Employer of Record in Belgium & PEO

Hire Globally, Pay Locally, Expand Effortlessly

INS Global operates as a local partner providing international companies with global Human Resources outsourcing services.

By using our PEO, your company can establish itself, hire employees, and begin operations in over 100 countries around the globe, all without the traditional hassles that go along with global expansion.

A PEO (Professional Employer Organization) is a global mobility partner that ensures total legal compliance assurance in a target market for all overseas employees.

A PEO in Belgium gives companies the local expertise needed global expansion. Hire and provide HR services for employees in as little as 48h with INS Global

An EOR (Employer of Record) is a third-party provider of employment outsourcing services that acts as an employer for tax and HR administrative purposes. INS Global’s EOR in Belgium allows companies to securely and cost-effectively hire and manage employees overseas in less than 48 hours.

Employer of Record in Belgium & PEO - Summary

Employer of Record in Belgium & PEO

The Many Benefits of using a Professional Employer Organization

Assured Legal Compliance

The knowledge of local legal and administrative procedures provides your business with guaranteed compliance assurance throughout the entire process

Reduced Cost And Time

Issues created through misunderstanding best practices and local regulations can lead to a surprisingly high occurrence of fees and fines. A PEO’s local experts can minimize and avoid these errors.

Heightened Focus on Company Growth

Through the provision of many HR outsourcing services like headhunting, payroll outsourcing, and contractor management, a PEO allows you to accelerate your market entry and increase growth.

Fast Market Entry

Time for Company Incorporation in Belgium: 4-12 months

Time to establish a PEO relationship in Belgium: 2-5 days

One Contact for Everything

A PEO covers all the required aspects of HR services and streamlines these into a single point of contact.

Why a PEO is More Advantageous Than Company Incorporation

Incorporating your company in a new foreign market is complicated and time-consuming, requiring a legal and physical presence to begin operations. A PEO allows you to avoid these issues by operating as a legal intermediary for essential HR services.

- Saves time

- Saves money

- Avoids potential administrative or legal pitfalls

- Makes the most of local resources and expertise

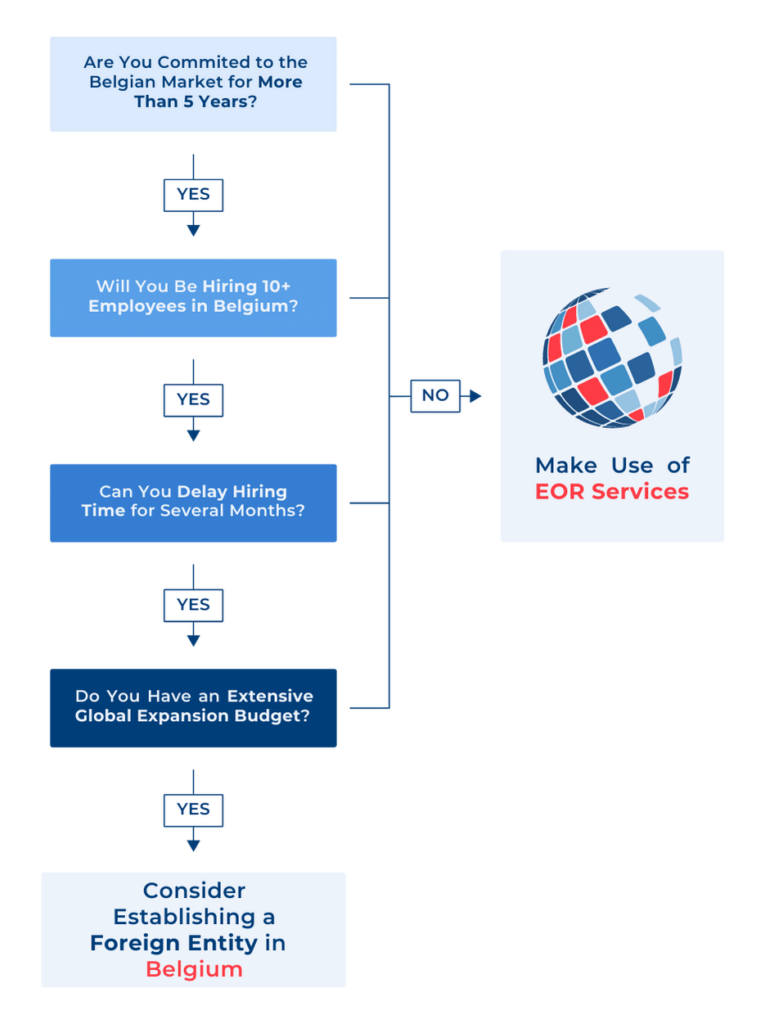

PEO/EOR vs Company Incorporation

The Advantage in Figures

PEO/EOR

Company Incorporation

Price

80% Less Expensive

Market Entry

2-5 Days

6 Months

How Does Our PEO in Belgium Operate in 4 Steps?

INS Global’s Belgium PEO can be used to manage your employee recruitment or assignment needs in 4 comprehensive steps:

We meet with you to understand your requirements and formulate a plan that will best fulfill your needs.

Our professionals will provide a legal entity you can use to bring in staff to begin operating in Belgium.

We take on all of the administrative and legal aspects of HR compliance in Belgium, including hiring and paying your staff

Your staff can continue day-to-day operations and keep working towards your company’s success in the Belgian market while we manage all necessary HR services

PEOs (Professional Employer Organization) vs. EORs (Employer of Record)

Once you’ve decided to expand into the Belgian market and wish to make the most of a PEO agreement, it’s helpful to understand how PEOs can differ from EORs in order to choose the one that best fits your business needs:

- A PEO provides HR outsourcing services to employees of other companies expanding globally.

- The services that can be provided include tax compliance, payroll outsourcing management, and regulatory assurance, among others.

- An EOR is a company that acts like a PEO while also legally and officially hiring employees on behalf of their clients.

- In addition to services provided by a PEO, an EOR is responsible for all liabilities associated with onboarding and employment.

- Under a PEO agreement, the contract will remain between your company and the employee.

- In an EOR agreement, the contract is directed by your company but made between the EOR and your employee.

INS Global offers both PEO and Employer of Record services in Belgium. Contact our team of experts today, or read this article to learn more about the specifics of these two services.

Labor Law in Belgium (2024 Updated)

Employment Contracts in Belgium

An employment contract in Belgium should contain a description of the employee’s duties, relevant information about the nature of the role, work conditions, pay, and other special clauses like confidentiality and non-compete clauses.

Any changes made to a contract without the employee’s written consent will result in that contract being null and void.

There are multiple types of employment contracts in Belgium. These contracts consist of: fixed type, student employment, replacement contract, and full-time employment.

Due to the multilingual nature of the Belgian market, contracts must be stated in the local language for the area of the company’s headquarters. The contract’s language should be either French, Dutch, or German.

Working Hours and Overtime in Belgium

Working hours in Belgium should not exceed 8 hours per day. In cases where it is necessary for more work than stipulated above, the employee must receive compensatory rest time and payment of 150% salary for overtime.

Annual Leave and Public Holidays in Belgium

Full-time employees in Belgium are entitled to 4 weeks of paid annual leave in the year following a full year of service.

In some particular cases, such as with young or elderly workers, the amount of leave allowed or leave pay may differ.

There are 10 days of paid public holidays per year in Belgium. If these days fall on a weekend, the employee can take an extra day of annual leave.

Sick Leave in Belgium

The employer is responsible for paying for the first 30 days of sick leave.

After this, employees are eligible for a sick leave payment given via social security, subject to providing medical proof of illness.

Maternity and Paternity Leave in Belgium

Maternity leave in Belgium is 15 weeks, paid for by social security at 82% for the first 30 days and 75% for time after this. This pay is subject to a maximum daily amount.

Paternity leave is 10 days, paid at 82%. The first 3 days are expected to be paid by the employer.

Paid Educational Leave

Due to Belgium’s particular language make-up, employees can take between 10-15 days of paid educational leave. This is for cases in which they are enrolled in a government-recognized language course in either French or Dutch.

Tax Law and Social Security Contributions in Belgium

Corporate tax in Belgium is typically 25%. This rate is appliable to both domestic companies and foreign companies.

As defined by the Code of Companies and Associates, smaller and medium-sized corporations are allowed to profit from a reduced rate of only 20% for the first bracket of income up to EUR 100,000 of profit.

Personal income tax is paid on a progressive scale at a national (from 25-50%) and local communal level (at an average of 7%).

Social security contributes to all forms of social insurance for workers in Belgium, such as medical, employment, and pension insurance. Employees are expected to contribute 13.07% of their salary, and employers must expect to pay around 27% of an employee’s standard salary towards social security contributions.

Employer of Record in Belgium & PEO

CONTACT US TODAY

FAQs

A reputable Belgium PEO or EOR may take care of critical HR duties like payroll, contract administration, and ensuring tax compliance for a monthly fee based on a percentage of the co-employed employees’ salaries.

When an employee is handled by an EOR, they may get access to a range of services, including increased employee benefits, complete legal protection, local knowledge of all employer obligations, timely and correct payment, and more.

Working with a Belgium EOR allows you to relocate personnel or hire new ones legally, safely, and practically. With the help of this method, outsourcing is permissible for both short-term and long-term projects.

There may be a minimum or maximum number of employees you can recruit with some PEO companies. However, with INS Global’s worldwide services, you can co-employ as many people as your plans calls for.

In order to assist you in finding the best candidates among Belgian citizens and international residents, INS Global makes use of the most recent hiring technology and industry-specific knowledge. To avoid any potential problems, we take into account any changes in local customs and legislation regarding nationality when we hire employees on your behalf.

Members of our recruiting team have access to professional networks, in-depth knowledge of offline and online business resources, experience adhering to the region’s best practices, and more to help you locate the appropriate new team members in Belgium.

Payroll expenses must include indirect or supplemental costs like social insurance contributions, bonuses, or incentives in addition to wages and any payments made to recruiting firms or specialists.

Even though signing bonuses are optional, they must be taken into account when calculating the expense of recruiting competitively abroad.

No, it is necessary to use a local entity abroad to comply with each country labor law.

To provide the most competitive package to possible candidates, employees of a firm having a presence in Belgium should be allowed to select between a physical workplace and a home office.

Yes, an EOR protects you everywhere you go while taking into consideration all changes to local or regional employment laws.

Foreign companies can either set up a local entity in each country or use the services a local PEO (Professional Employment Organization) to hire the staff on-site directly.

In 2023, the minimum wage is €1,955 per month, with variations at the regional or industry level due to CBAs.

The Schengen Visa allows holders to visit Belgium as well as other Schengen Zone countries for up to 90 days within a 180-day period. This visa includes the option for the holder to perform business activities.

A Work Visa (D) can be obtained which allows the holder to work in Belgium for periods longer than 90 days. This can then be used to apply for a combined Work and Stay Permit or EU Blue Card which allows the holder to live and work in the country for up to 3 years at a time.

An Intra-Company Transfer permit can also allow workers to move from abroad to Belgium while working for a company with multiple subsidiaries around the world.

The employer of record is the legal entity liable for the staff employed in a specific country. In practice, a foreign company can either open a subsidiary to become the employer of record of its abroad employees or use a PEO to act as the employer of record.

procedures, etc.

In general, 1-month is necessary to have an employee based out abroad using an existing PEO as the employe of record. When incorporating a new subsidiary to be the employer of record, the delay varies from 4-12 months.

Contractors that connect with customers through an EOR or Belgian PEO have access to many of the same benefits and protections as normal employees while also keeping total control over their work process.

When looking for a quick, simple, and safe way to join the Belgian market, companies of all sizes, from SMEs to multinational corporations, should take into account hiring an EOR.

INS worldwide provides crucial PEO or worldwide Employer of Record services to businesses in a range of sectors, with our legal knowledge being suitable for anybody who either lacks their own internal structures or wants to avoid scaling issues while expanding.

It is possible to hire independent contractors both directly and through an intermediary, such as a staffing firm or an umbrella company. You might be able to identify the best contractors to fit your needs through networking, job boards, social media, trade organizations, and other channels.

Typically, independent contractors work for themselves or as the proprietors of small businesses through which they may send consumers invoices. Because of this, rather than through an employment arrangement, they should be employed under a work agreement for specific projects.

Before starting, an independent contractor could be required to provide a CV, portfolio, verified references, and possibly a signed NDA. The recruiting procedure, however, could change based on your requirements.

Payroll in Belgium is generally organized every month and paid at the end of each month. Employees will also often receive a 13th-month bonus at the end of the year.

Belgium has 10 paid public holidays per year with employees who work on holidays eligible for increased pay or time off. Holidays that fall on a typical rest day must also be compensated with a day off on the next available work day.

Multiple governmental departments oversee labor rights and conditions in Belgium, with the Labor Inspectorate operating day-to-day inspections of workplace safety and employee well-being.

Employers are required to provide a payslip each month detailing employee salary. This payslip should also include all deductions which the employer must make for tax and social security contribution management.

Exact employer contributions to social security in Belgium differ according to the region and industry, but currently, employers are expected to provide the equivalent of around 27% of an employee’s salary.

Employees who pay social security payments have access to standard employee benefits including annual leave (20-24 days), parental leave, and sick leave as well as extra benefits like pensions and healthcare insurance.

Many companies also offer an additional benefit in Belgium where they offer a 40-hour contract to employees despite the typical workweek being 38 hours. These additional hours worked then go towards an average of 12 additional days of holiday per year.

While contracts in Belgium don’t have to be made in writing, all changes or amendments have to be agreed upon in advance by both parties. In general, it is expected that contracts are carried out in full, so amendments may be difficult to manage.

Thanks to social security, workers in Belgium generally pay a fee when receiving medical care which is then reimbursed through national or private health insurance.

Workers with 6 months of seniority can make a written request to know the reason for termination in most cases, and the employer must prove that the termination is justified. If the employer cannot, the worker will be eligible for compensation.

Notice periods depend on whether the worker was contracted before 2014 or not, as well as whether their job counts as blue-collar or white-collar.

There are no national mandates on severance pay, although CBAs and individual contracts may include requirements.