- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

A PEO in Germany (Professional Employer Organization) offers companies around the world a quick and safe way to expand their operations to overseas markets by taking charge of essential HR services. Through a PEO in Germany, companies can hire and manage employees overseas in as little as 48h.

A PEO Germany provides companies with a cost-efficient and secure way to follow global expansion strategies by acting as the employer for oversees workers to simplify tax and compliance assurance responsibilities. For companies looking to boost their global mobility potential, INS Global’s EOR provides the perfect mix of experience and expertise in the international market.

A PEO (Professional Employer Organization), imilar to a global Employer of Record (EOR), can operate in Germany as a local partner assisting companies expanding into the German market.

Our PEO allows companies expanding into this new market to outsource the burdensome aspects of HR and avoid the complex requirements of establishing a separate legal entity in Germany.

Incorporating a company in Germany can be an excessively complex, frustrating process that requires companies to understand local laws in detail and establish a physical presence. Using a PEO in Germany will allow you to begin operating in the country without having to incorporate a new physical entity.

A PEO:

Germany can offer you extensive knowledge of the necessary local regulations, and informed opinions on local administrative procedures that keep your company compliant with tricky regulations.

When entering new markets, even a simple HR mistake could lead to increased risks and wasted time. A PEO reduces these risks, decreases your market entry time, and saves money.

A PEO can provide payroll outsourcing in Germany, along with management services and recruitment strategies. When your time isn’t being taken up with these tasks, your employees can put their efforts into facilitating company growth.

Estimated time for Company Incorporation in Germany: 4-12 months

Estimated time to establish a PEO in Germany: 5 days

*Estimate

Everything your company needs is provided by one single point of contact. This will limit misunderstandings that arise when dealing with many team members and provide you with a simple communication chain.

INS Global’s PEO in Germany will manage employee recruitment and assignment needs by following these 4 simple steps:

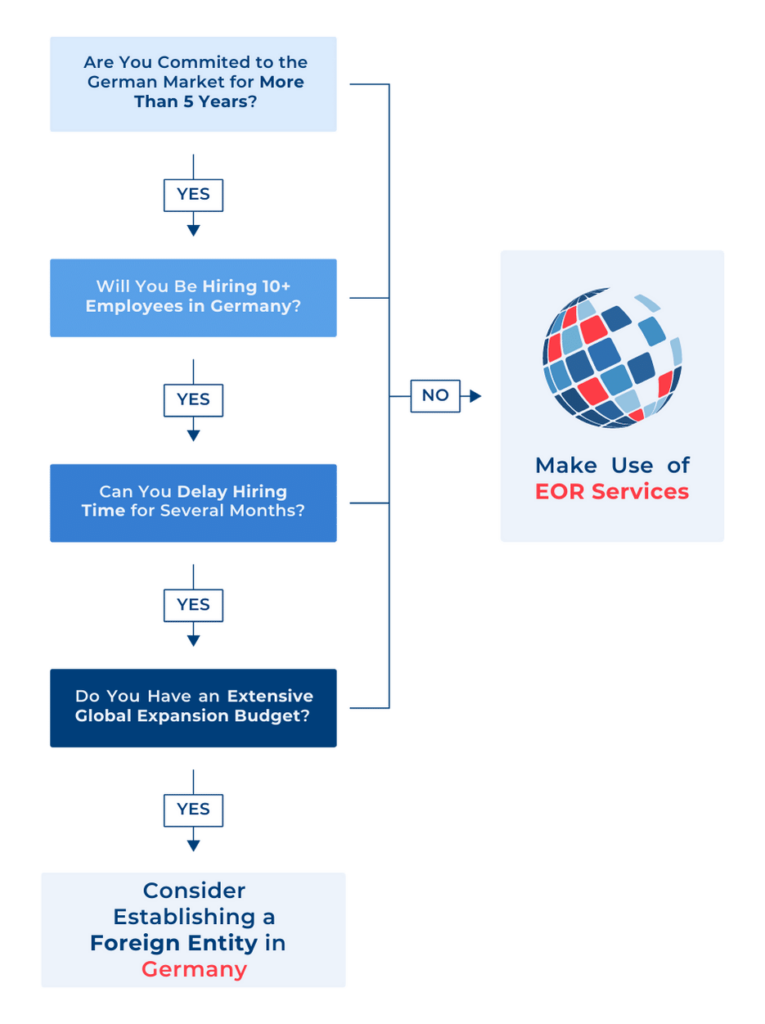

Once you and your team have decided to enter the German market, our expert staff can help you to understand the differences between a PEO in Germany and an Employer of Record in Germany. It’s necessary to be fully informed of the differences between these potential solutions to make the best choice for your company.

A PEO operates a distinct, separate entity that provides other companies with HR services

The services that are provided include: payroll outsourcing in Germany, tax, and legal advice, compliance assurance, among others

An EOR operates similarly to a PEO in that it is also a separate company, but it is legally liable for your employees that it hires on your behalf

An EOR will be responsible for all liabilities related to employment

In a PEO agreement, the contract remains between your company and your employee

In an EOR agreement, the contract is directed by your company but executed between the EOR and the employee

In total, there are 14 sources related to labor and employment laws in Germany, including but not limited to The Civil Code, The Minimum Wage Act, and The Hours of Employment, among others.

Most employment law acts refer to dependent employees only. The German Commercial Code later formally defined the terms ‘self-employed’ and ‘employed’.

Employment contracts created in Germany will typically cover the following information: start date, title, description, location, vacation, and salary among several other areas of relevant information regarding the position.

There are several minimum employment terms required by law that set out the minimum terms and conditions of employment, like the Minimum Wage Act, which requires EUR 9.35 gross per hour, and the Federal Vacation Act.

The Federal Labor Vacation Act regulates statutory minimum vacation days for employees in Germany. The mandatory minimum is 20 working days. Additionally, for each employee’s respective industry, if a a collective trade agreement regulates that industry, then that employee may be entitled to more vacation days every year. In general, German workers will expect that they will be entitled to around 6 weeks of vacation each year.

Mandatory work holidays will differ from region to region, depending on if that region is historically more Catholic or Protestant. A comprehensive overview of the intended region for market entry should be carried out to avoid potential misunderstandings later.

CIT

Germany taxes its corporate residents on the income they earn worldwide. However, most DTTs (Double Tax Treaties) make income attributable to a PE (Permanent Establishment). Non-residents with a PE or who have property income will be taxed German-sourced income.

Those that have earned royalties are taxed by withholding at the source. Interest that’s paid abroad is free of German tax altogether, in most cases.

Corporate tax in Germany is levied at a rate of 15%, and is then subject to an additional 5.5% surcharge. In total the CIT in Germany is 15.825%.

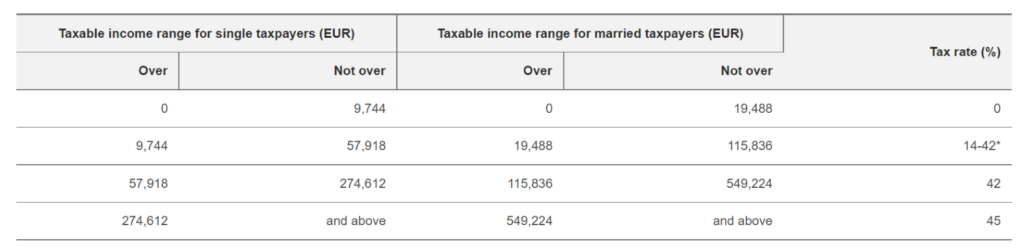

Personal income is taxed progressively according to the following scale:

Individual/Employer Social Contribution Rates

As of January 2021, social security rates will be levied on employment income, and contributions by employers are generally tax free. The following are contributions that are split between the employer and employee 50/50 and have an income ceiling of EUR 85,200 per year:

The remaining social contributions are as follows:

When you work with a reliable PEO in Germany to manage all important HR responsibilities, including payroll, contract administration, and guaranteeing tax compliance, the cost is calculated as a monthly fee calculated as a portion of the co-employed workers’ salary.

Working with an EOR will allow you to hire or relocate people in Germany in a safe, practical, and legal manner. You can use this outsourcing option on a short-term or long-term basis while setting up your own business structure abroad.

When an employee is managed by a PEO, they have access to a number of benefits, including full legal protection, local understanding of all employer responsibilities, quick and accurate payment, improved employee perks, and more.

While maintaining complete control over their work process, contractors who interact with consumers through a PEO have access to all the same employment perks and protections as regular employees.

Yes, a PEO takes into consideration any differences in local or regional employment regulations to give you global protection wherever you are.

Payroll expenses must account for indirect expenditures like social insurance contributions, bonuses, or incentives in addition to wages and any payments made to recruiting firms or experts.

Also, while signing incentives are optional, they could make you stand out to potential new coworkers and therefore should be factored into recruitment costs if chosen.

With certain PEO organizations, there may be a minimum or maximum number of employees you may hire. However, with INS Global, you may co-employ as many or as few employees as your development strategy demands.

Like many other countries, Germany has effectively adjusted to employee remote work options since the COVID-19 outbreak. The alternative between a physical workspace and a home office should be available to employees of a German-based corporation both for fair employment practices and as a competitive incentive.

Our recruiting team members are familiar with regional best practices, have access to professional networks, and are informed about both offline and online business resources.

In Germany, professional staffing companies or recruitment agencies frequently charge a hiring fee that is calculated as a portion of the new hire’s first gross monthly salary.

Yes, the recruitment, PEO, and Employer of Record services INS Global offers are advantageous to both German nationals and foreign residents.

Employees in Germany are required to be paid at least once per month with a written pay slip provided as proof that breaks down gross pay and all relevant payroll deductions.

Currently, the German federal minimum wage is 12 euros per hour.

As a member of the EU, those seeking to live and work in Germany for longer than 90 days are subject to largely the same types of visa as are available in other EU countries.

Currently, applicants can choose between a Temporary Residence Permit, an EU Blue Card, an EC Long-Term Stay Permit, and a Permanent Settlement Permit. These generally include the ability to travel and move within the Schengen Area.

All employee salaries are subject to social security contributions based on a percentage of the employee’s gross salary. These contributions are shared equally between employer and employee.

Employer contribution amounts are for Pension (9.3%), Unemployment (1.2%), Long-Term Care (1.525%), and Healthcare (7.3%).

Thanks to a robust social security system, workers in Germany are eligible for all the usual statutory employee benefits like parental leave, healthcare, annual and sick leave, and more.

In addition, to remain competitive many companies in Germany now offer fringe benefits like a flexible schedule, wellness packages, and home office support.

All changes to employee contracts must be made through the agreement of both employer and employee to be counted as valid. Written contract benefits may not go below statutory federal minimums.

Everyone who pays social security as part of their salary in Germany pays into their public health insurance fund. Should an employee need to receive treatment or take paid sick leave, this is at least partially paid for via their health insurance.

While there are no mandated guidelines for severance in Germany, in order to avoid a termination dispute employees can expect around 50% of a month’s salary per year of service with a company as part of a severance package.

Aside from the German Basic Law Code, which includes a lot of regulations concerning labor practices, there are also labor courts at local, regional, and federal levels that act as the arbitrators and guarantors of most labor requirements.

Depending on the state, there are around 10-13 days of public holidays per year in Germany. These are paid holidays in addition to annual leave, with workers requested to perform duties on them being expected to receive an additional salary even though this is not mandated by law.