- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

Our PEO in Italy can help your company set up operations, hire employees, and start working, all while avoiding associated red tape and extra costs. Through our premium Human Resources services, you can achieve your expansion goals efficiently and effortlessly.

For companies wishing to hire and manage crucial HR functions in overseas target markets in as little as 48 hours, a PEO (Professional Employer Organization) offers a simple and secure path to total global mobility. INS Global offers a PEO in Italy service combining expertise and experience for internationally expanding companies.

An EOR in Italy is an organization that acts as the Employer of Record for companies wishing to streamline the global expansion process. By making hiring and managing overseas employees simpler, cheaper, and safer through their innovative technology-based EOR solution, INS Global offers locally based solutions to global employment problems.

A PEOs local knowledge of administrative and legal processes safeguards your compliance against every potentially problematic aspect of local law.

Simple complications related to HR lead many companies to incur high fees and fines when entering a new market. PEOs provide companies with the guidance of local experts to avoid these errors.

By providing payroll outsourcing in Italy, recruitment, and contractor management services, a PEO takes care of the HR processes required for entry into this new market while your employees concentrate on growth

Time for Company Incorporation in Italy: 4-12 months

Time to establish a PEO relationship in Italy: 5 days

*Estimate

A PEO covers all the essential aspects of HR services and streamlines this information into one point of contact, limiting the amount of interfering data or communication overlap.

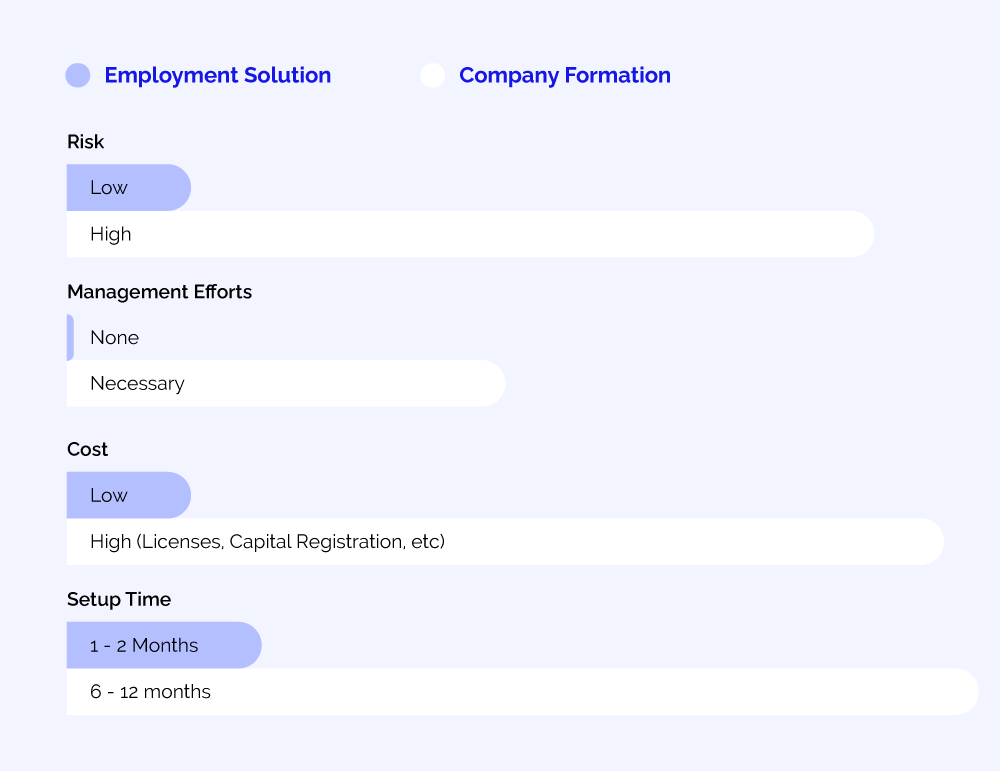

The Competitive Advantages of a PEO Over Company Incorporation

INS Global‘s consultants can begin your PEO agreement in Italy with these simple steps:

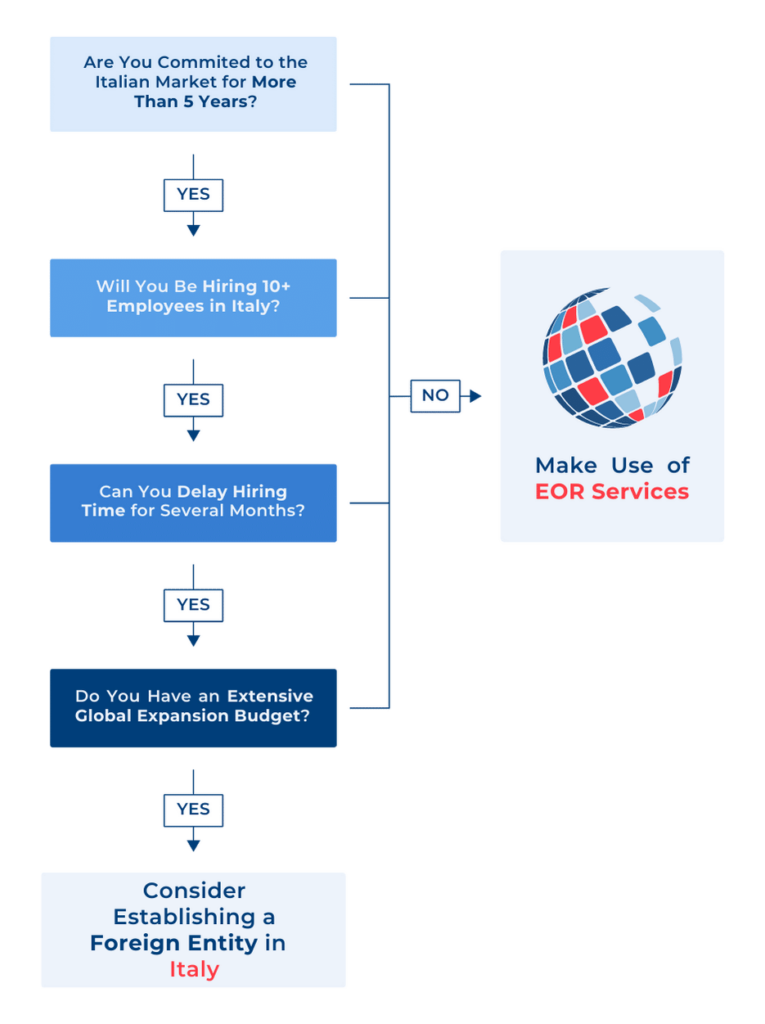

When you decide to expand into the Italian market and begin an EOR/PEO agreement, it‘s necessary to understand the difference between these two solutions to make a choice that better suits your professional needs:

A PEO acts as a company providing HR services to employees of other companies.

INS Global can provide both PEO and EOR services in Italy according to your needs. Read this article or contact our team of specialists today to learn more about PEOs and EORs and determine which may be best for your company.

According to European Union Directive No. 533/91 implemented in Italy, information on the main terms and conditions of a contract should be made in writing and provided to the employee within 30 days of being hired.

An employment contract in Italy will typically have an unlimited duration period.

The maximum number of hours in a standard workweek must not exceed 40 hours per week. Anything beyond this is considered overtime.

On top of this, typically, overtime must not exceed 8 hours per week. However, this may be subject to collective agreements depending on the sector.

While legally, overtime must be paid at a minimum of 110% standard rate, in practice, this is more likely to be 130% for overtime hours worked.

Employees in Italy are eligible for four weeks of paid annual leave.

There are 11 days of public holidays in Italy (with one extra day of holiday in each region of Italy). Employees must be given an additional day of paid leave per day of public holiday.

Employees are eligible for up to 180 days of sick leave in Italy, and the employer pays for the first 3 days of leave. Following that, employees receive a sick leave benefit generally equivalent to 50-66% of standard pay.

Maternity leave can be taken for 8 weeks before the birth of a child and 12 weeks afterward. This is paid for at 80% standard salary through social security.

Collective agreements in many sectors require that employers make up the additional 20% of an employee’s salary on maternity leave.

Paid paternity leave in Italy is 10 days within the first 5 months after the birth of a child. This is paid for through social security.

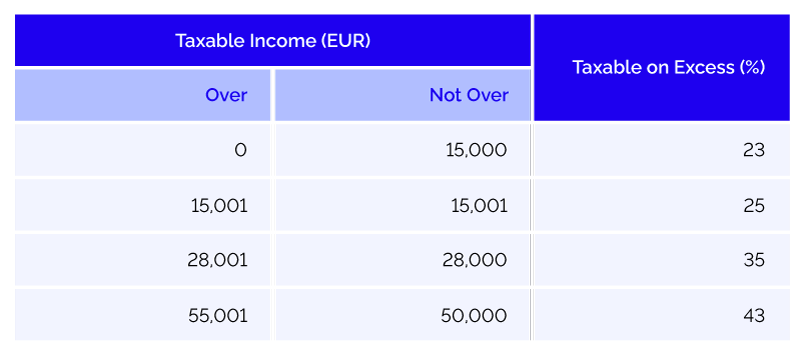

The Italian tax system is mostly codified through a general tax law (called Testo Unico Per le Imposte sui Redditi, or IRES, in Italian) that is updated every year through an annual Finance Act.

Generally:

Taxes in Italy are divided into two types, direct and other. Direct taxes are levied on income tax for corporations and individuals. Other taxes include those taxes on goods, services, and imports..

Individual income tax is paid at a national level between 23-45%.

Income is also taxed at a regional level between 1.23-3.33%.

The standard rates for Corporate Income Tax in Italy are 24% for IRES and 3.9% for IRAP

Employers should expect to pay around 40% of an employee’s salary towards pension and social security contributions (employees will pay around 10%).

Payroll, contract administration, and assured tax compliance are important HR tasks that a reliable Italy PEO or EOR can handle for a monthly charge based on a proportion of a co-employed employee’s monthly compensation.

You may move individuals legally, securely, and effectively when working with an Italy EOR. You can also acquire new employees where you need them. This approach has made outsourcing acceptable for both short-term and long-term initiatives.

An employee who is co-employed by an EOR may have access to a variety of services, including improved employee benefits, comprehensive legal protection, in-depth familiarity with all employer requirements locally, timely and accurate payment, and more.

While having complete control over their work process, contractors who interact with clients through an EOR or Italian PEO are entitled to many of the same perks and protections as regular workers.

Yes, an EOR safeguards your rights wherever you are while taking into consideration any modifications to local or regional labor legislation.

With certain PEO businesses, there can be a minimum or maximum amount of employees you can hire. To employ and outsource the HR of as many individuals as your growth plans require, use INS Global’s expansion services.

In addition to salaries and any payments made to recruiting agencies or experts, payroll expenditures must also account for any additional or indirect costs like social insurance contributions, bonuses, or incentives.

Although signing incentives are not required, they must be included when assessing the cost of running a worldwide hiring operation.

Employees of a company with a presence in Italy should have the option of choosing between a physical workplace and a home office to provide the most competitive package to potential applicants.

Our recruitment specialists can assist you in finding the ideal new team members in Italy thanks to their access to professional networks, in-depth knowledge of both offline and online business resources, expertise in adhering to local best practices, and more.

INS Global uses the most latest hiring technology and industry-specific information to help you locate the best candidates among Italian citizens and foreign residents. When we hire on your behalf, we take into account any changes in regional norms and legislation relating to nationality in order to prevent any issues.

Using an EOR provides a quick, easy, and secure alternative to in-house HR and recruiting for businesses of all kinds, from SMEs to large multinational enterprises.

Our legal expertise is perfect for anybody who either lacks their own internal structures in-country or wants to prevent scaling concerns while growing. INS worldwide offers vital PEO or worldwide Employer of Record services to firms in a variety of sectors.

Examples of third parties that may be utilized to directly or indirectly hire independent contractors include staffing agencies and umbrella companies. Through networking, job boards, social media, trade organizations, and other means, you might be able to find the finest contractors to meet your demands.

Most independent contractors run their own businesses or own small businesses through which they take money from clients. As a result, for some jobs, people must be employed under a work agreement as opposed to an employment contract.

An independent contractor may be asked to submit a CV, portfolio, verified references, and perhaps a signed NDA before work begins.

Payroll in Italy is typically done each month, with a 13th–month payment at the end of the year and some CBAs including an additional 14th–month payment in July. All companies employing workers must inform the central employment bureau (Centro per l’Impiego) before starting payroll for staff.

Italy has no national minimum wage. However, CBAs may require some type of minimum or expected salary.

Along with the potential to apply for an EU Blue Card which is available across the EU, non-EU citizens seeking to live and work in Italy need a visa, work permit, and residence permit.

Companies hiring non-EU citizens require a permit (nulla osta), with the country practicing a cap on non-EU workers allowed to move to Italy annually.

Work permits in Italy can be made for a maximum of 2 years at a time.

Employers in Italy are responsible for making deductions and contributions on behalf of their employees for individual income tax and social securities. Employer social security contributions in Italy are high, with employers expected to pay the equivalent of 30% of an employee’s salary toward their social security fund (employees pay an additional 10%).

Employers who register with the mandatory INPS (Istituto Nazionale Previdenza Sociale), INAIL (Istituto Nazionale Assicurazione Infortuni sul Lavoro), and Labor Office provide their employees with all the usual employment benefits. These include employment insurance, workplace accident insurance, basic health insurance, paid leave (annual, medical, and parental), and a pension.

Employers in Italy must discuss any changes to an employment contract with the employee beforehand and get their agreement (preferably in writing).

With a mixed public-private healthcare system, Italy offers basic healthcare for free to all residents, with some services paid though heavily subsidized. The healthcare system is largely funded by social security and corporate taxes.

Notice periods in Italy depend on the specific terms of the relevant CBA, with most jobs requiring anywhere from 10-75 days of notice (or payment in lieu).

In cases where severance pay is required, compensation is the average annual salary divided by 13.5.

Labor working environments are overseen by a mix of local, regional, and national bodies, with the body overseeing the workers’ CBA also being involved in any disputes around contracts or employment terms.

Most regions in Italy have around 12 paid public holidays per year (11 nationally plus 1 locally).

Level 39, Marina Bay

Financial Centre Tower 2,

10 Marina Boulevard

Singapore 018983