Testimonial

Manuel Ramos

TERAO ASIA

Managing Director

We think INS Global is a good solution about starting in a market like China. Understanding the market doesn’t mean you need to set up a company immediately.

5/5

With services available in over 160 countries worldwide, INS Global is the perfect expansion partner for any company that’s looking to enter new markets quickly and securely. Our PEO and EOR services will handle every aspect of payroll and HR so that you can focus on company operations and expansion goals. A PEO in Jordan makes setup easier and smoother than with traditional expansion methods.

You can bring in your staff, hire new employees, and ensure legal compliance at every step, all in just a few days.

An EOR in Jordan takes on all administrative and legal responsibilities of an employer, including keeping up to date with local labor laws. Partnering with a PEO or EOR makes global expansion a reality without wasting any time or resources.

Figuring out a foreign legal system and necessary HR functions can be complicated and time-consuming, and you’re more likely to make costly errors. Our legal advisors can keep you in line with every local regulation and requirement while also saving you expenses and time.

The obstacles on the road to global expansion don’t have to stop you from growing. A PEO has tailor-made solutions to meet your every need and make market entry fast and easy.

Recruitment, onboarding, contractor management, payroll, and HR services: You can have all of these and more taken care of by partnering with a single professional PEO services provider.

With traditional company incorporation, it can take up to a year to get the company set up in a new country. A PEO can have you operating smoothly in less than a week.

You can have access to long-term recruitment, payroll, and HR services via a single dedicated point of contact.

While traditional company incorporation can be a reliable method of global expansion, it takes a long time due to requiring you to establish a legal branch or subsidiary of the company in the new country. With a PEO you can operate in a new market without having to set up a separate entity.

Other advantages of using a PEO include:

Manuel Ramos

TERAO ASIA

Managing Director

We think INS Global is a good solution about starting in a market like China. Understanding the market doesn’t mean you need to set up a company immediately.

INS Global’s PEO can manage your recruitment and employment needs in Jordan with just 4 simple steps.

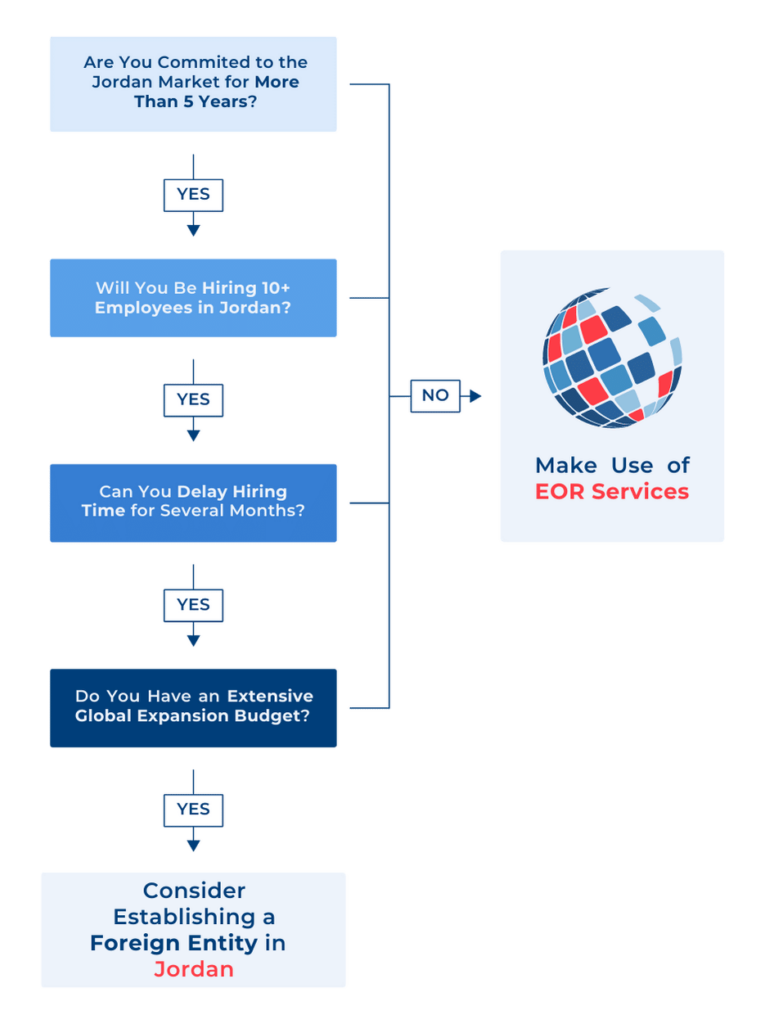

PEO and EOR are often mentioned together in a discussion of HR outsourcing. While they provide similar services, they are not the same. It’s important to understand how each one functions so that you can partner with a provider that offers the service that best suits your needs.

A PEO and EOR are both third-party organizations that provide HR services to employees of a client company. These services cover many different tasks, including payroll, tax, legal compliance, etc.

However, an EOR can also legally hire employees on behalf of the client company. As a result, an EOR is officially responsible for all the liabilities of recruiting and employing workers.

Another difference is how a contract is made between parties. In a PEO agreement, the contract is made between the client company and the employee. In an EOR agreement, however, the contract is directed by the client company but is officially between the EOR and the employee.

While both verbal and written contracts are valid, employment contracts are typically made in writing to avoid problems later. Contracts should be in Arabic and any compensation amounts should be in the local currency of the Jordanian dinar.

The current minimum wage in Jordan is JD260 per month.

Probation periods are 3 months or 90 days, maximum.

The termination notice period is 1 month. Severance pay is calculated at 1 month’s wages for each year of service.

Weekly work hours in Jordan can go up to 48 hours over 6 days. Any work hours beyond this are counted as overtime.

Overtime pay is 1.25 times normal wages and 1.5 times if the overtime work is on a weekend, rest day, or public holiday.

Employees must be allowed to take Friday off unless otherwise agreed upon.

There are at least 8 public holidays each year in Jordan. Some groups of workers must be allowed to celebrate certain important religious or cultural holidays in addition.

All employees who have worked a minimum of 1 year for a company are entitled to 14 days of annual paid leave.

After 5 years of continuous employment, annual leave is increased to 21 days.

Unused annual leave can be carried over to the next year if agreed upon with the employer.

The annual sick leave allowance for employees is 14 days at full pay.

If the employee is hospitalized, sick leave can be extended by another 14 days at full pay, or at half pay if hospitalization is not required but a medical report is provided.

Employees need to provide a statement from the doctor to receive sick leave reimbursement from their social security fund.

Maternity leave is 10 weeks in total, with a mandatory six weeks after birth.

Mothers are allowed to take a 60-minute break each day for nursing for up to a year after the birth of a child.

Mothers can also take unpaid leave for up to a year after birth and still be protected in their position.

The minimum paid paternity leave in Jordan is 3 days.

Corporate tax in Jordan varies according to the industry. The standard corporate tax is 20% which rises to 24% for companies in financial, insurance, electric, telecommunications, and those companies that mine for raw minerals. Banks are taxed at 30% corporate tax.

Income tax is assessed at a progressive rate from 5-30%.

Social security contributions are 14.25% for employers, and 7.5% for employees.

Income from outside Jordan can be deducted if tax was already paid in the country of origin. Jordan has entered into DTT (Double Taxation Treaty) with many countries globally so it’s vital to check first.

Sub Title Slider 4

VIEW DETAILS

Sub Title Slider 3

VIEW DETAILS

Sub Title Slider 1

VIEW DETAILS

No, it is necessary to use a local entity abroad to comply with each country labor law.

Foreign companies can either set up a local entity in each country or use the services a local PEO (Professional Employment Organization) to hire the staff on-site directly.

The employer of record is the legal entity liable for the staff employed in a specific country. In practice, a foreign company can either open a subsidiary to become the employer of record of its abroad employees or use a PEO to act as the employer of record.

In general, 1-month is necessary to have an employee based out abroad using an existing PEO as the employe of record. When incorporating a new subsidiary to be the employer of record, the delay varies from 4-12 months.

Level 39, Marina Bay

Financial Centre Tower 2,

10 Marina Boulevard

Singapore 018983