- SOLUTIONS

-

- Countries

- Stories

- About Us

-

-

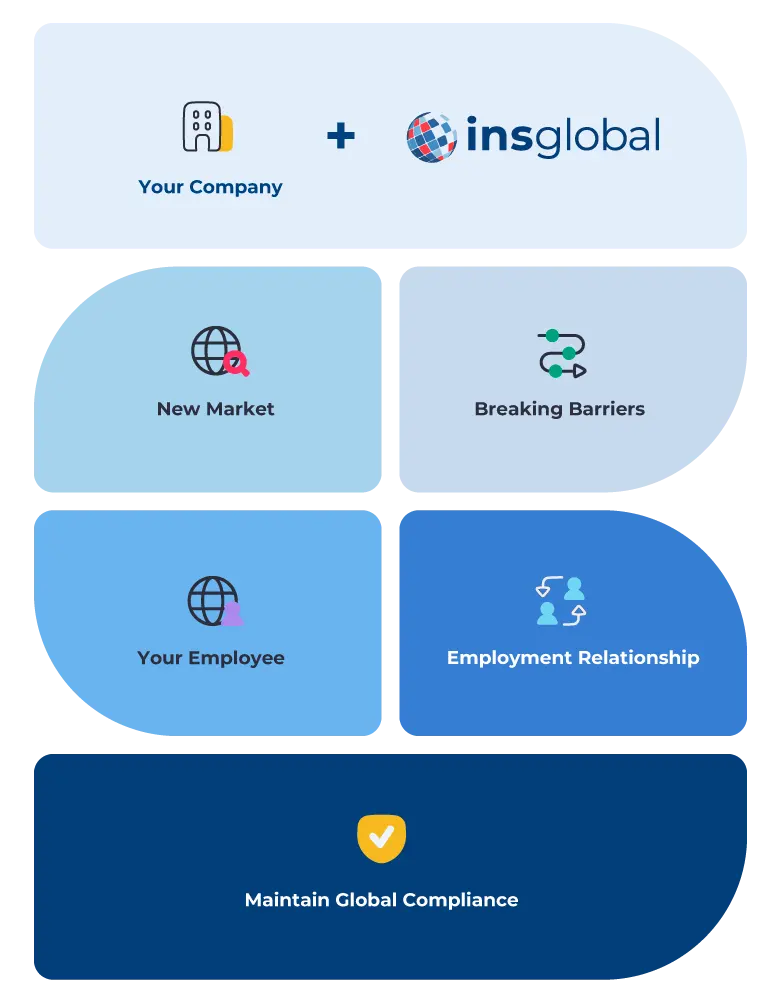

- HOW CAN WE HELP?

- Find out how we can assist you to achieve higher growth through services that are tailored to your company needs.

-

- GLOBAL INSIGHTS

Country Guide

Capital City

Canberra

Languages

English

Currency

Australian dollar ($, AUD)

Population Size

25,771,300

Employer Taxes

18.45%

Employee Costs

2%

Payroll Frequency

Monthly

An Employer of Record in Honduras can be your link for expanding seamlessly into a new market. EOR (Employer of Record) services handle HR administration and ensure you’re legally compliant with the country’s tax and labor laws. As a result, you can quickly hire local talent or dispatch foreign workers, pay employees in local currency, and comply with Honduran labor laws without incorporating a legal entity.

Ordinarily, companies seeking to expand abroad must navigate a foreign country’s complex legal and administrative frameworks. This process is capital-intensive, slow, and rife with legal risks.

However, using an Employer of Record (EOR) abroad is a streamlined and innovative global expansion approach in Honduras. EOR service providers become the legal employer of your staff in Honduras and handle all accompanying employer liabilities so that you can focus on growth.

Want to have a Team in Honduras TODAY?

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers

Incorporating your company abroad is a tried and tested expansion route, but it brings numerous risks and hassles. This method involves complex legal procedures and substantial costs, which can limit or endanger your expansion strategy. Also, incorporating a subsidiary abroad can take several months, making it inappropriate for time-sensitive projects.

In contrast, EORs allow hiring and paying employees locally without establishing a separate entity abroad. Also, unlike company incorporation, your Honduran EOR partner handles all ongoing administrative or compliance duties for you. This streamlined approach allows you to focus on primary business and pivot successfully.

Hence, an EOR in Honduras allows you to quickly and safely:

The Advantage in Figures

PEO/EOR

Company Incorporation

Price

80% Less Expensive

Market Entry

2-5 Days

6 Months

Ensure Compliance with Local Laws

The Honduran labor landscape can be intricate for foreign companies, but partnering with an EOR in Honduras ensures your business complies with all local laws and regulations.

Streamline Expenses and Timeframes

Establishing a legal entity in Honduras is costly and time-consuming. However, companies save costs and speed up the expansion process using a local EOR instead.

Concentrate on Business Growth

Minimize Business Risks

Operating in a foreign country like Honduras is risky since you are interacting with foreign compliance and employment laws. But an EOR with a deep understanding of Honduran regulations allows you to operate compliantly and protects your reputation.

Comprehensive Global Presence

Leverage our understanding of the local market, industry-specific challenges, and best practices to optimize your expansion in Honduras and 160+ countries globally.

The process for engaging an EOR in Honduras is simple:

1

Assessment of business requirements: First, our team at INS Global conducts a comprehensive review of your business needs and employment requirements in Honduras. This evaluation helps us develop a customized plan for your expansion objectives.

2

The legal entity for hiring: Once a unique plan is agreed upon, we will immediately provide a legal entity for hiring and deploying your workers in Honduras.

3

HR administration and compliance: As your EOR partner, we immediately assume full legal responsibility for HR administration and ensure compliance with Honduran tax and labor laws concerning your operations.

4

Focus on growth: Finally, you can concentrate on managing the day-to-day operations and employee contributions toward your business’s growth. We will manage the local HR and legal aspects of your business in Honduras while you work on building success.

PEOs and EORs are equivalent to 2 service types falling under the umbrella of employment outsourcing.

A PEO in Honduras acts as a co-employer, sharing certain employer liabilities with your company while providing HR operational support.

In contrast, an EOR assumes full legal responsibility for all HR and employment-related matters, such as hiring and transferring workers, payroll management, tax compliance, issuing and documenting employment contracts, and other HR tasks.

While both options can be valuable depending on specific business needs, an EOR offers more comprehensive support and flexibility for many international companies seeking to expand into Honduras.

Check Our Latests Labor Law Guides

Honduras recognizes oral employment contracts, but best practice suggests providing a written contract clearly outlining the terms and conditions of employment. Such handy agreements help to avoid future misunderstandings and disputes.

The labor contract should contain these essential details:

The contract should specify whether it is for a fixed or indefinite period. Fixed-term contracts should clearly state the contract’s duration or end date.

These are the common forms of employment agreements in Honduras:

The maximum probationary period allowed by law in Honduras is 2 months or 60 days.

In Honduras, contract termination can be relatively straightforward if the employer and the employee agree to terminate the contract. They can agree on the terms and conditions of termination, including any severance or compensation.

However, when one party fails to fulfill its contractual obligations or engages in serious misconduct, the party seeking termination must provide valid reasons for termination. Such terminations can be done without notice or severance pay and may involve disciplinary action.

When terminating a labor contract without cause, employees are required to provide notice and make severance pay appropriate to the employee’s length of service as described below:

In an indefinite contract, either party can terminate it by providing notice to the other party.

An employer is obliged to make a severance payment when terminating without cause:

Working Hours In Honduras

The normal working hours in Honduras are at most 8 per day or 44 hours weekly. However, the 44-hour limit does not apply to these groups of workers or industries:

Managerial and supervisory workers

Still, these workers cannot be required to remain at work for more than 12 hours a day and are entitled to a minimum rest period of 1.5 hours.

The normal work hours on any day may be continuous or divided into 2 or more periods with breaks for rest as are appropriate to the nature of the work and the worker’s requirements.

For continuous work hours, the worker shall be entitled to a minimum of 30 minutes rest in the day; this rest shall be counted as working time.

In Honduras, the maximum daily working time is 12 hours (both normal and overtime). Employers cannot require individual workers to work overtime for more than 4 times a week.

Overtime work in Honduras is remunerated as follows:

Full-time employees in Honduras should receive a 13th-month salary (to be paid out as a Christmas bonus in December) and a 14th-month salary payment in July. Each payment equals one month’s standard salary.

Public Holidays in Honduras

Employees in Honduras are eligible for paid leave on the country’s 10 nationally recognized public holidays:

Annual Leave in Honduras

To be entitled to paid annual leave, a Honduran worker must have performed at least 1 year of continuous employment with the same employer. The yearly leave duration is proportional to the time of work performed with the same employer:

Sick Leave in Honduras

Employees in Honduras are entitled to sick leave, and their compensation during this period is supported by social insurance. The insurance covers approximately two-thirds (66%) of their average monthly salary over the previous 3 months.

Employees can receive such payments, which can continue for up to 26 weeks. In certain circumstances, the payment duration can be extended to a maximum of 52 weeks.

However, employees are entitled to 100% of their pay if they are hospitalized and without dependents. The employer and the state share the cost of sick leave equally.

Maternity/ Paternity Leave in Honduras

Female employees have the right to up to 10 weeks of maternity leave, plus 4 weeks before giving birth. During leave, the workers recieve 66% of their normal pay.

Female employees have the right to up to 3 months of paid maternity leave for illnesses related to pregnancy or childbirth upon providing a medical certificate. This absence can continue indefinitely but is unpaid beyond the initial 3 months.

Female workers not covered by social insurance will receive maternity leave payments from their employers.

There are no laws for paternity leave in Honduras currently.

Social security tax contributions in Honduras are assessed as follows in HNL (Honduran lempira):

Personal income tax in Honduras is progressively based on income bracket, as shown below:

Income (Honduran lempiras) | Tax rate (%) |

0 – 199,039.47 | Exempt |

199,039.48 – 303,499.90 | 15 |

303,499.91 – 705,813.76 | 20 |

705,813.77 and over | 25 |

Honduran citizens and residents are taxed on income earned from worldwide sources, while non-residents are taxed only on Honduran-sourced income.

A resident company’s corporate income tax rate in Honduras is 25% of its net taxable income.

Contact Us Today

Employer of Record (EOR) in Australia

View Details

Employer of Record (EOR) in Australia

View Details

solutions

faqs

No, it is necessary to use a local entity abroad to comply with each country labor law.

Foreign companies can either set up a local entity in each country or use the services a local PEO (Professional Employment Organization) to hire the staff on-site directly.

An Employer of Record (EOR) in Honduras takes on the responsibilities and obligations of being the legal employer for a company abroad. EORs assume various employer-related tasks and liabilities, including payroll administration, tax withholding, benefits management, and compliance with employment laws.

The price of professional EOR services in Honduras is a percentage of the worker’s monthly compensation. This fee covers all HR-related tasks to ensure compliance with local employment laws.

Yes. An EOR in Honduras is a safe, legitimate, and efficient way to handle employer responsibilities without establishing a corporate structure in the country.

An EOR service agreement in Honduras ensures your team members are paid accurately and on time each month. Also, employees can access all Honduran employee benefits and be completely protected by the law thanks to legal expertise and compliance assurance support.

Independent contractors who interact with clients using an EOR in Honduras will retain complete control of their work and may qualify for the same benefits as regular employees. So, partnering with an EOR is like working via an umbrella organization with your interest.

Yes. Our team of recruitment consultants experts can find the best local talent in Honduras for your needs.

Yes. An Employer of Record can tap into its online or offline pool of professional networks to help you find workers in various cities or regions within Honduras.

An EOR handles headhunting, interviews, and candidate selection in specific Honduran cities or regions, depending on your needs or preference.

You can employ any number of employees to achieve your goals. Some PEO or EOR service providers have a minimum or maximum limit, but INS Global has no number limit when hiring. This is because we recognize the importance of flexibility when implementing a business strategy in Honduras, allowing you to scale up or down quickly at any time.

The option for your employees to work in a shared workspace is good. But using a PEO in Honduras eliminates the need for a local business address.

Yes. We can manage the necessary visa and work permit processes for foreigners in Honduras. Also, we can handle situations where the local employment laws, tax laws, or employee benefits differ for Hondurans and foreigners.

EOR and PEO solutions are great for SMEs and multinational corporations. They ensure the efficient and secure employment of foreign or local workers. In addition, such services allow you to scale employment demands to meet work operations.

Staffing firms and umbrella corporations are third-party ways to hire independent freelancers in Honduras.

The cost of hiring in Honduras factors in all expenses like salary, recruiting service fees, signing bonuses, and social security contribution payments.

Employers in Honduras manage payroll for all workers and are responsible for withholding and remitting amounts corresponding to employees‘ income tax and social security fund contributions monthly.

There is no single national minimum wage in Honduras. Instead, minimum wages are determined by industry.

Here are the common visa types for employees in Honduras:

In Honduras, employers are responsible for organizing and withholding employees‘ income tax payments and social security fund contributions every month.

Employees in Honduras are entitled to a state pension, a 13th and 14th-month salary, severance pay, public holidays, paid leave (sick, annual, and parental leave), and health insurance.

Honduras does not permit unilateral changes to an employee‘s contract. Instead, changes to an employee‘s working conditions must be agreed upon and signed by the employer and employee.

In addition to private healthcare, the government operates the main public healthcare system in Honduras, which is funded through tax revenue and contributions to the Honduran Social Security Institute (IHSS). This system provides healthcare services through a network of public hospitals, health centers, and clinics across the country.

Employers in Honduras wishing to terminate an employee’s contract must give appropriate notice and make severance payment as shown below:

Labor regulations in Honduras are regulated and enforced by the Ministry of Labor and Social Security (Secretaría de Trabajo y Seguridad Social – STSS). The ministry is responsible for formulating and implementing labor policies, ensuring compliance with labor laws, and protecting workers’ rights and welfare in Honduras.

Employees in Honduras are eligible for paid leave on the country‘s 10 nationally recognized public holidays.

A Global Employer of Record is an effective solutions for companies like yours that are looking to expand a workforce abroad effortlessly.

This approach allows you to outsource the international hiring process quickly and efficiency, providing access to a global talent pool while still managing payroll compliance in each country.

Public Holidays Calendar

Download the PDF Guide