- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

INS Global is your local partner for global human resources services. Through our PEO, you can establish your business, hire the best workers, and achieve success in 160+ countries.

We help you expand quickly and efficiently, all while cutting through the red tape and extra costs that often occur with global expansion.

A PEO (Professional Employer Organization), like a global EOR (Employer of Record) provides crucial HR outsourcing services to companies seeking quick, safe, and cost-effective strategies for global mobility.

INS Global’s PEO in Poland allows companies to hire compliance assured workers in as little as 48h.

As a third-party organization that takes on the responsibilities of an employer, an Employer of Record (EOR) in Poland provides companies with a cost-effective and simple solution for the complications of overseas hiring and employee management.

INS Global offers EOR services for companies looking to streamline the complexities of global mobility.

A PEO (Professional Employer Organization) is a local partner for companies that want to outsource their HR services, or expand into a new region or country without having to create a separate legal identity.

A PEO will not only assist you in legally employing your staff, but it will also manage other employee services such as recruitment, payroll, benefits, and compensation.

With an in-depth knowledge of local legal and administrative procedures, a Professional Employer Organization ensures that your company complies with every aspect of local law in a safe and efficient way.

When entering a new market, even having a minor issue related to HR can lead to shockingly high fees and fines. A PEO provides local experts who will assist you in avoiding costly errors.

By providing payroll outsourcing, recruitment, headhunting, and contractor management services, a PEO allows you the time and energy to focus on successful growth.

Estimated time for Company Incorporation in a new market: 4-12 months

Estimated time to establish a PEO relationship: 5 days

*Global estimate

A Professional Employer Organization covers every aspect of HR services and streamlines them into a single point of contact.

Introducing your company to a foreign country can often be a complicated and challenging process, requiring both a legal and physical presence in the target market.

By working with a PEO, your company can operate in the new market without stumbling through the many steps necessary to form and incorporate your entity.

A PEO:

The Advantage in Figures

PEO/EOR

Company Incorporation

Price

80% Less Expensive

Market Entry

2-5 Days

6 Months

INS Global’s PEO in Poland can take care of your employee recruitment and HR needs via 4 simple steps:

When you decide to expand into a new market with a PEO or global EOR (Employer of Record), it’s helpful to know the differences between these two similar services in order to choose which one is the most suitable for your needs:

INS Global offers both PEO and EOR solutions in Poland according to your requirements. You can read this article on the differences to learn more, or talk to one of our consultants today to see which would be best for you.

Contracts in Poland must be written in Polish, and currencies must be in Polish zloty. The contract should include key details regarding salary, vacation days, sick leave, etc., and must be submitted to the social security office a minimum of one week before the start date.

In the case of a contract not being provided, the employer must show some form of a written agreement that confirms the employee’s work and wages.

There are 13 days of annual paid public holidays in Poland as follows: Jan. 1, Epiphany, Easter Sunday and Monday, Labor Day, Constitution Day, 1st day of Whitsun Holidays, Corpus Christi, St. Mary’s Ascension Day, All Saints’ Day, Independence Day, and Christmas.

However: Those holidays which traditionally fall on a Sunday are nott counted as paid.

The number of annual vacation days given to workers in Poland correlates to the length of time that they have worked for a company.

For those who have worked less than ten years, the minimum number of paid vacations days is 20, and the number increases to 26 for those who have worked over ten years. Unused vacation days may be carried over for up to three years.

The maximum working hours are 8 hours per working day, and and average of 40 hours a week. Work hours exceeding this are classified as overtime and must be paid at a rate of 150% to 200% above expected salary, or by an amount of paid leave days equivalent to that amount. Annually, overtime hours should not exceed 150 hours, unless otherwise agreed.

Employees in Poland are eligible for 33 days of paid sick leave from their employer, provided the employee can provide valid documents from a doctor or hospital.

Employees of 50 years or older can receive 14 days of paid sick leave.

In both of the above circumstances, should the absence continue for longer, the state will continue to issue further payments.

Parental leave in Poland is covered by the state, not the employer. The length of paid maternity leave in Poland changes according to the number of children a parent has. Maternity leave begins at a minimum of 20 weeks and can go up to as many as 37 weeks for the 5th child.

Maternity leave can begin up to six weeks before birth. In total, a 14-week maternity leave is required for new mothers. A mother can return to work earlier if the father takes the remaining mandatory days of maternity leave.

Parents who have been employed with a company for over six months may take an additional 36 months of unpaid childcare leave.

Fathers may take two weeks of paid paternity leave before the child turns 2, and they must give notice at least one week before their leave.

Both employees and employers in Poland are required to give a percentage of their earnings towards social services such as health insurance, workplace injury compensation, pension, etc.

The percentage may vary according to the industry, but can be estimated to around 14% of standard salary for the employee and 18% for the employer.

As of January 2022, individual income tax is 17% for annual income amounts between PLN30,000 and PLN120,000. Amounts above this are subject to a tax rate of PLN15,300 + 32% (for the excess over PLN120,000).

Corporate tax is approximately 19% according to PWC

Specialized EOR services are priced in Poland as a percentage of an employee’s monthly salary. This cost covers all HR duties necessary to guarantee adherence to all regional employment laws.

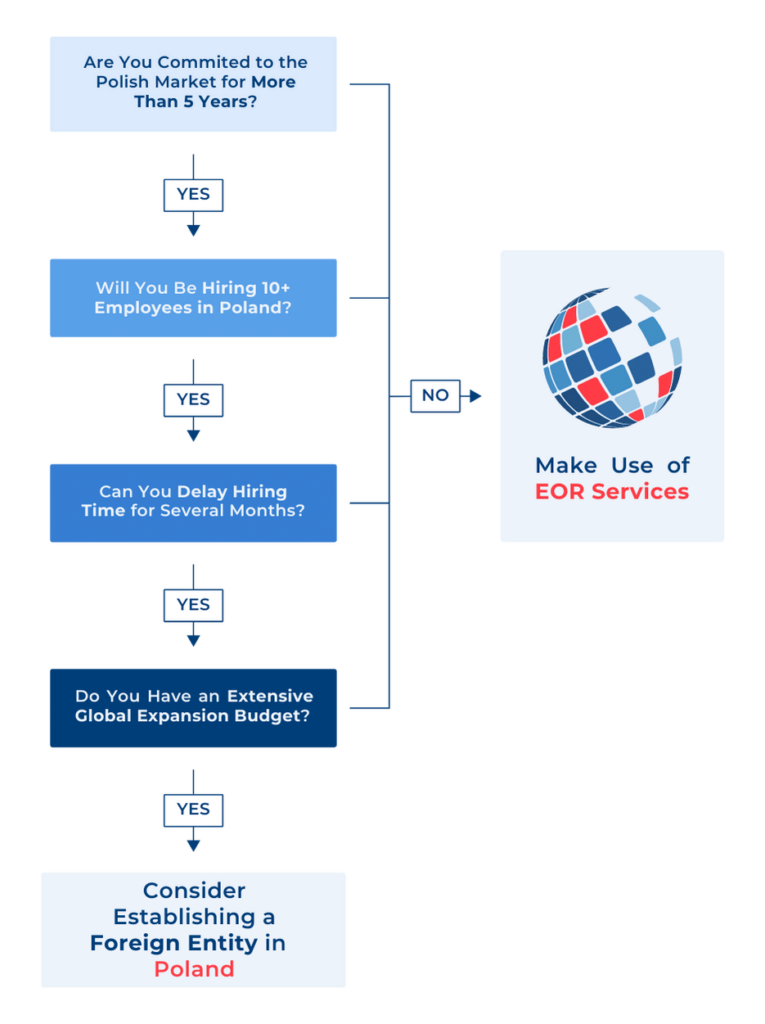

In Poland, managing employer responsibilities through an EOR without establishing a new local firm structure is safe, legal, and effective. EOR services accomplish this by providing excellent HR support and in-depth knowledge of the local legal system.

Your team members will be legally protected, get accurate and timely monthly payments, and be qualified for all Polish employee benefits when you establish an EOR service agreement with a reputable provider.

Independent contractors that connect with clients through a Polish EOR may be entitled to many or all of the same advantages as regular employees or if they were working under an umbrella business, in addition to having full control over their work as usual.

By leveraging our extensive professional networks, in-depth understanding of the available local business resources and standards, and rigorous adherence to ethical hiring processes, our recruiting specialists can locate the best Polish locals for your requirements.

As a result, it is simpler and more efficient to integrate new hires into our Polish EOR system rather than hire them via more traditional employment practices.

Through INS Global, you receive comprehensive compliance-assured employment outsourcing assistance from a genuinely international EOR services provider in Poland. Employer of Record services assist you in adhering to all applicable state and federal requirements across the country.

There may be severe hiring requirements or a cap on the number of employees you may hire at once with a PEO or EOR. Poland is a market with constantly changing opportunities, and your long-term business plan may call for you to scale up or down quickly. That’s why you can collaborate with us and employ as few or as many people as you need to reach your objectives.

The entire cost of hiring in Poland should account for payroll expenses, hiring fees, signing bonuses, and other direct and indirect costs, including incentive programs, handling the taxes of international employees, and social insurance.

Utilizing Polish PEO services will relieve you of the burdensome incorporation regulations since you won’t require a local office.

Giving your staff the choice to work in a shared workspace or the freedom to do so whenever and wherever it’s most convenient is still a good idea, however. Because of this, INS Global can also help you find appropriate workspaces in Poland to meet your needs.

When Polish nationals or international workers are subject to specific local employment regulations, tax legislation, employee incentives, visa restrictions, or work permit rules, we can cope with any distinctions.

Companies of all sizes, from SMEs to major multinationals, can leverage EOR and PEO solutions to hasten their progress in a new market. Thanks to options for employment outsourcing, it is now possible to employ local or foreign workers effectively and securely.

Our services offer simple ways to scale up to match the demand for new workers and can even replace more complex internal HR requirements.

Businesses in a variety of industries that either don’t have their own structures in a target country (or seek to avoid cost-scaling issues while focusing on expansion) may find the legal expertise offered by PEO and EOR services most valuable.

Two more ways to employ independent employees directly or indirectly include staffing companies and umbrella companies.

The majority of independent contractors in Poland work for themselves or own their own small enterprises. Labor service agreements, not employment contracts, are required by Polish law when hiring contractors.

Before starting work in Poland, an independent contractor could be asked to submit a resume, a portfolio, verified references, and a signed NDA.

Employers must withhold and manage Personal Income Tax in Poland, alongside social security contributions, on behalf of their employees as part of the monthly payroll process. Companies will also make yearly tax filings for their employees in addition to their own.

Currently, Poland is raising the minimum wage twice per year in an effort to meet the rising cost of living. The minimum wage in Poland was previously increased to 3,600 zlotys per month in July 2023.

All non-EU foreign citizens require a work visa and work permit to live and work in Poland. The type A work permit is the most commonly used form of work permit in the country and is applicable for most worker types for up to 3 years.

All employers in Poland must make employer contributions toward their employee‘s social security funds during the payroll process. This labor cost in Poland is equivalent to 19.2-22.4% of an employee‘s monthly salary and provides the funding for most national employee benefits.

All employees in Poland must have a reasonable employment contract, health and safety protections in the workplace, and protection from any kind of workplace discrimination. In addition, all employees have the right to paid leave (for sickness, parental concerns, and annual vacation), a pension, and insurance in cases of unemployment, injury, and disability.

The easiest way to amend an employment contract in Poland is through the written consent of both parties.

Otherwise, an employer may apply for a variation of the employment contract through notice, where the employee will have a set amount of time to accept or reject the change. Rejecting changes made in this way can mean the end of the employment contract.

Poland’s public healthcare system (Narodowy Fundusz Zdrowia) provides healthcare services through health insurance contributions and company taxes to all citizens of Poland and those with compulsory health insurance. Medical care is heavily subsidized as a result, meaning while care is not free, the majority of services cost very little.

Notice periods in Poland vary from 2 weeks (for those employed for less than 6 months) to 3 months (for those employed for more than 3 years.

Severance pay is required when a company with more than 20 employees ends an employee’s employment contract due to redundancy or collective dismissal. It amounts to 1 month’s salary (for those employed for less than 2 years) to 3 months’ salary (for those employed for more than 8 years).

The Labour Protection Council of the Sejm of the Republic of Poland and the Labor Inspectorate are both government bodies that oversee the correct implementation of all national labor laws and protections.

Polish employees have, on average, 13 days of paid public holiday in Poland per year. These only apply if the holidays fall on a typical work day.