中国のPEO

グローバルに採用し、現地で報酬を支払う。迅速に拡大する。

中国のPEO - Summary

中国のPEO

中国のPEO を利用するメリット

確実な法的遵守

予算や人材不足のため、海外の従業員の人事管理を扱う人事部門を運営できない企業にとって、PEOは効率的に機能するために必要なすべてのサービスを提供します。

コストと時間の削減

人事に関する単純な問題でも、新規市場参入時に高額な手数料や罰金が発生する可能性があります。PEOは現地の専門知識を提供し、高額になるミスを回避するお手伝いをします。

企業成長に注力する

PEO は、給与計算のアウトソーシング、人材紹介、ヘッドハンティング、契約社員管理などのサービスを提供することで、お客様が新しい市場への参入に必要な人事プロセスを代行し、お客様は事業の成長に専念することができます。

迅速な市場参入

新規市場における会社設立の所要時間:4~12 か月

PEO との関係構築の所要時間:5 日

*グローバルな見積もり

すべてを網羅する単一のプラットフォーム

PEO は、1 つの窓口を通じて人事サービスのあらゆる面をカバーしています。

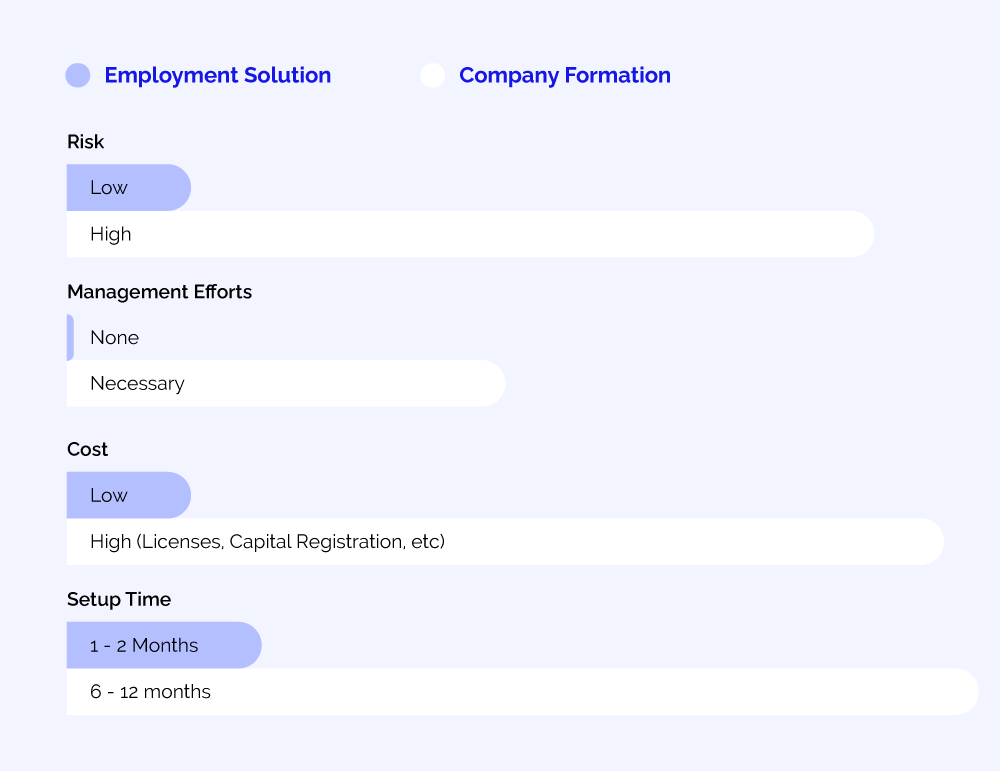

会社の設立よりも PEO を選ぶ理由

海外市場で会社を設立することは、複雑で困難なプロセスであり、対象市場に法的および物理的な存在感を確立する必要があります。PEO を利用することで、企業は、そのような別個の事業体を設立するために必要な手続きを経ることなく、新しい市場で事業を展開することができます。

中国における PEO はどのように機能するのでしょうか?

INSグローバルのPEOは、中国における従業員の採用や配置に関するご要望を、4つの簡単なステップでサポートします::

- ご要望をヒアリングし、最も適したプランを策定します。

- 弊社は、中国での事業開始のために人材を採用するための事業実体を用意します。

- 人材の採用と給与支払に関する事務的・法的な手続きを代行します。

- 弊社は人事関連業務を担当し、お客様は日常業務に専念し、中国市場での成功に向けて努力を続けることができます。

PEO と雇用記録管理業者(Employer of Record)の違いは何ですか?

中国の労働法 - 2024年最新版

雇用契約書

- 中国での雇用には、書面による雇用契約の提示に続き、従業員の責任と福利厚生の詳細を明記した雇用契約書の締結が必須です。

- 中国の雇用契約書に記載されるすべての金額は、外国通貨ではなく人民元(RMB)で表記されなければなりません。

- 中国の労働法に基づき、中国の雇用契約は従業員の解雇に対する 強い雇用保障を提供しています。

- 雇用主が中国で従業員を解雇する場合、通常は解雇手続きが長期化することを避けるため、解雇手当を支払わなければなりません。

- ただし、従業員が雇用契約で定められた規則や規程に重大な違反を犯したと判断された場合、雇用主は解雇手当を支払わずに契約を解除できます。

- 試用期間中の解雇の場合、従業員が明らかに職務に適さないことが証明された場合、雇用主は解雇手当を支払わずに契約を解除できます。

勤務時間

- 中国労働法では、標準的な労働週を1日8時間、週5日と定めています。

- 中国のほとんどのオフィスでは、標準的な労働時間が午前8時から午後6時までです。

- 昼食休憩は通常1時間ですが、最大2時間になる場合もあります。

- 通常時間を超える勤務時間は残業とみなされ、1.5倍の賃金で支払わなければなりません

- 残業時間は、1日あたり3時間、または1ヶ月あたり36時間を越えてはなりません

- 週末に勤務を求められる労働者は、通常の2倍の賃金が支払われなければなりません。

祝日

- 中国労働法に基づき、中国の国慶日に勤務する従業員には、標準賃金の3倍の賃金が支払われる必要があります 。

- 中国政府は、以下の7つを、有給の国の祝日と指定しています:元旦、春節(旧正月)、清明節、労働節、端午節、国慶節:

- これらの祝日は、1日以上の公休日を含む場合があり、旧暦に基づいて決定されるため、雇用主はこれらの祝日の日付が毎年変更される可能性がある点に注意する必要があります。

- 春節/旧正月は地元の人々や組織にとって特に重要なため、雇用主はこの時期の年次有給休暇の取得について柔軟に対応することが推奨されます。

- 中国では、公休日が通常の休日と重なる場合や、公休日を週末に延長するため、代休制度が採用されています。

病気欠席

- 従業員が企業に在籍した期間に応じて、中国の従業員は医療治療のための休暇を3ヶ月から24ヶ月まで取得する権利があります。

- この期間中の給与は、地域の最低賃金の80%未満であってはなりません。 [Ba2]

- 労働中に受けた病気や怪我の場合、中国労働法に基づき、従業員は最大1年間の有給病気休暇を取得する権利を有します。

産前産後休暇/育児休暇

- 中国の法律は、98日間の有給産前産後休暇を保障しています。

- 一部の地域では、24歳以上の女性に対して最大30日間の追加休暇が認められる場合があります。

- 中国で産前産後休暇を取得する女性は、通常、雇用主または社会保険を通じて全額支給され、この期間中の契約解除に対して法律で強く保護されています。

- 中国の法律では、地域当局の裁量により限定的な父親休暇 が認められていますが、14日を超えてはいけません。

中国の税法

- 中国労働法に基づき、労働者に対して「5つの保険」として健康保険、年金保険、労災保険、出産手当、失業手当が提供されています。

- 地域によっては、これらの保険に加え住宅手当が追加される場合があり、これは従業員の個人別の所得区分に基づいて決定されます。

- 最近の中国法 の改正により、外国人従業員に対する多くの免除措置が廃止されました。

中国のPEO

今すぐお問い合わせください

よくある質問

いいえ、各国の労働法に準拠するため、海外で現地法人を設立する必要があります。

外国企業は、各国に現地法人を設立するか、現地の PEO(Professional Employment Organization、専門職業紹介機関)のサービスを利用して、現地で直接スタッフを採用することができます。

Employer of Record(EOR)は、特定の国で雇用されている従業員に対して法的責任を負う法人です。実際、外国企業は、海外の従業員の記録上の雇用主となるために子会社を設立するか、PEO(プロフェッショナル・エンプロイヤー・オーガニゼーション)を利用して記録上の雇用主として機能させるかのいずれかの方法を選択できます。

債務は国によって異なり、従業員管理に関するすべての責任を含みます:労働契約に関する問題、給与管理、税務遵守、社会保険管理、経費精算の申告、採用と解雇の手続きなどです。

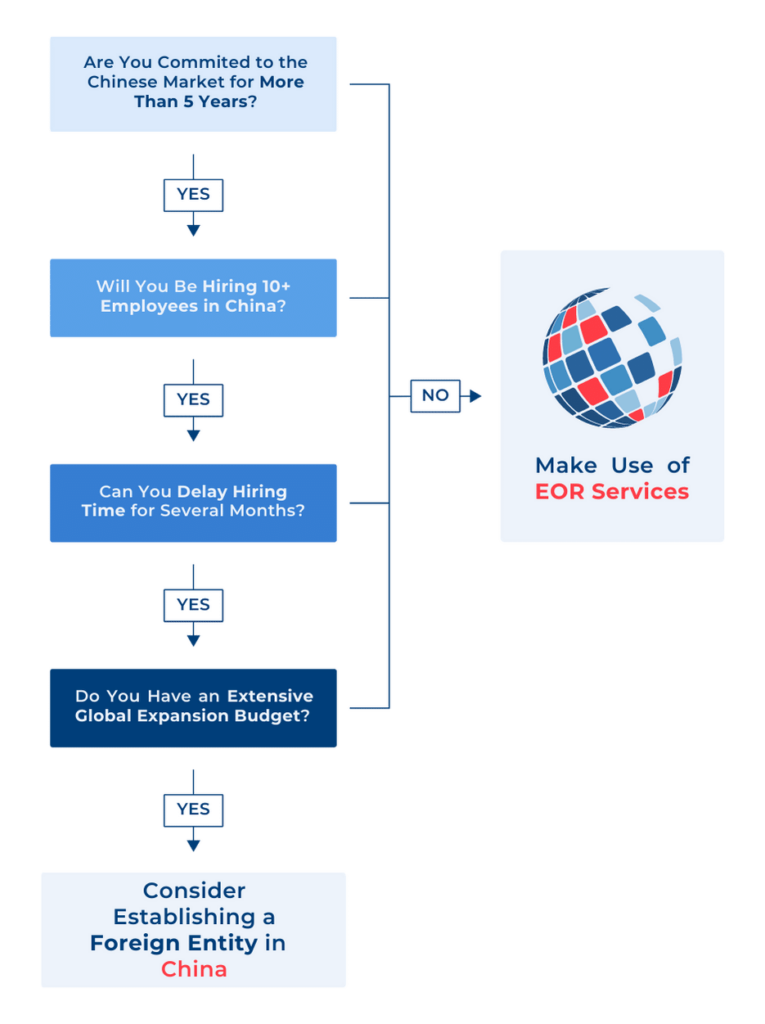

一般的に、既存の PEO を正式な雇用主として海外に従業員を配置するには 1 か月かかります。正式な雇用主となる新しい子会社を設立する場合、その手続きには 4 か月から 12 か月かかります。

高品質の PEO サービスプロバイダーは、給与計算から契約管理、税務コンプライアンスの保証に至るまで、必要なあらゆる人事機能を、共同雇用者の給与額に基づく月額固定料金で提供します。

はい、EOR(Employer of Record)は、中国で従業員を雇用または転籍する際に、安全かつ合法的な方法を提供します。これは、長期的な雇用や、会社組織を設立するまでの期間に限定した雇用にも適用されます。

中国の給与と給与支払いは通常、月ごとに支払われます。多くの企業では13ヶ月目のボーナスが支給されます。雇用主は、従業員の 代わりとして、給与税と従業員の社会保険拠出金を天引きする責任を負います。

中国で新たな従業員を採用し雇用するとは、単に給与を支払うだけでなく、社会保険の保険料などの間接費用を負担し、さらにボーナスやインセンティブも提供する必要があることを意味します。

はい、中国各地の都市や省で労働法規が異なるものの、EORは必要な場所で従業員を雇用する際の要件をすべて対応可能にします。

中国における雇用契約の変更は、すべて従業員との合意が必要となります。一方的に契約を変更しようとする行為は、重大な罰金処分を招く可能性があり、企業は通常、損害賠償を支払うよう命じられることになります。

中国の雇用主は、安全な職場環境の提供、給与天引きの管理、および労働契約が国家の最低基準を満たしていることを確認するなど、多くの責任を負っています。

はい、税金の支払いに加え、企業は中国の社会保険制度への従業員と事業主の保険料の支払いも負担する必要があります。この制度には6種類の保険料(いわゆる「5+1」システム)が含まれます。これらの保険料の具体的な金額は、都市や行政区画によって異なります。

一部の PEO 企業は、そのサービスを通じて雇用できるスタッフの人数に最低人数または最高人数を設定している場合があります。しかし、INS Global では、お客様の事業拡大戦略に必要な人数だけ、スタッフを管理することができます。

中国では、正当な理由による解雇の場合、退職金 は義務付けられていません。その他の解雇形態における標準的な退職金は、勤続年数1年につき1ヶ月分の給与相当額となります。

従業員が不当解雇を主張して勝訴した場合、企業は高額な罰金や追加の賠償金を支払わされる可能性があります。

中国では、従業員はリモートワークと「在宅勤務」の両方を選択可能です。企業は物理的な住所を保持する必要がありますが、従業員は雇用主の同意を得た上で、最も適切な方法で勤務することができます。

もちろんです。弊社の採用専門家は、地域の基準や業界水準に精通しており、オンラインとオフラインの両方でプロフェッショナルな採用リソースとネットワークにアクセス可能です。

中国の採用プラットフォームは通常、高額ではありませんが、雇用主から少額の料金を請求する場合があります。

中国における専門の採用代理店または採用サービス提供者 は、通常、新規採用者の月額総給与の一定割合を基に採用手数料を請求します。

Recruitment platforms in China are not usually expensive but may require a small fee from employers.

A professional recruitment agency or provider in China will typically charge a recruitment fee based on a percentage of the new hire’s monthly gross salary.

中国には7つの公式な有給の祝日があります。そのうちの一部は太陰暦に基づいており、毎年変更されます。さらに、中国の祝日は週末と組み合わせて「ゴールデンウィーク」と呼ばれる期間に調整される場合があります。ただし、このような場合、従業員は周辺の週末に働いてそれらの日を補填することが予想されます。

近年、労働者の権利は改善されてきたものの、中国における労働者の権利は依然としてばらつきがあります。労働者は雇用法上は名目上は非常によく保護されていますが、外国人従業員は法制度を運用する上で困難を覚えるかもしれません。また、就労ビザは特定の雇用主と役職に結びついているため、非現地従業員が新しいポジションに移行する際の複雑さが増しています。

中国における雇用主は、法的および国家レベルの複雑な要件を遵守するために、適切な対応を講じる必要があります。中国における雇用主の責任をすべて履行することは、時間と労力を要する困難な作業であり、企業は規制の変更が突然行われるリスクに常にさらされています。このような変更は、ほとんどまたは全く予告なしに行われることが多く、法的遵守を確実に行わない場合、重大な罰金や罰則、甚至いは刑事告発を受ける可能性があります。

はい、中国国民と外国人双方にとって、雇用手続きを簡素化する選択肢は存在します。