- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

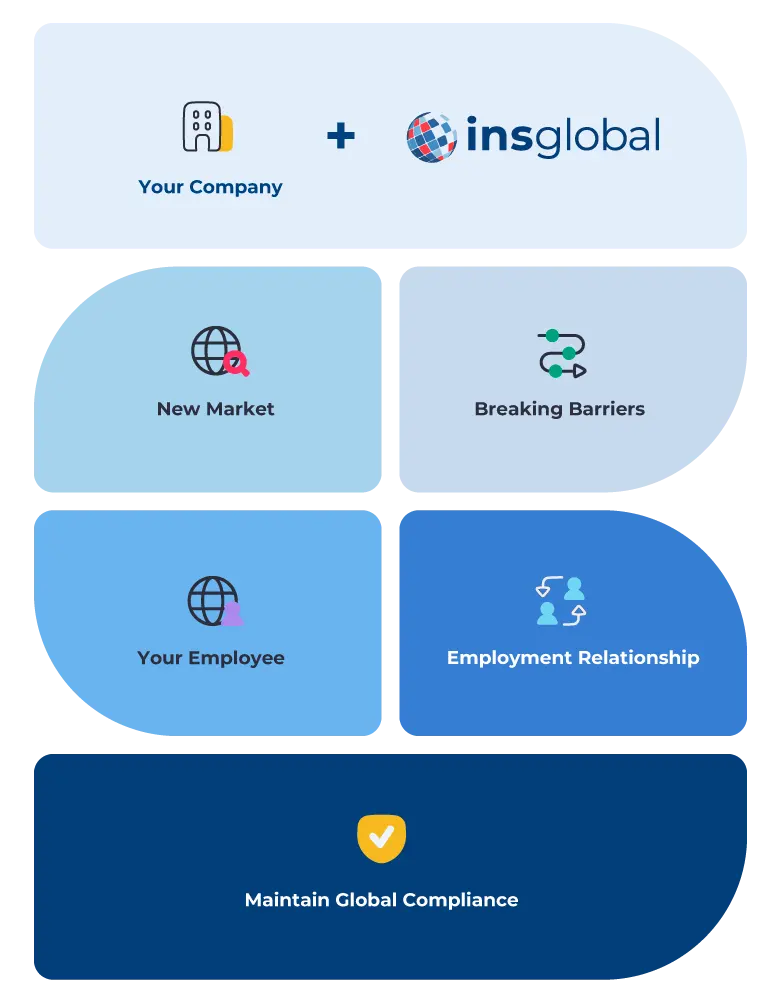

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

Country Guide

Capital City

Canberra

Languages

English

Currency

Australian dollar ($, AUD)

Population Size

25,771,300

Employer Taxes

18.45%

Employee Costs

2%

Payroll Frequency

Monthly

By working with a high-quality Employer of Record in Bulgaria like INS Global, you can establish, hire, and grow while bypassing the complexities and expenses of global expansion.

PEO services in Bulgaria provide a secure, efficient, and cost-effective solution for accessing local expertise. INS Global offers PEO services in Bulgaria, enabling you to swiftly recruit and manage HR services for your in-country employees.

By serving as the legal employer for your employees, our Employer of Record (EOR) in Bulgaria handles the intricacies of local employer responsibilities and ensures compliance. This streamlined process allows businesses to expand within 48 hours, providing a safe and cost-effective approach to global expansion in Bulgaria or 160+ other countries worldwide.

Want to have a Team in Bulgaria TODAY?

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers

Incorporating a company in a foreign country can be complicated, time-consuming, and expensive. On the other hand, working with a PEO comes with a range of benefits that helps you expand internationally with ease.

Working with a PEO…

The Advantage in Figures

PEO/EOR

Company Incorporation

Price

80% Less Expensive

Market Entry

2-5 Days

6 Months

Legal Assurance

PEOs have the right local experience and knowledge to help meet even the most complex regulations. This ensures that you‘re compliant with every labor law, preventing costly fines and penalties.

Grow Your Company Faster

PEOs allow you to outsource your payroll, recruitment, and contractor management with a simple and efficient solution in Bulgaria. EOR and PEO services empower your company to focus on growing your business abroad with a partner that understands the local market.

Expand Efficiently

When you expand internationally with a PEO, you can reduce the time needed to launch in a new country. While starting a new entity abroad can typically take anywhere from 4 to 12 months, working with a PEO streamlines the process to just a few weeks.

Save Money and Time

Working with a PEO allows you to outsource your HR and prevent costly fines and penalties when expanding internationally. The local expertise helps keep your business compliant while cutting through red tape and saving you from costly fines.

Manage Your HR Online

NS Global offers a streamlined, cloud-based solution that lets you control every aspect of your business online in one place. This platform allows you to manage a diverse, international workforce with ease.

INS Global’s Bulgarian EOR manages employee recruitment and management in four simple steps.

1

We work with you to discuss your plans and create a strategy that best serves you.

2

Our organization provides a legal entity that helps you hire staff in Bulgaria.

3

We handle all HR-related tasks such as recruitment, employment contracts, and payroll to ensure legal compliance.

4

Your employees continue to work towards your goals while we handle HR.

When expanding into a new country, you may be considering working with a PEO (Professional Employment Organization) or an EOR (Employer of Record). Here’s a quick guide to the differences between these options.

Bulgaria offers one of the most competitive cost-to-talent ratios in the European Union. Known for its rapidly growing tech sector, strong education system, and multilingual professionals, Bulgaria has become a regional hub for IT services, fintech, customer support, and back-office operations.

Additionally, as an EU member, Bulgaria provides companies with access to the broader European market under a familiar regulatory structure. However, local labor and tax laws require careful attention. A trusted Employer of Record (EOR) in Bulgaria allows international companies to benefit from the country’s advantages without the delays, costs, or risks associated with establishing a local entity.

With strong internet infrastructure and one of the highest percentages of STEM graduates in Europe, Bulgaria is ideal for building remote or hybrid teams. But even remote employees are subject to Bulgaria’s labor laws, including rules for minimum leave, payroll deductions, and social contributions.

A Bulgarian EOR enables you to:

Hire remote employees with legally compliant contracts

Ensure accurate payroll, taxes, and benefits contributions

Comply with employment protections such as maternity leave, notice periods, and rest breaks

Onboard and support team members through a centralized, digital platform

This model is ideal for companies testing the European market or expanding regional support teams.

Check Our Labor Law Guide

Working Hours

Annual Leave

Sick Leave

Maternity / Paternity Leave

Contact Us Today

Employer of Record (EOR) in Australia

View Details

Employer of Record (EOR) in Australia

View Details

solutions

faqs

No, it is necessary to use a local entity abroad to comply with each country labor law.

Foreign companies can either set up a local entity in each country or use the services a local PEO (Professional Employment Organization) to hire the staff on-site directly.

An Employer of Record is the legal entity that‘s responsible for staff hired in a specific country. You can make use of PEO services to help with administrative tasks such as payroll management, hiring, recruiting, and even tax compliance.

An Employer of Record in Bulgaria can help with all kinds of HR-related tasks to ensure compliance for your workforce. This includes payroll management, tax compliance, employment contracts, social security deductions, and more.

Starting a new company abroad can take anywhere from 4 to 12 months. However, you can hire staff and expand abroad in less than a month with the help of INS Global‘s PEO services.

A PEO can help you save money by streamlining your entire expansion plan. While these services can range, INS Global‘s PEO comes with a monthly fee that‘s based on your employee‘s salary.

EORs are a safe, reliable, and efficient solution for businesses looking to expand into Bulgaria. EOR services speed up your expansion plans and help cut through red tape along the way.

Salaries and payroll are usually processed monthly in Bulgaria. However, some employers prefer to pay staff weekly. Employers are responsible for deducting taxes and social security contributions from all employee payments.

Yes! INS Global can help you streamline all your employment functions for both Bulgarian and foreign employees. You can control everything on a single cloud-based platform, making the entire process even easier to manage.

A Global Employer of Record is an effective solutions for companies like yours that are looking to expand a workforce abroad effortlessly.

This approach allows you to outsource the international hiring process quickly and efficiency, providing access to a global talent pool while still managing payroll compliance in each country.

Public Holidays Calendar

Download the PDF Guide