Since that passage of the 2008 Enterprise Income Tax Law, China’s corporate taxation system now has foreign and domestic companies under the same tax regime, eliminating the previous bifurcated system.

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers

In a hurry? Save this article as a PDF

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers.

Fill up the form below 👇🏼

Enterprise Income Tax

Companies in China pay a standard 25% tax on all income earned. The corporate tax rate in China can be lower for qualified companies in some specific, strategic industries or promoted regions (explained below).

Taxation Basis

According to China’s corporate taxation law, a corporation is considered to be a tax resident of China if it was established in China or if it is effectively controlled and managed from China. If a company is registered in China (regardless of if it is domestic, foreign invested (FIE) or foreign-owned (WFOE)), it is considered a Tax Resident Enterprise (TRE).

Tax Residency

For TREs, the enterprise income tax of 25% is imposed on the global income of the company. If a company is not a TRE, the enterprise income tax applies only to income sourced in China.

Check Our China Labor Law Guide

Learn how the Chinese law is applied in all aspects and situations, from an employer and employee perspective

Withholding Tax

The Enterprise Income Tax Law officially stipulates a 20% withholding tax on passive income derived by foreign companies (non-TREs) in China. Passive income includes income earned from dividends, royalties, rental income and others. The payer in China is the withholding agent. For dividends, the withholding obligation begins when the dividend is declared. Dividends distributed out of profit earned prior to 2008 are exempted from withholding tax. For royalties, interest and rental, the obligation begins when the payment is due. There is no tax on branch remittances.

Withholding Tax Reduction

The withholding tax is reduced to 10% under a tax treaty, according to the Detailed Implementation Regulations of the Enterprise Income Tax Law.

Relief from Double Taxation

Double taxation, for companies, occurs when the income is taxed both in the jurisdiction in which the income sourced, as well as the jurisdiction in which it is received. China’s extensive network of Tax Treaties provides for relief from double taxation.

Related Party Transactions

Related-party transactions must be conducted on an arms-length basis. In other words, prices on all transactions between an MNC’s Chinese affiliate and a foreign affiliate should reflect the cost of the transaction as if the two parties were entirely unrelated. Chinese taxation authorities closely monitor such transactions, attempting to prevent the manipulation of such prices/payments to reduce an MNC’s tax burden. It is recommended to gather concrete evidence to justify that the price in a related-party transaction reflects the arms-length equivalent, especially when the non-Chinese affiliate is located in a jurisdiction with a lower corporate tax rate.

Special Corporate Tax Rates

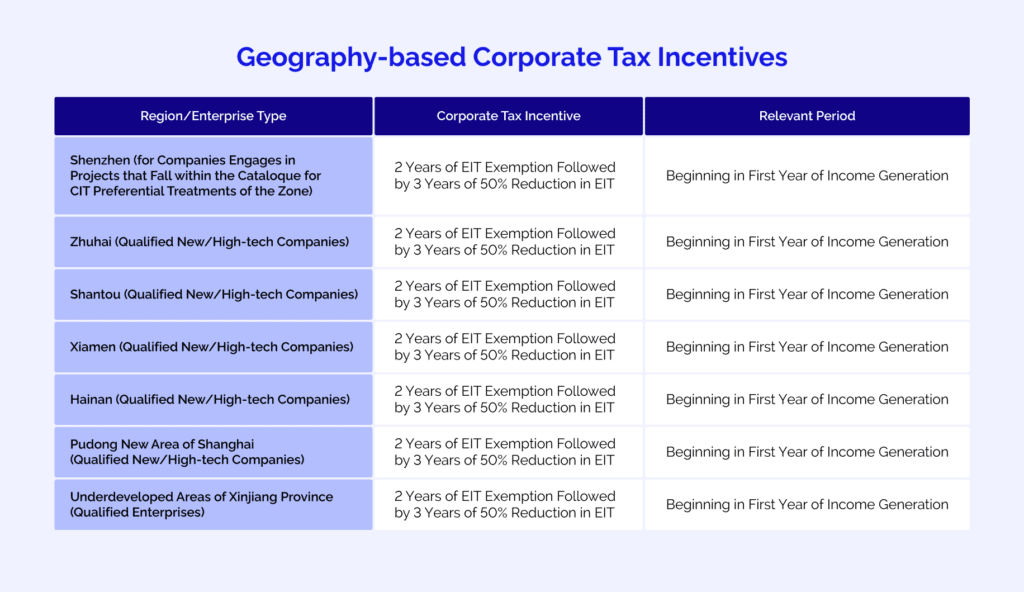

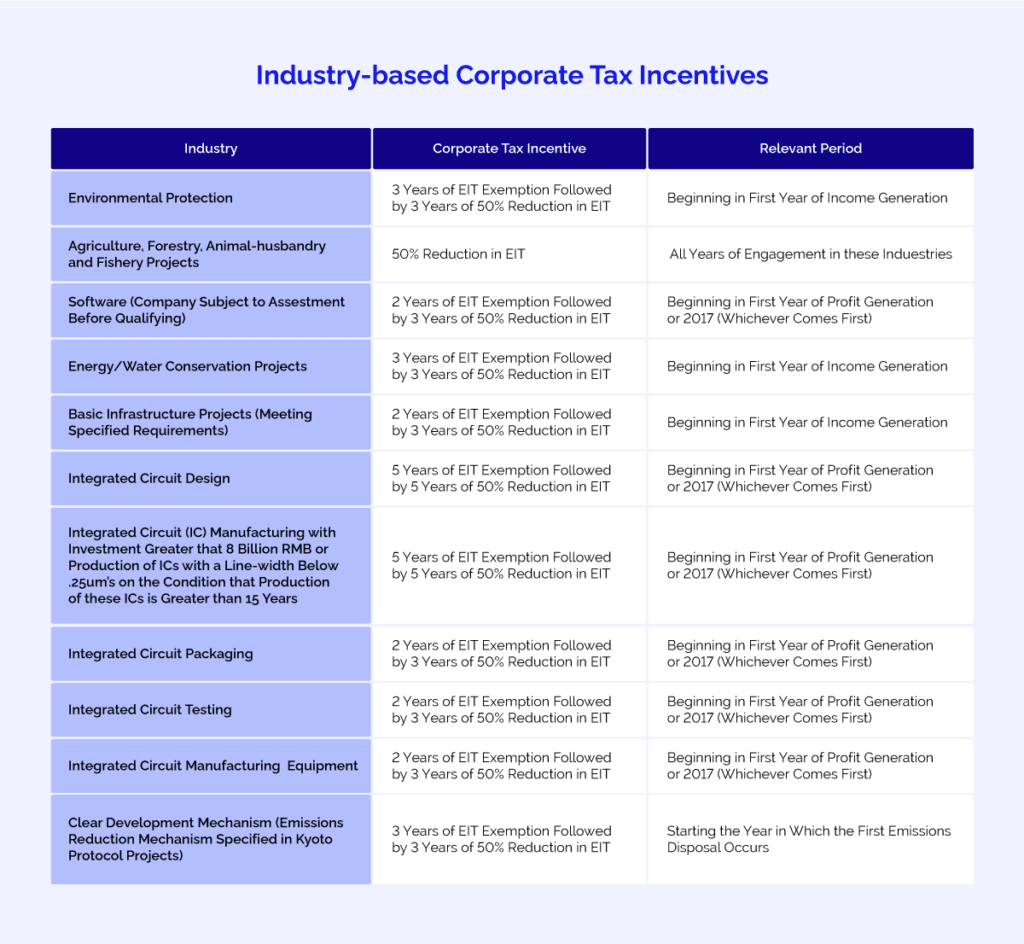

There are a number of industry-based and region-based tax incentives which lower or eliminate the enterprise income tax for a period of time. This is part of the effort to bring investment into a number of strategic industries promoted by the government and targeted development.

SHARE