Country Guide

Employer of Record Mauritius

Capital City

Languages

Currency

Population Size

Employer Taxes

Employee Costs

Payroll Frequency

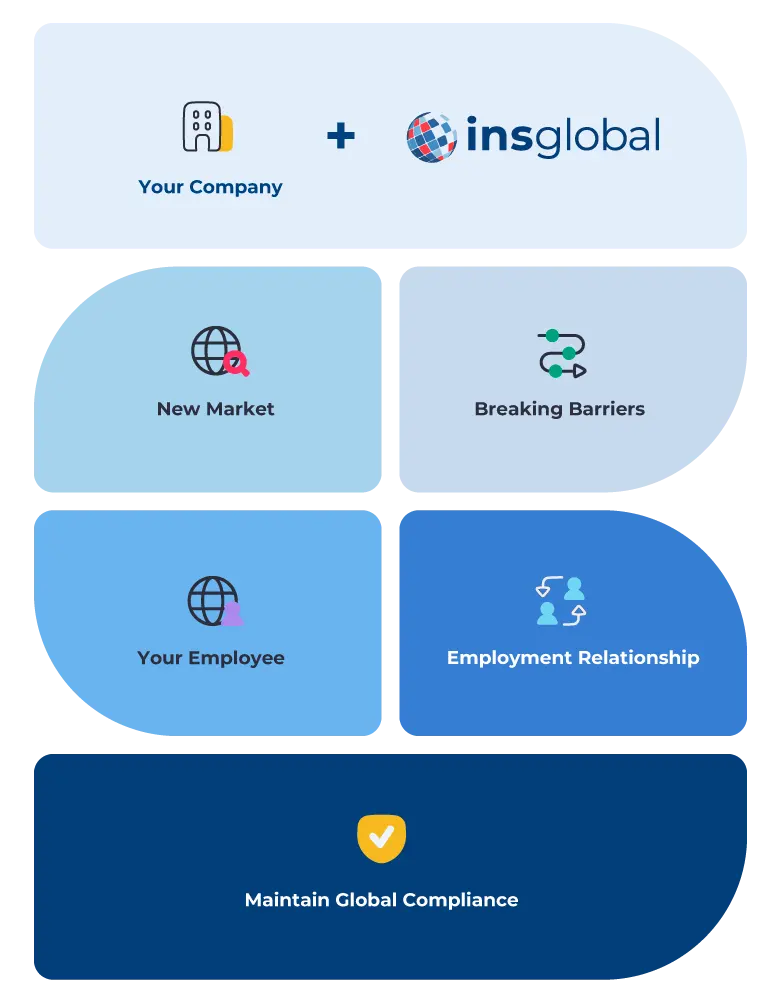

Expanding to Mauritius? EOR (Employer of Record) Services Help You Hire Globally, Pay Locally, and Expand Effortlessly

Are you embarking on your next stage of global expansion? Trust in the efficiency of INS Global’s EOR services to meet all your worldwide HR needs. Our Employer of Record in Mauritius services provide for smooth recruitment and local management processes without the need for a local entity.

Global expansion is an exciting step towards business success, so benefit from a dependable and efficient solution to confidently manage local talent in new markets.

Want to have a Team in Mauritius TODAY?

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers

Streamlining the Expansion Process

Opting for EOR services in Mauritius expedites expansion, allowing you to grow in less than a week. Collaborating with a Mauritian EOR saves time on growing your business abroad, significantly lowering expansion costs, ensuring local compliance, and providing the focus needed for growing your business within Mauritius’ unique business context.

PEO/EOR vs Company Incorporation

The Advantage in Figures

PEO/EOR

Company Incorporation

Price

80% Less Expensive

Market Entry

2-5 Days

6 Months

The Advantages of Using an EOR or Professional Employer Organization in Mauritius

Legal Compliance Assurance

Opt for an Employer of Record (EOR) in Mauritius who is intimately aware of the regulatory landscape. This ensures effective recruitment and supervision of your international workforce with a keen focus on meticulous legal compliance. This proactive stance protects against potential fines and effortlessly aligns your business with Mauritius’ specific regulations.

Lower Expansion Costs

Collaborate strategically with an Employer of Record in Mauritius to drive global growth while significantly cutting down on the customary expenses tied to expansion. Scale your operations without the necessity of establishing a new entity in Mauritius, providing a distinctive advantage tailored to the Mauritian business context.

Focus on Growing Your Company

An Employer of Record in Mauritius takes on the entire spectrum of HR-related responsibilities, streamlining your operations and granting you the liberty to concentrate solely on your business’s international aspirations.

Expand Effortlessly

While creating a new company in Mauritius and organizing all elements of the employment process may take up considerable time, ranging from 4 to 12 months on average, partnering with a local Employer of Record accelerates the expansion process. Gain entry into the Mauritian market in as little as a week, ensuring a swift and efficient point of entry.

Manage Your HR Online

Leverage INS Global’s advanced digital platform for efficient online management of your diverse global workforce. Our cloud-based HR system lets you seamlessly oversee all your employees and their needs remotely.

How Does an EOR In Mauritius Work?

INS Global’s EOR in Mauritius simplifies your company’s expansion abroad in just four steps, finely tuned to fit the Mauritian business environment.

1

We collaborate with your business to craft a personalized expansion plan.

2

Our organization has established the necessary legal entity to hire and manage staff, ensuring compliance with Mauritius’s legal requirements.

3

We efficiently handle HR-related tasks such as hiring, contract management, and payroll management, ensuring local compliance in Mauritius.

4

Your employees concentrate on your goals while we manage HR and legal compliance, providing a seamless experience within Mauritius’ business landscape.

What is the difference between PEO and Employer of Record Services in Mauritius?

In Mauritius, PEO (Professional Employer Organization) services provide a strategic HR partnership for handling various Human Resources tasks. Conversely, an EOR (Employer of Record) possesses the additional legal authority to hire and manage employees on your behalf, streamlining the entire process in line with Mauritius’ regulations.

INS Global offers both choices, ensuring you have the support you need to expand comfortably while providing heightened flexibility.

INS GUIDES

Check Our Labor Law Guides

Labor Law in Mauritius

Employment Contracts in Mauritius

- Professional employment in Mauritius should always include an offer letter and an employment contract.

- Employers can usually include a 3-month probation period in their contracts. This can be extended depending on the nature of the role.

- An employment contract should specify and describe the employee’s role in detail.

- An employer can end the contract early if the employee violates the conditions of their employment contract.

- Employees are entitled to 30 days’ notice before the termination of their agreement. If the employee has been with the company for over 3 years, the notice period is 3 months.

- Severance pay is required for employees and depends on the nature of the termination. This equals 25% of the employee’s monthly wages for every year of service. If they are being let go unfairly, this increases to 3 months’ wages for every year of service.

Working Hours in Mauritius

- The working week in Mauritius runs from Monday to Friday.

- Full-time employees generally work 8 hours per day, 45 hours per week.

- Employees cannot work more than 40 hours per week without receiving overtime pay.

- Employees are entitled to a higher hourly rate for overtime. This is set at 150% of the normal rate for overtime.

Types Of Leave

Annual Leave in Mauritius

- Mauritius has 15 official national holidays.

- Employees are entitled to 20 days of paid annual leave every year.

Sick Leave in Mauritius

- When an employee cannot attend work due to illness, they need to get a doctor’s note and present it to HR as soon as possible.

- Employees are entitled to up to 15 days of paid sick leave per year.

- Employees are entitled to 15 days of sick leave after 1 year of service.

Maternity / Paternity Leave in Mauritius

- According to Mauritian law, female employees are entitled to a minimum of 12 weeks of maternity leave.

- Maternity leave should be taken 6 weeks before and 6 weeks after the expected birth date.

- Male employees are entitled to 5 days of paternity leave.

Tax Laws in Mauritius

- Employers in Mauritius are responsible for withholding all taxes and social contributions.

- Employers contribute the equivalent of 15.5% of their employees’ salaries towards social security and insurance costs, while employees contribute an additional 7%.

- The corporate income tax rate is set at 15% for companies in Mauritius.

- Personal income tax can range from 0% to 20%, depending on the level of income. The top bracket of 20% is for employees earning over MUR 2.3 million.

Contact Us Today

Frequently Asked Questions

faqs

While setting up a local entity is an option, it’s more efficient to collaborate with a local Employer of Record in Mauritius. Employer of Record services leverage local expertise, facilitating hiring and staff management on your behalf.

An Employer of Record in Mauritius manages various HR tasks, including payroll, tax compliance, employment contracts, and social security contributions, ensuring comprehensive compliance for your entire workforce.

Establishing a new company abroad can take anywhere from months to a year with delays. However, INS Global’s EOR services let you hire employees and expand to a new market in as little as a week.

EOR service costs are directly linked to your employee’s salary, calculated as a percentage and covering all HR functions for compliant employment in Mauritius.

Collaborating with an Employer of Record in Mauritius is a legal and efficient solution, simplifying your expansion plans while reducing costs.

Salaries are typically processed monthly for full-time employees, while part-time workers may be paid weekly or bi-monthly.

Recruitment in Mauritius varies in cost, but INS Global simplifies remote recruitment and staff management, reducing the expenses of managing an international workforce.

A Mauritius Employer of Record can recruit and hire employees from all regions, facilitating quick expansion across the country.

Modifications to employment contracts require mutual agreement.

Yes, employers in Mauritius are responsible for withholding taxes and social contributions from employee salaries, including an employer’s contribution to each employee’s social security fund.

INS Global tailors its services to your company’s needs, assisting with recruiting and hiring as many or as few employees as required for your expansion plans.

Severance pay is required for employees and depends on the nature of the termination. This equals 25% of the employee‘s monthly wages for every year of service. If they are being let go unfairly, this increases to 3 months‘ wages for every year of service.

In Mauritius, employees can be hired for both in-person and remote opportunities, allowing for reduced overheads during international expansion.

Certainly! Our local experts bring extensive experience in finding top talent globally by providing support in recruiting, hiring, and managing your workforce, regardless of your location.

Mauritius observes 15 public holidays where employees are entitled to a paid day off. Working on these holidays usually involves a higher hourly rate.

Employers must adhere to strict labor laws and regulations to avoid costly penalties and fines. Partnering with an experienced EOR in Mauritius ensures compliance during your expansion.

Yes! INS Global assists in recruiting and managing a diverse workforce, simplifying the hiring process of Mauritian citizens and foreigners.

A Global Employer of Record is an effective solutions for companies like yours that are looking to expand a workforce abroad effortlessly.

This approach allows you to outsource the international hiring process quickly and efficiency, providing access to a global talent pool while still managing payroll compliance in each country.