- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

Sweden, with its innovative economy and strategic location in Northern Europe, presents significant potential for companies aiming to grow their international presence. However, expanding into the Swedish market requires careful navigation of the country’s detailed labor laws and tax regulations. Partnering with an Employer of Record (EOR) in Sweden can simplify this process by serving as your local expert, ensuring a seamless market entry and continuous compliance with all relevant legal standards.

Collaborating with an EOR in Sweden, such as INS Global, starts with an in-depth analysis of your business goals. This involves evaluating the number of employees, their roles, and your timeline for entering the Swedish market. The EOR customizes its services to meet your specific needs, ensuring a streamlined entry into Sweden.

When establishing a new team in Sweden or transferring existing staff, an EOR manages all the essential legal requirements. This includes processing visas, work permits, payroll, and contract management, ensuring adherence to Swedish labor laws. Acting as your legal employer in Sweden, the EOR reduces the complexities and expenses involved in setting up a local entity.

Once your operations are active in Sweden, an EOR provides ongoing HR and payroll management. This encompasses salary processing, overseeing employee benefits, and ensuring compliance with health insurance and social security contributions. The EOR functions as the HR point of contact between you and your Swedish team, handling administrative duties and employee-related issues, freeing you to focus on business development.

An EOR in Sweden facilitates a smooth market entry by efficiently handling tax obligations and labor laws, ensuring your compliance from the start.

Navigating Sweden’s regulatory framework can be complex, but EORs are well-versed in ensuring your business adheres to local tax laws, labor regulations, and social security requirements.

As your legal employer in Sweden, an EOR reduces the risks associated with local employment laws, ensuring your business stays compliant and protected from potential legal issues.

EOR services in Sweden offer a financially efficient alternative to setting up a local entity, especially for smaller teams or temporary projects, helping you avoid the high costs of incorporation and ongoing administrative responsibilities.

Outsourcing HR responsibilities, including recruitment, payroll processing, and tax management, to an EOR allows you to concentrate on your core business objectives and pursue strategic growth.

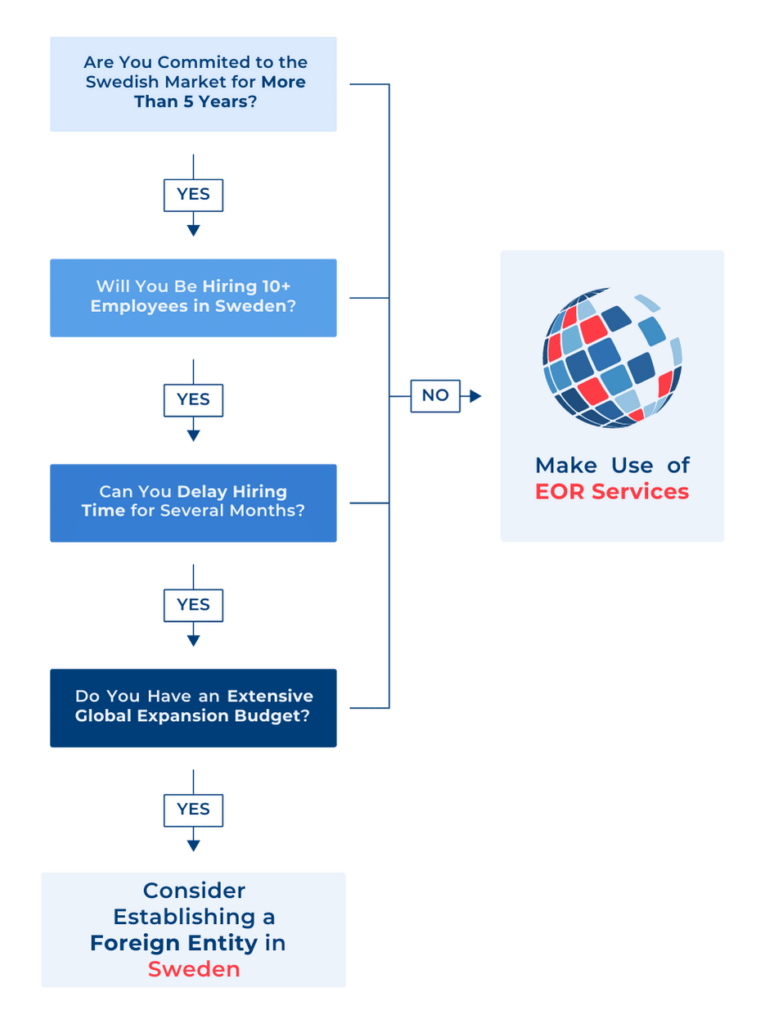

While forming a subsidiary in Sweden is one option, opting for an EOR presents several benefits:

Choosing the right EOR in Sweden is vital for smooth market entry. Consider these 5 important factors:

Navigating Sweden’s labor laws requires careful attention to detail, especially given the country’s strong worker protection regulations. Partnering with an EOR in Sweden ensures that your business remains fully compliant with all labor laws, protecting you from potential legal challenges and allowing you to concentrate on your core business activities.

An EOR ensures that your business adheres to the Swedish Employment Protection Act (LAS), which governs employee rights, including job security, notice periods, and fair termination practices. They handle the legal complexities, keeping your business compliant.

Yes, an EOR in Sweden manages the administration of parental leave, which includes up to 480 days of leave per child. They ensure that all legal requirements are met and that employees receive the appropriate compensation during their leave.

An EOR facilitates recruitment and onboarding by managing the legal requirements for employment contracts, work permits (if necessary), and compliance with Swedish labor regulations. They streamline the process, ensuring a smooth start for new hires.

An EOR helps navigate the complexities of collective agreements, which are common in Sweden and often provide additional rights to employees beyond statutory requirements. They ensure that your business complies with these agreements and integrates them into employment contracts.

An EOR handles contributions to Sweden’s occupational pension schemes (such as ITP), ensuring that both employer and employee contributions are accurately calculated and processed in line with legal requirements.

Yes, an EOR manages the scheduling and compensation of public holidays and the mandatory 25 days of annual leave in Sweden, ensuring that your business adheres to local regulations and that employees receive their full entitlements.

An EOR in Sweden manages the application process for work permits and residence permits for non-EU employees, ensuring compliance with Swedish immigration laws and facilitating a smooth transition for international hires.

Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard

Singapore 018983DOWNLOAD THE INS Expansion Insights

DOWNLOAD THE PDF