- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

We act as your Employer of Record in the Philippines. This country, with a robust economy and skilled workforce, offers significant opportunities for international businesses. However, the Philippines’ complex regulatory landscape can be a serious hurdle for those unfamiliar with local market requirements or best practices. That’s why it can a big advantage to have an Employer of Record (EOR) in the Philippines like INS Global to act as your local partner, ensuring a smooth market entry and ongoing compliance with all necessary regulations.

Your engagement with an Employer of Record in the Philippines starts with a comprehensive consultation to understand your business goals. This includes discussing the number of employees, their roles, and your timeline. This initial phase ensures that an Employer of Record like INS Global can tailor their services to align with your objectives, helping your employees to quickly integrate into the Philippines’ unique tax system and labor laws.

Whether you are forming a new team in the Philippines or transferring existing employees, the Employer of Record handles all legal processes associated with legal local employment. This includes managing visas and work permits to ensure complete and consistent compliance with Filipino regulations. By acting as your workers’ employer in the Philippines from the outset, an Employer of Record removes the need for you to establish a local entity, saving you valuable time and resources.

Once your employees are on board, the Employer of Record oversees ongoing HR and payroll functions in the Philippines. This includes processing salaries, managing employee benefits, and ensuring compliance with Social Security System (SSS) contributions. An Employer of Record like INS Global thus serves as the HR interface between you and your Filipino team, managing administrative tasks and addressing employee concerns, allowing you to focus on business expansion with confidence.

Avoid the complexities of navigating the Philippines’ tax system and labor laws. An Employer of Record simplifies the setup process, ensuring compliance from the start.

Regulations can be complex or varied according to your industry and location in the Philippines. Employer of Records like INS Global have the expertise to keep your business compliant with local tax laws, labor regulations, and social security contributions.

Acting as your legal employer in the Philippines, an EOR reduces the risks associated with employment regulations and ensures compliance.

Delegate HR tasks like recruitment, payroll processing, and tax management to your EOR, freeing up your time to focus on core business activities.

EOR services can be more economical than establishing a local subsidiary, particularly for smaller teams or projects with scaling or temporary needs, by avoiding initial incorporation costs and ongoing administrative burdens.

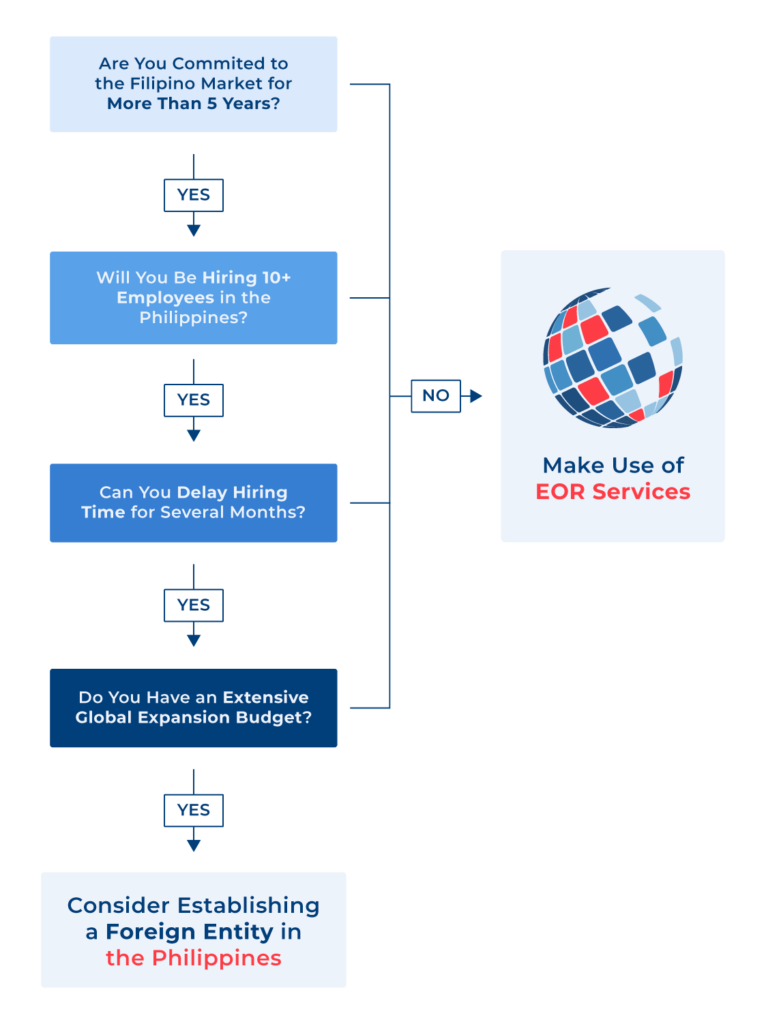

While setting up a subsidiary in the Philippines provides more control, opting for an Employer of Record like INS Global as your expert local partner offers several comparative advantages, such as:

Navigating these complexities in-house can be challenging and time-consuming. Partnering with an Employer of Record in the Philippines ensures your business remains compliant with labor laws, protecting you from potential risks and allowing you to focus on growth.

An Employer of Record manages all legal, HR, and compliance tasks, allowing businesses to enter the Philippine market quickly without needing to establish a local entity.

Using an Employer of Record can be more cost-effective than setting up a subsidiary, as it eliminates initial incorporation costs and reduces ongoing administrative expenses. Instead, the Employer of Record provider in the Philippines will provide everything you need for compliant employment based on a percentage of your employee’s pay.

Yes, an Employer of Record manages the entire visa and work permit application process, ensuring compliance with local immigration laws and regulations.

Employer of Record services are beneficial for businesses of all sizes, especially those seeking rapid market entry, cost savings, and reduced administrative burdens.

Employer of Records have local experts who stay updated on regulatory changes and manage all compliance aspects, ensuring your business adheres to Filipino labor laws.

While the Employer of Record is the legal employer, you retain significant control over day-to-day management and operational decisions regarding your employees.

Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard

Singapore 018983DOWNLOAD THE INS Expansion Insights

DOWNLOAD THE PDF