- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

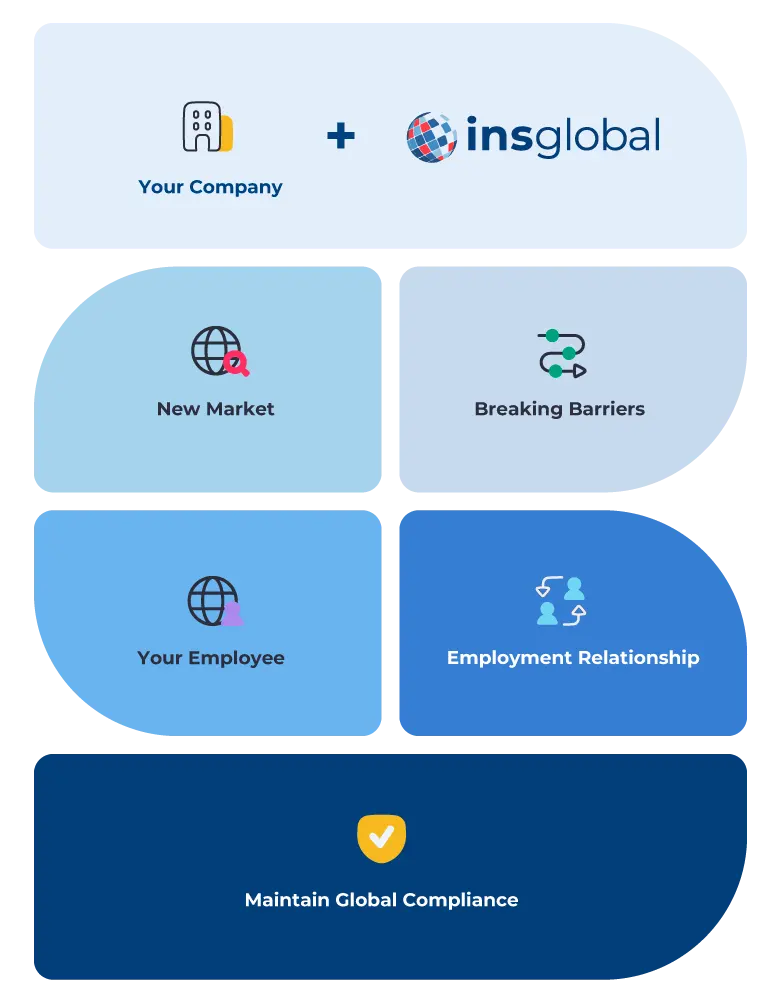

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

Country Guide

Capital City

Canberra

Languages

English

Currency

Australian dollar ($, AUD)

Population Size

25,771,300

Employer Taxes

18.45%

Employee Costs

2%

Payroll Frequency

Monthly

When it comes to expanding your business on a global scale, INS Global offers a comprehensive solution. Through collaboration with our experienced Employer of Record in Antigua and Barbuda, you have the ability to effortlessly attract, hire, and oversee employees without the requirement of establishing a local entity. This allows you to successfully navigate the intricacies and expenses that come with international expansion.

Our PEO services in Antigua and Barbuda provide a secure, efficient, and cost-effective solution for sourcing, employing, and managing local talent. With INS Global’s exceptional PEO services available in Antigua and Barbuda and more than 160 countries worldwide, you can effortlessly manage a diverse and international workforce from anywhere in the world.

By serving as the authorized employer, our dedicated Employer of Record (EOR) in Antigua and Barbuda assumes full responsibility for all HR-related activities on your behalf. This streamlined process enables you to expand your business within the span of a week, significantly reducing both the time and costs associated with growing your business overseas.

Want to have a Team in Antigua and Barbuda TODAY?

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers

Establishing a new company takes time but also increases your operational overheads. On the other hand, working with an EOR in Antigua and Barbuda streamlines the entire process.

Working with an Antiguan EOR…

The Advantage in Figures

PEO/EOR

Company Incorporation

Price

80% Less Expensive

Market Entry

2-5 Days

6 Months

Legal Compliance

For companies that may not have the budget or staffing to operate entire HR departments that can manage HR operations for overseas workers, PEOs provide all the services required to function efficiently.

Lower Expansion Costs

Working with a local PEO allows you to expand internationally at a fraction of the cost. Since you don’t have to create a new company, you can reduce your overheads and expand to new markets faster.

Focus on Growing Your Company

EORs take all the HR-related responsibilities off your shoulders so that you can focus on growing your business efficiently. This empowers your staff to work towards your goals knowing that all the admin and HR are being taken care of.

Expand Quickly and Effortlessly

If you were to set up a new company overseas, the process can take anywhere from 4 to 12 months. Working with a local EOR/PEO can have you running in less than a week. This makes expanding to new countries quick, easy, and cost-effective.

Manage Your HR Remotely

INS Global offers you a way to manage your global workforce online. With modern cloud technology you can build and manage your international workforce from anywhere in the world.

INS Global’s PEO in Antigua and Barbuda empowers your company to expand abroad in just four simple steps.

1

We work with you to create a strategic plan that meets all your needs.

2

Our organization provides a legal entity to help hire and manage staff in Antigua and Barbuda.

3

We handle HR-related tasks such as hiring, contract management, and payroll processing to ensure legal compliance.

4

Your employees focus on your goals while we take care of HR and legal compliance.

When expanding abroad, you may be considering working with a PEO (Professional Employment Organization) or an EOR (Employer of Record) in Antigua and Barbuda. Here’s what you need to know about these two options.

Check Our Labor Law Guides

Working Hours

Annual Leave

Sick Leave

Maternity and Paternity Leave

Contact Us Today

Employer of Record (EOR) in Australia

View Details

Employer of Record (EOR) in Australia

View Details

solutions

faqs

No, it is necessary to use a local entity abroad to comply with each country labor law.

Foreign companies can either set up a local entity in each country or use the services a local PEO (Professional Employment Organization) to hire the staff on-site directly.

The employer of record is the legal entity liable for the staff employed in a specific country. In practice, a foreign company can either open a subsidiary to become the employer of record of its abroad employees or use a PEO to act as the employer of record.

Liabilities may vary from country to country and include all the staff management responsibilities: labor contract issues, payroll management, and tax compliance, social security management, expenses claim declaration, hiring and termination

procedures, etc.

In general, 1-month is necessary to have an employee based out abroad using an existing PEO as the employe of record. When incorporating a new subsidiary to be the employer of record, the delay varies from 4-12 months.

PEO services streamline your expansion plan, and the costs typically depend on a percentage of your employee’s salary.

Yes, collaborating with an Employer of Record in Antigua and Barbuda is a legal and efficient solution that simplifies your expansion plans while reducing costs.

Salaries are generally processed on a monthly basis for full-time employees, while part-time workers may prefer weekly or bi-monthly payments. Employers are responsible for deducting taxes and social contributions.

INS Global streamlines and optimizes recruitment, hiring, and staff management remotely, reducing the costs associated with managing an international workforce.

Absolutely, an Employer of Record in Antigua and Barbuda can recruit and hire employees from all regions, expanding your talent pool.

Modifications to employment contracts necessitate mutual agreement. An Antiguan PEO ensures compliance with local labor laws.

Yes, employers in Antigua and Barbuda are responsible for deducting taxes and social contributions from employee salaries.

INS Global customizes its services to meet your specific requirements, assisting you in recruiting and hiring as many employees as needed for your expansion plans.

Termination costs vary depending on the circumstances. However, employees are generally entitled to 1 days’ pay for every month of service.

In Antigua and Barbuda, you have the flexibility to hire employees for both in-person and remote opportunities, ensuring cost-efficiency during market entry.

Yes! Our recruitment experts possess extensive experience in sourcing top talent globally. We provide comprehensive support in recruiting, hiring, and managing your workforce, regardless of your location.

Antigua and Barbuda observe 12 national holidays, and most employees are entitled to a paid day off. Working on these holidays usually involves receiving a higher hourly rate.

Employers must comply with strict labor laws and regulations to avoid penalties and fines. Collaborating with an experienced PEO in Antigua and Barbuda ensures compliance during seamless expansion.

Definitely! INS Global facilitates the recruitment and management of a diverse workforce remotely, making it easy to hire both Antiguan citizens and foreigners.

A Global Employer of Record is an effective solutions for companies like yours that are looking to expand a workforce abroad effortlessly.

This approach allows you to outsource the international hiring process quickly and efficiency, providing access to a global talent pool while still managing payroll compliance in each country.

Public Holidays Calendar

Download the PDF Guide