Testimonial

Manuel Ramos

TERAO ASIA

Managing Director

We think INS Global is a good solution about starting business in new and complex markets. Understanding the market doesn’t mean you need to set up a company immediately.

5/5

INS Global is your PEO in Mexico. We provide international HR outsourcing services to companies that want to expand around the world easily and safely. We provide both PEO (Professional Employer Organization) and Employer of Record (EOR) services in over 160 countries worldwide. Our team of experts is fully equipped to help make your transition swift and problem-free.

A PEO (Professional Employer Organization), like a global EOR (Employer of Record) provides crucial HR outsourcing services to companies seeking quick, safe, and cost-effective strategies for global mobility. INS Global’s PEO in Mexico allows companies to hire compliance assured workers in as little as 48h.

As a third-party organization that takes on the responsibilities of an employer, an Employer of Record (EOR) in Mexico provides companies with a cost-effective and simple solution for the complications of overseas hiring and employee management. INS Global offers EOR services for companies looking to streamline the complexities of global mobility.

Instead of trying to familiarize yourself with local labor laws and legislation on your own, a PEO has legal professionals on hand with years of experience. They will smooth over any misunderstandings and complications and make sure that you adhere to local laws without fail

Traditional company incorporation is a long process that can take up to a year; with a PEO, you can operate in a new country in just a few days

A PEO can handle all aspects of HR, including recruitment, headhunting, contract management, and payroll outsourcing. This way, you can devote all your time and energy to leading your company to success

Save on overhead costs and potential delays by employing a PEO to make the most of their innovative tools and systems to help you can get started in the target market in a fraction of the time

Increase your efficiency by having just a single point of contact that meets all your HR requirements professionally and securely

Establishing yourself in a new market and country is a lengthy process that usually involves a good deal of red tape. Even the smallest mistakes can result in having to pay expensive fines or fees. You can decrease the chance of such risks by partnering with a global PEO or EOR services provider. This way, you can be guaranteed that both your employees and your company are in full legal compliance.

The Advantage in Figures

PEO/EOR

Company Incorporation

Price

80% Less Expensive

Market Entry

2-5 Days

6 Months

Manuel Ramos

TERAO ASIA

Managing Director

We think INS Global is a good solution about starting business in new and complex markets. Understanding the market doesn’t mean you need to set up a company immediately.

While these two services are often discussed together, they are not identical. It’s good to understand the differences to choose the one that best suits your company and its needs.

INS Global offers both PEO and global EOR services in Mexico to provide the most suitable solution to your specific needs.

Written employment contracts are mandatory in Mexico and should detail the contract duration, compensation, benefits, etc. The contract language should be Spanish, and the salary amount should be in the local currency of the Mexican peso.

Probation periods are typically 30 days and cannot go beyond six months.

Mexican labor law dictates that a working day cannot exceed 8 hours, and the total number of weekly work hours cannot be more than 48. Overtime pay is double the regular wage for the first nine hours; any hours beyond that require triple payment. Overtime hours are limited to three hours daily and for three consecutive days.

Employees required to work on Sunday are expected to be paid 25% more than their regular hourly wage.

There are 8 days of public holiday in Mexico. Employees who must work during those days are entitled to 300% of their regular salary.

Employees in Mexico must receive a minimum of 6 vacation days after one year of employment. They will receive 2 additional vacation days for each year of work until the fourth year. After the fourth year, employees should receive 2 extra days for every five years of employment.

Sick leave payments are covered by the government social care system and require medical documents before granting paid leave. As long as the employee has made their social security payments for at least four weeks before asking for sick leave, they will receive 60% of their wages from day 4 to 52 of sick leave. If their illness or injury results from work, they will receive 100% compensation.

Expectant mothers may take six weeks before birth and six weeks after for paid maternity leave, and fathers can take five days. The government covers maternity leave payments.

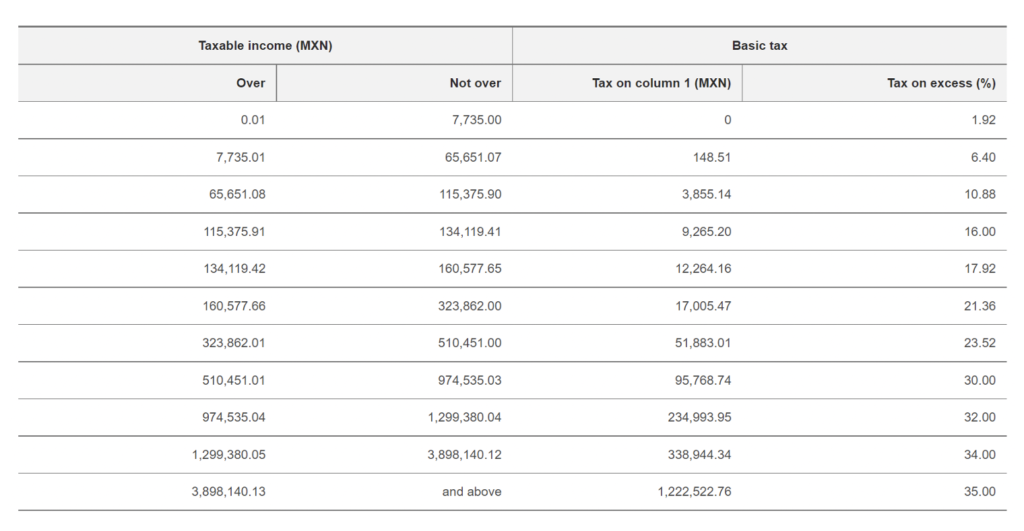

Income tax in Mexico is levied progressively depending on a person’s residency status. Non-residents are taxed either 15% or 30% for amounts over a minimum, while residents are taxed according to a bracket system.

Employers in Mexico are expected to contribute to the social security system with 2% of an employee’s salary amount going toward their retirement fund and 3.15% toward unemployment benefits.

Corporate income tax is 30%. (source)

No, it is necessary to use a local entity abroad to comply with each country labor law.

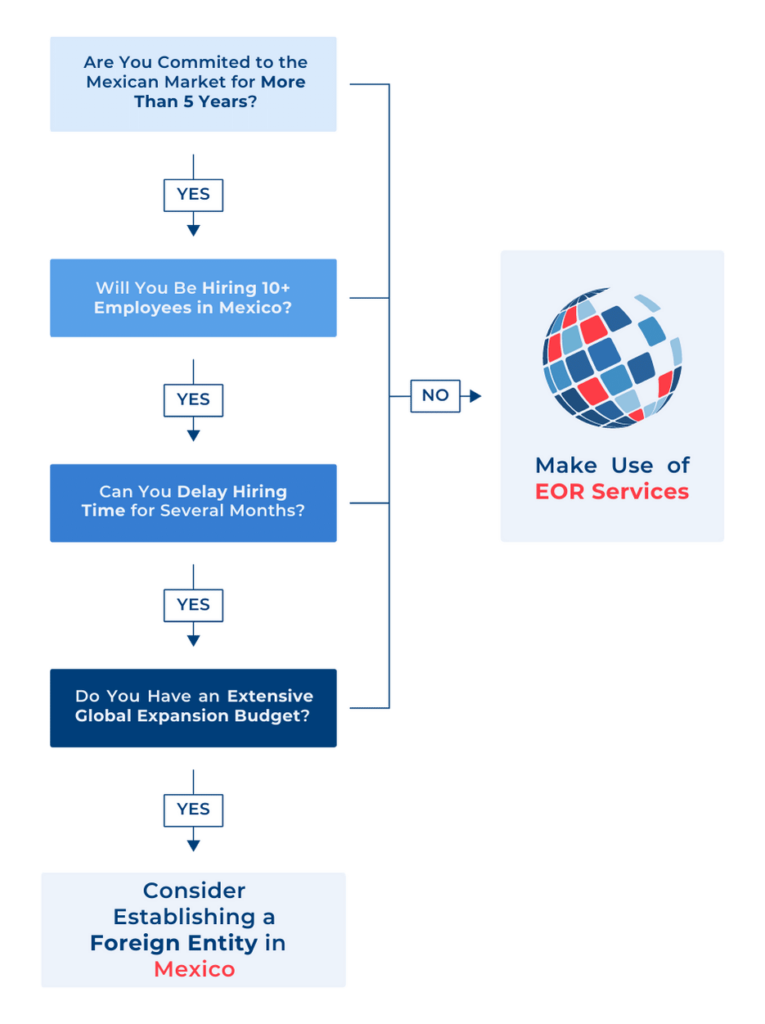

Foreign companies can either set up a local entity in each country or use the services a local PEO (Professional Employment Organization) to hire the staff on-site directly.

The employer of record is the legal entity liable for the staff employed in a specific country. In practice, a foreign company can either open a subsidiary to become the employer of record of its abroad employees or use a PEO to act as the employer of record.

In general, 1-month is necessary to have an employee based out abroad using an existing PEO as the employe of record. When incorporating a new subsidiary to be the employer of record, the delay varies from 4-12 months.