This page will explain you how to set-up a WFOE (WOFE) in China, including: types, advantages & limitations, market entry vehicles, pre-establishment considerations, procedures, taxation, common mistakes to avoid, what’s new and factors to consider when doing business in China.

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers

In a hurry? Save this article as a PDF

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers.

Fill up the form below 👇🏼

Wholly Foreign-Owned Enterprises (WFOE) in China

In China, the original concept for WFOEs was to encourage manufacturing activities that were either export orientated or introduced advanced technology to Chinese industry. However, with China’s entry into the World Trade Organization (WTO), these conditions were gradually changed.

WFOE business entities in China are increasingly shifting more to consulting and management services, software development, and trading.

Types of WFOE Structures

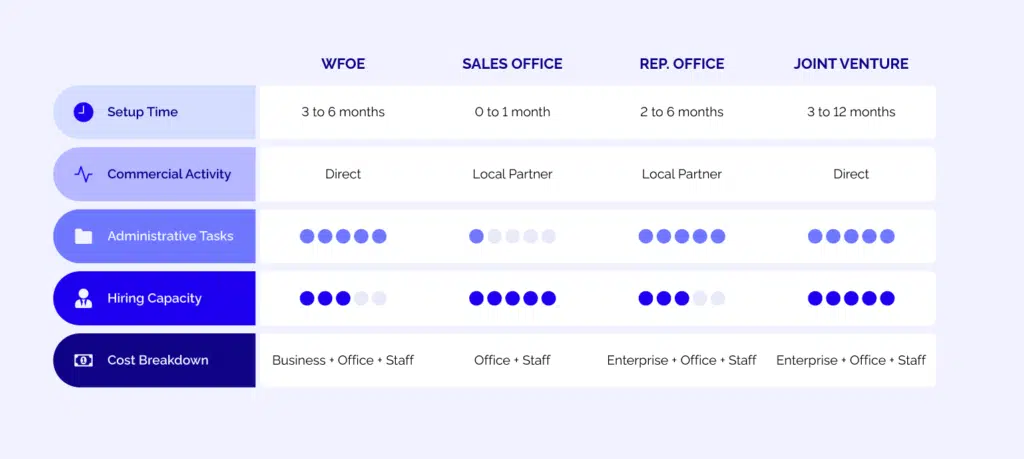

As you can see in the graphic, WFOE isn’t your only option to start doing business in China. WFOE corporate structures also have several options. In Mainland China, there are four types of organizational structure for foreign investors: WFOE (65%), Representative Office (20%), Partnership Enterprise (FIPE) (10%), and Joint Venture (5%).

The definition of a WFOE is neither clean nor pristine. The Ministry of Commerce makes the rules, but each province and tier 1, tier 2 and tier 3 city can interpret those rules to their benefit. Thus, not only must you know the national law, but you must also be ready to adapt to the local interpretations of those laws. In any case, there are three basic variations:

- Consultancy of Services WFOE

- Manufacturing WFOE

- Trading WFOE

Within these three basic options, there are next level breakdowns as you get into the particular type of operations within each category. They can be identified by the conditions and requirements for setting up the business. The steps to set it up are the same. It’s the paperwork and foreign investment fund required to get approval for the business to operate.

Check Our China Labor Law Guide

Learn how the Chinese law is applied in all aspects and situations, from an employer and employee perspective

The Advantages of a WFOE

The benefits of establishing a WFOE include, but are not limited to:

- No Chinese partner must be considered in the business strategy of the WFOE. The WFOE is independent and free to chart its course within the specifications of Chinese business law.

- Have the ability to carry out business formally. They can issue invoices to customers in the China required foreign investment fund (RMB) and receive revenues in the same manner.

- Have the capability of converting profits from the RMB to US dollars and send it outside of China to the parent company.

- Have protection under Chinese law for intellectual knowledge and technological assets.

- Have sole control over human resources so long as they comply with Chinese law.

- When it comes to innovation and business efficiency, WOFE’s can improve operations, management, and future development so long as they stay within the scope of business operations described in the paperwork that was filed to get approval to operate.

- This is a new advantage created when the Ministry of Commerce changed some of the WOFE requirements on March 1, 2014. Now, an investor’s parent company does not have to be in existence for more than two years to be able to establish a corporation in China. This is a case of abductive logic at work. China wants exposure to cutting edge technology. Much of the new technology is owned by startup corporations that have been in existence for a very short time. The Chinese observe and adapt in leaving room for alternate solutions.

- Are exempt from having to obtain an import/export license for the products they manufacture.

- Can buy real estate in China.

The Limitations of a WFOE

- High Establishment Difficulty – The application process is very involved, and each step may have a profound impact on the future development of the company including in the areas of business scope, financing, tax rates, director board management, etc. The process is long, involves many authorities, and it is easy to make mistakes (from 6 to 18 months).

- Restrictions – A WFOE faces limited access to government support and a potentially steep learning curve.

- Investors must provide foreign funding for the company’s registered capital, something that isn’t required for a Representative Office.

- There may be practical variations in the application of the Chinese legislation.

- You have to contend with regional differences in regulations within China.

China Market Entry Vehicles Comparison

Pre-establishment Considerations When Establishing a WFOE

Business Scope

A WFOE’s business scope is a one-sentence description of the company’s activities within China. Once written and approved, it’s printed on the company’s business license. A business scope answers questions like, how many employees will a WFOE have, the nationality of the employees and the kind of work that they will perform, activities of the business, who are the target customers of the business? Where will the income go? Among others.

Function of the Business Scope

The one-sentence business scope affects a company’s legal operations and its ability to issue official invoices to clients.

This is a crucial aspect, since clients may be unable or unwilling to work with you if you’re unable to issue correct invoices (fapiao). Clients require the correct fapiao in order to offset value-added tax liabilities and receive reimbursements.

Challenges of Establishing the Business Scope

The business scope is typically passed quickly by requisite administrative government offices. However, it then goes to the state and local tax bureaus that do a thorough check.

Since further application and approval would be required to amend the business scope, it should be prepared carefully and agreed on before incorporation.

In order to prepare the business scope properly, you would need to be familiar with the Foreign Investment Industries Guidance Catalogue, which lists the industries that are encouraged, restricted and prohibited for foreign investment into China.

Here are the categories in the Foreign Investment Industries Guidance Catalogue, released by the Ministry of Commerce (“MOFCOM”) and The National Development and Reform Commission (“NDRC”):

- Encouraged Industries

Includes planting, developing and producing woody edible oil, ingredient and industrial raw material; prospecting, exploiting, and beneficiation of scarce mineral resources in China (like sylvine and chromite); developing and producing forest food; cleaning processing leather and fur; Producing fluorine recycling from phosphorus chemical and aluminum smelting.

- Prohibited Industries

Includes processing and producing nuclear fuel; producing genetically modified plant seeds; processing petroleum and coking; producing sound and video recordings and electronic publications; tobacco sales; operating antique stores and auction houses selling Chinese cultural relics; Chinese legal consulting (excluding providing information relevant to Chinese legal environment); operating theater line companies.

- Restricted Industries

Includes exploring and mining plumbago; producing satellite television receivers and key parts; corporate of highway passenger transport; status enquiry and grade service companies; constructing and operating large theme parks.

You can read the extensive, official list here.

If your particular industry isn’t listed as prohibited, restricted or encouraged, for now, it’s “deemed as allowed”. Negotiation would be required if Ministry of Commerce (MOFCOM) and Administration of Industry and Commerce (AIC) authorities find the proposed activities in your WFOE scope to be formally or informally restricted.How to change the business scope?

The process of changing a WFOE’s business scope is complicated and time-consuming, lasting several months.

Here are the steps involved:

- Shareholders resolution for change of business scope.

- Application to AIC for the change of business scope, in accordance with the shareholder resolution.

- Obtaining and filling out the registration form to change the business scope.

- Obtaining a new business license.

- Tax registration.

Registered Capital

Registered capital refers to the amount of capital that would be sufficient to support a WFOE’s activities for a minimum period of one year after establishment. Currently, there is no fixed rule as regards the minimum Registered Capital. However, prospective investors have to understand that injecting less Registered Capital can result in severe cash flow challenges and that the transfer of funds from overseas for purposes of increasing the Registered Capital later will require re-registration of the minimum capital. Otherwise, the funds will be treated as income and taxed accordingly.

Calculation of Registered Capital

The WFOE’s registered capital shouldn’t be too little, which would lead to rejection of the enterprise application and risk insolvency. It shouldn’t also be too much, leading to idle funds and missed opportunities.

The sufficient amount of capital varies based on such factors as the WFOE’s industry, the region of incorporation, among others.

This is what a typical registered capital would be for WFOEs in various industries:

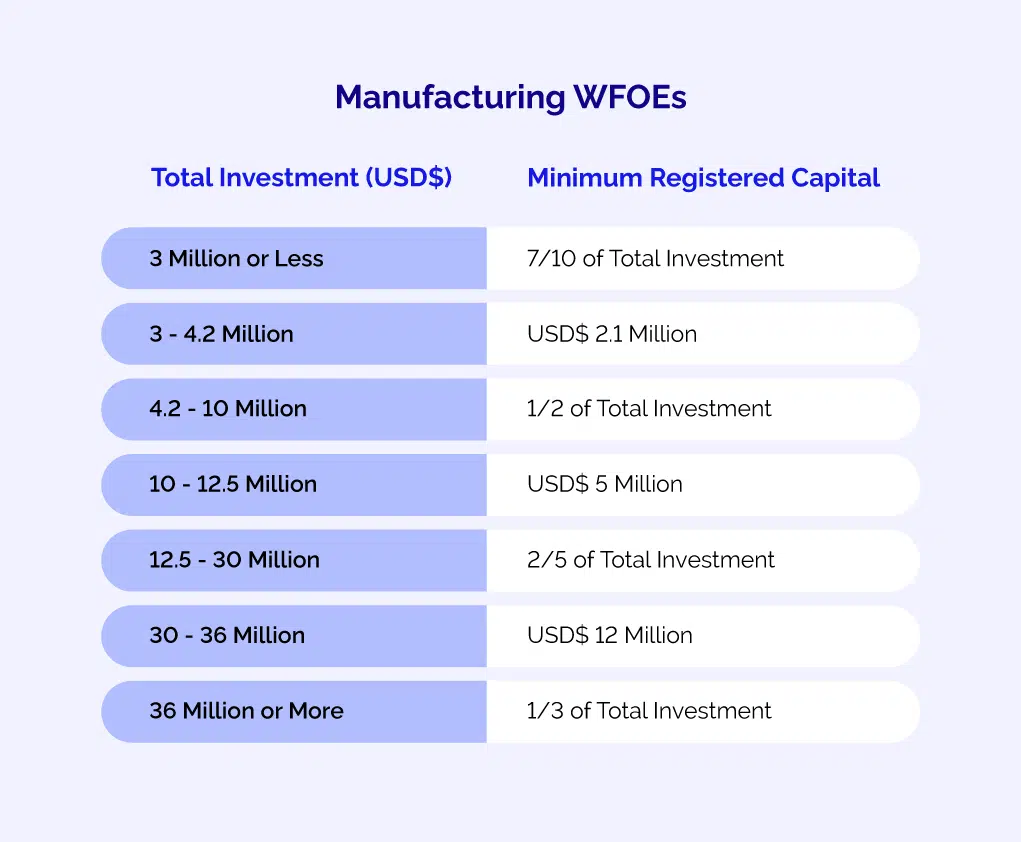

This is what the typical Investment to Capital Ratios would look like for manufacturing WFOEs:

Regulation of Registered Capital

Investors have the freedom to choose the period of contribution of the registered capital. Here, the Articles of Association specifies the schedule of contributions.

Based on the Company Law of the People’s Republic of China, the Articles of Association (AoAs) should be made before a WFOE company can apply to be set up. The AoAs provides detailed rules of such aspects as the company’s management structure, rights, business activities, share transfer and obligations.

Currently, there’s no formal requirement on the amount of registered capital and when it must be contributed, and no fixed rule on the amount of each contribution of capital. However, as a business standard, you need enough capital to cover the WFOE operations, including employee salaries, utilities, rent and government taxes/ charges.

Moreover, the past requirement that 30 percent of registered capital consist of cash contribution no longer applies.

Note that the Ministry of Commerce (MOFCOM) closely examines the proposed registered capital contribution to assess whether it’s sufficient to support a WFOE’s activities for a minimum period of one year after establishment.

Registered capital must be injected from outside China, by the overseas investor. It can be paid in cash, or through installments or as a lump sum. Once paid, it cannot be freely wired out of China.

How to Proceed if an Extra Injection of Capital is Needed

An injection of additional capital may be required to increase the WFOEs official Registered Capital. This is a tax-free transaction. However, the disadvantage would be the time-consuming process of amending the WFOE’s business license in accordance with the increased Registered Capital.

A more rapid alternative to funding the WFOE’s operations would be a related-party transaction between the WFOE and its parent shareholder. This way, the parent company receives consulting services from the WFOE and the WFOE, in return, receives payment to fund its activities. The downside with this second option is the tax implication, since the transaction would be subject to VAT and corporate income tax.

How Does RC Vary According to Industries?

WFOEs operating within most industries have no minimum required registered capital. Such industries include retailing, trading, consulting, and information technology.

The typical minimum capital commitment for a basic consulting WFOE would range from RMB 200,000 to 500,000. This is low compared to what a manufacturing WFOE would require. On the other hand, such industries as banking and forwarding have a required minimum registered capital requirement.

Personnel Requirements

In any WFOE, the shareholder(s), who raise the capital, form the company’s highest authority. A WFOE should either have an executive director or a board of directors, who set the company’s agendas per the decisions of shareholders.

According to Company Law, all WFOEs should have at least one supervisor who oversees the performance of company duties by its directors as well as top management personnel.

To avert any conflict of interest, all directors and the senior management personnel are not allowed to concomitantly act as supervisors. A relatively small company with a few shareholders can have one or two supervisors. However, bigger companies are required to have a board of supervisors of not less than three members.

Any board of supervisors must be made up the shareholders representatives, and not less than one-third of the board members should be made up of the company staff and workers’ representatives. The precise ratio should be clearly specified in the company’s articles of association. There should be one chairman of the board of supervisors, whose election must be endorsed by more than 50% of all supervisors.

A WFOE should have a general manager whose responsibility is to run the day-to-day company operations. The general manager can be one of the members of the board of directors or the executive director.

Lastly, a WFOE can employ local staff directly without going through employment agencies. The law does not stipulate any restrictions on hiring foreign staff. However, in practice, the number of foreign workers depends on the amount of social capital (social relations with productive benefits) a WFOE invests.

Income Tax and VAT are Key Considerations for WFOEs in Tax Planning

How Does the Taxation on WFOEs Work?

Understanding how taxation on WFOEs works would help you determine the deductible costs you incur during the setup process. Take note of the pre-operation period, starting from the day of company name confirmation from the AIC or the establishment date on your business license, to the date when the company first generates revenue or issues its first invoice.

If you provide valid tax invoices, some of the costs of this pre-operation period can be deducted on your income tax. These include wages, printing fees, training fees, registration fees, transport fees, and purchases of non-fixed assets.

As much as WFOEs are allowed to repatriate funds to an overseas shareholding entity, it would be vital to take know that funds can be repatriated using loans or dividends only if the recipient company is a shareholder of the WFOE.

For instance, in the U.S., a China-based WFOE repatriating profits to a shareholding company in the United States through dividends will be subjected to a 10% Withholding tax (WHT), depending on the DTA existing between the U.S. and China. The WHT paid in China might be claimed in the U.S. as a foreign tax credit, to cut down on the income tax burden of the shareholding company.

It is important to bear in mind that not all profits can just be repatriated. Some requirements must be met before any distribution of dividends. A fraction of the profit (Not less than 10% for WFOEs) should be put in the WFOE’s reserve fund account up to a time when the reserve holding hit the 50% mark of the WFOE’s registered capital.

A WFOE can also remit undistributed profits to a U.S. based sharing company through a loan to their overseas shareholder. The interest income of the WFOE will be subjected to a 25% Corporate income Tax (CIT) as well as a 5% Business Tax.

However, the CIT paid in China might later be used to offset any U.S. income tax liability sustained as per the terms of the US-China DTA.A WFOE can also repatriate funds as a service fee by putting pen to paper in a service agreement between them and a company abroad. He service fee will then be subjected to a 6% value-added tax (VAT) as well as related surcharges, and probably CIT too (about 3.75 to 12.5%), which depends on there being a “permanent establishment (PE).”

WFOEs would be registered as general taxpayers to obtain such VAT deductions.

All investors of WFOEs in China are required to select an official investor shareholder of the companies. This shareholder could be the final beneficiary of all undertakings in China or could just be an intermediary structure, which is commonly referred to as a holding company and, in most cases, set up outside China. Further tax benefits can be derived by using a holding company as an intermediary holding structure to be the formal investor shareholder of the WFOE. Investors would then enjoy preferential tax treatment by locating the holding company in a region having favorable tax treaties with China.

Traditionally, investors might have been in a position to derive certain preferential benefits by ensuring that the location of their holding structure is in a legal jurisdiction with a considerate tax treaty with China. A good example of such a country is Hong Kong. As much as this continues to form the basis of using a holding company while establishing a WFOE in China, the analysis may no longer be straightforward as it used to be. Several countries which are home to customary foreign investors such as the Netherlands, UK, and Ireland have managed to negotiate reasonable tax treaties with China, hence doing away with the need to locate their holding companies in countries such as Hong Kong. As a matter of fact, the ability to qualify for favorable tax benefits has been made more difficult, as the Chinese government authorities have moved to seal any loopholes that are open to abuse.

The other simple and straightforward reason as to why setting up a holding company is important is that, if the investors may wish to change the WFOE’s shareholders at any later stage – mostly happens during divestiture or restructuring – it becomes much easier and quicker when done outside China.

Doing this in China normally needs a tax clearance, a potential formal valuation of the WFOE, as well as official updating of the WFOE’s registration records with the concerned Chinese government agencies. This could easily drag on for months, generate considerable tax liabilities – which need to be cleared before proceeding, and any change of shareholders could be blocked by the Chinese government – in theory. However, this could be done in matter of days in certain jurisdictions.

Annual Compliance Procedures

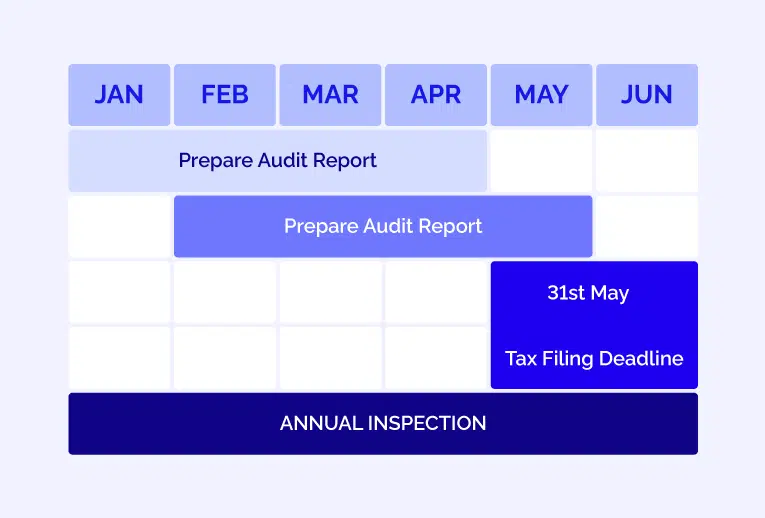

The annual compliance procedures include: annual audit, corporate income tax (CIT) reconciliation, foreign currency reconciliation, annual tax filing and annual inspection, plus other region-specific requirements.

Here is an illustration of the annual compliance timeline (subject to regional variance):

Annual Audit

- Annual audits ensure that WFOEs meet official Chinese financial and accounting standards.

- Audit procedures take approximately 4 months. Certified Public Accounting CPA firms start preparing the reports in January, immediately after closing the previous year’s account, and complete it before the end of April to meet the tax filing deadline on May 31.

Annual Inspection

This is mandatory for all enterprises registered in China. Failing inspection would affect the company’s qualification for a business license.

- It starts from January to the end of June

- Annual inspection involves completing the relevant information and submitting forms to: The Tax Bureau, the Foreign Investment Administration Department, the Economic Committee, the State Administration for Industry and Commerce, the State Administration of Foreign Exchange, the Finance Ministry and the Customs Bureau.

Which Taxes is Your WFOE Subject to?

WFOEs pay turnover, income and dividend tax, among others.

The turn overtax involves such taxes as:

- Business tax for consulting and service enterprises. This is based on the business turnover.

- VAT tax is applicable to manufacturing and trading businesses. Such a tax is based on the value added part of products. It’s 17 or 13 percent of certain utilities, foods, books and other goods.

Income tax covers such taxes as:

- Corporate income tax – applies if the enterprise partners are companies. This is based on the company’s profits and has been leveled to 25 percent.

- Individual income tax – This is personal taxes on wages/salaries. Ranging from 3 to 45 percent.

- Dividend tax is 20 percent of the registered capital, while public companies pay a 10 percent dividend tax.

Hiring Checklist to Improve Your Recruitment Process

When hiring the use of a checklist will assist you in systematizing your recruiting process

WFOE and Intellectual Property

China follows a ‘first-to-file’ policy regarding intellectual property rights (IPR). This means the first to file for IPR obtains those rights.

Such a policy would pose problems for foreign companies seeking to expand into China, since an opportunistic investor may have already filed the IPR. Hence, the first step to entering the Chinese market would involve checking your trademark and filing the correct paperwork with the appropriate authorities.

How Does IP Work in China?

The options you have for protecting your IPR include:

- Copyrights – Registration of works with the National Copyright Administration ensures evidence of ownership.

- Patents – Filed with the State Intellectual Property Office in Beijing, following the ‘first-to-file’ system. If you don’t have a commercial office in China, you must file patent applications through authorized patent agents.

- Trademark – Filed with the Trademark Office of the State Administration for Industry and Commerce (SAIC), located in Beijing and having 13 local offices. A trademark is protected only within the category under which it’s filed. Foreign companies require an authorized trademark agency to file an application. It is also important for foreign companies to establish their trademarks in Chinese. This helps in averting any future situations where other companies might try to copy their names. Setting up foreign companies with only English names has become a very common phenomenon in China lately.

After securing the IPR, you must also be proactive and vigilant in protecting it against prevailing troublesome IPR violations. This can be done through regular online research, attending trade shows and other strategies to check for possible violations. You can also request for the Chinese customs’ free-of-charge monitoring of trademark infringement.

Transfer Pricing

Transfer pricing refers to the price charged when associated enterprises in different jurisdictions engage in intercompany transactions.

What are the Rules for Transfer Pricing in China for WFOEs?

China follows the ‘arm’s length principle‘ with regard to transfer pricing rules. This means related party transactions must be treated in a similar manner to transactions between unrelated parties.

Especially with transactions with parent companies, WFOEs should:

- Appropriately disclose related party transactions in tax returns

- Prepare and maintain detailed transfer pricing documentation, if required.

WFOE Set-Up Procedures

New regulations have streamlined and eased the setup process for WFOEs, including lifting regulatory thresholds for companies in particular industries like finance and energy and offering a five-in-one business license instead of five different certificates from different authorities.

Classic Steps from Pre-licensing to Post-licensing

The pre-licensing procedures for establishing a WFOE in China, include:

Name Approval

The structure of company names is governed by the Implementation Measures on Registration and Administration of Enterprise Names and the Regulations on Registration and Management of Enterprises Names.

This includes the following aspects:

- Administrative region name of incorporation

- Brand name

- Industry or business

- Company limited

The law doesn’t require you to submit a specific number of names for registration. Some people suggest that you submit about ten names to beat the possibility of your chosen company name already being in existence. However, you must choose a few suitable Chinese company names. The names must follow the following sequence:

- Company name

- City name (written in brackets)

- Kind of company

You can check for the availability of your preferred name by searching business registration and trademark databases of the China Trademark Office and Trademark Office of the Administration for Industry and Commerce (AIC). You can then send an application to the local AIC to reserve your name and process the approval.

Various restrictions and considerations apply in selecting the most appropriate name, including:

- The name shouldn’t contain content that misleads consumers or hinders fair competition.

- A company name shouldn’t contain content that damages or contradicts national unity, social ethics, policies, religion or culture.

- No special characters like Arabic numerals or foreign alphabets or symbols.

- Only in limited circumstances can you use such words as ‘China’, ‘National’, ‘Chinese’, ‘International’ or ‘State’.

- An English transliteration or translation of the name isn’t required for registration, but may be as valid as a Chinese name if there’s enough evidence to associate it with the Chinese name (for example, having a bilingual company chop with the two names).

When selecting the right name, make use of these valuable strategies:

- Conduct market research on industry competitors’ naming strategies to find out the typically successful names.

- The name should reflect your brand’s key attributes and appeal to your target demographic.

- Understand the Chinese language nuances, especially subtleties in pronunciation and character meaning, which could have negative interpretation or connotation.

Leasing an Office/ Facility

The name of the company is formatted to include the company name, the activity, the location i.e. the name of the city and lastly, the structure of the company. For example, a company called BLM registering in Beijing that engages in business consulting will be called BLM Business Consulting (Beijing) Co., Ltd. The name appears both on paper and as the everyday name of the company.

Hence, if you don’t own a facility, you should lease space before submitting your application for incorporation. You should have a minimum of 12 months rental period starting from the date you submit your application for registration of your company. It is normally impossible to move the registration of your company from one city to the next. Since your official company name must carry the name of the city of registration. It chooses your company’s city of operation an important undertaking.

These extra conditions should also be followed:

- Ensure your lease is made with correct formatting and registered with the local real estate authority.

- To ensure the legitimacy of the property you lease, obtain a land rights certificate and personal documentation from the landlord.

- It’s recommended that the contract has a clause stating that the lease can be voided in case your WFOE application is rejected.

- Submit to the local AIC a copy of the Certificate of Premise of Ownership (CPO) issued by the local real estate authority.

You should make a selection of your city location carefully because of the following reasons:

- Certain city names carry prestige and confer credibility, which can affect operations by impacting sales, government relations and business development.

- Relocation would be a taxing and expensive process, especially cross-district, potentially requiring registration with a new tax authority and AIC. You would also need revision of bank information, business license and other company certificates.

Environmental Impact Assessment for Manufacturing WFOEs

To control impact on the environment, an environmental impact assessment is required for manufacturing enterprises.

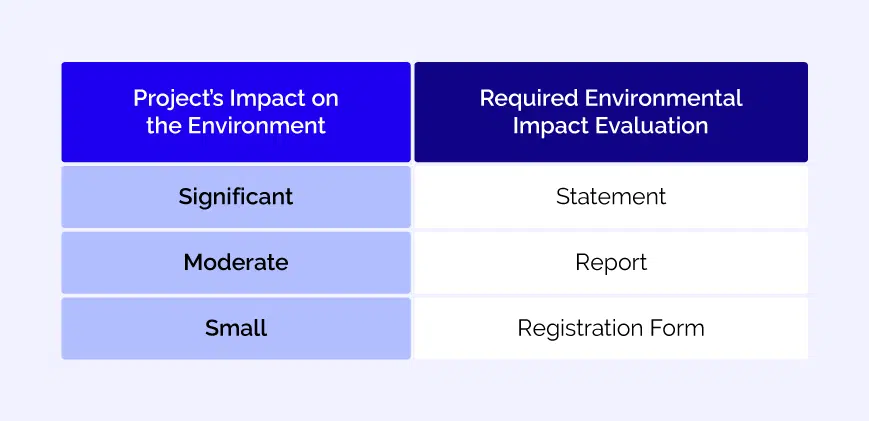

The Catalogue for Classified Administration of Environmental Impact Assessment provides the following classification of manufacturing projects, with the attendant environmental impact evaluation required:

Depending on the enormity of the environmental impact involved, registration of the company might be stopped or face very stringent operational regulations.

Other requirements include:

- Environmental impact evaluation should only be done by a qualified institution with a certificate issued by the environmental impact protection department of the State Council.

- Local environmental protection authorities should also be provided with information on the raw materials to be used, equipment and machinery, consumption and disposal of hazardous materials and measures for environmental protection.

MOFCOM Approval or Record-filing

A simplified record-filing process applies to companies whose business scope isn’t restricted by the Negative list for Foreign Investment (in free trade zones) or those who aren’t subject to the special administrative measures for foreign investment access.

The simplified record-filing process was recently promulgated in the Provisional Measures for the New Filing System issues by MOFCOM. It involves:

- An application form

- Commitment letter by all investors or their representatives

- Business license of pre-approval documents for the WFOE’s name

- Power of attorney appointing the representatives and identity papers of the representatives

- Certificate or identity document of investors and legal representatives for the application

Getting a 5-in-1 Business License

You can register and apply for a business license to the local AIC within 30 days of receiving an Approval Certificate from MOFCOM.

The business license application has been simplified, replacing the previous three-in-one license with a five-in-one license. The standardized national credit number simultaneously covers:

- Business license

- Organization code

- Tax registration certificate

- Social security registration certificate (new addition to the five-in-one license)

- Statistical registration certificate (new addition to the five-in-one license)

Once you get the five-in-one license it means the company now legally exists. However, this type of license is required by companies specializing in certain industries such as Energy and Finance.

The Post-licensing Procedures for Establishing a WFOE in China

Carving Chops

In China, unlike the West, a company’s official seal has legal authority over a legal representative’s signature. Regardless of who uses it, it has the power to validate documents and contracts. For this reason, its possession and whereabouts must be carefully observed.

Having an official seal is a legal requirement for all companies operating in China. It should be round and bear the official Chinese company name (it can also have an English name). The seal can be obtained from the local Public Security Bureau (PSB). A signed contract is legally binding only if an authentic seal is used, and its’ the opposite party’s responsibility to ensure it is so.

Opening a Foreign Exchange and RMB Bank Account

WFOEs must have at least two bank accounts, which have specific purposes.

An RMB basic account:

- This is a must for the WFOE’s daily business operations within China.

- It’s the only account from which a WFOE can withdraw RMB cash.

- Being the default designated account; it will be used in tax payments.

A foreign currency capital contribution account:

- Approval to open this account is obtained from SAFE.

- This is necessary to receive capital injections from overseas.

Import and Export Registration Procedures

Import and export registration procedures specifically apply to trading WFOEs. To conduct import-export trading and distribution activities, the trading WFOE must:

- Obtain a customs registration certificate and an import-export license. This allows the WFOE to exchange foreign currencies to RMB, and refund VAT or sales on exported or imported products.

- Complete foreign trader operator filing with MOFCOM.

- Make quality inspection registration with Entry-Exit Inspection and Quarantine Bureau.

- Obtain an E-port IC card, card reader and software with the China Electronic Port.

General VAT Taxpayer Related Procedures

There exist two categories of VAT Taxpayers in China: general and small-scale taxpayers.

Small-scale taxpayers include:

- Wholesale and retail businesses with less than RMB 800,000 per year sales.

- Manufacturers (including companies that offer processing, repair, and replacement services) with sales below RMB 500,000 per year.

- Taxpayers offering VAT-taxable services with RMB 5 million maximum annual sales.

All other VAT taxpayers are classed as general taxpayers.

Small-scale taxpayers benefit from lower VAT rates. However, general taxpayers can reduce their overall tax burden by deducting input VAT from output VAT. The general taxpayer status permits companies to issue special VAT fapiao to customers and clients. Fapiao can be used as legal receipts and for tax deductions.

Based on a sound accounting system, small-scale taxpayer entities can also apply for the general taxpayer status. However, once in the general taxpayer status, the company cannot revert to small-scale status.

Contact our team for highly customized market entry advice and a tailor-made quotation that will help you start your WFOE in the best way possible. Our professional service will radically improve your potential for rapid success and help you avoid unexpected future problems. General taxpayers are normally subjected to a VAT that ranges from 0 – 17% and are in a position to credit input VAT, while the VAT rate for small-scale taxpayers is 3%, without any input tax deductions.

Taxation on WFOE

- Corporate tax: 15% to 25% (depending on the WOFE’s location and industry)

- Income tax: rates up to 35% of business profits

- Personal taxes:(wages/salaries) 3% to 45%

- Consumption tax:1% to 56% of sales revenue of goods. Export are exempt.

- Stamp duty tax: 1%

- Land appreciation tax: 30% to 60% of gains on transfer

- Resources tax: 1% to 20% depending on material

Withholding Taxes

- VAT:17% / 13% for certain food, goods, books and utilities.

- Dividend tax: 20%

- Interest tax: 20%

- Royalties tax: 20%

- Deed tax: 3% to 5%

- Social Security tax: 37%

- Real Estate tax: 12% on rental value

Common Mistakes to Avoid When Setting up a China WFOE

- Miscalculation of the time required to set up the WFOE. Time is your enemy in this process. Every day spent chasing down all the details and weathering the delays in approval costs money. Take care with estimating your capital requirements for WFOE start-up. Use a well thought out, conservative estimate to make sure you don’t run short.

- Your Business Scope documents and Articles of Association (AoA) require very precise and well-considered language. Do not use vague language as it will probably hurt you in the long run when it comes time to update your documentation to expand your activities.

- Many companies underestimate the complicated and laborious process of setting up a WFOE. The more you know before getting to China, the better off you’ll be.

- Location, location, location … do it right the first time as changes to this factor in your business plan is the largest cause of delays in getting WFOE approval.

- Failure to register your trademark and intellectual property declarations in China well before you start the process to set up a WFOE. The fact that those trademarks and intellectual property issues have been declared in another country means nothing to the Chinese.

What’s New?

The Chinese government has implemented new regulations regarding foreign-invested enterprises (FIEs) in China. The key changes affect both consolidated and future market entrants into China.

FIEs Online Filing Registration Form

The new FIE online filing registration form (“new form”) requires an explicit FIE report of the actual controlling person of the enterprise.

Determining the Controlling Person

The “new form” requires basic information of the enterprise’s actual controlling person(s), involving:

- Selecting one out of seven options on the nature of the actual controlling person(s), including foreign natural person, foreign listed company, international organization, foreign government agency (including funds controlled by government), domestic listed company, collective enterprise or state-owned enterprise (SOE) and domestic natural person.

- Choosing one of three options as an explanation on how “control” operates under the registered actual controllers: contractual control over decision making of the foreign entity; equity ownership; or rights over personal nomination, operation and management, technology, financial conditions or other aspects of the enterprise.

Since a private entity is not listed in the seven options on the nature of the actual controlling person, you would have to select a natural person (CEO or group of individuals like a board) if the investor isn’t a public institution or listed company. Moreover, companies with complex controlling structures should consult a professional legal agency when seeking to explain the kind of control that exists within the company. This presents a challenge since the ownership structure may be so complex that the ultimate beneficiary shareholders aren’t known.

Foreigners are not allowed to submit the application documents for registering the WFOE. The proper procedure is for them to partner with a PRC entity cleared with the relevant authorities as a sponsor to submit the application on their behalf. Due to the complexity of the procedure involved in the incorporation of a WFOE, it is better to appoint a Global PEO that has partnerships with competent legal firms and PRC registered agencies to handle the process on your behalf.

SHARE