- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

Widely known as one of the best countries to do business in and with a solid reputation for building worldwide brands, Sweden is an ideal place to start your new business venture.

Like an international EOR, a PEO (Professional Employer Organization) provides companies with a way to simply and securely expand their operations overseas by outsourcing critical HR services to a third-party provider like INS Global.

With a PEO in Sweden, companies can office compliance assurance to employees worldwide in less than 72 hours.

An EOR (Employer of Record) offers employment outsourcing solutions to take care of HR and administrative responsibilities and streamline the global expansion process. INS Global is a provider of third-party EOR in Sweden solutions to companies looking to improve and accelerate their international mobility.

Having a partner who understands the market challenges and can offer you help to get started accelerates your market entry and reduces problems.

Incorporating a legal entity in Sweden may take longer than anticipated, and a rigorous process needs to be followed to ensure you remain compliant. A PEO allows for faster market access, meaning your business can get set up and start generating revenue quicker.

When setting up your legal entity in Sweden, you become liable for the entire setup process and all related business actions. This means that your company needs to stay updated with all employment laws in Sweden. An international PEO company can provide an alternative way to operate in the country while avoiding costly liabilities.

Depending on your business needs, a PEO is likely more cost-effective than setting up your own legal entity. Many companies choose to use a PEO because it requires a lot less time, resources, and staffing to maintain.

Whether you wish to hire more staff in Sweden or you want to reduce the size of your operation to save costs, using a PEO company makes scaling easy.

A professional HR outsourcing partner allows your staff to focus on what matters without exerting the effort required to take care of HR. It also gives you access to a while new range of skills and capabilities without needing to expand your team.

More companies worldwide are starting to use PEO services as an alternative means of company incorporation. For SME’s and companies wishing to try out the market flexibly, a PEO option provides an ideal choice, combining flexibility with stability.

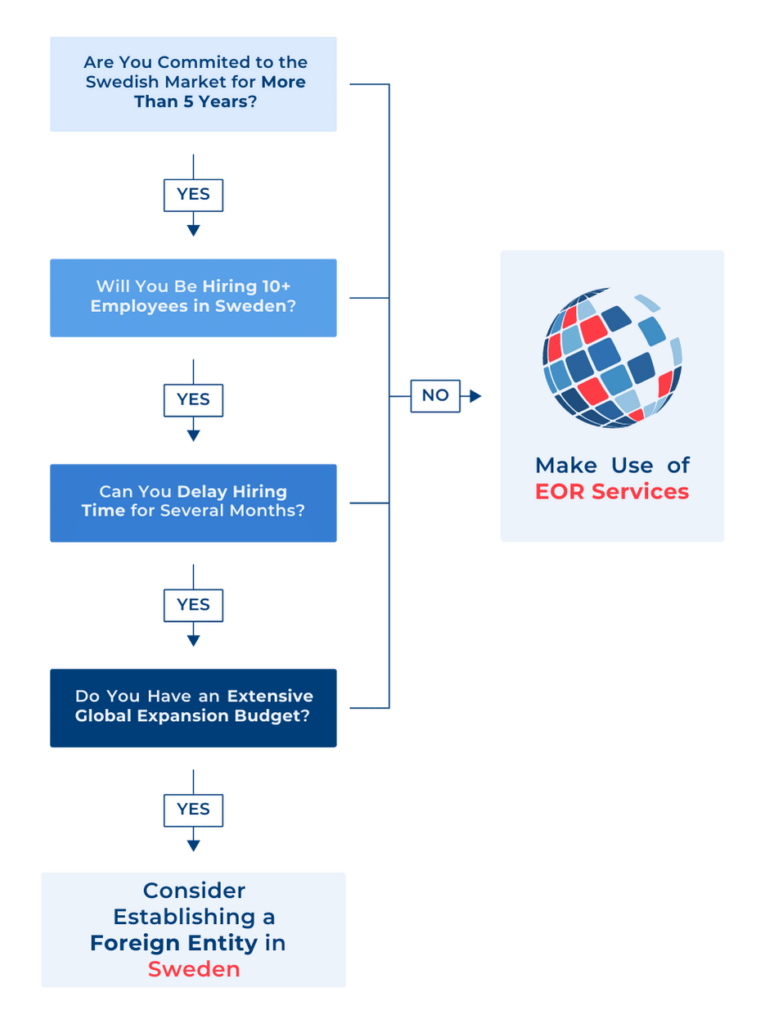

Companies currently partner with PEO services providers over setting up their own separate entities for many reasons. Based on your business needs, targets, and long-term goals, it’s easier to determine the right choice for you.

The Advantage in Figures

PEO/EOR

Company Incorporation

Price

80% Less Expensive

Market Entry

2-5 Days

6 Months

INS Global ensures proper onboarding and administrative procedures for all of your employees, who will be immediately eligible to work and carry out your operations legally in Sweden.

PEOs are often discussed in the same way an EOR (Employer of Record) in terms of HR outsourcing solutions. However, there are key differences in how these two services offer these services.

INS Global offers both EOR and PEO services in Sweden. Contact our team of PEO specialists today to discuss your needs and determine which service may be best for you.

The most significant feature of the labor market in Sweden for international employers is that it is regulated by employer organizations and trade unions more than by government intervention.

Many terms and conditions in an employment agreement are regulated through laws and regulations in collective bargaining agreements.

An employment agreement between an employer and an employee in Sweden does not have to be in written form to be valid.

In general, standard working hours cannot exceed 40 hours per week, and overtime cannot exceed 50 hours in a calendar month.

Overtime pay can be agreed upon through an individual agreement or an applicable collective bargaining agreement.

According to statutory provisions, employees are entitled to at least 25 days of paid holiday each year. Employees can take 20 of these days over a continuous vacation period in the summer months (June, July, and August).

Employees become eligible for the paid holiday after working for a year. In addition to the 25 days of statutory annual leave, there are 13 public holidays in a calendar year. Generally, employees are given paid leave during public holiday periods.

In the case of illness or serious injury that affects the employee’s ability to work, the employee is eligible for paid time off. According to Swedish law, the first day of illness or injury is generally unpaid and is considered a “qualifying day.”

From day 2 up until and including day 14, an employer is responsible for paying the employee 80% of their standard wage.

Sweden has one of the most generous policies regarding parental leave globally. In Sweden, parents are entitled to a continuous period of at least 7 weeks of leave before the expected date of birth and 7 weeks after.

In addition, for a home with two parents, each parent is entitled to 240 days of paid parental leave, cumulatively amounting to 480 days. For single-parent households, the caregiver is entitled to a full 480 days.

Tax residents in Sweden are taxed via a local tax, known as Municipal Income Tax, which ranges between 29.08% and 35.15% annually, depending on the specific municipality. For those who earn above 540,700 Swedish kronor (SEK), they must pay an additional 20% for National Income Tax.

The cost of specialized EOR services in Sweden is determined as a portion of a coworker’s monthly salary. This cost covers all HR duties necessary to guarantee adherence to all regional employment laws.

In Sweden, handling employer responsibilities through an EOR is safe, legal, and effective without the requirement for a specific firm structure. EOR services do this by having excellent HR support and possessing in-depth knowledge of regional legal authorities.

Your team members will be totally protected by the law, get accurate and timely monthly payments, and have access to all the Swedish employee benefits of an EOR service agreement.

Independent contractors have complete control over their work while working with clients inside a Swedish EOR framework and may be entitled to many or all of the same benefits as regular employees in a similar way to if they were using an umbrella firm.

By utilizing their extensive professional networks, in-depth understanding of the company resources and standards in the area, and firm adherence to ethical hiring practices, our recruiting specialists can locate the best local personnel in Sweden for your requirements.

As a result, integrating these candidates into our Swedish EOR system will be simpler and more efficient compared to hiring them through more traditional employment processes.

Through INS Global, you receive comprehensive compliance-assured employment outsourcing assistance from a truly international EOR services provider. This complies with all applicable regional, national, and local legislation.

Some Swedish PEO or EOR service providers may have stringent hiring standards or a cap on the number of employees you can hire at once. According to your global business plan, INS Global is aware that you could need to scale up or down swiftly. When you partner with us, you can hire as few or as many people as you require to reach your objectives.

Payroll expenses, hiring fees, signing bonuses, and other direct and indirect costs like incentive schemes, handling the taxes of international employees, and social insurance should all be taken into account.

You won’t need a local site if you employ Swedish PEO services. However, giving your employees a choice of working in a shared workspace or the freedom to do so whenever and wherever it’s most convenient is still a smart idea. INS Global can provide assistance with setting up suitable working environments in Sweden.

We can deal with the essential distinctions, like visa and work permit requirements, if Swedish citizens or foreigners are subject to various local employment regulations, tax legislation, or employee incentives.

For enterprises of all sizes, from SMEs to multinational corporations, the greatest EOR and PEO solutions enable the effective and secure hiring of foreign or local workers in Sweden. Our services are simple ways to scale up to meet the demand for new employees, and they can even take the place of more intricate internal HR requirements.

Businesses in a variety of industries that either don’t have their own structures in a target country (or desire to avoid cost-scaling issues while focusing on expansion) would benefit greatly from the legal expertise offered by PEO and EOR services.

Two more third parties that may be used to directly or indirectly employ independent contractors are staffing companies and umbrella corporations.

The majority of independent contractors in Sweden work for themselves or own their own small enterprises. According to Swedish legislation, labor agreements rather than employment contracts must be used when recruiting contractors.

Before work starts, an independent contractor might be required to provide a CV, portfolio, verified references, and a signed NDA.

Payroll periods in Sweden typically last a month, with employers being responsible for managing tax and social security contributions on behalf of their employees. Payroll requirements in Sweden may differ at both the national and local levels.

There is no single minimum wage in Sweden. However, minimums may be set locally or based on specific industry standards. One point to note is that from 2023 work permit applicants must earn a minimum of 80% of the national median wage (currently SEK 26,560) for their application to succeed.

Citizens of the Nordic countries or EU state members can live and work in Sweden without additional paperwork. However, they will have to register with local authorities if they are playing to stay there long-term.

For everyone else, a work permit is required, valid for up to 2 years at a time, which has specific financial restrictions, including a minimum salary requirement. With this, the holder can apply for a right of residence.

In Sweden, employers are responsible for withholding and managing tax and social security contributions on their employees’ behalf. In addition, employers pay a contribution toward their employee‘s social security equivalent to 31.42% of the employee‘s standard salary (with employees paying an additional 7%).

Employers in Sweden must provide paid leave for holidays, sickness, and parental responsibilities, in addition to contributing to their employees’ social security fund.

In general, employers in Sweden have a right to manage work as they see fit. This means there is a possibility to amend the circumstances of a worker‘s employment at their discretion so long as it falls within the scope of the job. This is typically determined according to the worker’s CBA.

Healthcare in Sweden is largely publicly funded, universal, and decentralized, with the majority of its funding coming from social security contributions. Healthcare services may be provided by public or private carers, with end users generally only paying a small amount for some specialist services.

Notice periods in Sweden range from 1-6 months, depending on seniority. In general, Sweden does not have national standards on severance pay requirements or amounts. Instead, these are set according to the worker’s CBA.

The Swedish Work Environment Authority oversees the implementation of occupational safety and workers’ rights in the country.

There are generally 13 paid public holidays in Sweden each year. For holidays falling on the weekend, an additional day is generally provided on the next standard working day. Some companies may also practice bridge days, linking public holidays to a weekend, but these are not officially required.