- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

As your Employer of Record in Costa Rica, we can act as your local partner and one-stop solution, simplifying the procurement process and ensuring compliance with local regulations.

Costa Rica’s reputation as a business-friendly haven with a skilled workforce is well-deserved. However, its unique labor laws and bureaucratic hurdles can make setting up shop a challenge.

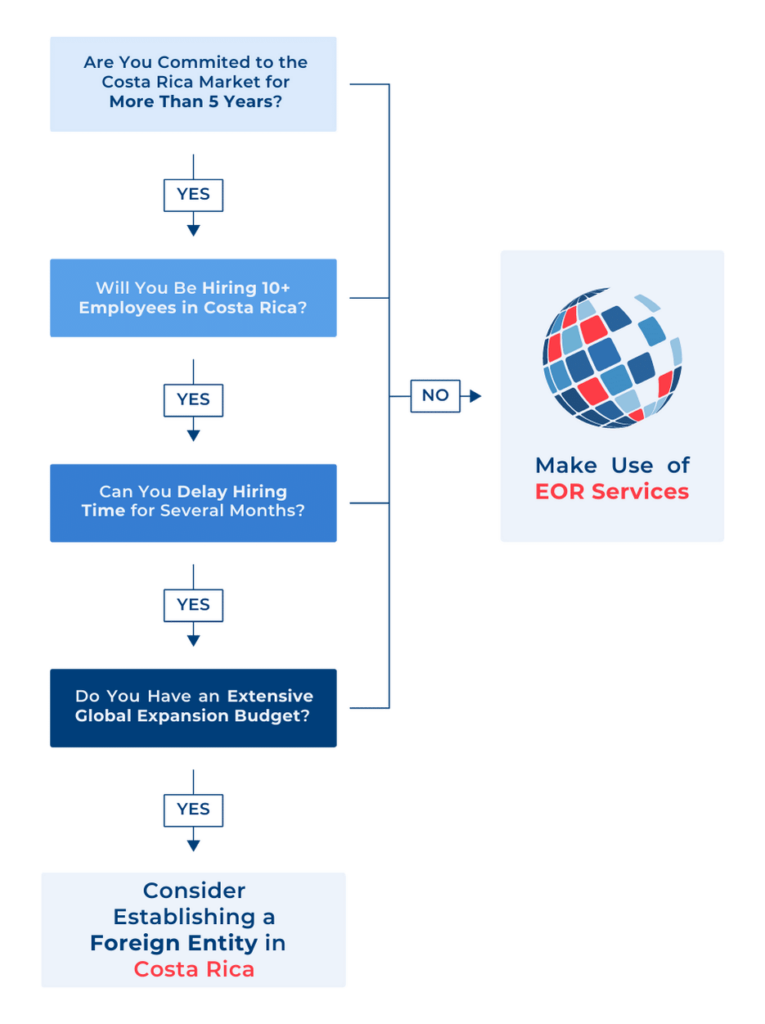

Company incorporation in Costa Rica is thought of as the default option for entering the market as it offers you more control, but it’s essential to understand the massive benefits that come with instead choosing to use an Employer of Record in Costa Rica, such as:

Costa Rica’s labor laws can be intricate, but an Employer of Record streamlines the hiring process, handling work permits, visa applications, and ensuring adherence to local regulations.

Cut through bureaucratic hurdles with the help of an Employer of Record in Costa Rica. They handle the complexities of payroll processing, social security contributions, and tax administration on your behalf.

An Employer of Record acts as your legal employer in Costa Rica, minimizing your risks associated with employment regulations and ensuring compliance.

Offload HR tasks like onboarding and employee administration to your Employer of Record . This allows you to focus on growing your business and building your team in Costa Rica.

For smaller teams or companies with temporary needs, Employer of Record services can be more cost-efficient than establishing a local entity because you avoid upfront incorporation costs and ongoing administrative burdens.

Working with our Employer of Record in Costa Rica simplifies the expansion process for businesses of all shapes and sizes through the following:

Your journey begins with a consultation between you and our team of local experts. They will learn more about your specific goals in Costa Rica, including the number of employees you plan to hire, their roles, and your desired timeline.

This initial discussion ensures the clearest understanding of your needs and vision and tailors our services accordingly.

Whether you’re building a new Costa Rican team or transferring existing staff, our Employer of Record team handles all the legalities. This includes work permit applications, navigating Costa Rica’s labor laws, and ensuring compliance with all local employment regulations.

Our expertise allows us to act as your legal employer in Costa Rica from day one, eliminating the need for establishing your own entity and saving you significant time and resources.

Once your employees are operational in Costa Rica, our Employer of Record takes care of ongoing HR and payroll functions. This includes processing salaries, managing employee benefits and social security contributions, and ensuring adherence to tax regulations.

Our Employer of Record acts as your HR liaison between you and your Costa Rican team, handling any administrative tasks or employee concerns that arise.

By outsourcing these tasks, you’re free from the complexities of Costa Rican legalities, and you can focus your energy instead on strategic business development and managing your core operations with complete peace of mind.

Costa Rica boasts a business-friendly environment, but its labor laws can have hidden complexities for unwary foreign companies.

Here’s a breakdown of key points and how an Employer of Record in Costa Rica can help you navigate them.

Selecting the right Employer of Record in Costa Rica is crucial for a successful market entry. Here are 5 key factors to consider:

In Costa Rica, the terms EOR (Employer of Record) and PEO (Professional Employer Organization) are generally interchangeable. Both handle employment responsibilities for a fee, but Employer of Records typically offer a wider range of HR and payroll functions while acting as your legal employer in Costa Rica.

Costs usually vary depending on the services offered, the number of employees you have, and their location. INS Global is one of the most cost-effective options, as the costs are a fixed percentage of your local payroll, allowing you to scale and expand efficiently.

The corporate income tax rate in Costa Rica is 30%. However, there are various tax incentives and free trade zone programs that can significantly reduce this rate for qualifying businesses.

Faster market entry, reduced compliance burden, cost-effectiveness, access to local HR expertise, and minimized risk are all key advantages of partnering with an Employer of Record in Costa Rica.

Yes, Employer of Records in Costa Rica handle payroll processing and ensure adherence to tax and social security regulations.

Absolutely. An Employer of Record streamlines the hiring process, eliminates the need to establish your own entity, and ensures you comply with Costa Rica’s labor laws thanks to their local expertise. This allows you to focus on growing your business and reaching your target market in Costa Rica faster, while also minimizing risk for your employees.

Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard

Singapore 018983