Are you considering working for an Irish company remotely? Or perhaps you’re an Irish company wondering how to best implement remote work policies? This guide is designed to address your most common questions and provide valuable insights into the world of remote work with Irish companies.

Whether you’re a seasoned remote worker or just starting your journey, understanding the legal, cultural, and practical considerations is the first step to global success. To help, we’ve answered the 7 most frequently asked questions and provided simple solutions to the challenges you may be facing.

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers

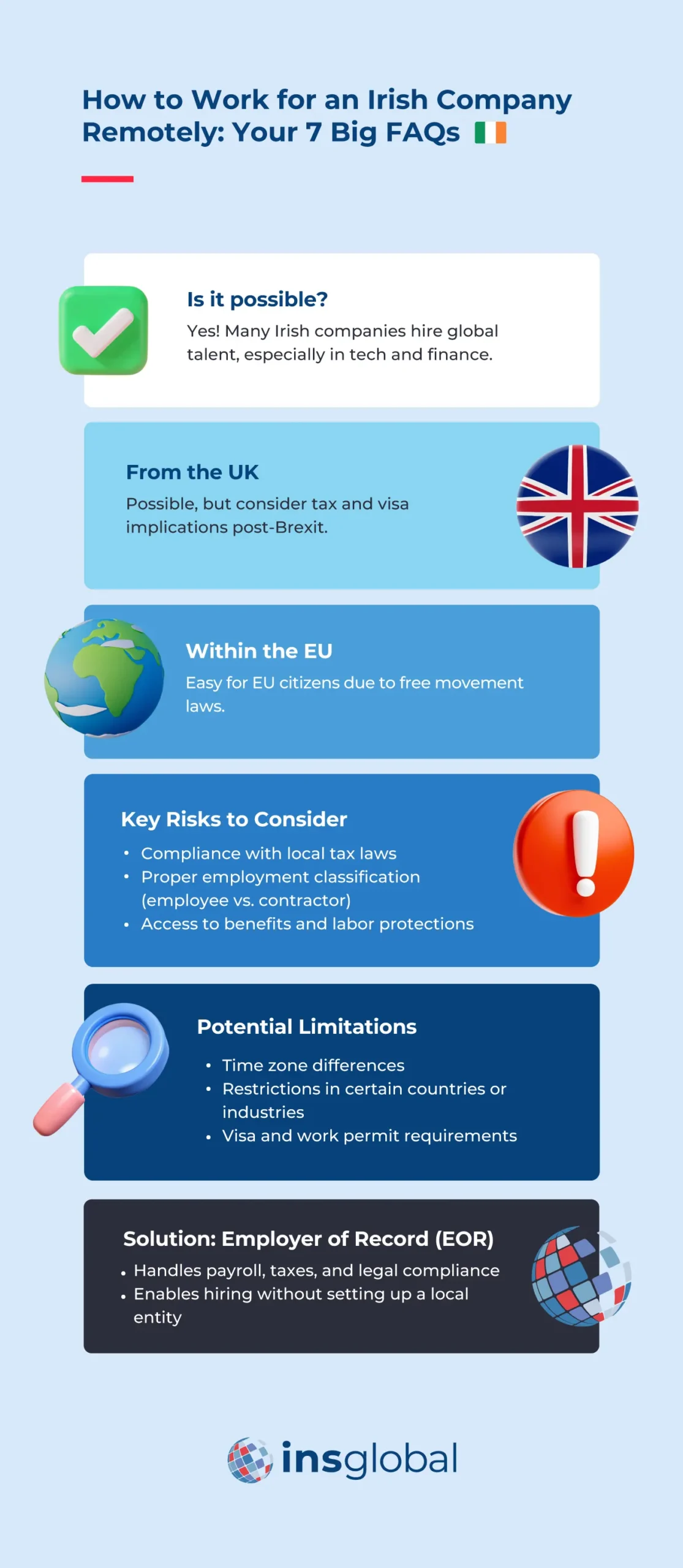

Can I Work for an Irish Company Remotely from Anywhere in the World?

Yes, working for an Irish company remotely from almost anywhere in the world is possible. Like many countries, Ireland has embraced remote work policies, especially in the tech and finance sectors, where global talent is highly sought after. Many companies have adopted flexible working arrangements, and Irish employers now look beyond national borders for top talent.

However, working remotely from a foreign country introduces legal complexities. Depending on where you are based, you will need to consider employment laws in your home country as well as in Ireland. Additionally, you must ensure that your employer can legally hire you and manage payroll for you in your country of residence. Setting up an entity in your country or using an Employer of Record (EOR) is a common way to handle this.

Can I work for an Irish company in the UK?

Absolutely! The proximity of Ireland and the UK, along with shared time zones, makes remote work between the two countries highly convenient. Despite Brexit, Irish companies continue to seek talent from the UK, especially in industries such as finance, technology, and customer service.

However, you will need to navigate some post-Brexit challenges, such as work visas and tax implications. Depending on the nature of your work and the length of your employment, your employer may need to handle issues like visa sponsorship or ensure tax compliance to avoid penalties. Using an EOR can help Irish companies employ UK-based workers more smoothly without setting up a legal entity in the UK.

Can I Work Remotely in the EU for an Irish Company?

Yes, working remotely for an Irish company from within the EU is very common and relatively straightforward. As Ireland is a member of the European Union, EU citizens can live and work freely in any member state without needing a visa. Remote employees from countries like Germany, France, and Spain frequently collaborate with Irish companies, particularly in the tech and startup scenes.

For example, living in Spain and working for an Irish company is an attractive option for many due to Spain’s warm climate and appealing work-life balance. With Spain’s Digital Nomad Visa introduced in 2023, remote workers from around the world can live and work in Spain legally for up to 12 months, with the option for renewal.

Each EU country, however, has its own tax laws, employment protections, and residency requirements that must be adhered to. France and Germany, for example, may have stricter labor laws than other EU countries. Employers and employees alike should ensure that they are compliant with local regulations to avoid any legal issues.

What Are the Risks of Working Remotely for a Foreign Company?

Working remotely for a foreign company, such as an Irish one, comes with certain risks that must be managed carefully. These risks include compliance with local tax laws, legal employment classifications, and ensuring access to employee benefits and protections. Misclassifying employees as contractors or failing to provide the correct employee protections can lead to penalties.

Additionally, you could face double taxation issues, where both Ireland and your country of residence seek to tax your income. Ireland has tax treaties with many countries, which can help mitigate this, but careful planning and expert advice are crucial. INS Global, with its expertise in tax and legal matters, can help remote workers and their employers navigate these challenges smoothly.

Are There Limitations When Working Overseas for an Irish Company?

Working overseas for an Irish company can involve some limitations. Certain roles may require you to work within specific time zones, particularly for customer-facing or time-sensitive positions. Additionally, some countries may have restrictions on hiring foreign workers, or you may face challenges in obtaining the necessary visas or work permits.

For example, while EU citizens can freely work for Irish companies without major restrictions, non-EU citizens may need to ensure their work agreements comply with immigration and labor laws. Furthermore, industries such as finance, healthcare, and data management may have specific compliance requirements in certain countries.

How Do Employer of Record (EOR) Services Work If I Want to Work for an Irish Company Remotely?

An Employer of Record (EOR) is an excellent solution for those who want to work remotely for an Irish company. EOR services handle the legal and administrative aspects of employment, including tax compliance, payroll, and benefits. This allows you to work for the Irish company without the employer needing to establish a legal entity in your home country.

For remote employees, EOR services provide access to full employment benefits, including health insurance, pensions, and paid leave, while ensuring that all local laws are followed. Irish companies can use EOR services to hire remote workers globally without dealing with the complexities of international employment law.

How Much Does an EOR Cost for Remote Workers?

The cost of EOR services for remote workers varies depending on the location, the number of employees, the services provided, and other specifics such as if the employees will be working from home or in an office. For Irish companies hiring remote workers, the EOR will handle payroll, tax filing, compliance, and employee benefits, among other services. Generally, these costs are calculated based on a percentage of the employee’s salary or a flat fee per worker.

Using an EOR is often more cost-effective than setting up a legal entity in another country. The fees usually include everything needed to stay compliant with local employment laws, making it a streamlined solution for companies looking to expand their remote workforce internationally.

How INS Global’s Employer of Record Can Help You Expand Internationally Through EOR Services

Accepting an opportunity to work for an Irish company remotely, or hiring new remote workers for Irish companies can be seamless with the right EOR partner. INS Global offers EOR services in over 160 countries, helping companies expand their workforce without the hassle of setting up local entities or navigating complex compliance issues.

Since 2006, INS Global’s expert team has provided tech-forward, high-hand, and tailored solutions to ensure both employers and employees can thrive in the global remote work landscape. So, whether you’re looking to work remotely for an Irish company or expand your team abroad, INS Global has the experience and knowledge to make it happen.

Contact INS Global today to explore how we can help your business grow globally through compliant remote hiring.

SHARE