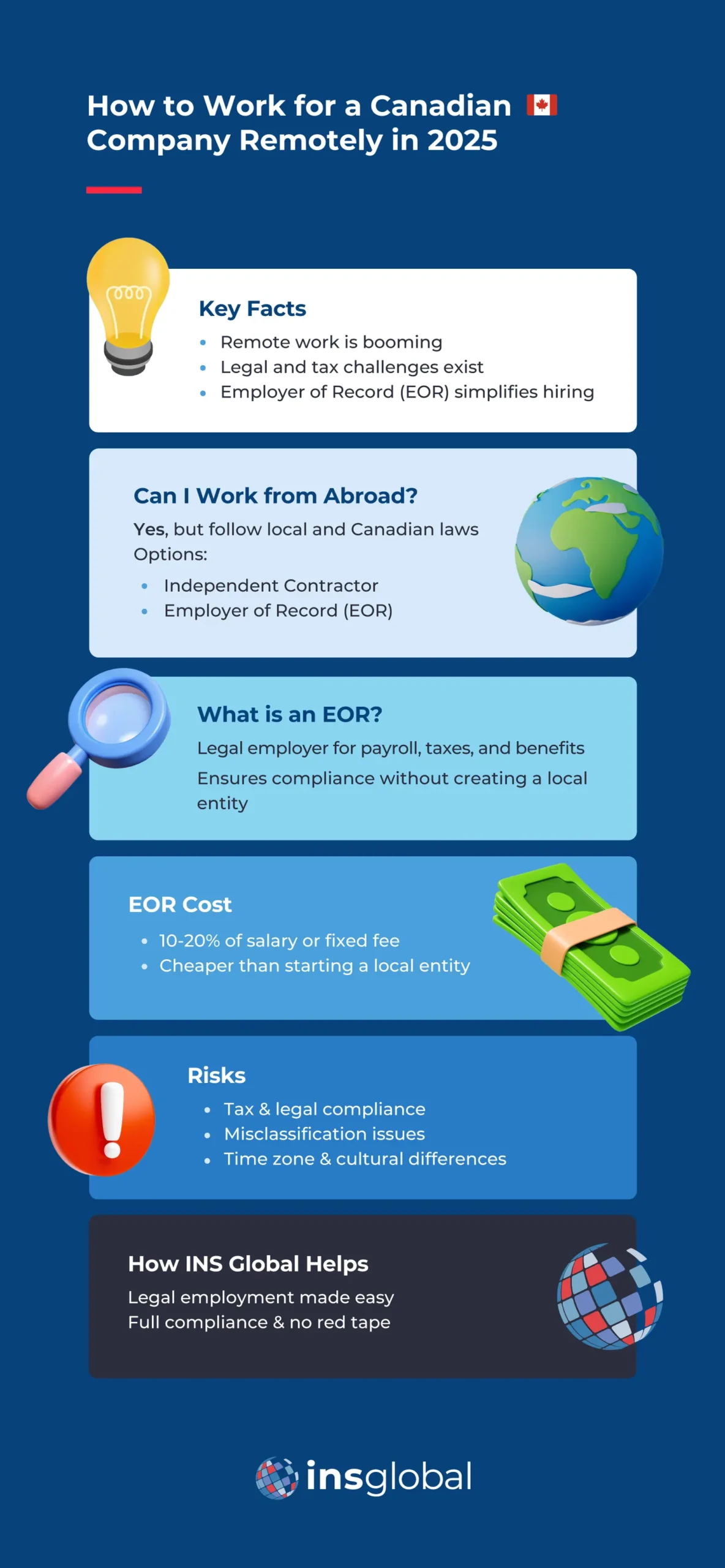

If you are considering an opportunity to work for a Canadian company remotely, it’s essential to understand the logistics, legalities, and potential challenges. The digital age has revolutionized the way we work, breaking down geographical barriers and enabling professionals to work for companies located anywhere in the world.

The rise of remote work has provided unprecedented flexibility, allowing individuals to collaborate with international teams from wherever they want, but this article will provide a comprehensive guide on how to navigate remote work for a Canadian company effectively, including the inherent risks and issues.

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers

Can I Work for a Canadian Company from Overseas?

Yes, you can work for a Canadian company from overseas. Today, many Canadian companies are looking to hire international talent because of the diverse skills and expertise it brings.

However, before starting down that path, several factors need careful consideration, such as legal requirements, tax obligations, and employment regulations. In particular, working remotely for a Canadian company means you must comply with your labor rules in both your home country and Canada. This will include being compliant with complex systems around tax and social security.

There are several ways to get started after you find an opportunity to work for a Canadian company remotely, depending on your situation and preferences.

Typically, unless the company has an entity already in your country of residence, you can be hired either as an independent contractor or through an Employer of Record (EOR) service.

As an independent contractor, you would have to manage your taxes and benefits by yourself. For many, this allows an attractive level of independence and flexibility, but it also brings with it a high degree of personal responsibility and not a lot of security.

Instead, a hiring company may partner with an EOR service that can handle all required aspects of local employment processes, ensuring you and the Canadian company adhere to legal requirements and avoid possible problems.

How do Employer of Record Services Work in Canada?

An Employer of Record in Canada is a third-party organization that becomes the official employer of workers on behalf of another company. The EOR handles all employment-related tasks, including payroll, taxes, benefits, and compliance with local labor laws. This arrangement allows companies to hire international employees without establishing a legal entity in the employee’s country of residence.

The EOR service manages the employment contract, ensuring it meets local legal standards. They also handle employee onboarding, payroll processing, tax withholding, social security contributions, and any other statutory requirements. For the employee, an EOR provides a seamless employment experience, allowing them to focus on their work without worrying about administrative and legal complexities.

Can I Work Remotely for a Canadian Company Through an EOR?

Yes, making arrangements to work for a Canadian company remotely through an EOR is a more and more common solution to the challenges of remote work because it is both practical and simple for both parties.

This setup is particularly good for international employment as the EOR takes on the legal responsibility of employing the worker in their country, ensuring compliance with local laws and regulations without needing to go through the hassles of setting up an overseas company entity.

For remote employees, this means they can work for companies in different countries while the EOR handles payroll, tax compliance, and key employee benefits like health insurance and sick leave. This thus provides peace of mind and allows both employer and employee to focus on the job at hand.

How Much Does an EOR Cost?

The cost of EOR services varies depending on the variety of services provided and the country of employment. Typically, EOR services charge a fee based on a percentage of the employee’s monthly salary, which can range from 10% to 20%. Some EORs might also charge a flat monthly fee per employee or adapt the fee to the payroll period of a country.

Some EOR providers may include additional costs such as setup fees, extra charges for statutory benefits, and fees for ensuring specific compliance requirements in the employee’s country of residence. As a result, it’s important to first check out available reviews for an EOR provider to avoid hidden costs or necessary services.

While using an EOR can seem expensive, it often proves more cost-effective when compared to the expenses and complexities of setting up an entirely new legal entity in a foreign country and managing said entity in-house. For this reason, EORs are particularly good for companies considering short-term or temporary projects or when looking at entering a new market.

Are There Limitations on What I Can Do When Working Overseas for a Canadian Company?

This will depend on the situation. Extra legal steps and tax compliance processes can be a significant concern for both the employee and the employer if they are unfamiliar with the market. As a result, you may find yourself facing significant delays at first due to new processes, and mistakes made early on can mean significant problems later.

If choosing to work for a Canadian company remotely as a contractor, this can also limit the amount of work you do for a single company due to contractor classification rules. Using this method may also restrict you from making use of certain benefits or social security elements that are only available to employees.

Communication and time zone differences can also pose challenges, as working remotely requires a range of different communication strategies to bridge the gap caused by different working hours and cultural differences.

What are the Risks of Choosing to Work for a Canadian Company Remotely?

While choosing to work remotely overseas brings advantages, there are, of course, several risks associated with it. One primary concern is tax compliance and navigating the differences between Canadian tax systems and those in your country of residence. In general, many countries have double taxation agreements with Canada, but working with tax experts to learn about your responsibilities can be a crucial step towards compliance assurance.

Employment law compliance is another risk, as different countries have varying labor laws, and knowing which are the relevant regulations can be challenging. Specific issues like misclassification of employment status (e.g., contractor vs. employee) can lead to legal and financial penalties.

At the same time, cultural differences and communication barriers may also impact your work experience. In particular, recent changes to data protection laws around the world have made it more important than ever to work safely and effectively when communicating with colleagues overseas.

How INS Global’s Employer of Record Can Help Companies Work Worldwide

INS Global’s Employer of Record services provide a comprehensive solution for companies looking to hire talent worldwide. INS Global handles all employment-related tasks by acting as the legal employer when you work for Canadian company remotely, ensuring compliance with local laws and regulations without establishing a legal entity in each country.

INS Global manages all the processes involved with payroll including taxes, social security, and key benefits. INS Global also provides employees with a seamless and legally compliant employment experience, allowing all parties to focus on the task at hand without worrying about legal and administrative complexities.

Contact our global expansion advisor team today for a free consultation and simplify the way you work remotely.

FAQ

An Example – Can I Work for a Canadian Company from the US?

Yes, you can work remotely for a Canadian company while residing in the US. In general, the proximity and strong economic ties between Canada and the US really help this kind of arrangement.

Using an EOR can help in this situation as the US requires specific tax and payroll steps, which are often complex and put a lot of personal responsibility on workers. In this case, an EOR in the US will manage payroll, taxes, and social security contributions, ensuring compliance with both US and Canadian regulations.

Another Example – Can I live in Canada and Work in a Foreign Country?

Living in Canada and working for a foreign company requires careful attention to Canadian employment laws, tax obligations, and residency requirements, all of which can also be helped by an EOR in Canada.

Canada taxes worldwide income for its residents, so you will need to report your foreign income to the Canadian tax authorities in this case. Depending on your home country’s laws, you might also face double taxation, but as many countries have tax treaties with Canada to mitigate this issue, extra costs can often be avoided.

SHARE