- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

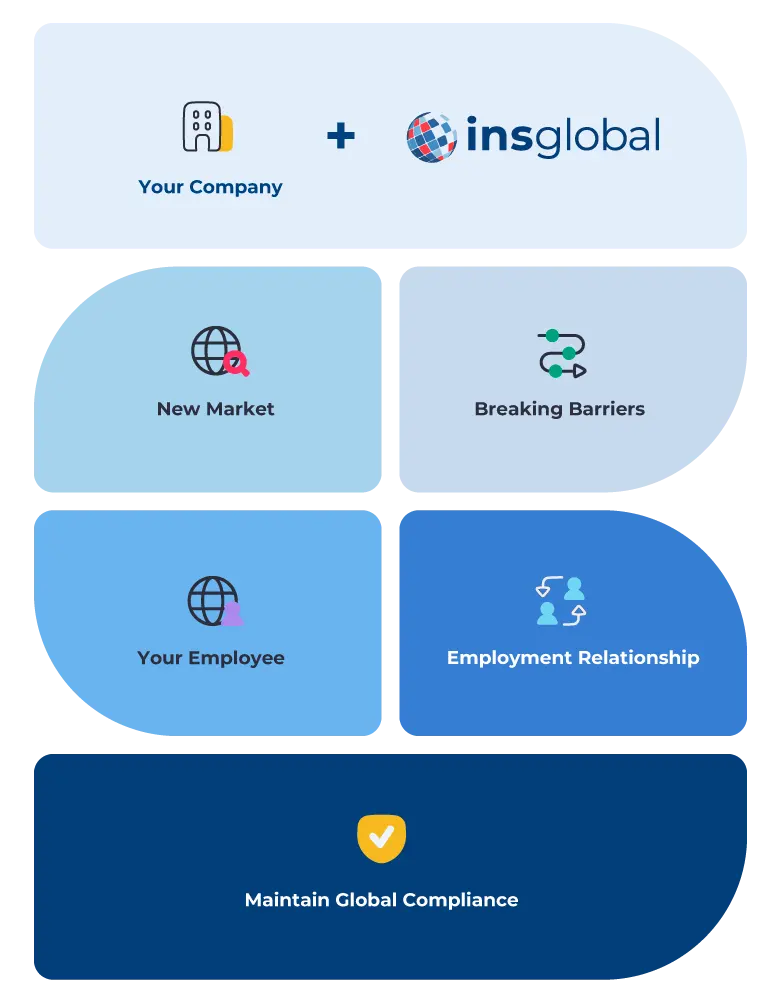

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

Country Guide

Capital City

Languages

Currency

Population Size

Employer Taxes

Employee Costs

Payroll Frequency

Expanding internationally with a planned development in Ghana? EOR services from INS Global facilitate seamless recruitment and management without establishing a local entity. Enjoy a reliable, streamlined solution, swiftly overseeing local and international talent and entering new markets in record time.

Want to have a Team in Ghana TODAY?

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers

Working with a Ghanaian EOR…

The Advantage in Figures

PEO/EOR

Company Incorporation

Price

80% Less Expensive

Market Entry

2-5 Days

6 Months

Legal Compliance Assurance

Opt for an Employer of Record (EOR) service well-versed in Ghana’s regulatory landscape for effective recruitment and supervision of an international workforce, ensuring meticulous legal compliance. This proactive approach shields against potential fines by providing support specifically tailored to Ghana’s regulations.

Lower Expansion Costs

Collaborate with an Employer of Record in Ghana to propel global expansion and significantly reduce typical expenses associated with expansion. Scale your operations without the need to establish a new entity in Ghana, offering a unique advantage within the Ghanaian context.

Focus on Growing Your Company

An Employer of Record in Ghana assumes all HR-related responsibilities, streamlining your operations and granting you the freedom to focus solely on the international goals of your business, aligning seamlessly with Ghana’s business environment.

Expand Effortlessly

Creating a new company in Ghana can be time-consuming, ranging from 4 to 12 months in some cases. In contrast, teaming up with a local Employer of Record expedites the expansion process, allowing entry into the Ghanaian market in as little as a week, ensuring a swift and efficient entry point

Manage Your HR Online

INS Global provides an efficient means to manage your diverse, global workforce online through a state-of-the-art digital platform. Utilize our advanced cloud-based HR system to easily oversee all your employees and their needs remotely, tailored to fit Ghana’s digital landscape.

INS Global’s EOR (Employer of Record) in Ghana facilitates your company’s expansion abroad in just 4 simple steps:

1

We collaborate with your business to create a tailored expansion plan that integrates local requirements with your global expansion strategy.

2

Our organization provides the legal entity needed to hire or transfer staff, ensuring compliance with Ghana’s legal requirements from day 1.

3

We handle HR-related tasks related to the transition and beyond, such as hiring, contract and payroll management, and employee benefits tracking, ensuring local compliance in Ghana.

4

Your employees focus on your goals while we ensure consistent HR and legal compliance, delivering a seamless experience within Ghana’s evolving business landscape.

In Ghana, a PEO (Professional Employer Organization) handles various Human Resources tasks like payroll or benefits as a strategic HR partner.

On the other hand, an EOR (Employer of Record) possesses the full legal authority to hire and manage employees on your behalf without needing a new entity, streamlining the process from start to finish per Ghana’s employment regulations.

INS Global offers both choices, ensuring that whether you need an EOR or PEO in Ghana, you have the support you need to expand comfortably, providing flexibility tailored to Ghana’s business environment.

Check Our Labor Law Guides

Working Hours

Holidays and Annual Leave

Sick Leave

Maternity / Paternity

Contact Us Today

faqs

While setting up a local entity is an option, collaborating with a local Employer of Record proves more efficient in Ghana. Employer of Record services give you local expertise and resource support, facilitating hiring and staff management on your behalf.

An Employer of Record in Ghana manages various HR tasks, including payroll, tax compliance, employment contracts, and social security contributions, ensuring comprehensive compliance for your entire workforce

Establishing a new company abroad can take months to a year, but with INS Global’s EOR services, you can hire employees and expand to a new market in as little as a week.

EOR service costs are directly linked to your employee’s salary, calculated as a percentage and covering all HR functions for compliant employment in Ghana.

Yes, collaborating with an Employer of Record in Ghana is a legal and efficient solution, simplifying your expansion plans while reducing costs.

Salaries are typically processed monthly for full-time employees, while part-time workers may be paid weekly or bi-monthly.

Recruitment in Ghana varies in cost, but INS Global simplifies remote recruitment and staff management, reducing the expenses of managing an international workforce.

Absolutely, a Ghanaian Employer of Record can recruit and hire employees from all regions, facilitating quick expansion across the country.

Modifications to employment contracts require mutual agreement.

Yes, employers in Ghana are responsible for withholding taxes and social contributions from employee salaries, including an employer’s contribution to each employee’s social security fund.

INS Global tailors its services to your company’s needs, assisting with recruiting and hiring as many or as few employees as required for your expansion plans.

Severance pay is required for employees being let go in Ghana and is negotiated by their collective representative or trade union.

In Ghana, employees can be hired for both in-person and remote opportunities, allowing for reduced overheads during international expansion.

Certainly! Our local experts bring extensive experience in finding top talent globally by providing support in recruiting, hiring, and managing your workforce, regardless of your location.

Ghana observes 13 public holidays where employees are entitled to a paid day off. Working on these holidays usually involves a higher hourly rate.

Employers must adhere to strict labor laws and regulations to avoid costly penalties and fines. Partnering with an experienced EOR in Ghana ensures compliance during your expansion.

Yes! INS Global assists in the recruitment and management of a diverse workforce, simplifying the process of hiring both Ghanaian citizens and foreigners.

A Global Employer of Record is an effective solutions for companies like yours that are looking to expand a workforce abroad effortlessly.

This approach allows you to outsource the international hiring process quickly and efficiency, providing access to a global talent pool while still managing payroll compliance in each country.

Public Holidays Calendar

Ghana

| Date | Day | Holiday | Notes |

| 1 January | Wednesday | New Year’s Day | Celebrates the start of the new year. |

| 7 January | Tuesday | Constitution Day | Commemorates the establishment of the 1992 Constitution. |

| 6 March | Thursday | Independence Day | Marks Ghana’s independence from British colonial rule in 1957. |

| 31 March | Monday | Eid ul-Fitr | Celebrates the end of Ramadan. Date may vary based on lunar calendar. |

| 1 April | Tuesday | Eid ul-Fitr Holiday | Observance of Eid ul-Fitr. |

| 18 April | Friday | Good Friday | Commemorates the crucifixion of Jesus Christ. |

| 21 April | Monday | Easter Monday | Celebrates the resurrection of Jesus Christ. |

| 1 May | Thursday | May Day (Workers’ Day) | Honours the contributions of workers. |

| 6 June | Friday | Eid al-Adha | Festival of Sacrifice. Date may vary based on lunar calendar. |

| 1 July | Tuesday | Republic Day | Commemorates the establishment of the Fourth Republic. |

| 4 August | Monday | Founders’ Day | Honours the contributions of Ghana’s founding fathers. |

| 21 September | Sunday | Kwame Nkrumah Memorial Day | Commemorates the birth of Ghana’s first President. |

| 22 September | Monday | Kwame Nkrumah Memorial Day (Observed) | Observed on the following Monday if the holiday falls on a weekend. |

| 5 December | Friday | Farmers’ Day | Recognises the contributions of farmers and fishermen. |

| 25 December | Thursday | Christmas Day | Celebrates the birth of Jesus Christ. |

| 26 December | Friday | Boxing Day | Traditionally a day for giving gifts to the less fortunate. |

Download the PDF Guide