Testimonial

Manuel Ramos

TERAO ASIA

Managing Director

We think INS Global is a good solution about starting in a market like China. Understanding the market doesn’t mean you need to set up a company immediately.

5/5

Instead of going through the lengthy and complicated process of global expansion on your own, you can partner with a professional and legally secure PEO or EOR service to boost your growth potential. INS Global has employment outsourcing services available in more than 160 countries around the world. With over 15 years of experience in helping companies of all sizes enter new markets with speed and efficiency, our PEO in Egypt is the perfect partner for your expansion needs.

A PEO in Egypt can reduce the risk of error and make sure that your employees receive their payroll on time and in full legal compliance. With a PEO, you can be set up in just a few days and can continue company operations as usual.

An EOR in Egypt can handle all legal responsibilities so that you can focus on company growth and market success. The services that a PEO or EOR offers can make global expansion possible without you having to spend unnecessary time, resources, and money.

Our legal advisors have the knowledge and expertise to ensure that you and your employees are always in line with local regulations.

Traditional methods of global expansion tend to be expensive and time-consuming. A PEO gives you a shortcut by providing specific solutions for your every need.

A PEO doesn’t just handle employee payroll. Recruitment, onboarding, contractor management, and any other HR services you need to succeed are covered securely by a PEO provider.

A PEO can allow you to enter new markets in less than a week. With company incorporation, you might have to wait 4-12 months to start operations.

Instead of hiring multiple partners with separate lines of communication, a PEO gives you everything through a single dedicated point of contact.

Traditional company incorporation is a tried-and-tested method of global expansion, but it isn’t fast or easy. With company incorporation, you will be required to set up a legal branch of the company in the new country before any operations can progress.

Alternatively, a PEO acts as your legal entity so you can enter the new market without having to set up a separate company subsidiary.

With a PEO you can also:

The Advantage in Figures

PEO/EOR

Company Incorporation

Price

80% Less Expensive

Market Entry

2-5 Days

6 Months

Manuel Ramos

TERAO ASIA

Managing Director

We think INS Global is a good solution about starting in a market like China. Understanding the market doesn’t mean you need to set up a company immediately.

In just 4 simple steps you meet your global expansion needs with INS Global.

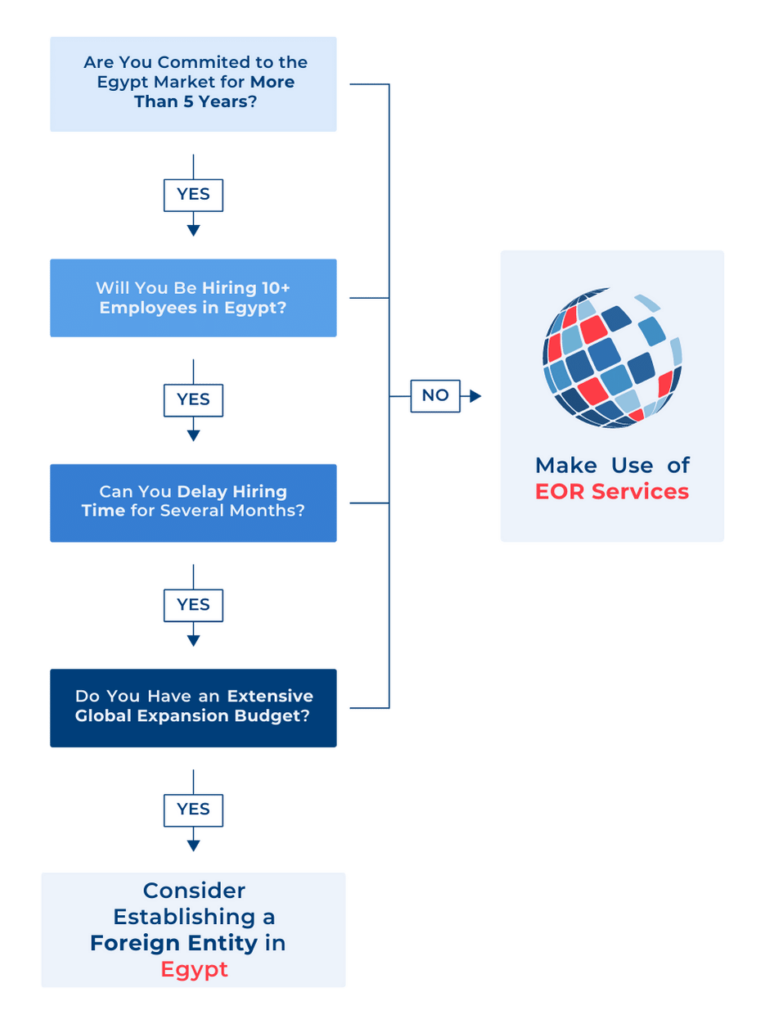

While a PEO and EOR offer similar services, they aren’t exactly the same. Each operates distinctly so you can choose the one that’s most suited for your specific needs.

Both a PEO and EOR provide HR services to employees of other companies. These services cover a wide range of tasks, including payroll, contract compliance, onboarding, etc.

Unlike a PEO, an EOR can legally hire employees on behalf of other companies. An EOR is also officially held liable for all responsibilities of the employees they recruit and hire.

As a result, in a PEO contract, the agreement is made between the company and the employee. In an EOR contract, however, the contract is directed by the company but is officially made between the EOR and the employee.

Payroll for staff of a non-profit organization can be challenging in a new market, especially if you’re unfamiliar with the specific laws around non-profit employees and organizations. It doesn’t have to be a lengthy or arduous process though. INS Global’s PEO in Egypt is well-equipped to handle your NGO staff payroll needs and ensure that they are receiving their salaries following local regulations.

A PEO also makes finding new staff for your NPO or NGO much easier. We employ innovative recruitment methods to help you recruit dedicated and passionate candidates from all over the world. With our expertise, you can help those in need effectively and securely.

Written contracts are required in Egypt, and a copy must also be given to the local labor office. Contracts should be written in Arabic and any compensation amounts stated in the local currency of the Egyptian pound.

Probation periods can last a maximum of 3 months and cannot be extended.

The minimum wage for 2023 is EGP2,700 per month.

Termination notice periods depend on the length of time the employee has been with the organization. If the employee has worked for less than 10 years, the notice period is 2 months. For those who have worked for over 10 years, the requirement is at least 3 months.

Severance pay is calculated at half a month’s wages for the first 5 years of employment, and a full month’s wages for every year after the first 5.

A typical work week is 40 hours, with traditional rest days being Friday and Saturday.

Any work performed outside of the usual 8 hours per day is counted as overtime. Overtime pay is 35% more than regular wages for daytime work and 70% more for night work.

Employees who work on rest days are entitled to receive double pay and an additional day off.

There are 19 public holidays each year in Egypt. There are also significant historical, religious, and cultural holidays that may change depending on the region.

All employees who have worked a minimum of 6 months are also entitled to 21 days of annual paid leave.

After 10 years of continuous employment, employees will receive 30 days of annual leave.

Employees who have worked a minimum of 5 years are eligible to take one month off for a religious pilgrimage.

Protected annual sick leave can extend for up to 6 months.

For the first 90 days of sick leave the employee can claim compensation from social insurance at 70% standard salary. A further 90 days will be reimbursed at 85%.

Medical certification must be provided to qualify for sick leave.

Expectant mothers who have worked a minimum of 10 months can receive 3 months of paid maternity leave. They must take 45 days’ leave before delivery.

Maternity leave can be taken a maximum of 3 times during an employee’s service period.

If a company has 50 employees or more, mothers can also take 2 years of unpaid leave to care for their children.

There is no required paid paternity leave according to Egyptian law.

The corporate tax in Egypt is 22.5%. Oil exploration companies are taxed at 40.55%.

Employer contributions to social security tax are equivalent to 18.75% of an employee’s salary. Employees also contribute the equivalent of 11%.

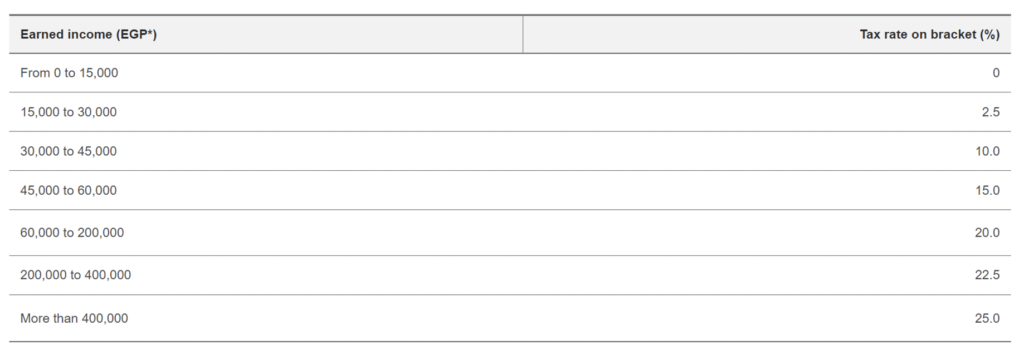

Income tax is charged at a progressive rate from 0-25%.

Standard VAT is 14%.

Residents are taxed on worldwide income, while non-residents are only taxed on the income received in Egypt.

No, it is necessary to use a local entity abroad to comply with each country labor law.

Foreign companies can either set up a local entity in each country or use the services a local PEO (Professional Employment Organization) to hire the staff on-site directly.

The employer of record is the legal entity liable for the staff employed in a specific country. In practice, a foreign company can either open a subsidiary to become the employer of record of its abroad employees or use a PEO to act as the employer of record.

In general, 1-month is necessary to have an employee based out abroad using an existing PEO as the employe of record. When incorporating a new subsidiary to be the employer of record, the delay varies from 4-12 months.