- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

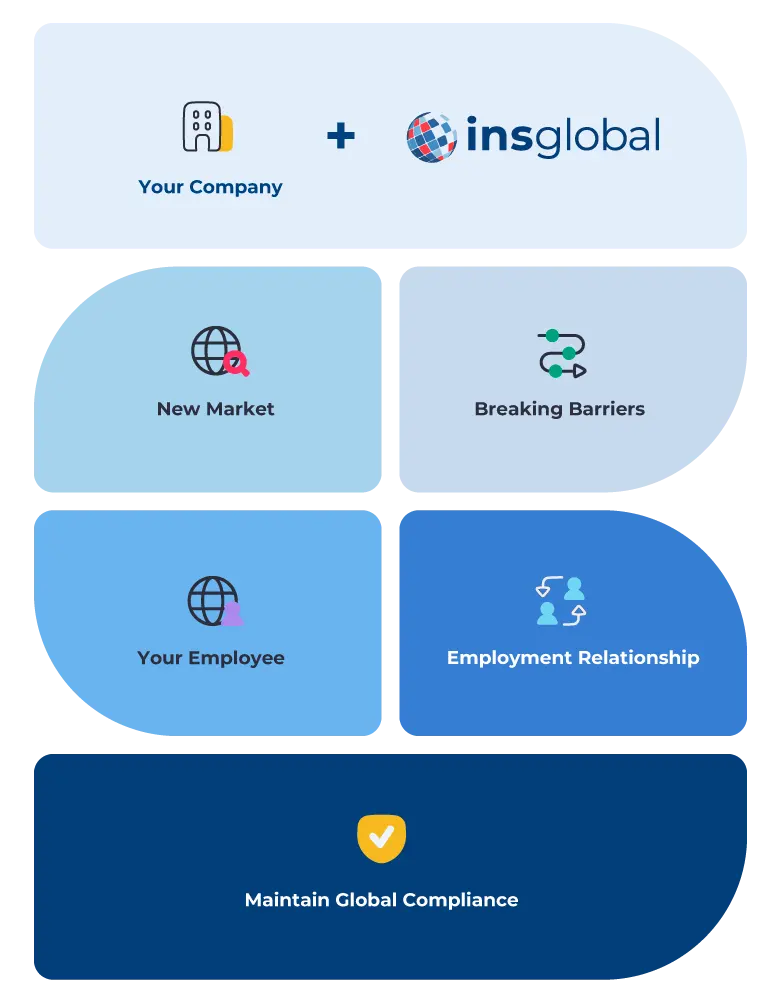

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

Country Guide

Capital City

Canberra

Languages

English

Currency

Australian dollar ($, AUD)

Population Size

25,771,300

Employer Taxes

18.45%

Employee Costs

2%

Payroll Frequency

Monthly

Embarking on global expansion by entering the market in Djibouti? Employer of Record services streamline employee recruitment and management without local entity establishment. This helps you navigate international complexities effortlessly and ensures efficiency in overseeing a globally dispersed workforce from anywhere.

Want to have a Team in Djibouti TODAY?

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers

Opting for EOR services in Djibouti streamlines the expansion process, allowing you to expand in less than a week. Collaborating with a Djiboutian EOR saves time on growing your business abroad, lowers expansion costs, ensures local compliance, and allows you to focus on growing your business.

The Advantage in Figures

PEO/EOR

Company Incorporation

Price

80% Less Expensive

Market Entry

2-5 Days

6 Months

Legal Compliance Assurance

Opt for an Employer of Record (EOR) service well-versed in Djibouti’s regulatory landscape for effective recruitment and supervision of an international workforce. This proactive approach shields against potential fines by providing support specifically tailored to Djibouti’s regulations.

Lower Expansion Costs

Focus on Growing Your Company

An Employer of Record in Djibouti assumes all HR-related responsibilities for new hires of transferred employees, streamlining your operations and granting you the freedom to focus solely on the international goals of your business.

Expand Effortlessly

Creating a new company in Djibouti can be time-consuming and expensive. In contrast, teaming up with a local Employer of Record expedites the expansion process, allowing entry into the Djiboutian market in as little as a week.

Manage Your HR Online

INS Global provides an efficient means to manage your diverse, global workforce online through a state-of-the-art digital platform.

Utilize our advanced cloud-based HR system to easily oversee all your employees and their needs remotely.

INS Global’s EOR in Djibouti facilitates your company’s expansion abroad in just 4 simple steps, specifically tailored to the Djiboutian business environment.

1

We collaborate with your business to create a tailored expansion plan.

2

Our organization provides the legal entity needed to hire and manage staff, ensuring compliance with Djibouti’s legal requirements.

3

We handle HR-related tasks, such as hiring, contract management, and payroll management, ensuring total local compliance in Djibouti.

4

Your employees focus on your goals while we take care of evolving HR and legal compliance needs.

In Djibouti, PEO (Professional Employer Organization) services handle various Human Resources tasks, serving as a strategic HR partner. On the other hand, Djibouti EOR (Employer of Record) companies possess the legal authority to hire and manage employees on your behalf, streamlining the process from start to finish in accordance with Djibouti’s employment regulations.

INS Global offers both choices, ensuring that whether you need an EOR or PEO in Djibouti, you have the support you need to expand comfortably, providing flexibility tailored to Djibouti’s business environment.

Check Our Latests Labor Law Guides

Working Hours in Djibouti

The working week in Djibouti runs from Monday to Friday.

Full-time employees generally work 8 hours per day, 40 hours per week.

Employees are not allowed to work more than 40 hours per week without receiving overtime pay.

Employees are entitled to a higher hourly rate for overtime. This is generally 150% of the normal rate.

Annual Leave in Djibouti

Djibouti has 11 official national holidays.

Employees are entitled to 30 days of paid annual leave every year.

Employees are entitled to 2.5 days of leave per month that they are with the company.

Sick Leave in Djibouti

When an employee is unable to attend work due to illness, they need to get a doctor’s note and present it to HR as soon as possible.

Employees get half of their salary for the first month of sick leave. For the remainder of the leave, an allowance can be claimed from social security.

Employees with seniority are entitled to 50% of their salary for 3-9 months, depending on seniority.

Maternity / Paternity Leave in Djibouti

According to Djiboutian law, female employees are entitled to 14 weeks of maternity leave.

Maternity leave can be claimed from social security.

Male employees are entitled to 3 days of paternity leave.

Employers in Djibouti are responsible for withholding all taxes and social contributions.

Employers contribute 4% to social security, 6.2% to disability insurance, and 5.5% to family allowances. Non-residents are taxed at 10%.

The corporate income tax rate is set at 25% for both local and foreign companies.

Personal income tax ranges from 2% to 15%.

Contact Us Today

Employer of Record (EOR) in Australia

View Details

Employer of Record (EOR) in Australia

View Details

solutions

faqs

While setting up a local entity is an option, collaborating with a local Employer of Record proves more efficient in Djibouti. Employer of Record services leverage local expertise, facilitating hiring and staff management on your behalf.

An Employer of Record in Djibouti manages various HR tasks, including payroll, tax compliance, employment contracts, and social security contributions, ensuring comprehensive compliance for your entire workforce

Establishing a new company abroad can take months to a year, but with INS Global’s EOR services, you can hire employees and expand to a new market in as little as a week.

EOR service costs are directly linked to your employee’s salary, calculated as a percentage and covering all HR functions for compliant employment in Djibouti.

Yes, collaborating with an Employer of Record in Djibouti is a legal and efficient solution, simplifying your expansion plans while reducing costs.

Salaries are typically processed monthly for full-time employees, while part-time workers may be paid weekly or bi-monthly.

Recruitment in Djibouti varies in cost, but INS Global simplifies remote recruitment and staff management, reducing the expenses of managing an international workforce.

Absolutely, a Djiboutian Employer of Record can recruit and hire employees from all regions, facilitating quick expansion across the country.

Modifications to employment contracts require mutual agreement.

Yes, employers in Djibouti are responsible for withholding taxes and social contributions from employee salaries, including an employer’s contribution to each employee’s social security fund.

INS Global tailors its services to your company’s needs, assisting with recruiting and hiring as many or as few employees as required for your expansion plans.

Severance pay is required for employees being let go in Djibouti as long as they have served for more than a year. For a year of service, the severance pay is equal to 1 month‘s salary. For 1 to 5 years, the severance increases to 2 months‘ salary. Employees who have worked for longer than 5 years are entitled to 3 months‘ pay.

In Djibouti, employees can be hired for both in-person and remote opportunities, allowing for reduced overheads during international expansion.

Certainly! Our local experts bring extensive experience in finding top talent globally by providing support in recruiting, hiring, and managing your workforce, regardless of your location.

Djibouti observes 11 public holidays where employees are entitled to a paid day off. Working on these holidays usually involves a higher hourly rate.

Employers must adhere to strict labor laws and regulations to avoid costly penalties and fines. Partnering with an experienced EOR in Djibouti ensures compliance during your expansion.

Yes! INS Global assists in the recruitment and management of a diverse workforce, simplifying the process of hiring both Djiboutian citizens and foreigners.

A Global Employer of Record is an effective solutions for companies like yours that are looking to expand a workforce abroad effortlessly.

This approach allows you to outsource the international hiring process quickly and efficiency, providing access to a global talent pool while still managing payroll compliance in each country.

Public Holidays Calendar

Download the PDF Guide