Country Guide

Employer Of Record Cape Verde

Capital City

Canberra

Languages

English

Currency

Australian dollar ($, AUD)

Population Size

25,771,300

Employer Taxes

18.45%

Employee Costs

2%

Payroll Frequency

Monthly

Expanding to Cape Verde? EOR Services Help You Hire Globally, Pay Locally, and Expand Effortlessly

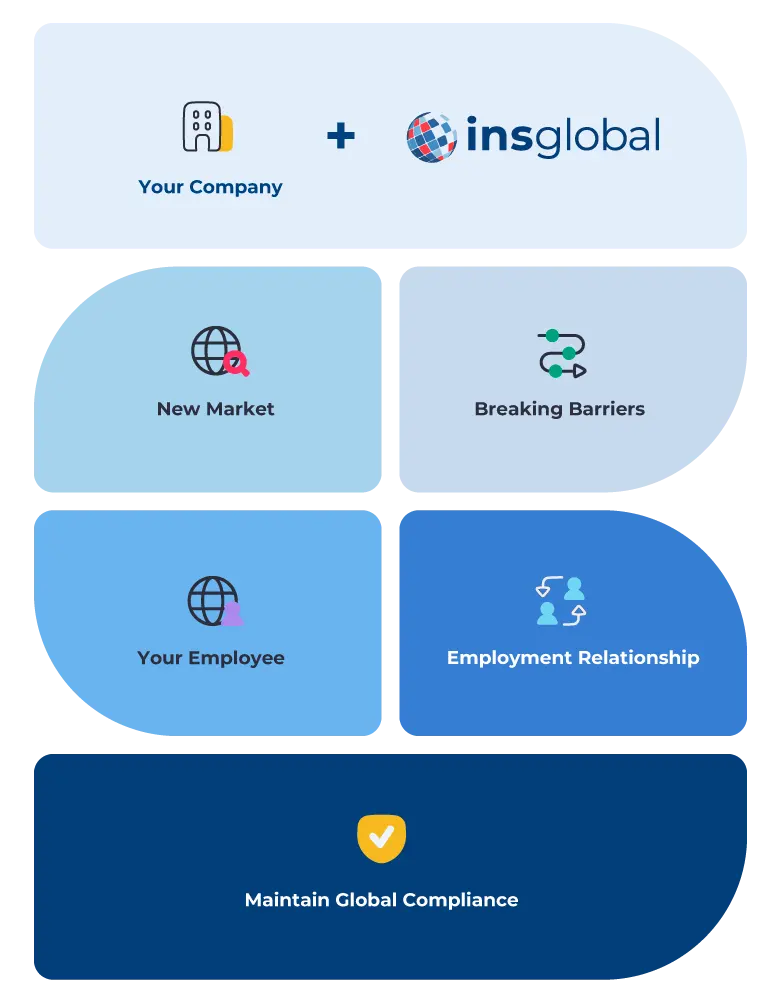

We act as your Employer of Record in Capa Verde. When it comes to expanding your business abroad, INS Global’s services are perfect for enhancing operational efficiency and ensuring compliance through our professional Employer of Record. Cape Verde and 100+ countries worldwide can all be entered quickly and simply by seamlessly recruiting and managing employees without the need to establish a local entity.

Our Employer of Record services in Cape Verde provide a trustworthy, streamlined, and cost-effective solution for sourcing, hiring, and overseeing local talent from anywhere in the world.

Serving as the local employer to your workers, our dedicated Employer of Record in Cape Verde assumes full responsibility for all HR-related functions on your behalf. This efficient process enables you to enter new markets in as little as a week, saving time and financial resources.

Want to have a Team in Cape Verde TODAY?

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers

Why Choose A Global Employer of Record Over Company Incorporation?

Creating a new company takes time but also adds to the cost of expansion in Cape Verde. Employer of Record services streamline the process and allow you to expand in less than a week.

Working with a Cape Verdean Employer of Record…

- Saves time on expansion

- Lowers costs

- Ensures legal compliance

- Allows your team to focus on growing your business

PEO/EOR vs Company Incorporation

The Advantage in Figures

PEO/EOR

Company Incorporation

Price

80% Less Expensive

Market Entry

2-5 Days

6 Months

The Advantages of Using an Employer of Record in Cape Verde

Expand Effortlessly

Establishing a new company in Cape Verde and hiring staff locally can be time-consuming, often spanning weeks, months, or even up to a year in problematic cases. In contrast, partnering with a local Employer of Record in Cape Verde expedites the expansion process, enabling you to enter the Cape Verdean market in as little as a week.

Focus on Growing Your Company

An Employer of Record in Cape Verde takes on the full range of HR-related responsibilities, streamlining your operations and freeing you to concentrate exclusively on the international expansion of your business.

Legal Compliance Assurance

Employer of Record (EOR) services with comprehensive knowledge of Cape Verde can support you in recruiting and overseeing an international workforce while ensuring strict legal compliance. This proactive approach helps you steer clear of costly fines and penalties.

Lower Expansion Costs

Collaborating with an Employer of Record in Cape Verde simplifies global growth while significantly lowering the typical overhead expenses associated with expansion. In particular, avoiding the need to create a new entity in the region allows you to scale your operations without a substantial increase in processing time.

Manage Your HR Online

INS Global offers an effective means for managing your diverse, global workforce online through a modern tool. With our revolutionary cloud-based HR platform, you can easily monitor all your employees remotely.

How Does an Employer of Record In Cape Verde Work?

INS Global’s Employer of Record in Cape Verde helps your company to expand abroad in 4 simple steps.

1

We work with your business to create an expansion plan.

2

Our organization provides the legal entity needed to help find and manage staff.

3

To ensure local compliance during the onboarding process, we handle HR-related tasks such as recruiting contract management, taxes, and payroll.

4

Your employees focus on your goals while we continue to watch for all legal changes and take care of HR and legal compliance.

What is the difference between PEO and Employer of Record Services in Cape Verde?

A PEO (Professional Employer Organization) takes charge of a wide array of human resources tasks, including payroll management, tax compliance, and contract administration. It operates as a strategic HR partner, providing essential support for your workforce needs.

In contrast, an EOR (Employer of Record) bears similarities to a PEO but holds the legal authority to hire and manage employees on your behalf, simplifying the entire process.

With a PEO, the employment contract is directly established between you and the employee, while the PEO firm assists with HR tasks.

Conversely, with an Employer of Record, you maintain control over the employment contract, but it is legally structured between the Employer of Record and the employee, imparting an additional layer of formality and legal validity.

INS GUIDES

Check Our Labor Law Guide

Labor Law in Cape Verde

Employment Contracts in Cape Verde

- Professional employment in Cape Verde starts with a written offer of employment.

- Employers can include a probation period ranging from 6 to 12 months in employment contracts, depending on the nature of the role.

- The employment contract should specify the nature and responsibilities of the employee’s role.

- An employer can end the contract quickly if the employee violates the conditions of their contract.

- Employees are entitled to a minimum of 15 days’ written notice. This notice can be up to a maximum of 2 months, depending on the reasons for termination and the employee’s seniority.

- Severance pay is required for employees who have worked for more than a year. Employers have to pay employees 8.33% of their annual salary for every year of service after their 1st.

Working Hours

- The working week in Cape Verde runs from Monday to Friday.

- Full-time employees generally work 8 hours per day, 44 hours per week.

- Part-time employees work 20 hours per week.

- Employees are entitled to a higher hourly rate for overtime. This is generally 150% of the normal hourly rate.

- Employees working nights are entitled to 125% of the normal hourly rate.

Types Of Leave

Holidays and Annual Leave

- Cape Verde has 11 official national holidays.

- Employees are entitled to a minimum of 22 days of paid vacation.

- Employees can roll over their annual leave to the next year.

Sick Leave

- Sick leave is dependent on the employment contract for each company and employee.

- Employees are entitled to a maximum of 30 days of absence from work for illness.

- Illnesses over 30 days should be examined by the Health Board.

Parental Leave

- According to Cape Verdean law, female employees are entitled to 60 days of consistent maternity leave.

- Female employees are entitled to 80% of their standard salary during this time.

- Male employees are entitled to parental leave equal to the mother in the event of complications or death.

Tax Law

- Employers in Cape Verde are responsible for withholding all taxes and social contributions.

- Employers contribute the equivalent of 15% towards social security.

- Employees contribute the equivalent of 8% towards social security.

- Corporate income tax is set at 22% for companies of all sizes.

- Personal income tax is based on your worldwide earnings. This depends on the amount of income, according to the tax table below.

Income (Cape Verde Escudo CVE) | Tax Rate (%) |

0 CVE – 960,000 CVE | 16.5% |

960,000 CVE – 1,800,000 CVE | 23.1% |

1,800,000 CVE + | 27.5% |

Contact Us Today

Discover More Solutions in Cape Verde

Employer of Record (EOR) in Australia

View Details

Employer of Record (EOR) in Australia

View Details

solutions

Frequently Asked Questions

faqs

Many companies expand and establish a local company in every market, but collaborating with a local Employer of Record in Cape Verde is more efficient and cost-effective. Employer of Records possess local expertise and simplify hiring and managing staff on your behalf.

An Employer of Record in Cape Verde handles various HR-related tasks, including payroll processing, tax processing, employment contracts, social security deductions, and more, ensuring local compliance for your entire workforce.

Establishing a new company abroad can take months and slow down the expansion process, but with INS Global’s Employer of Record services, you can hire staff and expand in as little as a week.

Employer of Record services simplify and streamline your expansion plan, and the costs vary depending on your employee‘s salary.

Yes, working with an Employer of Record in Cape Verde is a legal and cost-efficient solution that speeds up your expansion plans while reducing costs.

Salaries are typically paid on a monthly basis for full-time employees, while part-time workers may receive weekly or bi-monthly payments. Employers are responsible for deducting taxes and social contributions.

Public Holidays Calendar

Download the PDF Guide