Employer of Record in Portugal & PEO

Hire Globally, Pay Locally, Expand Effortlessly

A PEO (Professional Employer Organization) is a third-party company that can provide many HR outsourcing services to benefit your business in Portugal. These services can include all elements of HR operations, from recruitment and onboarding to payroll and leave management.

Like an EOR (Employer of Record), a PEO in Portugal can be your local partner, hiring and managing HR operations for your employees on your behalf and allowing you access to new markets without establishing a new separate legal entity.

A PEO (Professional Employer Organization), like a global EOR (Employer of Record) provides crucial HR outsourcing services to companies seeking quick, safe, and cost-effective strategies for global mobility. INS Global’s PEO in Portugal allows companies to hire compliance assured workers in as little as 48h.

When businesses need support throughout the global expansion process, an Employer of Record (EOR) in Portugal offers cost-effective utility by taking care of employer responsibilities. Hire or transfer employees in markets worldwide in a fraction of the time of traditional methods with INS Global’s innovative employment outsourcing solution.

INS Global has offered PEO and Employer of Record services for more than 15 years and now serves over 160 countries. Our experts in international HR can provide you with the knowledge and expertise you need to thrive in Portugal, all while avoiding costly setup processes and regulatory fees.

Employer of Record in Portugal & PEO - Summary

Employer of Record in Portugal & PEO

The Key Advantages of Using a PEO in Portugal

Full Legal Compliance

Be assured of compliance with every element of local law and regulations as they relate to you and your employees

Lower Costs

Studies commonly find that PEOs save companies money in multiple ways, like reducing the size of an HR department, lowering employee turnover rates, and avoiding fees or fines

Worldwide Employee Satisfaction

Your employees can feel secure knowing that all of their needs are being met quickly and efficiently by professionals specialized in the market

Increased Market Entry Speed

The process of incorporating a new company in a foreign market can take months, whereas entering with a Employer of Record Portugal is possible in less than a week

One Platform For All

Outsource as many services as you like to our team of specialists in a plan built to suit you thanks to our HR Software.

PEO Over Company Incorporation: What are the Advantages?

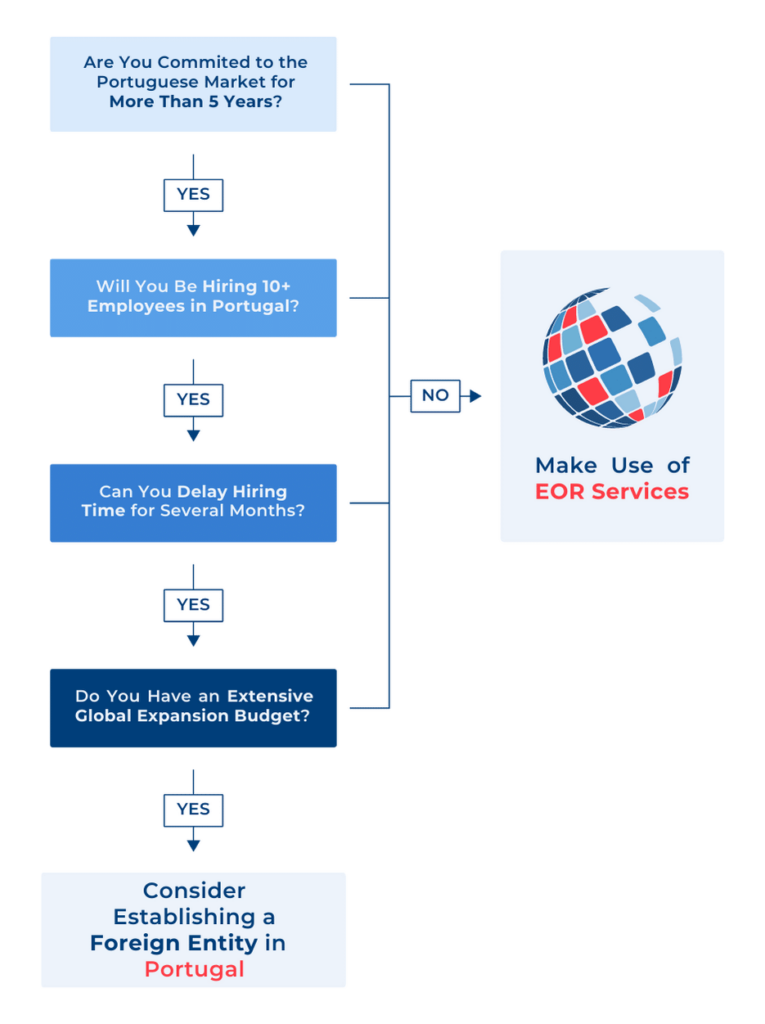

Company incorporation can be a complex and costly process if you’re trying to establish a new entity in a foreign market. While company incorporation may seem advantageous in the independence and long-term options it provides, these come at a cost in time and overheads that may work against growth and expansion goals.

A PEO grants you the flexibility to invest in Portugal to a level you desire and the confidence that you will avoid the risks associated with fully diving into a new and unfamiliar market

A PEO:

- Gives you knowledge and expertise in your target market instantly

- Allows you to feel secure knowing you are fully compliant with all local regulations

- Avoids overheads related to establishing and running a company in Portugal

- Provides full scalability to suit your needs

PEO/EOR vs Company Incorporation

The Advantage in Figures

PEO/EOR

Company Incorporation

Price

80% Less Expensive

Market Entry

2-5 Days

6 Months

How Can You Get Started With Our PEO in Portugal?

Have your employees recruited or assigned in Portugal in 4 simple steps:

- Discuss your needs with one of our Portugal PEO specialists to formulate a plan that serves your needs best

- INS Global provides you with a legal entity in the market that can hire or manage HR operations for your employees.

- We manage all elements of compliance and HR for your employees.

- You can get to work immediately while we take care of the rest

PEOs and Employer Of Records: How Do They Differ?

In most countries, the two services are considered identical for compliance purposes. However, it’s helpful to understand the main differences between them to choose one that better suits your needs.

- A PEO is a third-party company that provides services to your employees in a foreign country

- In a PEO agreement, the employees’ contracts remain with you

- An EOR is a third-party company that provides services to your employees while also legally hiring them on your behalf

- In an EOR services agreement, the employees’ contracts are made directly with the EOR at your direction

- This way, the EOR takes on all legal responsibilities for your employees

According to your needs, INS Global can offer both PEO and EOR services in Portugal. Contact one of our consultants today to find out more about which option is best for you.

Labor Law in Portugal - 2025

Employment Contracts

The primary source of information on employment law in Portugal is the Labor Code, last updated in 2022.

Contracts in Portugal may be written or verbal, although written contracts are always suggested to avoid unnecessary disputes later on.

Portuguese labor law includes options for many different contract types, such as part-time, specified duration, or unspecified duration.

Portugal has a minimum wage, although this is adjusted depending on the region.

Working Hours and Overtime

A new law, passed in November 2021, makes it illegal for bosses to text employees outside of work hours. This was passed to improve work-life balance as a result of remote work.

Portuguese labor law establishes a maximum of 8 hours per workday and 40 hours per week. Collective bargaining agreements may apply to increase the amount and flexibility of those hours, so long as the average falls within an acceptable maximum.

Any hours worked outside of this maximum is considered overtime. Overtime should only be arranged temporarily, although an employer can declare overtime to be mandatory.

Overtime pay should be calculated (based on standard salary) as:

- Working days: 125% for the first hour, 137.5% for additional hours

- Rest days: 150% for each hour

Holidays and Annual Leave

Employees in Portugal are eligible for a minimum of 22 days of paid leave per year. There are circumstances in which this can be higher or lower depending on the employee’s time spent with the company and when the employee takes this leave during a year.

There are 13 days of public holidays in Portugal. Employees are not entitled to an extra day of leave if a public holiday falls on a rest day.

Maternity/Paternity Leave

Female employees are eligible for 120 days of maternity leave, paid at 100% by social security. Mother must take off at least 90 days after the birth of a child.

Male employees are eligible for 20 days of mandatory paid paternity leave, 5 of which must be taken immediately following the birth of a child.

Parents can apply for additional parental leave at varying rates of remuneration.

Sick Leave

Employees in Portugal are entitled to sick leave paid for by their social security. The maximum amount of sick leave that can be taken is 3 years. During this time, they are paid 55% standard salary for the first month to 75% for over a year.

Taxes and social contributions

Corporate tax in Portugal is 21%.

Non-residents are taxed on Portuguese-sourced income at a flat rate of 21%.

Residents in Portugal are taxed on their worldwide income on a progressive scale from 14.5-48%.

Social Security payments cover family, pension, and unemployment benefits and are shared by the employee and employer at the following rates:

- Employer: 23.75% employee’s standard salary

- Employee: 11% employee’s standard salary

Employers must also purchase an additional occupational accidents insurance premium to cover their workers.

Foreign employees may opt out of social security contributions in Portugal if they already pay into a similar national scheme.

CONTACT US TODAY

FAQs

Working with a trustworthy PEO in Portugal to handle all significant HR duties, such as payroll, contract administration, and ensuring tax compliance, comes at a minimal fee that is determined as a monthly charge based on the wages of the co-employed employees.

You may recruit or move individuals to Portugal safely, practically, and legally by working with an EOR. You can employ this outsourcing option on a short- or long-term basis.

An employee who is handled by a PEO has access to a wide range of advantages, including complete legal protection, local knowledge of all employer obligations, prompt and correct payment, enhanced employee perks, and more.

Contractors that connect with customers through a PEO have access to all the same benefits and protections as normal employees while still having total control over their work process.

Yes, a PEO considers any variations in local or regional employment laws when providing you with protection wherever you are.

Indirect costs like social insurance contributions, bonuses, or incentives must be included in payroll expenses in addition to salaries and any payments made to recruiting agencies or specialists.

Also, even though signing bonuses are optional if selected, they should be taken into account when calculating recruitment expenses because they may help you stand out to possible new employees.

There can be a minimum or maximum number of employees you can recruit with some PEO companies. With INS Global, however, you are free to co-employ as many or as few workers as your development plan dictates.

Since the COVID-19 outbreak, Portugal, like many other nations, has successfully adapted to employee remote work possibilities. For fair employment practices and as a competitive incentive, employees of a company with its headquarters in Portugal should still provide the choice between a physical workspace and a home office.

Members of our recruiting team have access to professional networks, are knowledgeable about offline and online business resources, are familiar with regional best practices, and more, to help you find the perfect new member of the team in Portugal.

Indeed, INS Global can help you find the best in both Portuguese nationals and international residents via our recruiting services.

A PEO is perfect for companies of all sizes, from SMEs to global corporations, who are looking for a fast, simple, and secure way to enter the Portuguese market.

INS Global provides high-quality PEO services to companies in a vast of industries, with our legal expertise being perfectly applicable to anyone who either lacks their own internal structures or wants to cut down on company bloat during the expansion process.

Portuguese Independent contractors may be recruited directly or through a middleman, such as a staffing firm or umbrella business. Independent contractors might be located through networking, job boards, social media, trade associations, or other channels.

In most cases, an independent contractor can be engaged as a self-employed freelancer or they may have their own sole proprietorship or limited firm via which they can send clients invoices.

An independent contractor can be required to provide a CV, portfolio, and references, as well as perhaps sign an NDA, however, recruiting procedures may differ according to your needs.

Employees in Portugal are paid on a monthly cycle, with 13th– and 14th-month payments in the summer and winter.

Currently, the Portuguese national minimum wage is €760.00 per month.

As a member of the EU, non-EU citizens seeking to live and work in Portugal for longer than 90 days are subject to largely the same types of visa as are available in other EU countries. EU citizens do not need additional documents.

Currently, applicants can choose between a Temporary Stay Visa (for up to 1 year), a Residency Visa (for 1-2 years), or an EU Blue Card.

Social security and unemployment insurance contributions are required of all employee salaries based on a portion of the employee’s gross pay. Both the employer and the employee pay a part of these contributions.

In Portugal, employers pay an equivalent of 23.75% of an employee’s wage to social security, and 1% to unemployment insurance.

Additionally, employers with a large number of workers on fixed contracts must pay an additional payroll tax of 2%.

Along with mandatory 13th– and 14th-month payments, employees in Portugal have access to a number of benefits including healthcare, unemployment, a pension, and various types of paid leave as paid for through social security contributions.

They are also guaranteed wage relief if their employer defaults on payments thanks to the 1% wage fund contribution.

As contracts in Portugal may be made verbally, and are not legally required to be made in Portuguese, it might seem like contracts can be changed easily. However, employers in Portugal must have employee consent before changing the details of an employment contract, unless the employee signs a stipulation saying that employers can unilaterally change the contract. In this case, changes must still adhere to legal minimal obligations.

Portuguese national healthcare covers many costs thanks to social security contributions, with some other services such as calling an ambulance or visiting a family doctor being subject to minimal fees. Additionally, employees can choose to take private health insurance or seek private healthcare.

Severance pay in Portugal is 12 days‘ salary (plus additional seniority bonuses) per year of employment up to a maximum of 12 or 240 times the standard monthly salary.

Accordion ContThe Authority for Working Conditions (ACT) regulates employment law compliance in Portugal. ent

There are 13 national public holidays in Portugal that are designated as paid bank holidays. In addition, there may be regional holidays that the employer may not be obliged to pay for.