INS Global is a leading partner in providing international Human Resources services. Through our PEO, your company can start hiring, set up operations, and start working in over 160 territories throughout the world, all while enjoying reduced costs hassle associated with global expansion.

As a safe and simple way to offer compliance assured HR functions for employees in an overseas target market, a PEO (Professional Employer Organization) in Taiwan gives companies a way to hire and manage employees in less than 48h. INS Global’s PEO in Taiwan is a professional third-party supplier of expert global mobility services.

An Employer of Record (EOR) in Taiwan offers employment outsourcing solutions to take care of HR and administrative responsibilities and streamline the global expansion process. INS Global is a provider of third-party EOR in Taiwan solutions to companies looking to improve and accelerate their international mobility.

A Professional Employer Organization (PEO), similar to an Employer of Record (EOR), provides HR services in foreign countries. Companies use PEOs to begin operations in a foreign market while avoiding the complicated regulatory burden of creating a separate legal entity.

When entering a new market, local regulations commonly create confusion and waste your workforce on issues related to HR. PEOs can help by legally employing your staff and managing standard employee services, like payroll, compensation, and benefits. PEOs simplify the process and help you save time and money.

Creating a company in a foreign market is time-consuming and expensive. Working with a PEO removes the need for a physical and legal presence in the target market, which allows your employees to work on things that really matter.

A PEO:

A PEO will know legal and administrative procedures that can ensure your company will comply with every important aspect of local law, making market entry safe and straightforward.

Entering a new market can lead to a high amount of fees and fines when simple HR issues are mishandled. PEOs will provide expertise for local regulations that reduce costly errors.

By managing recruitment, headhunting, contractor management, and payroll, a PEO can handle every HR process required for entering a new market, allowing you to focus on expansion and growth.

Approximate time for Company Incorporation in a foreign market: 4-12 months

Approximate time to establish a PEO contract: 5 days

*Global estimate

A PEO can handle every area of HR services and streamline this information into one point of communication.

INS Global’s PEO solution manages the recruitment of your employees in Taiwan in 4 simple steps:

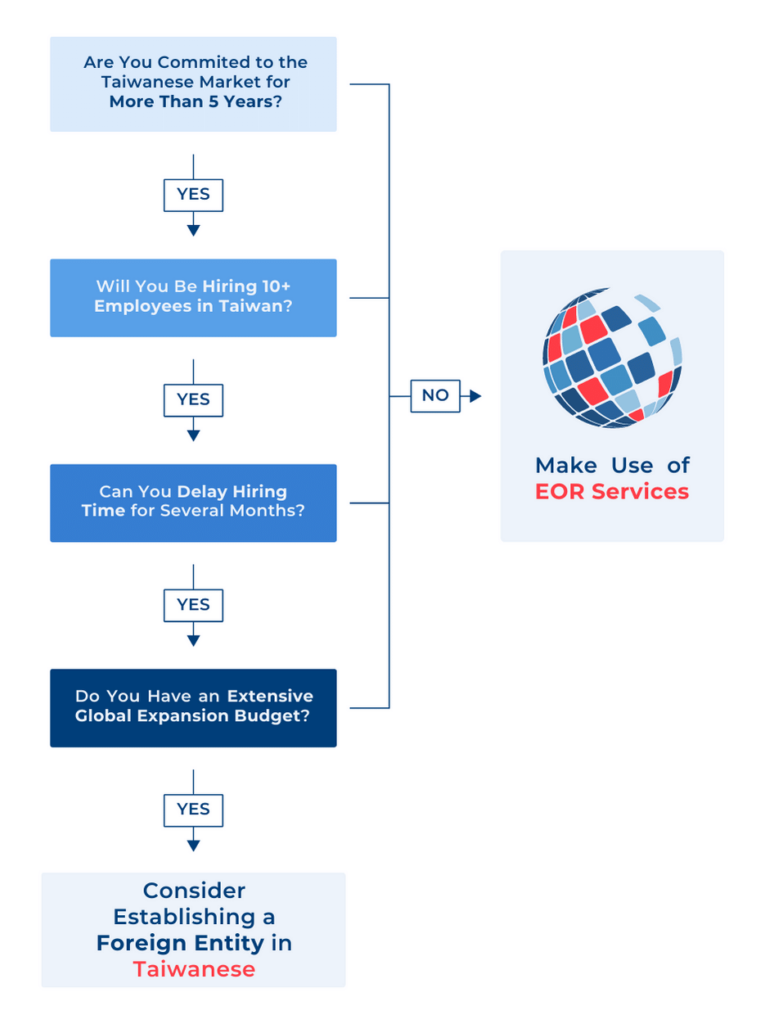

When you’ve decided to enter into a new foreign market and want to begin a PEO/EOR agreement, it’s necessary first to comprehend the difference between these two services to choose the one which suits your individual needs:

Typically, depending on the local regulations, these two terms are essentially interchangeable, and many PEOs will offer both services.

Most workers in Taiwan are protected under the LSA (Labor Standards Act) as it is the primary legislation regarding working rights. The LSA stipulates the basic wages, working hours, holidays, and working conditions for employees in Taiwan. The minimum wage in Taiwan is 24,000 TWD per month and 160 TWD per hour.

This law covers both foreign nationals and domestic workers. Employment contracts in Taiwan can be divided into two categories: fixed-term contracts and short-term contracts.

Any work done over an indefinite and continuous period of time should be considered as a non-fixed term contract.

Short-term work should not exceed six months, and seasonal work should not exceed nine months.

The LSA also sets annual leave minimum amounts for workers in Taiwan. Annual leave days are structured to increase for every year of employment. These days must be provided based on the following conditions:

Additionally, the LSA stipulates that employers are required to provide a notice of employee termination. The required length of advanced notification is also structured around the length of employment. The needed notification period is:

The maximum working hours are eight hours per day and 40 hours per week. In Taiwan, every employee must receive two days off every seven days. One of these days is flexible and can be worked at overtime rates, and the other is a compulsory rest day.

Any work that exceeds the standard weekly hours mentioned above is considered overtime and regulated using the employee contract.

Overtime in Taiwan is calculated as:

Overtime must not exceed 46 hours per month without additional agreements.

Taiwan’s labor laws also extend to parental leave. According to the LSA, women should be provided with eight weeks of maternity leave. If she has been working at the same company for the prior six months, then she is entitled to receive full wages during the entirety of her maternity leave in Singapore.

In cases where she doesn’t meet this requirement, she is entitled to receive half of her monthly wages. This paid time off also extends to miscarriages. Women who have already given birth are also given several breaks throughout the day for breastfeeding. Men are provided with three days of paternity leave. These laws also cover families who have decided to adopt as well.

In the event of a death of an immediate family member, employees in Taiwan are entitled to receive up to eight days of leave.

The employer is responsible for payroll contributions. These contributions cover necessary insurances, including labor, employment, pension, and health insurance. The rates for the required contributions are as follows:

Altogether, these insurance costs add 18.452% to the cost of employment, so employers should be aware of this when considering a recruitment budget.

Working with a reliable Taiwanese PEO to manage all important HR responsibilities, such as payroll, contract administration, and guaranteeing tax compliance, comes at a low cost that is calculated as a monthly charge based on the earnings of the co-employed personnel.

Working with an EOR allows you to transport staff or hire in Taiwan securely, practically, and legally. This form of outsourcing can be used either temporarily or long-term.

When an employee is managed by a PEO, they have access to several benefits, such as full legal protection, local understanding of all employer responsibilities, timely and accurate payment, improved employee perks, and more.

While maintaining complete control over their work process, contractors who interact with clients through a PEO or EOR have access to all the same perks and protections as regular employees.

Yes, a PEO takes into account any differences in local or regional employment regulations while offering you protection no matter where you are.

With certain PEO organizations, there may be a minimum or maximum number of employees you may hire. However, you are free to co-employ as many or as few employees with INS Global as your development strategy requires.

In addition to wages and any payments made to recruiting agencies or experts, indirect expenditures such as social insurance contributions, bonuses, or incentives must be included in payroll expenses.

Additionally, even though signing bonuses are optional if chosen, they have to be considered when figuring up recruiting expenditures as they could make you stand out to potential new hires in today’s increasingly competitive market.

Taiwan, like many other countries, has effectively adapted to the possibility of employee remote work since the COVID-19 outbreak. Employees of a corporation with its headquarters in Taiwan should still have the option between a physical workspace and a home office for fair employment practices and as a competitive incentive.

To assist you in finding the ideal new team member in Taiwan, members of our recruitment team have access to professional networks, in-depth knowledge of offline and online business resources, familiarity with area best practices, and more.

INS Global uses the best recruitment services to assist you to identify the finest in both Taiwanese natives and foreign residents.

Companies of all sizes, from SMEs to multinational businesses, that are searching for a quick, easy, and secure approach to joining the Taiwanese market should consider using a PEO.

With our legal experience being ideally relevant to anybody who either lacks their own internal structures or wants to reduce company bloat while expanding, INS Global offers high-quality PEO services to businesses in a wide range of sectors.

Taiwanese direct hiring of independent contractors is an option, as well as hiring them through an intermediary like a staffing agency or an umbrella company. Through networking, job boards, social media, trade associations, and other means, you may find the right contractors to meet your demands.

The majority of the time, an independent contractor can work as a self-employed freelancer or through their own small company, through which they can issue bills to clients.

Although hiring practices may vary depending on your needs, an independent contractor may be asked for a CV, portfolio, references, and maybe a signed NDA. Checking a contractor’s references is an absolute must to guarantee quality of service.

Payroll in Taiwan is organized every month, with many companies paying their employees in the middle of the month. 13th–month wages are usually paid during the lunar new year.

In 2023, the minimum wage is NT$26,400 (roughly US$842) per month.

A work permit, work visa, and alien residence permit are all required for employees looking to live and work in Taiwan. There are lists of requirements associated with each of the above, with work visas typically being limited to specific professional sectors. Employees apply for these documents through their company, the validity of the alien work residence permit being 1, 2, or 3 years.

Along with making deductions for individual income tax, companies also have to manage social security contributions on behalf of their employees during the payroll process. The total employer contribution to these funds amounts to around 17% of the employee’s monthly salary.

Social security contributions in Taiwan cover labor insurance, health insurance, and pension. Foreign workers are not eligible for the national pension program. Additionally, workers receive paid annual leave, sick leave, and parental leave.

Employers may not make unilateral changes to an employee’s contract if the changes are unfavorable to the employee. An exception to this may be if the changes relate to discretionary payments.

In general, employer changes must be considered reasonable, and it’s always best practice to seek signed employee consent.

Payroll contributions cover the majority of any costs required by the national single-payer healthcare system. As a result, the national health insurance system is mandatory, although many employers also still offer private healthcare plans.

Severance pay in Taiwan amounts to a month’s salary for each year of service.

Rather than a single governmental body, the Labor Standards Act (LSA) is overseen by several relevant authorities in charge of regulating the various aspects of an employment relationship.

There are around 12 national public holidays per year in Taiwan. Many of these holidays work according to a lunar calendar so may be subject to change. Payment on public holidays is not mandatory, although employees required to work on a national holiday can choose between a special payment rate or additional time off.

Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard

Singapore 018983DOWNLOAD THE INS Expansion Insights

DOWNLOAD THE PDF