-house legal or HR staff.

For small or medium-sized teams or temporary projects, an EOR in Slovenia is typically a cost-efficient solution. An EOR eliminates the need for up-front incorporation costs and reduces ongoing administrative expenses, making it easier for businesses to expand into Slovenia.

While incorporating a company in Slovenia gives you full control over your HR and operational processes, partnering with an EOR still gives you significant control over your local workforce without the administrative burden of establishing a local legal entity.

When selecting an EOR in Slovenia, it’s important to choose one with a strong track record. Look for an EOR with experience in your industry and the Slovenian market, with a proven ability to handle clients’ local employment needs successfully.

Ensure that the EOR offers a full suite of services, including payroll processing, tax compliance, and management of Slovenian labor regulations. The EOR should also be able to customize services to fit your specific business needs.

Your EOR in Slovenia should have the ability to scale its services to match the growth of your business. Whether you’re starting with a small team or expanding rapidly, the EOR should be flexible enough to accommodate your evolving needs.

Communication is key to a successful partnership. Choose an EOR that offers regular updates on regulatory changes, upcoming deadlines, and any potential challenges that may affect your business. Having a dedicated point of contact is essential for clear and efficient communication.

Compare pricing structures from different EOR providers in Slovenia to ensure transparency and competitive costs. Make sure there are no hidden fees, and that the pricing model aligns with your budget and long-term objectives.

Employment contracts in Slovenia must comply with local labor laws and outline all essential terms, including salary, working hours, benefits, and termination clauses. An EOR ensures that contracts meet Slovenian labor standards while protecting both your business and employee rights.

Probationary periods in Slovenia generally last up to 6 months, allowing employers and employees to evaluate fit. An EOR ensures that these probationary periods comply with local labor laws and align with your business goals.

The standard workweek in Slovenia is 40 hours, and employees are entitled to rest periods and overtime compensation. Overtime must be compensated either with extra pay or additional time off. An EOR helps manage working hours and ensures compliance with Slovenian labor regulations.

Employees in Slovenia are entitled to at least 20 days of paid annual leave, as well as paid leave for public holidays, maternity/paternity leave, and sick leave. An EOR manages these entitlements, ensuring compliance with Slovenian labor laws and proper employee compensation.

Employers and employees in Slovenia are required to contribute to the social security system, which includes health insurance, pensions, and other benefits. An EOR manages these contributions and ensures compliance with Slovenian social security laws.

Severance pay is required under certain circumstances in Slovenia, particularly in cases of redundancy or dismissal without cause. An EOR ensures compliance with local termination laws and manages severance pay obligations in accordance with Slovenian regulations.

An EOR in Slovenia manages all aspects of recruitment, from sourcing candidates and drafting compliant contracts to onboarding employees in full accordance with Slovenian labor laws.

An EOR allows businesses to avoid the high costs associated with establishing a local entity in Slovenia, such as incorporation fees and administrative overheads. The EOR manages payroll and HR processes at a fraction of the cost, making it an ideal solution for small and medium-sized enterprises.

An EOR in Slovenia ensures compliance by managing all employment-related processes through a team of local labor experts. This includes all necessary services including payroll, social security contributions, and tax filings, ensuring your business operates within local legal frameworks.

Yes, an EOR can manage the application process for work permits and visas for expatriates, ensuring compliance with Slovenian immigration laws and facilitating a smooth hiring process.

With an EOR, businesses can typically start hiring within a few weeks. The EOR handles all legal, administrative, and compliance tasks, enabling rapid market entry.

Industries such as technology, manufacturing, pharmaceuticals, and logistics benefit greatly from using EOR services in Slovenia, allowing them to expand quickly and efficiently.

An EOR manages payroll, including calculating salaries, taxes, and social security contributions, ensuring that employees are paid on time and in full compliance with Slovenian labor laws.

Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard

Singapore 018983DOWNLOAD THE INS Expansion Insights

DOWNLOAD THE PDF