Employer of Record in Denmark & PEO

Hire Globally, Pay Locally, Expand Effortlessly

INS Global is your top local partner for human resources services around the world. With our global PEO, you can set up your business, hire talented workers, and find success in 80+ countries, all while cutting through the red tape and extra costs that usually come with global expansion.

A PEO (Professional Employer Organization) is a local partner that facilitates companies who want to outsource their HR services or expand into a new region or country without having to create a separate legal identity.

With an Employer of Record in Denmark, you can be assisted in employing your staff and the management of other employee services such as recruitment, payroll, benefits, and compensation. ‘These global HR outsourcing services allow you to save time and money while avoiding complicated local regulatory procedures.

Employer of Record in Denmark & PEO - Summary

Employer of Record in Denmark & PEO

Using a PEO: Five Major Advantages

Legal Compliance

With a wealth of in-depth knowledge regarding local legal and administrative procedures at their disposal, a PEO ensures that your company complies with every aspect of local laws in an intelligent and efficient way

Reduced Cost And Time

One of the common issues encountered when entering a new market is that even a minor problem with HR can lead to shockingly high fees and fines. A PEO will help you avoid these costly errors

Increased Company Growth

By covering many laborious tasks, including payroll outsourcing, recruitment, headhunting, and contractor management services, a PEO allows you to focus your time and energy on successful market growth

Fast Market Entry

The estimated time for Company Incorporation in a new market: 4-12 months

The estimated time to establish a PEO relationship: 5 days

*Global estimate

One Platform For All Your Needs

A Professional Employer Organization covers every aspect of HR services and streamlines them into a single point of contact, saving you from having to manage multiple staff or departments at once

Why Choose PEO Over Company Incorporation?

Crossing over into a foreign market can often be a complex and challenging process, requiring both a legal and physical presence in the target market. But if you work with a PEO, your company can operate efficiently in the new market without struggling through countless laborious steps required to form and incorporate such an entity.

- Decreases processing time

- Reduces costs

- Avoids potential legal pitfalls

- Employs local networks and expertise

Testimonial

Manuel Ramos

TERAO ASIA

Managing Director

We think INS Global is a good solution about starting in a market like China. Understanding the market doesn’t mean you need to set up a company immediately.

How Does A PEO In Denmark Work?

With four simple steps, INS Global’s PEO will take care of your employee recruitment and HR needs in Denmark:

- We discuss your situation and requirements, and together build a plan that best serves you.

- Our organization provides a legal entity to bring in employees to begin operations in Denmark.

- We manage all the administrative and legal aspects of hiring and paying your employees.

- Your employees continue day-to-day operations, setting your company on the fast track to success in the Danish market while we cover all the HR details.

What’s The Difference Between PEO And Employer of Record?

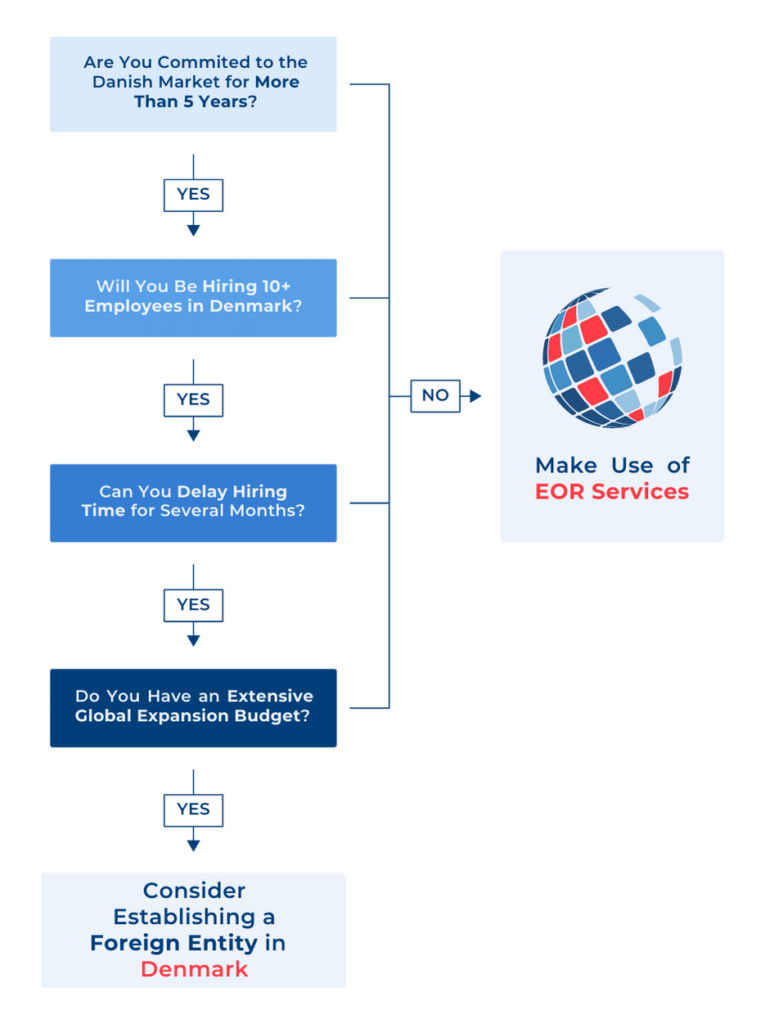

Once you decide to expand into a new market and want to begin a PEO agreement, it’s crucial that you understand the difference between PEOs and global Employers of Record (EOR) so that you can choose the service that’s the most suitable for your needs:

- A PEO is a company that provides HR services to employees of other companies. These services may include payroll, tax, and legal regulation compliance, among others.

- An EOR is a company that acts similarly to a PEO, but it can also legally and officially hire employees on behalf of other companies.

- Beside the services provided by a PEO, Employers of Record also take on all of the liabilities for recruiting and employing workers.

- In a PEO agreement, the contract is made between the original company and the employee.

- In an EOR agreement, the contract is directed by the original company but made between the EOR and the employee.

Labor Law in Denmark - 2024

The contract in Denmark should be written in Danish, with the currency as Danish krone. It must include all details of an employee’s responsibilities and benefits. The contract must be completed one month before the employee begins work. Failure to comply with this could result in the employer compensating the employee up to 10,000 Kroner.

Many details regarding an employee’s rights and benefits are decided via collective bargaining agreements (CBAs). CBAs determine essential aspects such as overtime pay and vacation days, so it is necessary to thoroughly understand them and the preexisting standards established by the relevant industry.

Working Hours and Overtime in Denmark

On average, the working week in Denmark is 37.5 hours, with 48 hours being the maximum including overtime. Employees are entitled to at least one day off per week, typically Sunday.

Employees are expected to take 11 hours off between work shifts unless otherwise negotiated.

Holidays and Annual Leave in Denmark

Public holidays in Denmark are as follows: Jan. 1, Maundy Thursday, Good Friday, Easter Monday, Common Prayer Day, Ascension, Pentecost, Whit Monday, Christmas Day, and Boxing Day.

These days are treated as paid national holidays unless the day would otherwise fall on a weekend or rest day.

Annual paid vacation days are calculated as 2.08 days per month worked, or roughly 5 weeks of leave per year.

Sick leave in Denmark

Employers will pay for the first 30 days of sick leave in Norway. Employees can expect to receive their full salary, bonuses included. Afterwards, the state will compensate the employee up to a maximum weekly amount.

Maternity/Paternity Leave in Denmark

Expectant mothers can take 4 weeks of leave during the pregnancy, and 14 weeks post-delivery and will receive at least 50% of their salary.Depending on the CBA, the amount can be as much astotal salary compensation.

Fathers are entitled to two weeks of leave after the birth of their child, also receiving 50% of their salary. Parental leave payments are typically issued by the government, not individual employers.

Tax Law and Social Contributions in Denmark

Employees in Denmark are expected to pay a complex system of taxes that cover a range of services, including a social security tax that is 8% of gross income.

The total amount of taxes should not exceed a maximum of 52.06%, but other smaller taxes such as church tax are not included in this total.

Employers are expected to withhold salary to contribute towards an employee’s social security contributions and contribute an amount towards their employees’ contributions themselves. Employers should expect to contribute DKK8000-10000 per year per employee.

CONTACT US TODAY

Discover More Solutions in Denmark

FAQs

A trustworthy Denmark PEO or EOR may perform crucial HR duties like payroll, contract administration, and guaranteed tax compliance for a monthly fee based on a percentage of a co-employed employee‘s salary.

Working with a Denmark EOR will allow you to transfer personnel legally, safely, and effectively, as well as hire new staff where you need them. Outsourcing is now acceptable for both short-term and long-term projects thanks to this strategy.

A worker who is co-employed by an EOR could have access to a range of services, such as enhanced employee benefits, all-encompassing legal protection, local knowledge of all employer needs, prompt and correct payment, and more.

Contractors that communicate with customers through an EOR or Danish PEO have access to many of the same benefits and protections as normal employees while having total control over their work process.

Yes, an EOR protects you wherever you go while accounting for any changes to local or regional labor laws.

There may be a minimum or maximum number of employees you may recruit with some PEO companies. However, you can use INS Global’s expansion services to hire and outsource the HR of however many people your expansion plans call for.

Payroll expenses must also include any additional or indirect costs like social insurance contributions, bonuses, or incentives, in addition to wages and any payments made to recruiting firms or specialists.

Even though signing bonuses are optional, they must be taken into account when estimating the price of conducting a global hiring operation.

To provide the most competitive package to possible candidates, employees of a firm with a presence in Denmark should have the choice of selecting between a physical workplace and a home office.

With access to professional networks, in-depth knowledge of both offline and online business resources, proficiency in adhering to regional best practices, and more, our recruiting professionals can help you locate the best new team members in Denmark.

In order to assist you in finding the finest applicants among Danish citizens and international residents, INS Global employs the most recent hiring technologies and sector-specific information. To avoid any problems, we take into account any changes in local customs and laws pertaining to nationality when we employ on your behalf.

For companies of all sizes, from SMEs to global corporations, using an EOR is a quick, simple, and safe alternative to in-house HR and recruitment.

INS Global provides crucial PEO or global Employer of Record services to businesses in a range of sectors, with our legal knowledge being suitable for anybody who either lacks their own internal structures in-country or wishes to avoid scaling issues when expanding.

A staffing agency or an umbrella company are examples of third parties that may be used to engage independent contractors either directly or indirectly. You might be able to identify the best contractors to fit your needs through networking, job boards, social media, trade organizations, and other channels.

The majority of independent contractors operate their own companies or are small business owners through which they accept payments from customers. As a result, they must be hired via a work agreement rather than an employment contract for some duties.

Before starting, an independent contractor can be required to provide a CV, portfolio, verified references, and possibly a signed NDA.

Payroll in Denmark is done each month, with employers being responsible for making deductions for tax and social security contributions at source. Employers use an employee’s digital tax card and provide each month’s payroll information to the Danish Tax Bureau on the employee’s behalf. Employers are then required to provide a detailed payslip each month.

Denmark has no nationally mandated minimum wage. Instead, the minimum salary in Denmark is guaranteed by CBA agreements in specific industries.

Workers from the Nordic region (Sweden, Sweden, Finland, Norway, Greenland, Iceland, Faroe Islands, and the Aland Islands) can live and work in Denmark without requiring a visa or residence permit.

For EU/EEA citizens intending to stay in Denmark for more than 3 months must register with Agency for International Recruitment and Integration (SIRI) in place of a work permit.

For workers from outside the EU/EEA, work permits are required which can last up to 4 years at a time.

Employers in Denmark are responsible for managing taxes and social security contributions for all employees, as well as making employer contributions to their employees’ social security funds.

Employer contributions are equivalent to DKK 8,000 – 10,000 per year.

Employees in Denmark, through their social security fund, gain access to a pension, training funds, workplace injury, and sickness insurance, parental leave, and annual leave (regardless of work status).

Employers in Denmark must give employees adequate notice of any changes to the conditions of a work agreement but they do not require an employee’s permission. If an employee disagrees with the change their contract is automatically considered to be terminated and termination procedures will begin (with the employee able to dispute the dismissal).

Healthcare in Denmark is typically provided free of charge, with the system being funded by social security. Some items such as medication or specialist services may not be entirely free but instead provided at a reduced cost.

Notice periods in Denmark begin at a minimum of 1 month and may extend as long as 6 months depending on seniority. Employers may choose to provide payment in lieu.

Nationally, 1 month of severance pay is mandatory for employees who have worked for the same company for 12-17 years, with employees who worked beyond 17 years being entitled to 3 months’ pay.

Some CBAs may include additional severance pay clauses.

Most labor regulations are overseen by the Danish Working Environment Authority (WEA).

Denmark has 10 paid public holidays per year in addition to 5 weeks of paid annual leave.