Country Guide

Employer of Record in New Zealand

Capital City

Languages

Currency

Population Size

Employer Taxes

Employee Costs

Payroll Frequency

Hire Globally, Pay Locally, Expand Effortlessly

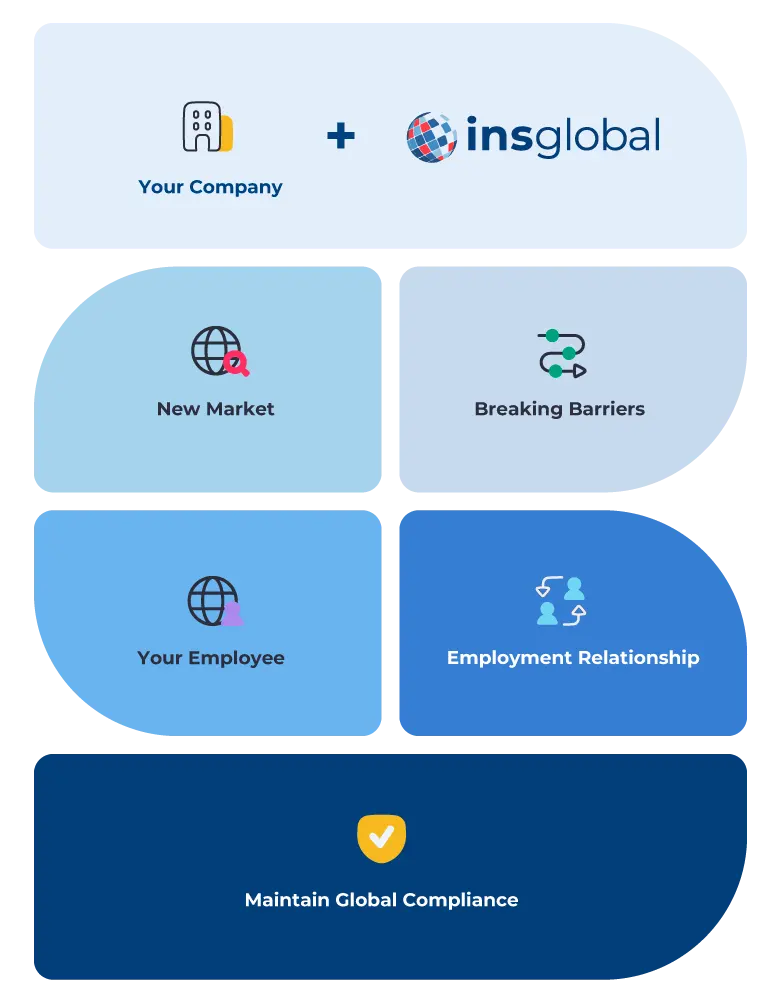

We serve as your Employer of Record in New Zealand , our experts incorporate their extensive networks and years of experience into working as your local provider for all your HR outsourcing needs. By employing our bespoke Employer of Record in New Zealand, our experts are available to be used to help your company hire employees and begin operations quickly, all without the hassles formerly associated with entering foreign markets.

Our Employer of Record services (sometimes referred to as an EOR) work in New Zealand as a local business partner to assist your company in its market expansion. Our Employer of Record in New Zealand can allow your company to outsource complicated, burdensome HR services and remove the need for creating a distinct legal entity within the country.

Employer of Records are the perfect vehicle for providing your company with numerous benefits that limit risks and increase your business’s competitive edge. Our Employer of Record works to your advantage by legally employing your staff, providing payroll outsourcing in New Zealand, and managing your employees’ benefits and compensation. These services save money, limit time wastage, and help you stay in compliance with local regulations.

Want to have a Team in New Zealand TODAY?

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers

The Best Strategy for Entering New Zealand: Employer of Record or Company Incorporation?

Incorporating your company in New Zealand can be a disproportionately complex and hazardous process, often requiring a local understanding of regulations and the establishment of a physical entity. Our Employer of Record in New Zealand allows you to operate your business without having to go through the many complicated steps to incorporate a new legal entity.

An Employer of Record:

Saves time

Saves money

Limits potential bureaucratic or legal pitfalls

Utilizes local networks and expertise

PEO/EOR vs Company Incorporation

The Advantage in Figures

PEO/EOR

Company Incorporation

Price

80% Less Expensive

Market Entry

2-5 Days

6 Months

The Distinct Advantages of Using a Employer of Record

Local Legal Experience

Employer of Records offer you knowledge of local regulations and current best practices for local administrative procedures that will keep your company and employees in constant legal compliance.

Lower Costs

When entering a new market, like New Zealand, simple errors in the HR department can lead to a disproportionate occurrence of fines that slow down your market entry. A Employer of Record reduces these errors, decreases market entry time, and saves you money.

Increased Focus on Expansion

An Employer of Record can provide payroll outsourcing in New Zealand, alongside recruitment and benefit management services. When your company doesn‘t have to worry about local payroll best practices, your employees can garner greater focus on critical operations.

Quicker Market Entry

Estimate time for Company Incorporation in New Zealand: 4-12 months. Estimate time to establish an Employer of Record in New Zealand: 5 days

One Point of Contact

Everything your business needs for global expansion can be provided through one point of contact. This streamlining decreases risks and provides you with a personable, custom solution for your unique needs.

Guide to Our Employer of Record in New Zealand

INS Global‘s Employer of Record experts manage employee assignment and HR needs in New Zealand using these four simple steps:

1

We learn about your requirements from speaking directly with you and creating an in-depth strategy for your company.

2

Our Employer of Record specialists provide legal expertise and HR operations knowledge which you can use to establish your presence in New Zealand seamlessly and efficiently.

3

Our experts can handle each of the legal aspects of recruiting and employing your staff while you and your current employees focus on the essential elements of growth and success.

4

Your employees will be able to continue focusing on their daily operations and improving at critical tasks while we manage HR services and payroll outsourcing in New Zealand.

What's the Difference: Employer of Record or EOR in New Zealand

Once your company decides on expanding into the New Zealand market, the differences between a Employer of Record (Professional Employer Organization) and EOR (Employer of Record) services can seem frustratingly vague. It‘s helpful to learn about their unique characteristics so that you can be informed and make the decision that‘s best for your company and employees.

An Employer of Record operates as a separate company providing HR services outsourcing to employees working at other companies.

These HR services can include payroll outsourcing, tax filings, and consulting on legal issues.

An Employer of Record is also a separate company that performs similar functions as that of a Employer of Record but is also legally liable for the employees it hires

In addition to providing the same services that a PEO provides, an Employer of Record is responsible for all the liabilities of recruiting and employment.

Under an Employer of Record agreement, the employment contract between your company and the employee remains unchanged.

- Under an Employer of Record agreement, the contracts are directed by you but are legally made between the Employer of Record and the employee.

Why Consider New Zealand for Global Hiring?

New Zealand offers a stable economy, transparent regulations, and a highly skilled, English-speaking workforce. With strengths in sectors like tech, agriculture, fintech, healthcare, and renewable energy, it’s an attractive destination for companies looking to expand in the Asia-Pacific region.

However, despite its business-friendly environment, setting up a local entity still requires navigating legal and administrative processes, including registering with the Inland Revenue Department (IRD), appointing local directors, and meeting compliance obligations under New Zealand’s Employment Relations Act.

An Employer of Record (EOR) in New Zealand provides a faster and more strategic alternative, enabling businesses to hire locally without establishing a company.

The Challenges of Setting Up a Local Entity in New Zealand

Opening a subsidiary in New Zealand involves more than company registration. You must:

-

Appoint at least one New Zealand-based director

-

Register for GST (Goods and Services Tax)

-

Open a New Zealand business bank account

-

Manage local employment agreements in compliance with the Holidays Act, KiwiSaver Act, and other statutes

-

Handle payroll, PAYE (Pay As You Earn), and tax filings directly with the IRD

This can delay operations by several months — especially for companies new to the region. In contrast, a New Zealand EOR handles these processes on your behalf, allowing you to focus on growth rather than bureaucracy.

Risk Management: How an EOR Protects Your Business

New Zealand employment law emphasizes fair treatment, employee rights, and proper dispute resolution. Misclassifying employees, mishandling terminations, or failing to meet obligations can result in legal action and reputational harm.

A local EOR provider ensures:

Accurate drafting and management of employment agreements

Proper calculation and payment of statutory entitlements, including paid leave and contributions

Full compliance with evolving labor laws and health & safety requirements

Correct handling of probationary periods and notice periods for termination

This level of compliance is essential for companies aiming to build long-term operations in New Zealand without legal exposure.

INS GUIDES

Check Our Labor Law Guide

Labour Law in New Zealand - 2025

Employment Contracts in New Zealand

New Zealand’s labor law is derived from statutes (Acts of Parliament) and common law (principles developed by Courts and Tribunals). Currently, a series of statutes constitute what has been referred to as the ‘minimum code’. This determines the minimum entitlements for employees working in New Zealand.

In cases where there are disagreements about labor contracts, the disputing parties can come to terms through the Employment Court and the New Zealand Court of Appeals.

Working Hours

In New Zealand, the usual number of working hours per week is 40 hours. However, this can be increased if both the employer and employee agree.

In many professions, there is no additional payment required for overtime work. However, there are collective agreements in many blue-collar industries that provide for overtime payments.

If an employee is required to work on one of the 11 annual public holidays and that day falls on a typical working day, then by law, the employee will be entitled to a paid day off on a different date.

As of 2021, workers in New Zealand can take 10 days of paid sick leave annually.

Types Of Leave

Maternity Leave in New Zealand

The Parental Leave and Employment Protection Act of 1987 provides the minimum entitlements to be provided for paid and unpaid parental leave for both mothers and fathers for both natural birth and adoption.

The “primary caregiver” can take up to 26 weeks of paid leave. This can be shared between partners.

Leave payments are made by Inland Revenue.

The other partner may be eligible for 1-2 weeks of unpaid Partner’s Leave.

Employees can also take a total of 52 weeks for extended unpaid parental leave. This is shared between partners.

Additionally, there are 10 days allowed for special leave, which can be taken by a female employee who is pregnant before she takes maternity leave for reasons connected with her pregnancy.

Tax Law in New Zealand

CIT

New Zealand resident companies are taxed on the income earned worldwide. Non-resident companies (including branches) will be taxed on the income they earn inside New Zealand. The New Zealand corporate income tax is 28%. There are no state or municipal income taxes in New Zealand.

Employer/Employee Contribution

New Zealand tax law requires that employers pay a compulsory employer contribution for employees if they meet the requirements that are set out in section 101C of the KiwiSaver Act. These requirements are:

- paid salary or wages from which the employer deducts contributions for their KiwiSaver scheme;

- aged 18 and over;

- not entitled to withdraw an amount from their KiwiSaver scheme or complying fund under the scheme rules that require lock-in

- not a defined benefit scheme member.

Contact Us Today

Frequently Asked Questions

No, it is necessary to use a local entity abroad to comply with each country labor law.

Foreign companies can either set up a local entity in each country or use the services a local PEO (Professional Employment Organization) to hire the staff on-site directly.

The employer of record is the legal entity liable for the staff employed in a specific country. In practice, a foreign company can either open a subsidiary to become the employer of record of its abroad employees or use a PEO to act as the employer of record.

Liabilities may vary from country to country and include all the staff management responsibilities: labor contract issues, payroll management, and tax compliance, social security management, expenses claim declaration, hiring and termination

procedures, etc.

In general, 1-month is necessary to have an employee based out abroad using an existing PEO as the employe of record. When incorporating a new subsidiary to be the employer of record, the delay varies from 4-12 months.

A Global Employer of Record is an effective solutions for companies like yours that are looking to expand a workforce abroad effortlessly.

This approach allows you to outsource the international hiring process quickly and efficiency, providing access to a global talent pool while still managing payroll compliance in each country.