With many regulatory changes occurring in China, one of the major changes for foreign persons working in Shanghai is the requirement to make social security contributions. Such a change will have a major effect on foreigners in the region, as well on companies who hire foreigners.

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers

In a hurry? Save this article as a PDF

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers.

Fill up the form below 👇🏼

How Does China’s Existing Social Insurance Scheme Work?

Currently China’s existing social scheme is made up of 5 different contributions. Although these contributions are the same countrywide, the percentage of each contribution differs from city to city. The 5 different insurance contributions, consist of:

- Pension insurance

- Unemployment insurance

- Work-related injury insurance

- Maternity insurance

- Medical insurance

An additional contribution made by Chinese nationals each month is the housing fund contribution. This is a contribution that is between 5% – 12% made by both employers and employees. This scheme was implemented to assist Chinese residents to save towards purchasing a house.

Previously foreigners were not subject to mandatory social security payments in some places like Shanghai. However, in other smaller cities, foreigners may have been subjected to mandatory contributions.

Currently, there are interim measures in place which now require foreigners to make social security contributions. According to these measures, if a foreign employee is employed by any entity in China, they are required to make contributions to the following social insurance schemes:

- Pension insurance

- Unemployment insurance

- Work-related injury insurance

- Maternity insurance

- Medical insurance

For foreign employees in China who are employed by entities out of China and have been dispatched to work through a branch office, representative office, or another office of this nature, the foreign entity is also required to make the relevant contributions. All foreign employees will be subject to this, even if their parent company is based abroad.

Why is this Change So Significant?

Before 2009, China had completely excluded foreigners from the social security system. This meant that foreigners were unable to participate whether they wanted to or not. In late 2009, the Shanghai local government issued a notice which would make it possible for foreigners who work in city and want to participate, to join the social insurance scheme. As such, those foreigners who voluntarily participated were able to make contributions pension insurance, medical insurance, and work-place injury insurance.

Two years after, in November of 2011, the Ministry of Human Resources introduced a new law that had countrywide application. In terms of this law all foreigners working in China were required to participate in the social insurance scheme. However, in certain cities like Shanghai, the locally implemented law was enforced, as such foreigners could still make a choice if they wanted to participate voluntarily or not.

However, the local law implemented in Shanghai in late 2009 was set to expire on the 15th of August 2021. This means that all foreigners and persons from Hong Kong, Macau, and Taiwan are now required to make social insurance contributions, as per nationwide regulations.

Check Our China Labor Law Guide

Learn how the Chinese law is applied in all aspects and situations, from an employer and employee perspective

Impact on Foreign Employees in Shanghai

In terms of the country-wide policy, foreigners are not exempted from making social security contributions and as such this will have a significant impact on a foreigner’s income. Aside from the normal individual income (IIT) tax payments usually made by employees, they will now also make further contributions, which amounts to around 10.5% – 11% of their salary.

As social insurance contributions are regarded as special deductions, they are deducted from the gross salary. This means that deductions will be made before calculating IIT. This however still means that foreign employees will be taking home significantly less income each month.

Impact on Employers in Shanghai

The impact of the regulatory change is not limited to employees. Employers who currently employ foreign staff will also be required to make social insurance contributions for all foreign employees, including employees from Hong Kong, Macau, and Taiwan.

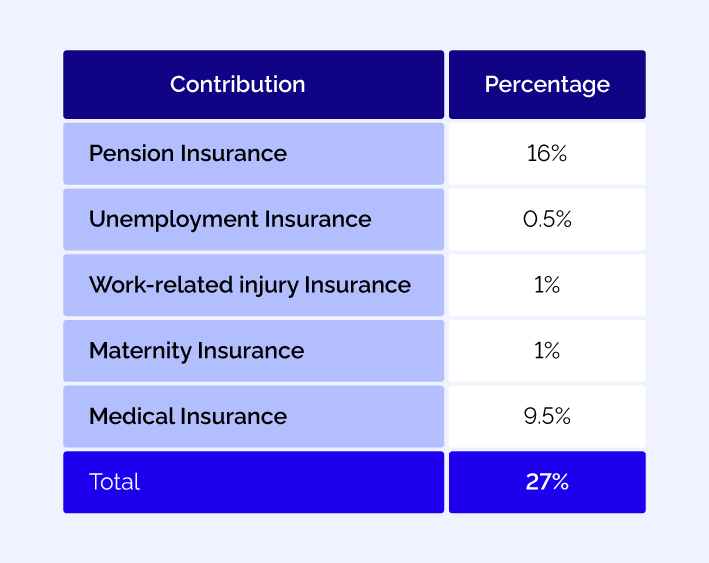

Under the countrywide law, employers are required to make the following contributions:

Aside from a substantial increase in payment for all foreign employees, there is also the additional duty of registering the employees with the relevant Social Insurance Bureau.

Once the relevant employees have been registered, employers will need to ensure that they make the correct calculations each month, withhold the correct sum, and ensure payment is correctly made.

Companies with Foreign Employees in China

Keep Employees Up to Date

It is important for companies to ensure that they keep their employees up to date with any changes that need to be made. Companies should be sure to explain the relevant impact these contributions will have on an employee’s salary. They should also ensure the employee that all withheld payments will be made by them, on the employee’s behalf.

Stay Up to Date with the Relevant Policy

The position for many companies is still not fully clear and although the nationwide law should be in effect, companies should keep a close eye on any updates by local city governments.

In Shanghai, it may be possible that the local government decides to extend the previous policy, once again exempting foreign employees and companies who hire foreign employees, from this contribution.

Companies should look out for any policy changes or updates on the matter to ensure they remain fully compliant with local laws.

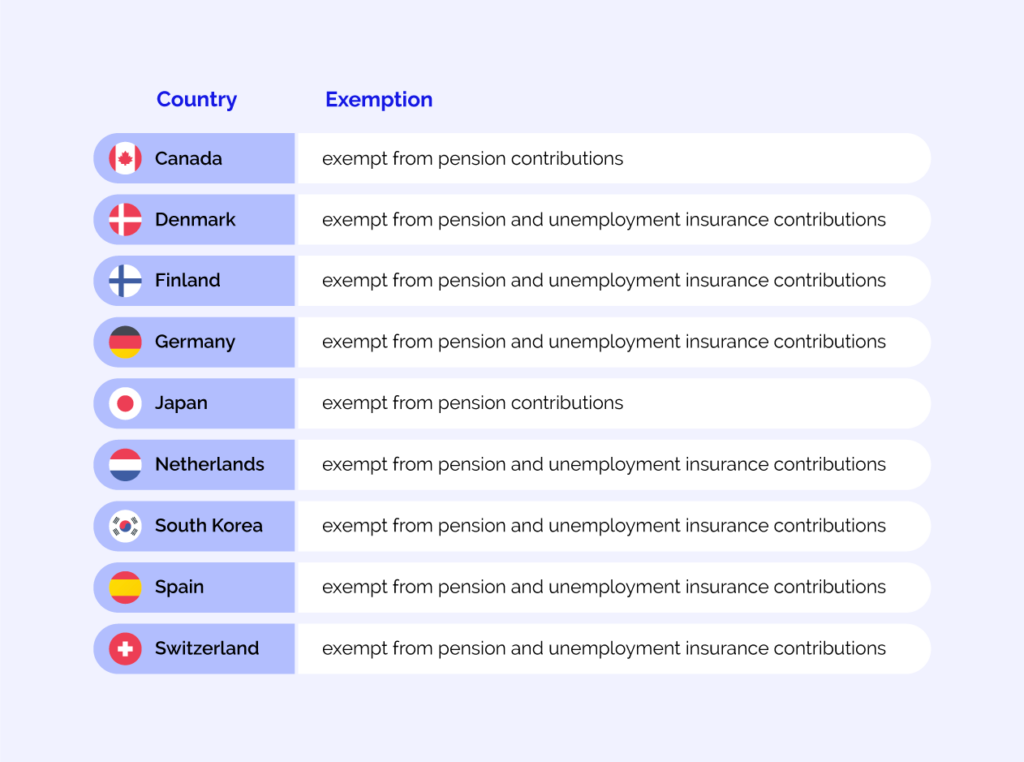

Who is Exempt from Making Social Security Contributions?

Despite the social security for foreigners now being applicable to all foreigners, China has bilateral agreements with some countries. Passport holders from these countries are not required to make specific social insurance contributions, in order to prevent them from making such contributions twice. These countries include:

Companies with employees from the above-mentioned countries should ensure that their employees are making the relevant contributions in their home countries.

How Can Foreigners Claim Social Insurance Payments When Leaving China?

For foreigners planning on leaving China for good, they are able to claim a refund of the social security contributions they made. According to Chinese law, foreigners can only get a refund on their medical insurance and pension contributions made.

If a foreigner had previously made social contributions and they had not closed their social insurance account, their contributions will be calculated cumulatively. If a foreigner decides to leave China for good, or he/she reaches retirement age, they are able to apply for a refund of their social insurance contributions made.

A foreign passport holder will need to file an application at the relevant Human Resources and Social Security Department. In their application the following documents will be required:

- An application form for the termination of their social contributions

- A social security card

- A valid passport with residence permit

- Proof of labor contract termination

Partner With INS Global in China

INS Global is a PEO company that helps businesses expand internationally. We have helped hundreds of companies grow their business in China and around the world. Our services include company incorporation, PEO and invoicing.

We have developed efficient systems that aim to help you get started in any new country. Contact INS Global today for expert advice on how to simplify your expansion in China and around the world.

SHARE