- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

Hire Globally

Pay Locally

Expand Quickly

Trusted by 3,200+ Companies

160+ Countries and counting …

Trusted by 3,200+ Companies

160+ Countries and counting …

today

simple

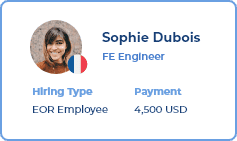

Select Your Ideal Job Candidate

Initiate INS Global Set-Up & Contract Creation

Onboard through a Globally Compliant Payroll System

Select Your Ideal Job Candidate

Initiate INS Global Set-Up & Contract Creation

Onboard through a Globally Compliant Payroll System

who

Since 2006, INS Global has been building a worldwide community of professionals and industries to connect the right companies to the right talent in the simplest, most efficient, and most compliant way possible

what

When you need support, you will work directly with your assigned advisor, who is an expert in the region you are hiring in

testimonials

Ins Global supports business expansion in Portugal and France, easing global payroll and tax compliance, focusing on business growth.

Lesia P

Company Name

INS Global’s commitment to addressing compensation, harassment, and employment issues promptly lets us focus on core work.

Juan I.

Company Name

INS Global provided an innovative PEO solution, more efficient than traditional global entity setup, enhancing our core focus.

Louis L.

Company Name

features

Quickly view and manage invoices, cash advances, and employee expense requests.

Initiate cash advances for flexibility in managing finances.

Allow employees to submit expenses and managers to approve them seamlessly at home and abroad.

Access, review, or download important contracts with ease.

Need assistance? Get in touch instantly with our support teams around the world.

numbers

content