- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

The United Kingdom, with its dynamic economy and strategic position in global trade, offers immense opportunities for international businesses. However, entering the UK market involves navigating complex labor laws and tax regulations. An Employer of Record (EOR) in the United Kingdom can simplify this process, acting as your local partner to ensure effortless market entry and ongoing compliance with all necessary regulations.

Partnering with an EOR in the UK, such as INS Global, starts with a detailed assessment of your business objectives. This includes understanding the number of employees, their roles, and your timeline for expanding into the UK. The EOR then tailors its services to meet your specific requirements, ensuring a seamless integration into the market.

Whether you are forming a new team in the UK or transferring existing staff, an EOR handles all necessary legal processes. This includes managing visas, work permits, payroll, and contract management, ensuring full compliance with UK labor laws. Acting as your legal employer in the UK, the EOR saves you the time and expense of setting up a local entity.

Once your employees are operational in the UK, an EOR manages ongoing HR and payroll functions. This includes salary processing, managing employee benefits, and ensuring compliance with health insurance and social security contributions. The EOR acts as the HR liaison between you and your UK team, handling administrative tasks and addressing employee concerns, allowing you to focus on business growth.

An EOR simplifies the complexities of entering the UK market by managing intricate tax systems and labor laws, ensuring compliance from the start.

Navigating the UK’s regulatory environment can be demanding, but EORs have the expertise to ensure your business complies with local tax laws, labor regulations, and social security contributions.

As your legal employer in the UK, an EOR mitigates the risks associated with employment regulations, ensuring full compliance.

EOR services are typically more cost-effective than setting up a local subsidiary, especially for smaller teams or temporary projects, helping you avoid initial incorporation costs and ongoing administrative burdens.

Outsourcing repeated HR tasks such as recruitment, payroll processing, and tax management to your UK EOR means you can concentrate on your core business activities.

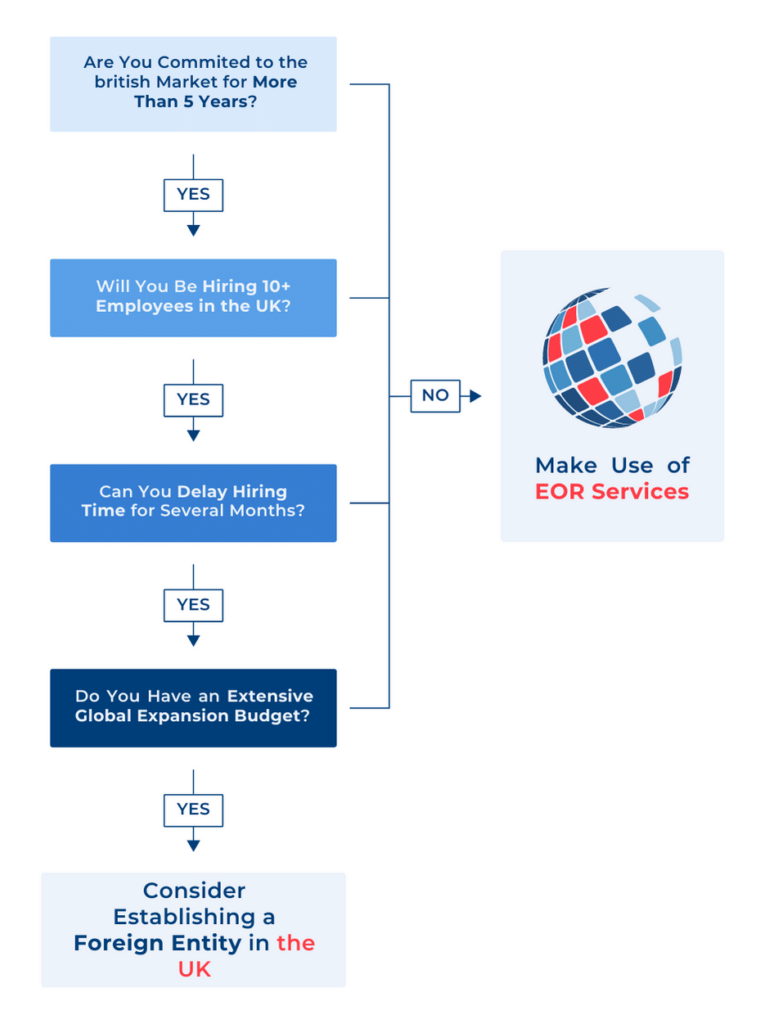

While setting up a subsidiary in the UK is an option, using an EOR provides several advantages:

Choosing the right EOR in the UK is crucial for successful market entry. Consider these 5 key factors:

Navigating these complexities in-house can be challenging and time-consuming. Partnering with an EOR in the UK ensures your business remains compliant with labor laws, protecting you from potential risks and allowing you to focus on growth.

An EOR manages all legal, HR, and compliance tasks, allowing businesses to enter the UK market quickly without needing to establish a local entity.

Using an EOR in the UK can be more cost-effective than setting up a local subsidiary, eliminating initial incorporation costs and reducing ongoing administrative expenses.

Yes, a UK EOR manages the entire visa and work permit application process, ensuring compliance with local immigration laws and regulations.

Industries such as finance, technology, and healthcare benefit significantly from EOR services in the UK due to the specialized knowledge required for compliance.

EORs have local experts who stay updated on regulatory changes, managing all compliance aspects to ensure your business adheres to UK tax laws.

While the EOR is the legal employer, you retain significant control over day-to-day management and operational decisions regarding your employees.

Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard

Singapore 018983