- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

Global expansion can be a complex and arduous process when you factor in the time it takes to establish yourself in a foreign market. It becomes additionally challenging when you factor in the difficulties of ensuring compliance with new local regulations and procedures.

A PEO (Professional Employer Organization), similar to an EOR (Employer of Record), is an HR services outsourcing provider with a local entity in Canada. This entity allows you to hire or transfer your employees in Canada to begin operations while also avoiding the lengthy procedures and red-tape surrounding company incorporation.

An international PEO, sometimes called an EOR (Employer of Record) lets companies hire and work with professionals worldwide in as little as 48 hours. As a cost-effective option for companies looking to expand quickly, an INS Global PEO in Canada gives companies total compliance assurance in their target market through global mobility expertise.

An EOR (Employer of Record) acts as an employer for purposes of outsourcing complex employer responsibilities. This is particularly useful for companies looking to expand their services globally in a safe and cost-effective way. INS Global’s EOR in Canada allows companies to follow their global expansion plans in less than 48h.

Due to a well-developed system of labor laws, it’s essential to stay compliant with every aspect of employment regulations in Canada. A PEO provides you with in-depth knowledge of everything that needs to be done to keep you and your employees safe

Rather than spending the months necessary for company incorporation in a new country, a PEO allows you to be up and running in a matter of days

A PEO provides you with guidance and advice from an entire team of global business specialists. You gain access to an understanding of local benchmarks and best practices that might otherwise be unavailable.

A PEO allows you to operate in Canada without the costly and arduous processes involved with company incorporation. This flexibility means your operations are scaled to your needs, whatever they are at any moment.

Your PEO partner covers the tasks that would otherwise require multiple professionals to operate smoothly. This efficiency allows you to keep your costs down and your employees on more necessary tasks.

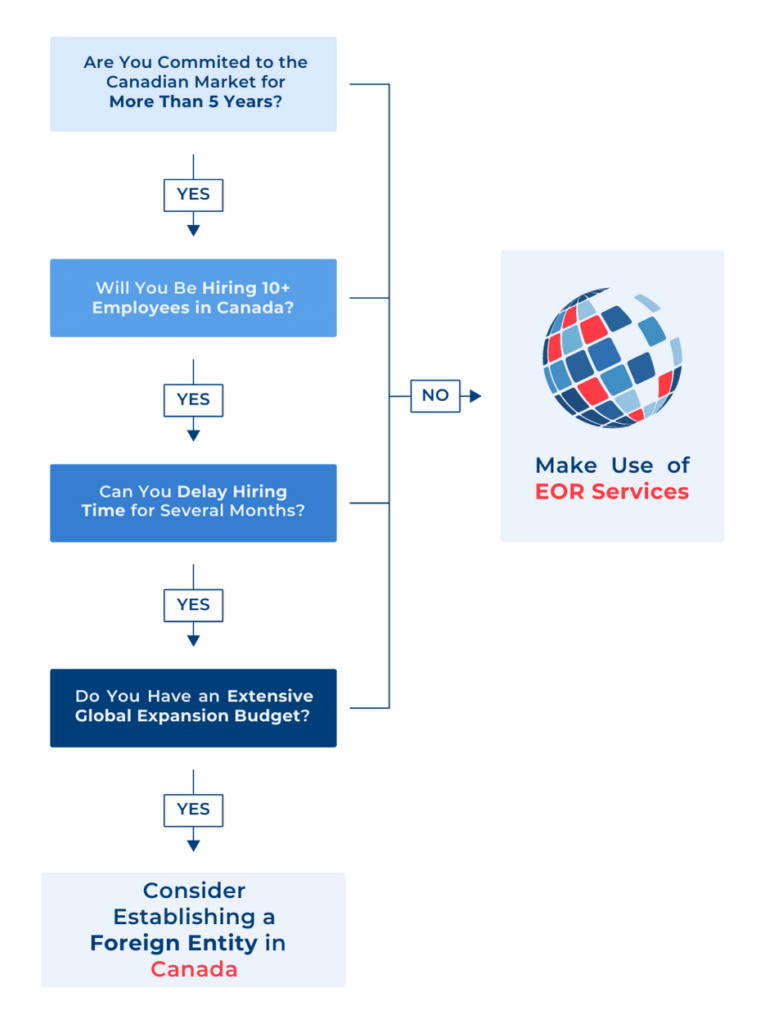

Company incorporation involves setting up a separate legal entity in the market of your choice. It often involves lengthy procedures and typically requires a physical presence in the country.

A PEO allows you to get to work in Canada while bypassing these steps, shortening what can take months into a matter of days and allowing you to get started on achieving your business goals quickly and compliantly.

The Advantage in Figures

PEO/EOR

Company Incorporation

Price

80% Less Expensive

Market Entry

2-5 Days

6 Months

According to Service Canada, a Record of Employment is the most important document there is for employees regarding their EI (Employment Insurance) benefits.

An ROE is a document employers must provide for employees that details their work history. It includes information used by the employee in the event of a disruption or potential disruption to their earnings.

A PEO can help you ensure that you can provide this vital document on demand for all of your Canadian employees.

To learn more about ROEs, you can read our article here.

INS Global’s local PEO allows you to get started in Canada in 4 simple steps:

While generally treated the same in most markets around the world, there are some differences in how PEOs and EORs offer their services.

INS Global offers both PEO and EOR services in Canada. Our recruitment team can work with you to provide advice on which solution may better suit your requirements.

In general, matters relating to employment are found in the Canada Labour Code.

While labor law typically applies at a federal level, it’s essential to consider potential variations used at a provincial or territorial level.

Canada’s employment regulations are highly complex and subject to many exemptions and areas for negotiation. It is advisable to seek advice from a knowledgeable source before hiring or operating with employees in Canada.

For an employment contract to be enforceable in Canada, it must meet national minimum standards.

Contracts in Canada can be written or verbal for a fixed or non-fixed term. It is advised that companies should make all arrangements in Canada in writing to avoid later disputes.

Should a company want to hire foreign workers for a position, they must first apply for a work permit for that employee.

The average workweek in Canada is 40 hours, applied over either 5 days of 8 hours, or more recently 4 days of 10 hours.

Most of Canada does not limit the number of hours that can be worked daily (Alberta limits the number of hours that can be performed daily to 12, and workers in Quebec can refuse to work more than 4 hours per day past the average). The amount is typically subject to agreement between the employer and employee, and fair rates and expectations must be applied.

Overtime and overtime pay are largely decided at a provincial and territorial level. Federally, any hours above the agreed-upon amount are classed as “overtime,” which is paid at 1.5X standard salary or remunerated by time-off with pay.

For a list of provincial and territorial rules on overtime, see here.

There is also a list of exemptions for various industries that require more flexible work schedules, such as logging or trucking.

Typically, an employee will be eligible for annual leave after their first year of service with a company.

Employees are eligible for a minimum of 10 days of paid leave annually.

Although this is not mandatory, many companies give their employees additional paid leave between Christmas and New Year.

There are a minimum of 6 federally regulated public holidays (as of the 2021 addition of the National Day for Truth and Reconciliation). However, this may be more at a provincial or territorial level.

According to federal law, employees in Canada are eligible for up to 5 days of paid sick leave per year, provided they have worked for their company for more than 30 days.

In 2021, the government introduced legislation that will increase the number of paid sick days to 10 if passed.

Different provinces and territories across Canada have variations on the rules regarding sick leave, such as only allowing unpaid leave or changing the number of available days.

Residents in Canada are taxed on worldwide income, while non-residents are subject to tax only on income earned in Canada.

Income earned in Canada is subject to federal income tax and may also be taxed by the province in which it was earned.

Owing to Quebec’s separate tax system, income earned in Quebec is taxed at a federal level at 16.5%

Employers in Canada should expect to pay the equivalent of 7.6% of their employees’ salaries as a contribution to Pension Insurance and Employment Insurance (8.2% in Quebec). Other payments may be required at a provincial and territorial level, and it’s advised to seek financial advice when preparing to hire employees in Canada.

No, it is necessary to use a local entity abroad to comply with each country labor law.

Foreign companies can either set up a local entity in each country or use the services a local PEO (Professional Employment Organization) to hire the staff on-site directly.

The employer of record is the legal entity liable for the staff employed in a specific country. In practice, a foreign company can either open a subsidiary to become the employer of record of its abroad employees or use a PEO to act as the employer of record.

In general, 1-month is necessary to have an employee based out abroad using an existing PEO as the employe of record. When incorporating a new subsidiary to be the employer of record, the delay varies from 4-12 months.