- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

INS Global is a local partner to international companies by providing global Human Resources outsourcing services. With our PEO, you can quickly establish yourself, hire talented workers, and start operating in dozens of countries worldwide, saving time and costs.

A PEO (Professional Employer Organization), often called a global EOR (Employer of Record) can provide companies with a cost-effective, quick, and simplified global mobility and expansion strategy by taking care of essential HR services and offering compliance assurance in unfamiliar markets. INS Global’s PEO in Greece allows companies to hire or transfer employees within 48 hours.

An Employer of Record (EOR) in Greece provides companies with a cost-efficient and secure way to follow international expansion strategies by acting as the employer for oversees workers to simplify tax and compliance assurance responsibilities.

For companies looking to boost their global mobility potential, INS Global’s EOR provides the perfect mix of experience and expertise in the international market.

Thanks to your PEO’s team of expert legal specialists, you can be assured of being in complete legal compliance at all times.

Mistakes and misunderstandings with local regulations can lead to high fees and fines. A PEO will help you avoid these errors and ensure your staff can focus on operations.

You’ll be able to fully concentrate on reaching your target growth while the PEO provider handles HR functions like payroll outsourcing and contractor management.

Company incorporation in a new country can take up to a year. With a PEO, you’ll be able to begin operations within a week.

*Estimate

A PEO partner offers full support for all of your HR needs and streamlines them into a single point of contact.

Bringing your company into a new foreign market is not an easy process, and it often demands a legal and physical presence to begin operations. A PEO helps you to avoid these issues and any other potential setbacks by operating as a legal intermediary.

The Advantage in Figures

PEO/EOR

Company Incorporation

Price

80% Less Expensive

Market Entry

2-5 Days

6 Months

INS Global’s PEO in Greece can be used to manage your employee recruitment needs in 4 simple steps:

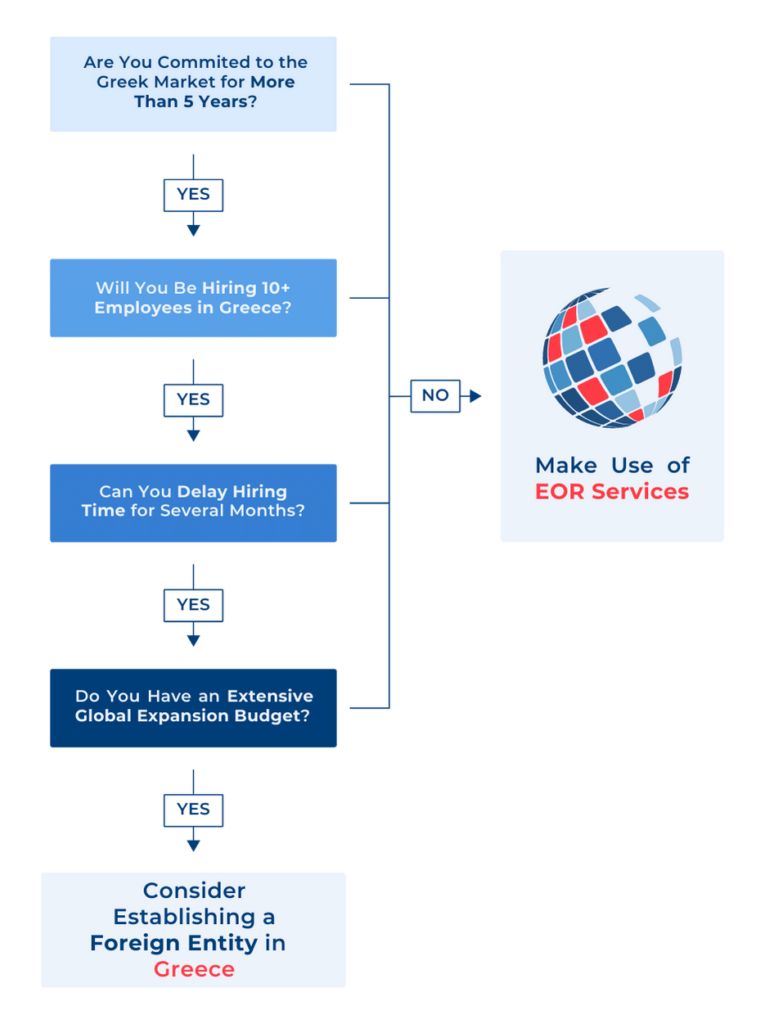

Once you’ve decided to bring your company to Greece, you should make sure that you understand the potential differences between a PEO and an EOR.

A PEO provides HR outsourcing services to employees in companies that want to expand globally. This includes tax compliance, payroll outsourcing management, and regulatory assurance, and more.

INS Global offers both Professional Employer Organization and Employer of Record services in Greece. Don’t hesitate to contact our team of experts today, or you can read this article to learn more about the specifics of these two services.

The conditions of employment, such as salary, benefits, working hours, etc. must be presented in written form.

The language in a contract must be Greek, and all currencies should be in Euros.

Contracts must be provided to employees within a fixed time, depending on the employment type.

A five-day, 40-hour working week is the standard in Greece. Any work beyond 45 hours a week is counted as overtime and must be compensated at 120% standard wages. Overtime work should not exceed three hours per day.

Employees in Greece also expect to receive bonuses at holidays throughout the year.

There are 12 days of paid public holidays each year in Greece. If an employee must work on one of these holidays, they are entitled to an additional 175% of their usual wage.

After working for one year, employees who work 5-day work weeks are entitled to 24 days of paid leave. Those who work six-day work weeks get 24 days of vacation annually.

The number of paid vacation days is typically increased by one each year after the first of employment.

The employer covers the first three days of sick leave at 50% of the employee’s regular wage. Social insurance continues payment from the fourth day forward.

Maternity leave in Greece is 17 days, typically taken 8 weeks before birth and 9 weeks after. If the mother has paid social insurance for 200 days before applying for maternity leave, they will receive 50% of their wage.

Fathers also receive paid paternity leave, from 2 days to 2 weeks, depending on their terms of service.

Employees with children under the age of 16 are entitled to up to 4 days of paid leave for their child’s education.

Parents who have been employed for a minimum of one year can also apply for unpaid parental leave for up to 4 months if their child is under 6 years of age.

Based on annual income amounts, personal income tax is levied progressively between 9-44%.

Employees who have worked a minimum of 50 days in the previous 15 months are eligible for free health and dental care via social security.

Employers and employees in Greece are also expected to pay a percentage of standard earnings towards social security. Social security contributions are 24.33% for the employer and 15.33% for the employee. These payments are capped monthly at EUR6600.

In Greece, the price of specialist EOR services is calculated as a percentage of a coworker’s monthly wage. This price includes all HR tasks required to ensure compliance with all local employment rules.

Without the need for a specific firm structure in Greece, managing employer responsibilities through an EOR is secure, legally permitted, and efficient. EOR services do this by retaining top-notch HR assistance and being experts in local legal authority.

With an EOR service agreement, your team members will be completely protected by the law, get correct and timely monthly payments, and have access to all Greek employee benefits.

When working with clients within a Greek EOR framework, independent contractors have total control over their work and may be eligible for many or all of the same benefits as regular employees or as if they were utilizing an umbrella business.

Our recruiting experts can find the top local talent in Greece for your requirements by utilizing broad professional networks, in-depth knowledge of local business resources and benchmarks, and steadfast commitment to ethical hiring methods.

As a result, integrating these candidates into our Greek EOR system will be simpler and more effective compared to when hired through more conventional hiring procedures.

You obtain thorough compliance-assured employment outsourcing assistance from a genuinely global EOR services provider through INS Global. This complies with all relevant local, state, and federal laws.

here is a chance that some Greek PEO or EOR service providers will have strict hiring requirements or a limit on how many employees you can hire at once. INS Global is aware that, based on your worldwide business plan, you might need to scale up or down quickly. Working with us allows you to employ as few or as many people as you need to accomplish your goals.

Payroll costs, hiring fees, signing bonuses, and other direct and indirect expenditures, such as incentive programs, managing overseas employees’ taxes, and social insurance, should all be considered.

By using Greek PEO services, you can avoid cumbersome incorporation regulations because you won’t require a local site.

However, it’s still a good idea to give your staff the option to work in a shared workspace or the freedom to do so whenever and wherever it’s most convenient, and INS Global can offer guidance on creating ideal working environments in Greece.

If Greek citizens or foreigners are subject to different local employment laws, tax laws, or employee perks, we can handle the fundamental differences, such as visa and work permit requirements.

The best EOR and PEO solutions are accessible for businesses of all sizes, from SMEs to multinational organizations, enabling the efficient and secure employment of international or local staff. Our services can easily expand to accommodate the demand for more staff, and they can even replace more complex internal HR requirements.

The legal expertise provided by PEO and EOR services would be very helpful to businesses in a number of industries that either don’t have their own structures in a target country (or seek to avoid cost-scaling difficulties while focusing on expansion).

Staffing firms and umbrella corporations are two more third parties that may be used to directly or indirectly engage independent freelancers.

In Greece, most independent contractors are self-employed or run their own small businesses. Greek law requires that when hiring contractors, labor agreements rather than employment contracts be employed.

An independent contractor may be asked to submit a CV, portfolio, verified references, and a signed NDA before work begins.

Employers typically handle payroll in Greece on a monthly basis. An employer must provide a detailed payslip, but this payslip can be either digital or physical. Employers are responsible for managing all employee tax and social security contributions as part of the payroll process in Greece.

Greece‘s minimum gross monthly wage was raised to €780 in April 2023.

Citizens of an EU/EEA state can live and work in the country without any additional requirements. As Greece is part of the Schengen agreement, Greek visas adhere to the usual breakdown of visa types. The visas most commonly used for business purposes in Greece are:

In Greece, employers must manage deductions and payments for taxes and social security on behalf of employees as part of the payroll process. Employers are also responsible for making their own separate payroll taxes and contributions to an employee‘s social security fund, equivalent to around 22-25% of the employee‘s standard gross salary (with caps).

Employers in Greece must provide holidays, sickness, and maternity/parental leave, in addition to the employee‘s social security funds which makes employees eligible for a national pension, healthcare, as well as injury and unemployment insurance. Employees are also eligible for up to 2 extra months of salary payments, paid in installments at Christmas, Easter, and upon vacation leave.

Employers in Greece have limited good faith managerial prerogative that they can use to amend contracts unilaterally. For any substantial or detrimental changes to an employment contract, employers must have the consent of the employee or risk a labor dispute.

Healthcare in Greece is provided by a national health service funded by social security contributions and a private supplementary system. All workers with social security in Greece are eligible for free healthcare, with some fees required for prescription medications.

Fixed-term contracts can be terminated with just cause at any time without the need for notice or severance. Without just cause or significant reason, an employee may choose to take an employer to court for any wages lost due to early termination.

Indefinite contracts may be ended in the first year in the same way as a fixed-term contract. After this period, a notice period of 1-4 months is required, depending on the employee’s length of service.

With 1-4 years of service, terminated employees in Greece are eligible for 1 month’s severance pay. For every 2 years of service after this, half a month’s salary is added to the total severance pay required. Should an employer wish to terminate an employee without providing adequate notice, they must double the severance pay to which the employee is eligible.

The Labor Inspectorate Body oversees the implementation of the Greek Civil Labor Code as provided by the Ministry of Labor and Social Affairs.

There are a minimum of 9 days of national public holidays in Greece, with employees eligible for paid leave for holidays that fall on a standard working day. In addition, further public holidays may be announced on a yearly basis, with most years having around 12 days of mandatory holiday in total.