Testimonial

Manuel Ramos

TERAO ASIA

Managing Director

We think INS Global is a good solution about starting business in new and complex markets. Understanding the market doesn’t mean you need to set up a company immediately.

5/5

If you’re looking for an organization that can provide professional and secure human resources services, INS Global is the ideal global expansion partner for your needs. Our Professional Employer Organization (PEO) services are available in over 160 countries and with our help, you can expand quickly and efficiently into any new market. As a result, a PEO in Kenya is the fastest and smoothest way to set up operations in the country.

A PEO will allow you to hire new staff and ensure accurate and legally compliant payroll services, all in just a few days. An Employer of Record (EOR) in Kenya takes on the role of being the legal employer to your staff so that you don’t have to handle the complications of local employment law. With a PEO or EOR, you can reduce costs, save time, and guarantee compliance for all your employees.

Without the expertise of a PEO, it’s easy to make simple mistakes that result in heavy penalties. Our legal team is equipped with the experience and local knowledge that will keep your company and employees compliant with every aspect of local regulations.

Skip the unnecessary hassles and roadblocks to new market entry by partnering with a PEO that has personalized solutions for every situation.

A PEO handles every aspect of recruitment, onboarding, contractor management, and payroll, allowing you to devote all your time and energy toward company goals and market growth.

The average time for company incorporation in a new country is 4-12 months. With a PEO you can be running operations in just a few days.

Get access to long-term payroll and HR services through a single point of contact.

Traditional company incorporation requires you to establish a legal and physical branch or subsidiary of the company in the new country. A PEO, however, allows a company to operate in a new country without having to set up a separate entity.

A PEO also helps you…

Manuel Ramos

TERAO ASIA

Managing Director

We think INS Global is a good solution about starting business in new and complex markets. Understanding the market doesn’t mean you need to set up a company immediately.

In just 4 simple steps INS Global’s PEO can manage all your market expansion needs in Kenya:

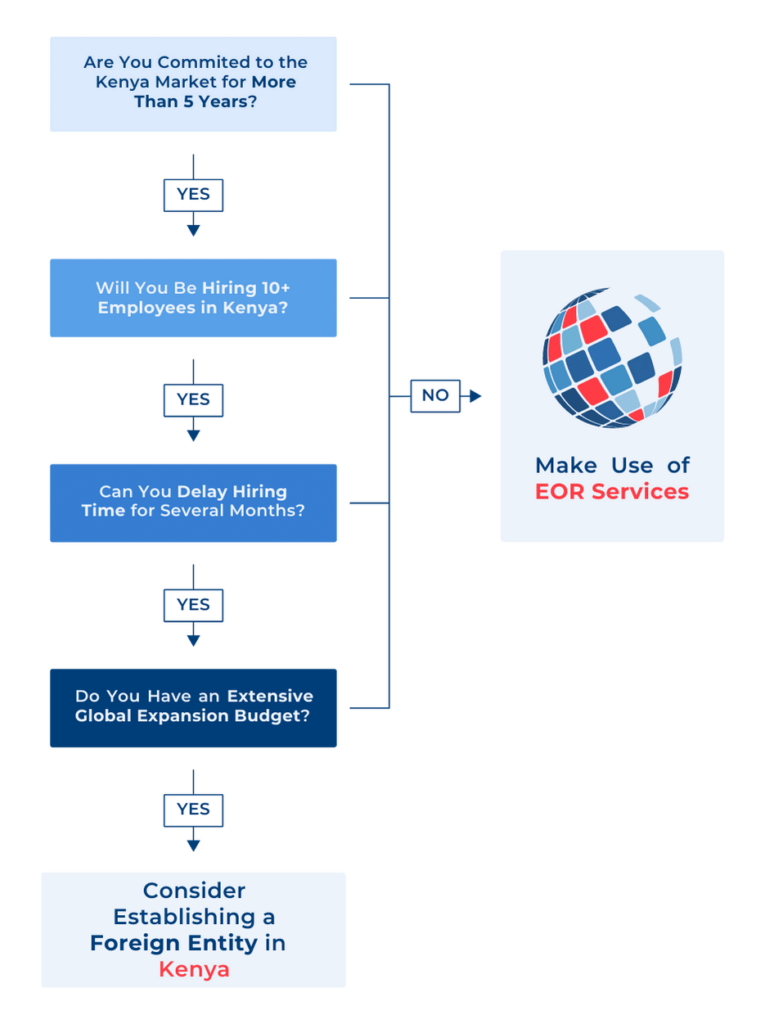

While the two organization types provide similar services, a PEO and EOR are not exactly the same. It’s important to understand the distinctions so that you can choose the one that best suits your needs.

A PEO is a third-party organization that provides HR services to employees of the client company. These services cover many different tasks, including payroll, tax, legal compliance, and more.

An EOR also provides these services, but they can also legally hire employees on behalf of the client company. Additionally, an EOR becomes officially responsible for all the liabilities of recruiting and employing employees.

In a PEO agreement, the contract is made between the client company and the employee. In an EOR agreement, however, the contract is overseen by the client company but made directly between the EOR and the employee.

Taking care of payroll for staff in a non-profit organization (NPO) or other types of NGO (Non-Governmental Organization) can be challenging when moving to a new country. There may be different local tax regulations for non-profit organizations and their employees, and you want to make sure you don’t waste any valuable expenses by having to pay fees or fines for errors.

With a PEO you can recruit new staff and volunteers globally, maintain accurate payroll for all employees, and make local connections easily so that your NPO or NGO can make a difference in local communities. We take care of your expansion needs so that you can take care of those in need.

Employment contracts in Kenya should be made in writing and state the salary amount in the local currency of Kenyan shillings.

Probation periods in Kenya should not last longer than 6 months. However, in the event of necessity, they may be renewed for a further 6 months.

Employers can terminate an employee without notice in Kenya. However, employers are then required to pay the employee the salary they would have otherwise received during the 28 day minimum notice period. This situation may be avoided if specifically stated in the contract.

Severance pay is calculated at 15 days’ wages for each year of employment.

A standard work week in Kenya ranges from 40-45 hours. This typically consists of 8 hours per day Monday to Friday, and 5 hours on Saturday. A maximum work week of up to 52 hours is permitted by law.

Overtime pay is 1.5 times the regular salary for weekday work and 2x the normal rate for overtime on Sundays or public holidays.

There are twelve public holidays annually in Kenya. Some holidays are expected for specific groups of workers, such as important Muslim or Hindu holidays.

If a public holiday falls on a Sunday, then the Monday immediately after is considered a day off instead.

All employees who have worked for a minimum of 12 consecutive months are entitled to 21 days of paid annual leave.

Annual vacation days should be taken consecutively unless otherwise agreed upon.

Unused annual leave days can be carried over to the next year with the agreement of the employer.

Annual sick leave is a minimum of 14 days: 7 days at full pay and 7 days at half pay. Employees must have worked a minimum of two months to be eligible for this sick leave.

Employees also need to provide a doctor’s statement or medical certificate to apply for sick leave and reimbursement by their social insurance fund.

Expectant mothers must receive up to 3 months of maternity leave at full pay.

Fathers can take 2 weeks of paternity leave, also at full pay.

Employers will be reimbursed by the state for paid maternity/paternity leave.

Both employers and employees must contribute 5% each month to the NSSF (National Social Security Fund). Employers are also required to remit NHIF (National Health Insurance Fund) contributions to employees.

Income tax is based on a Pay As You Earn (PAYE) system, and ranges from 10-30%.

Corporate tax in Kenya is charged at 30%.

Kenyan VAT is 16%.

Foreign residents in Kenya will be automatically taxed on both the income earned in the country and any income from abroad. Non-residents are only taxed on the income earned in Kenya.

Sub Title Slider 4

VIEW DETAILS

Sub Title Slider 3

VIEW DETAILS

Sub Title Slider 1

VIEW DETAILS

No, it is necessary to use a local entity abroad to comply with each country labor law.

Foreign companies can either set up a local entity in each country or use the services a local PEO (Professional Employment Organization) to hire the staff on-site directly.

The employer of record is the legal entity liable for the staff employed in a specific country. In practice, a foreign company can either open a subsidiary to become the employer of record of its abroad employees or use a PEO to act as the employer of record.

In general, 1-month is necessary to have an employee based out abroad using an existing PEO as the employe of record. When incorporating a new subsidiary to be the employer of record, the delay varies from 4-12 months.

Level 39, Marina Bay

Financial Centre Tower 2,

10 Marina Boulevard

Singapore 018983