管理および法的プロセスに関する習熟作業者派遣組織の現地知識は、現地法の潜在的に問題となるあらゆる面からコンプライアンスを守ります。

多くの企業は新しい市場に参入するときに、HRに関連する単純だけれど複雑な問題により、高額の手数料と罰金を科せられます。 習熟作業者派遣組織は、これらの失敗を回避するために、地元の専門家のガイダンスを企業に提供します

習熟作業者派遣組織は、従業員が会社の成長に集中している間、イタリアでの給与計算アウトソーシング、採用、請負業者管理サービスを提供することにより、この新しい市場への参入に必要な人事プロセスを処理します。

イタリアでの会社設立の期間: 4〜12か月

イタリアで習熟作業者派遣組織を確立する期間: 5日間

*見積もり

習熟作業者派遣組織は、HRサービスのすべての重要な面をカバーし、この情報を1つの連絡先に合理化することにより、データや通信の重複の量を制限します。

自分のビジネスを海外市場に組み込むことは、複雑で紛らわしい経験であり、市場への参入を容易にする複数の規制および経済的手続きがあります。 習熟作業者派遣組織を使うと、会社の繁栄を助けながら、これらすべての手順を実行しなくても、新しい市場で事業を展開できます。

習熟作業者派遣組織

INS Globalのコンサルタントは、次の簡単な手順でイタリアで習熟作業者派遣組織の契約を開始できます。

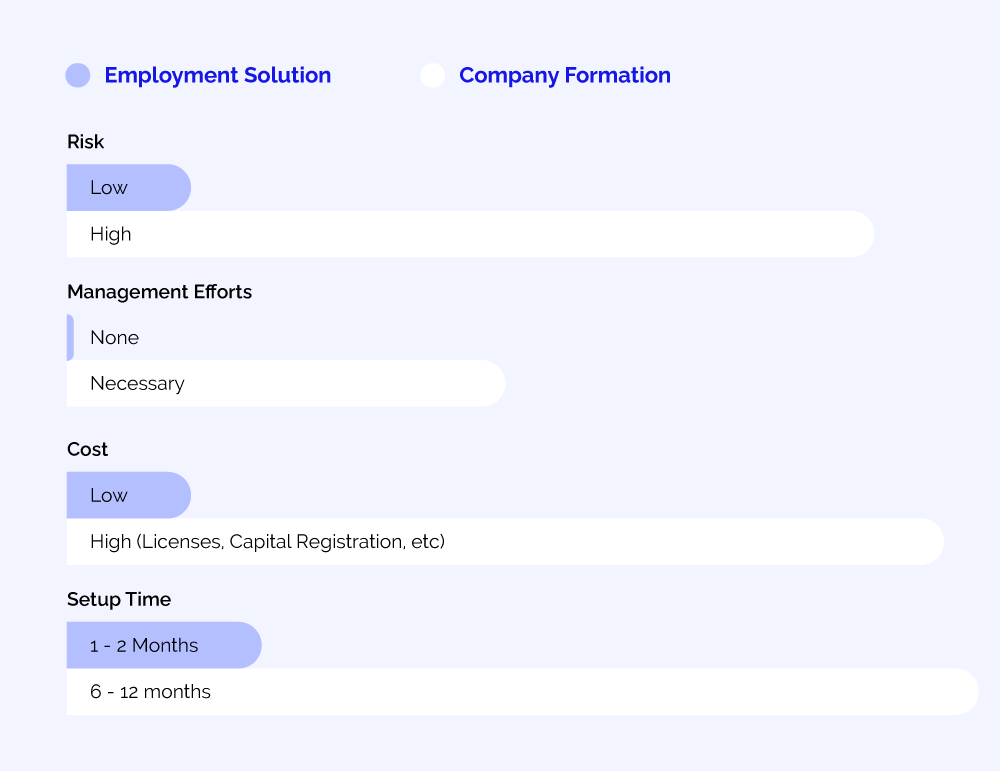

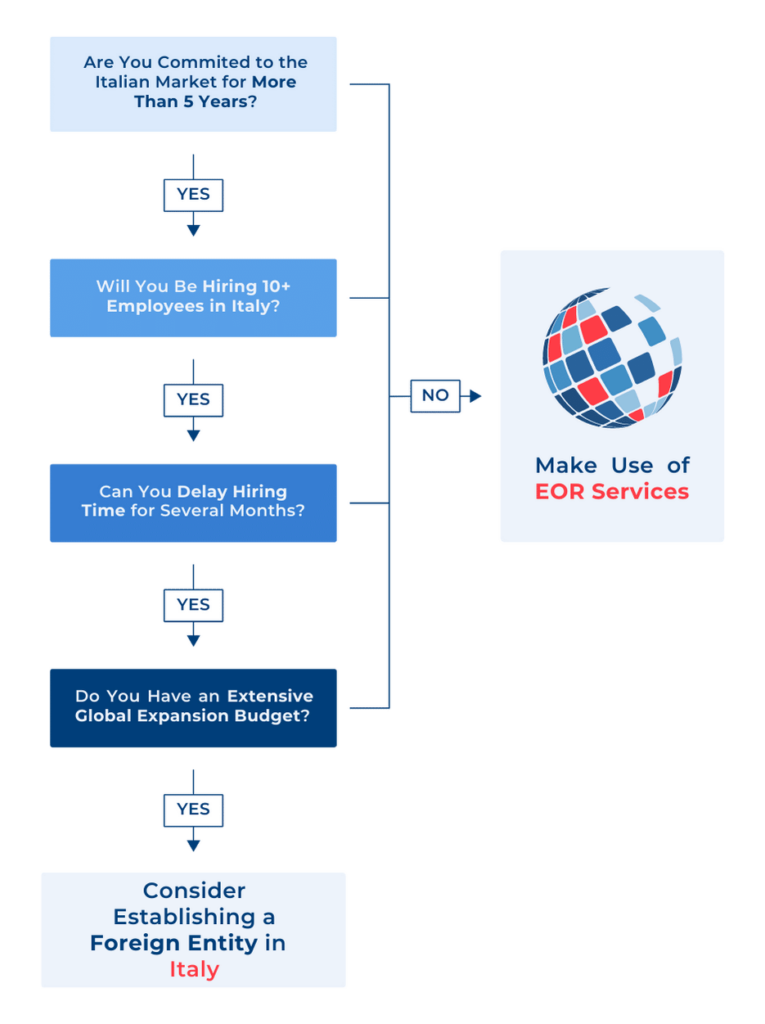

イタリア市場に進出して雇用代行業者/習熟作業者派遣組織の契約を開始する場合は、これら2つのソリューションの違いを理解して、専門的なニーズに、より適した選択を行う必要があります。

習熟作業者派遣組織は、他社の従業員にHRサービスを提供する会社として機能します

INS Globalは、お客様のニーズに応じて、イタリアで習熟作業者派遣組織と雇用代行業者のの両方のサービスを提供できます。 この記事を読むか、今日私たちのスペシャリストチームに連絡して、習熟作業者派遣組織とEOR 雇用代行業者の詳細を確認し、どちらが御社に最適かを選んでください。

イタリアで施行された欧州連合指令No.533/91によると、契約の主な条件に関する情報は書面で作成し、雇用されてから30日以内に従業員に渡す必要があります。 イタリアでの雇用契約には通常、期間が無制限です。

標準的な週労働時間の最大時間数は、週40時間を超えてはいけません。 これを超えるものは残業と見なされます。

これに加えて、通常、残業は週に8時間を超えてはいけません ただし、セクターによっては労働協約の対象となる場合があります。

法的に、残業は最低110%の標準料金で支払わなければなりませんが、実際には、残業時間の場合これは130%になる場合が多くなります。

イタリアの従業員は、4週間の有給休暇を取得する資格があります

イタリアには11日間の祝日があります(イタリアの各地域で1日余分に祝日があります)。

祝日の際、従業員は追加で1日有給が付与されます。 イタリアでは、従業員は最大180日間の病欠の資格があり、雇用主は休暇の最初の3日間の費用を支払います その後、従業員は一般的に標準賃金の50〜66%に相当する病気休暇手当を受け取ります。

出産休暇は、出産前8週間、出産後12週間取得できます。 これは、社会保障を通じて標準給与の80%で支払われます 多くのセクターの労働協約では、雇用主が出産休暇の従業員の給与の追加の20%を補うことが義務付けられています

イタリアでの有給の父親休暇は、出産後最初の5か月以内に10日です。 これは社会保障を通じて支払われます。

イタリアの税制は、主に一般税法(イタリア語でTesto Unico Per le Imposte sui Redditi、またはIRESと呼ばれる)によって体系化されており、毎年の財務法によって更新されます

一般的に:

イタリアの税金は、直接税とその他の、2つのタイプに分けられます。 企業や個人の所得税には直接税が課せられます。

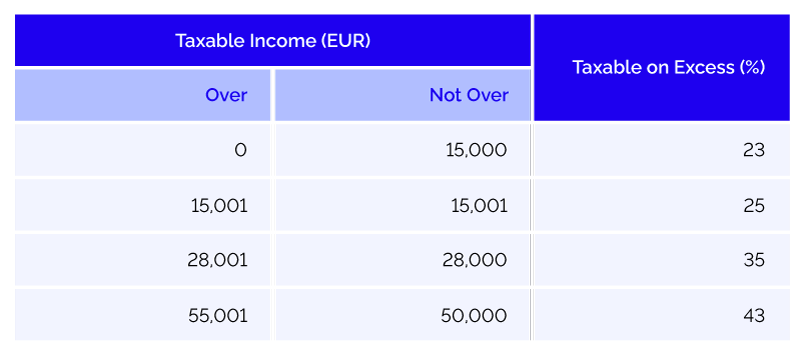

その他の税金には、商品、サービス、輸入品に対する税金が含まれます 個人所得税は全国レベルで23〜45%支払われます

所得も1.23〜3.33%の地域レベルで課税されます。 イタリアの法人所得税の標準税率は、IRESが24%、IRAPが3.9%です

雇用主は、従業員の給与の約40%を年金および社会保障拠出金に支払うことを求められますあ(従業員は約10%を支払います)

In general, 1-month is necessary to have an employee based out abroad using an existing PEO as the employe of record. When incorporating a new subsidiary to be the employer of record, the delay varies from 4-12 months.

You may move individuals legally, securely, and effectively when working with an Italy EOR. You can also acquire new employees where you need them. This approach has made outsourcing acceptable for both short-term and long-term initiatives.

An employee who is co-employed by an EOR may have access to a variety of services, including improved employee benefits, comprehensive legal protection, in-depth familiarity with all employer requirements locally, timely and accurate payment, and more.

While having complete control over their work process, contractors who interact with clients through an EOR or Italian PEO are entitled to many of the same perks and protections as regular workers.

Yes, an EOR safeguards your rights wherever you are while taking into consideration any modifications to local or regional labor legislation.

With certain PEO businesses, there can be a minimum or maximum amount of employees you can hire. To employ and outsource the HR of as many individuals as your growth plans require, use INS Global’s expansion services.

In addition to salaries and any payments made to recruiting agencies or experts, payroll expenditures must also account for any additional or indirect costs like social insurance contributions, bonuses, or incentives.

Although signing incentives are not required, they must be included when assessing the cost of running a worldwide hiring operation.

Employees of a company with a presence in Italy should have the option of choosing between a physical workplace and a home office to provide the most competitive package to potential applicants.

Our recruitment specialists can assist you in finding the ideal new team members in Italy thanks to their access to professional networks, in-depth knowledge of both offline and online business resources, expertise in adhering to local best practices, and more.

INS Global uses the most latest hiring technology and industry-specific information to help you locate the best candidates among Italian citizens and foreign residents. When we hire on your behalf, we take into account any changes in regional norms and legislation relating to nationality in order to prevent any issues.

Using an EOR provides a quick, easy, and secure alternative to in-house HR and recruiting for businesses of all kinds, from SMEs to large multinational enterprises.

Our legal expertise is perfect for anybody who either lacks their own internal structures in-country or wants to prevent scaling concerns while growing. INS worldwide offers vital PEO or worldwide Employer of Record services to firms in a variety of sectors.

Examples of third parties that may be utilized to directly or indirectly hire independent contractors include staffing agencies and umbrella companies. Through networking, job boards, social media, trade organizations, and other means, you might be able to find the finest contractors to meet your demands.

Most independent contractors run their own businesses or own small businesses through which they take money from clients. As a result, for some jobs, people must be employed under a work agreement as opposed to an employment contract.

An independent contractor may be asked to submit a CV, portfolio, verified references, and perhaps a signed NDA before work begins.

Payroll in Italy is typically done each month, with a 13th–month payment at the end of the year and some CBAs including an additional 14th–month payment in July. All companies employing workers must inform the central employment bureau (Centro per l’Impiego) before starting payroll for staff.

Italy has no national minimum wage. However, CBAs may require some type of minimum or expected salary.

Along with the potential to apply for an EU Blue Card which is available across the EU, non-EU citizens seeking to live and work in Italy need a visa, work permit, and residence permit.

Companies hiring non-EU citizens require a permit (nulla osta), with the country practicing a cap on non-EU workers allowed to move to Italy annually.

Work permits in Italy can be made for a maximum of 2 years at a time.

Employers in Italy are responsible for making deductions and contributions on behalf of their employees for individual income tax and social securities. Employer social security contributions in Italy are high, with employers expected to pay the equivalent of 30% of an employee’s salary toward their social security fund (employees pay an additional 10%).

Employers who register with the mandatory INPS (Istituto Nazionale Previdenza Sociale), INAIL (Istituto Nazionale Assicurazione Infortuni sul Lavoro), and Labor Office provide their employees with all the usual employment benefits. These include employment insurance, workplace accident insurance, basic health insurance, paid leave (annual, medical, and parental), and a pension.

Employers in Italy must discuss any changes to an employment contract with the employee beforehand and get their agreement (preferably in writing).

With a mixed public-private healthcare system, Italy offers basic healthcare for free to all residents, with some services paid though heavily subsidized. The healthcare system is largely funded by social security and corporate taxes.

Notice periods in Italy depend on the specific terms of the relevant CBA, with most jobs requiring anywhere from 10-75 days of notice (or payment in lieu).

In cases where severance pay is required, compensation is the average annual salary divided by 13.5.

Labor working environments are overseen by a mix of local, regional, and national bodies, with the body overseeing the workers’ CBA also being involved in any disputes around contracts or employment terms.

Most regions in Italy have around 12 paid public holidays per year (11 nationally plus 1 locally).

Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard

Singapore 018983DOWNLOAD THE INS Expansion Insights

DOWNLOAD THE PDF