Country Guide

Employer of Record in Spain (EOR in Spain)

Capital City

Languages

Currency

Population Size

Employer Taxes

Employee Costs

Payroll Frequency

Hire Globally, Pay Locally, Expand Effortlessly

Spain, with its thriving economy and prime location in Europe, offers significant growth potential for international companies.

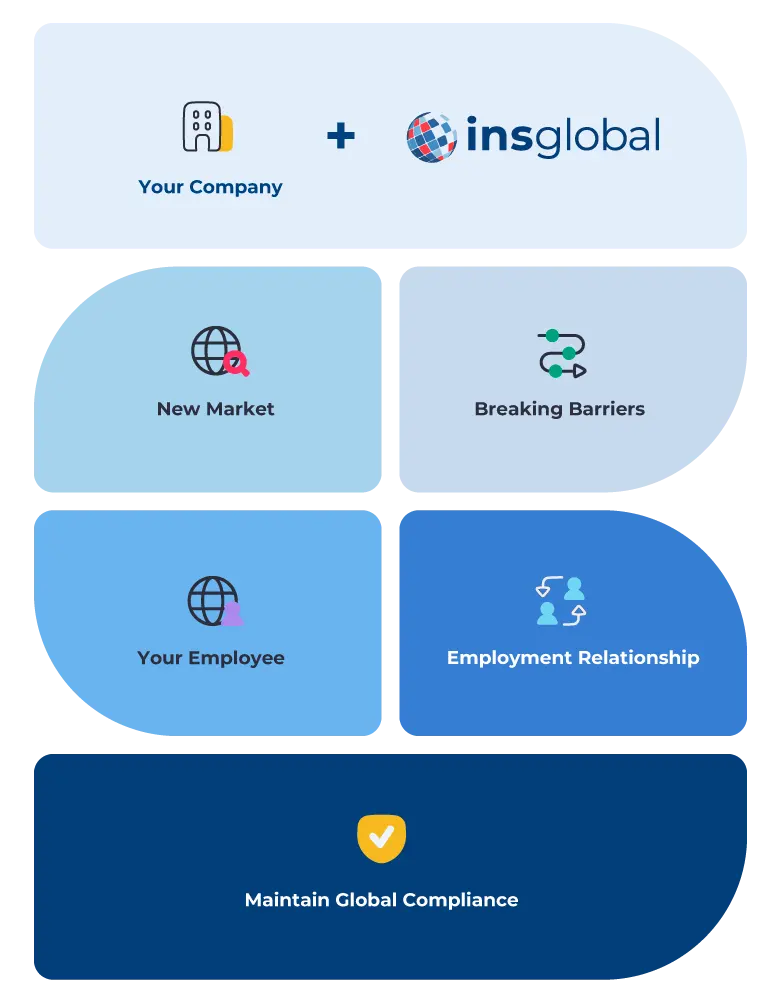

However, entering the Spanish market requires navigating a maze of labor laws and tax regulations. An Employer of Record (EOR) in Spain can streamline this process by acting as your local partner, ensuring effortless market entry and ongoing compliance with all necessary regulations.

Want to have a Team in Spain TODAY?

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers

How an Employer of Record in Spain Gets Your Operations Up and Running in 3 Steps

Step 1 – Comprehensive Planning & Needs Assessment

Working with an EOR in Spain, such as INS Global, begins with a comprehensive review of your business objectives. This involves evaluating the number of employees, their roles, and your timeline for expanding into Spain. The EOR tailors its services to fit your specific needs, ensuring a smooth and efficient market entry.

Step 2 – Streamlined Setup, Recruitment & Onboarding

When setting up a new team in Spain or transferring existing employees, an EOR handles all the essential legal processes. This includes managing visas, work permits, payroll, and contract management, ensuring full compliance with Spanish labor laws. Acting as your legal employer in Spain, the EOR saves you the hassle and expense of establishing a local entity.

Step 3 – Ongoing Management & Compliance Assurance

Once your team is up and running in Spain, an EOR takes over ongoing HR and payroll functions. This includes salary processing, managing employee benefits, and ensuring compliance with health insurance and social security contributions. The EOR serves as the HR intermediary between you and your Spanish team, managing administrative tasks and addressing employee concerns, allowing you to focus on business growth.

PEO/EOR vs Company Incorporation

The Advantage in Figures

PEO/EOR

Company Incorporation

Price

80% Less Expensive

Market Entry

2-5 Days

6 Months

The Advantages of a Spanish EOR On Your Business

Efficient Entity Management

An EOR simplifies the complexities of entering the Spanish market by managing intricate tax systems and labor laws, ensuring that you’re always compliant from the start.

Save Money

Navigating Spain’s regulatory laws can be demanding and complex, but EORs have the expertise to ensure your business is always compliant with local tax laws, labor regulations, and social security contributions.

Minimized Risk and Liability

As your legal employer in Spain, an EOR mitigates the risks that traditionally comes with employment regulations, ensuring full compliance at all times.

The Ability to Focus on Core Business Objectives

By outsourcing HR tasks such as recruitment, payroll processing, and tax management to your EOR, you can focus on your core business activities and growth.

Cost Planning and Management

EOR services are typically more cost-effective than setting up a local company, especially for smaller teams or temporary projects, helping you avoid incorporation costs and ongoing administrative burdens.

Choosing Between an EOR and Company Incorporation in Spain

While setting up a subsidiary in Spain is an option, using an EOR provides several advantages:

1

Speed – The process of setting up in Spain is faster with an EOR like INS Global, enabling you to begin operations and hire staff much quicker. Local incorporation can take several months, whereas an EOR can have your team operational within weeks or even days.

2

Compliance – Both EORs and subsidiaries must adhere to Spanish tax laws and labor regulations. EORs bring local knowledge to handle these complexities and ensure continuous compliance without the need for in-house experts.

3

Cost – For smaller teams or temporary needs, EOR services can be more cost-effective than establishing a subsidiary, as they help you avoid upfront incorporation expenses and ongoing administrative costs. For larger companies, EORs provide efficient integration into multi-country payroll systems.

4

Control – While incorporation offers complete control over HR, finances, and operations, EORs provide similar control over your workforce while reducing administrative responsibilities and liability.

5 Essential Factors for Selecting the Best Employer of Record in Spain

Choosing the right EOR in Spain is crucial for successful market entry. Consider these 5 key factors:

- Experience and Track Record – Look for an EOR in Spain with a proven track record and a strong industry reputation, such as INS Global. Client testimonials and industry awards can indicate reliability.

- Comprehensive Service Offerings – Ensure the EOR in Spain offers all necessary services or can customize their offerings to meet your needs. This may include visa and work permit support, payroll processing, tax compliance, and navigating Spain’s tax and labor regulations.

- Scalability – Choose an EOR in Spain that can scale its services as your business grows. They should be able to manage an increasing workforce and evolving business needs.

- Clear Communication and Transparency – Opt for an EOR in Spain known for clear and consistent communication. They should keep you informed about regulatory updates, impending deadlines, and potential issues. Look for a dedicated point of contact and online tools for easy access to vital information.

- Transparent Cost Structure – Compare the pricing models of various EOR providers in Spain. Ensure their fees are transparent and competitive, with no hidden costs. Third-party advice can help you get the best value for your EOR in Spain.

INS GUIDES

Check Our Spain Labor Law Guide

Spain Labor Law Overview

Employment Contracts in Spain

Employment Contracts – Contracts must be in Spanish or English and outline employment terms including salary, benefits, working hours, termination clauses, and minimum wage requirements. An EOR in Spain ensures your contracts comply with local labor laws.

Working Hours in Spain

- Standard work hours in Spain are usually 40 hours per week with limits on overtime. EOR services assist in tracking work hours and ensuring compliance with overtime regulations.

Types Of Leave

Annual Leave in Spain

- Employees in Spain are entitled to various types of paid leave including public holidays, annual leave, sick leave, and maternity leave. An EOR manages leave requests and ensures proper compensation according to Spanish labor laws.

Health Insurance and Social Security

- Both employers and employees contribute to health insurance and social security schemes. Your EOR handles these contributions as part of the payroll process.

Severance Pay

- Severance pay is required in certain situations such as termination without cause. An EOR guides you through severance pay practices and calculations to ensure compliance with local laws.

Contact Us Today

Frequently Asked Questions

faqs

An EOR handles the entire recruitment process, including managing job postings, screening candidates, and onboarding new hires, ensuring all procedures comply with Spanish labor laws.

An EOR takes care of payroll processing, ensuring timely and accurate salary payments, managing tax deductions, and handling social security contributions, relieving you of administrative burdens.

An EOR ensures that all employee benefits, such as health insurance and pensions, are managed according to local regulations, providing your employees with the necessary coverage.

An EOR handles all aspects of employee termination, including calculating and processing severance pay, ensuring compliance with local laws to minimize legal risks.

EORs have local tax experts who stay updated on regulatory changes, managing all tax filings and payments to ensure your business adheres to Spanish tax laws.

Yes, an EOR can support your business expansion across any and all regions in Spain, managing local employment regulations and ensuring compliance in each area.

A Global Employer of Record is an effective solutions for companies like yours that are looking to expand a workforce abroad effortlessly.

This approach allows you to outsource the international hiring process quickly and efficiency, providing access to a global talent pool while still managing payroll compliance in each country.