A PEO provides expert legal and regulatory support to ensure you don’t make mistakes when dealing with unfamiliar local legal systems.

A PEO can get you up and running in a new country in a matter of days

Your PEO services provider in Czechia will take care of every aspect of HR, allowing you to focus on company growth

You only need to pay a single monthly service fee per employee, saving you potentially thousands of dollars per year

With a single point of contact you can meet all of your HR operations requirements

Overseas company incorporation can be a long and complex process, involving many fees or potential penalties due to simple errors. By expanding with a global PEO or Employer Of Record services provider as a partner, you can benefit from their widespread networks and experience to accelerate setup in your market of choice.

習熟作業者派遣組織

The Advantage in Figures

While the two services are often discussed together, it’s helpful to understand their differences and how they might relate to your company.

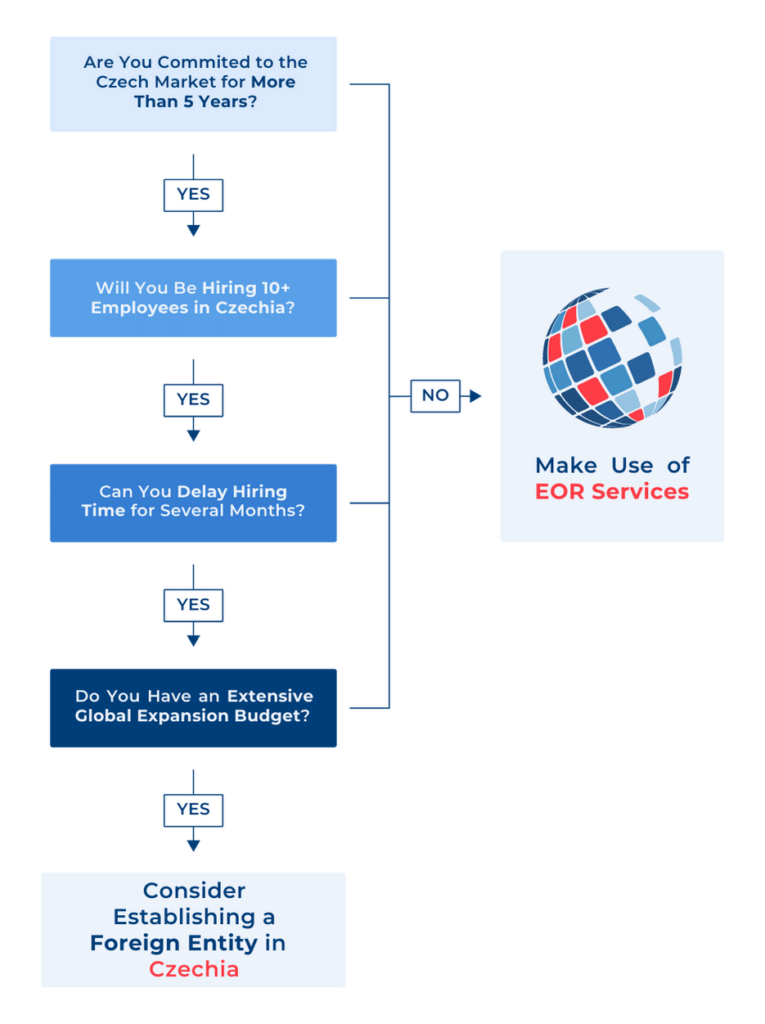

INS Global offers both PEO and global EOR services in Czechia. You are free to choose whichever service best suits your requirements.

Contracts made in Czechia must comply with the Labor Code, State Labor Inspectorate, respective Collective Bargaining Agreement, and Employment Act in order to be considered legitimate. Employment contracts in Czechia must be written form. Fixed-Term contracts cannot exceed 3 years or be repeated more than twice.

An average workweek consists of around 40 hours over 5 days. 12 hours per shift is the maximum allowed at one time.

Work hours over the average number set out in the contract should be paid at a premium of 125%.

After 1 year of service with a company, employees are eligible for a minimum of 4 weeks paid annual leave.

There are 13 days of annual public holidays in Czechia, and employers are expected to arrange for time off or compensation if an employee must work during these times.

Employees in Czechia are eligible for up to 380 days of paid sick leave. Sick leave is reimbursed through a sickness benefit up to a maximum amount. For the first 14 days, the employer pays the benefit, and afterward, it is paid by the government.

Female employees are eligible for up to 28 weeks of maternity leave, at least 6 weeks of which must be taken before the expected due date. Maternity leave benefit is 70% average gross salary.

Paid paternity leave in Czechia is 2 weeks as of 2022.

Corporate tax in Czechia is 19%. As of 2021, residents in Czechia are taxed at a flat rate of 15%. Those who earn above an upper threshold are taxed at 23%.

Social security contributions are used to fund pension, unemployment, and sickness benefits.

Employers in Czechia should expect to contribute 24.8% of an employee’s salary towards their social security contributions and 9% toward health insurance. Employee rates are 6.5% and 4.5%, respectively.

いいえ、各国の労働法を遵守するために、海外の現地法人を利用する必要があります。

外資系企業は、各国に現地法人を設立するか、現地の PEO (Professional Employment Organization) のサービスを利用して現地でスタッフを直接雇用することができます。

登録雇用主は、特定の国で雇用されているスタッフに対して責任を負う法人です。 実際には、外国企業は子会社を設立して海外従業員の登録雇用主になるか、PEOを使用して登録雇用主として行動することができます。

責任は国によって異なる場合があり、労働契約の問題、給与管理、税務コンプライアンス、社会保障管理、経費請求の申告、雇用と解雇など、すべてのスタッフ管理責任が含まれます。

手続きなど

一般的に、既存の PEO を記録上の従業員として使用して、従業員が海外に拠点を置くには 1 か月が必要です。 新しい子会社を正式な雇用主として設立する場合、遅延は 4 ~ 12 か月です。