Germany, a central European powerhouse, boasts a rich culture and strong economy, anchored by Berlin, its vibrant capital. With a federal parliamentary system, it thrives on engineering, manufacturing, and automotive industries. German labor law follows a codified civil system, prioritizing written legislation and judicial interpretation.

Renowned for its robust infrastructure, including the iconic Autobahn, Germany serves as a transportation hub. Germany warmly embraces foreign businesses, fostering innovation and collaboration through supportive government initiatives. Its EU membership further facilitates trade and cooperation, making Germany a cornerstone of global commerce.

Due to the requirement for strict adherence to German labor law and the often complex interplay of written legislation and judicial practice, foreign companies may find it difficult to ensure compliance during expansion into Germany. That’s why INS Global has put together this guide to help you understand the ins and outs of Germany as a market of opportunity and provide strategies to simplify the act of remaining 100% compliant with German labor law.

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers

German Labor Law Regulations

German labor law centers on the relationship between a person in work and his or her employer, as governed by the employment contract between them. In general, the law strives to balance the needs of the individual worker or team with the needs of the employer.

Certain minimum conditions of employment are contained in various laws, including the Federal Paid Leave Act (Bundesurlaubsgesetz), the Continued Payment of Remuneration Act (Entgeltfortzahlungsgesetz), the Part-time and Fixed-term Employment Act (Teilzeit- und Befristungsgesetz), the Caregiver Leave Act (Pflegezeitgesetz), and the Family Caregiver Leave Act (Familienpflegezeitgesetz).

Employment Contracts in Germany

Upon starting work in Germany, employers must provide a written contract within a month. Employers and employees in Germany sign contracts that must lay down the rights and duties that make up working conditions, including details such as: personal information, addresses, job descriptions, start dates, notice periods, compensation, working hours, paid and unpaid leave, and any relevant Collective Bargaining Agreements (CBA).

While contracts need not be in a specific language, employees should have adequate time for translation before signing if needed.

Contract Types

- Indefinite contracts (Unbefristeter Arbeitsvertrag) offer ongoing employment with a probationary period, terminable by either party for valid reasons.

- Fixed-term contracts (Befristeter Arbeitsvertrag) have set durations and are renewable up to 3 times but must not exceed 2 years.

- Minijob contracts and freelance agreements cater to part-time workers and self-employed individuals, respectively.

Probation Periods

Probation periods vary, allowing employers to assess employees’ in their roles. These periods can be part of open-ended or fixed-term contracts, with durations ranging from 1-9 months, depending on job level and skills required.

Employer Responsibilities

German labor law states that employers manage payroll deductions, plus making tax and social security contributions. Salaries in Germany are paid in 12 monthly installments directly to employees’ bank accounts.

Social security contributions provide workers with access to vital worker benefits such as health insurance and paid leave, meaning employers in Germany must ensure timely and accurate payments.

Working Hours and Overtime in Germany

According to German labor law, working hours include the total time employees are available for work, including readiness to work.

Daily work is capped at 8 hours, though this can be extended to 10 hours within a 6-month average. Sundays and public holidays are off-limits for work unless workers are given alternative rest days.

Overtime

Access to overtime in Germany is granted only by contract or CBA, not exceeding 12-hour days or 48-hour weeks.

Overtime pay isn’t required by law but can be part of monthly wages, with tax-free surcharges for night, Sunday, holiday, and work around Christmas.

Types of Leave in Germany

German labor law often includes extra or alternative laws for each state. In this way, public holidays vary by state, but nationally recognized ones include New Year’s Day, Easter Monday, Labor Day, Ascension Day, Whit Monday, Christmas Day, and Boxing Day.

If a holiday falls on a weekend, it’s observed on the next working Monday.

Employees are entitled to a minimum of 24 paid working days annually, effective six months into employment.

Sick leave allows up to 6 weeks of regular wage payment, requiring a medical note from the 4th day of illness.

Maternity leave spans 14 weeks at least. This extends in the case of more than 1 birth or in other special circumstances. Parental leave permits time off without salary, with job protection. Special leave covers events like family deaths, births, severe illnesses, and weddings.

Termination and Severance in Germany

In German labor law, termination can occur through mutual agreement, fixed-term contract expiration, or notice from either party. Special protection applies to groups like disabled or pregnant employees.

Notice periods are 4 weeks for both parties, though this grows with service length. Immediate termination is allowed for serious contract violations. Severance pay varies based on the reason for dismissal, with no obligation in small businesses.

Severance pay in Germany is based on half a month’s pay per year of service.

Establishing a Legal Entity in Germany

Establishing a business in Germany is seen as simple when compared to other countries thanks to a supportive environment and digital tools. Legal structures like a sole proprietorship or GmbH may be chosen based on liability and tax factors.

Short-stay visas cater to business visits, while long-term visas cover skilled workers, job seekers, and trainees.

The base for corporate tax in Germany is set at 15%. However, there are many differences around the country at a state and local level, plus an extra solidarity surcharge, both of which mean that the average corporate tax is around 29%.

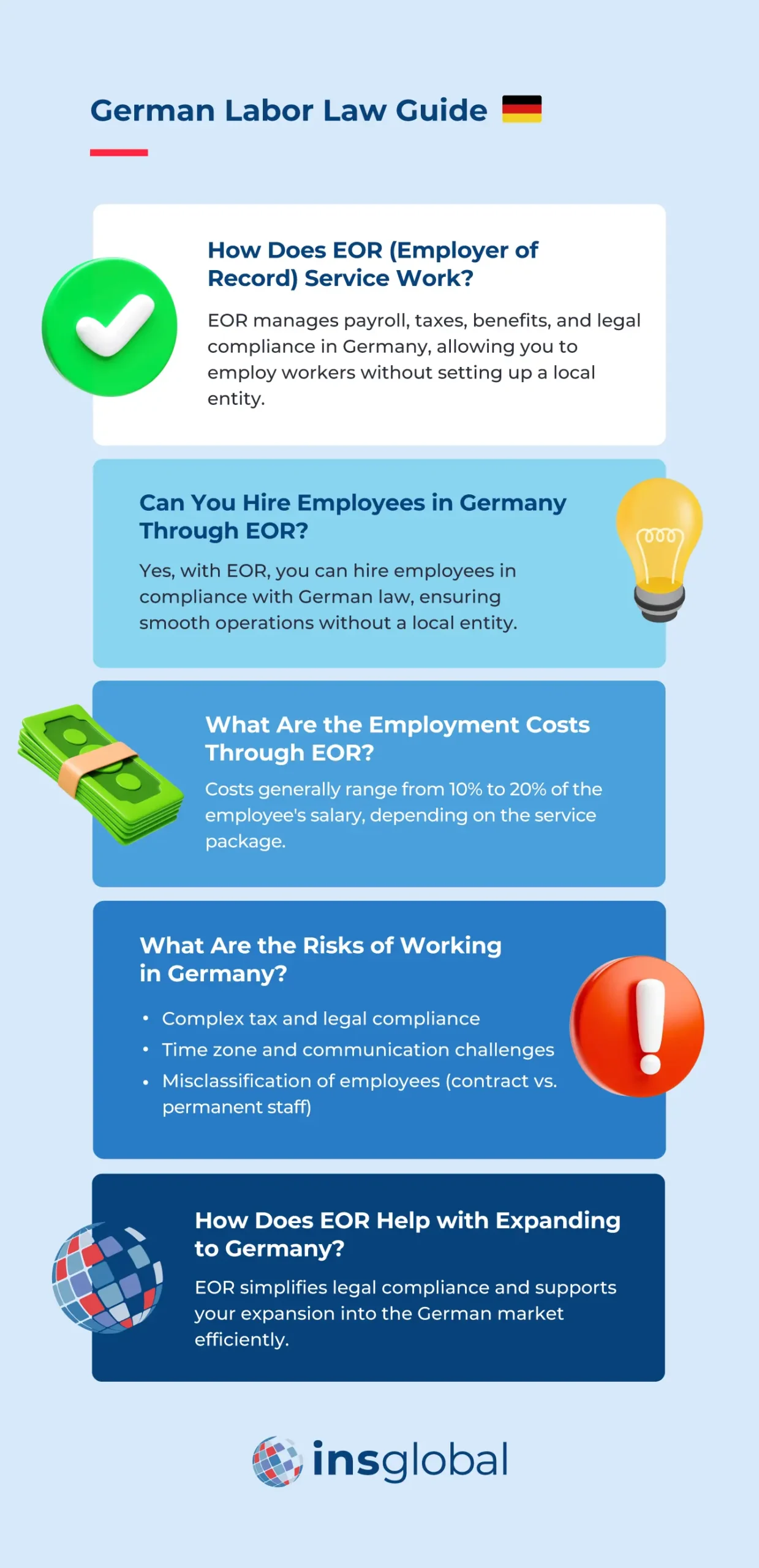

Why Choose INS Global as Your Partner for Safe and Simple Expansion to Germany?

Labor law in Germany offers both opportunities and stability for global companies, yet HR mistakes can pose significant risks.

INS Global, as a leader in worldwide recruitment and employment outsourcing, offers a range of solutions to meet the needs of businesses seeking seamless expansion into the German market without compliance issues or delays.

With nearly 20 years of experience helping companies find success in more than 160 countries worldwide, INS Global can manage every aspect of German labor law requirements. Our teams of expert global expansion advisors can ensure your market entry complies with every aspect of German labor law including payroll, taxes, and benefits.

Thanks to our technology-driven PEO (Professional Employer Organization) and EOR (Employer of Record) in Germany, you can enjoy a tailored range of services offered by a multinational team through an easy-to-use online platform.

To gain access to a global network of resources and expertise, and to empower your success in the global market, contact our team of specialists today for a free consultation.

SHARE