Commercial transactions in China are particularly regulated, especially when it comes to operational invoicing. It is obligatory to use specific invoices registered at, and provided by, the tax bureau. These are called fapiaos. In this article, we’ll take a look the ins and outs of the fapiao system and how it affects your business operations in China.

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers

In a hurry? Save this article as a PDF

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers.

Fill up the form below 👇🏼

What is a Fapiao?

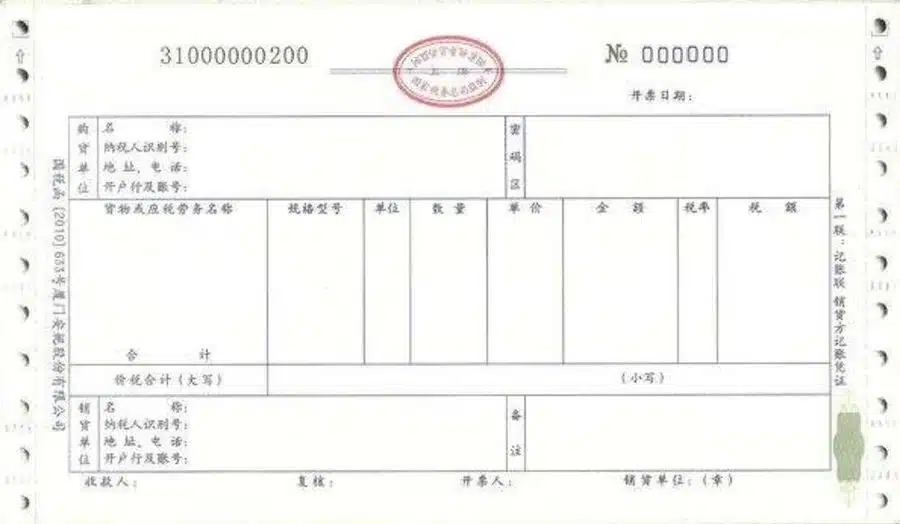

The term fapiao is a Chinese word that refers to an official slip that serves as proof of purchase for goods and services. In China, only the tax bureau is allowed to print invoices so any financial transaction recorded without using one of these invoices is not recognised in Chinese tax administration.

These fapiaos are specifically designed to prevent tax fraud, especially with regards to VAT. In a system without standardised invoices, it is easier for sellers to avoid paying part of the VAT collected. As for the consumer, they can only prove a purchase (to their employer for reimbursement for example) by presenting a fapiao.

Example of Fapiao in China

Check Our China Labor Law Guide

Learn how the Chinese law is applied in all aspects and situations, from an employer and employee perspective

Types of Fapiao

Issued under any other circumstances by a company of any other size. These may be issued in circumstances such as: sales of goods, tax-free services, or VAT-registered operations by small taxpayers. The general VAT fapiao is therefore to be used in all cases where a taxpayer subject to VAT is not authorized to give out the special VAT fapiao, notably for non-taxable transactions. It is used primarily by small retailers (food, clothing, alcohol and cigarettes etc.)

Invoicing regulations can therefore be complicated for a foreign professional who is looking to develop their business in China. Established in China since 2006, INS Global has in-depth knowledge of these regulations, and offers businesses a service for the efficient management of their invoices.

General VAT Fapiao: New requirements

- Company’s full listed Chinese name

- Tax ID number

- Fapiao with corresponding transaction summary

- Special fapiao chop from the sender

Special VAT Fapiao: New requirements

- The complete information of the correct beneficiary in the upper left corner of the corm (Chinese company name, tax ID number, address, telephone number, bank name, account number)

- Fapiao access code printed carefully in the correct field

- Breakdown of tax in accordance with goods and services

- Fapiao content with corresponding transaction summary

- Special fapiao chop from the sender

SHARE